Portfolio Construction: A Blueprint for Private Families

When Cambridge Associates began working with private investors and families 40 years ago, we applied the same investment philosophy and many of the same investment principles that have underpinned our approach to managing investment portfolios for some of the world’s leading institutional investors. Key tenets, such as a long-term time horizon, an explicit bias toward equities to grow the value of a portfolio net of spending and inflation over time, and the importance of diversification are foundational to this “endowment model” of investing. These investment principles should matter just as much to multi-generational families as they do to institutions.

Yet, portfolio management for families presents distinct complexities. Family portfolios often exist within a broader ecosystem of wealth, which has a meaningful impact on investment strategy and can inform critical inputs such as spending needs and tolerance for risk. Furthermore, family portfolios are often influenced by individual preferences, such as a desire to align investments with values, which can impact investment objectives and priorities. Taxes, a major factor for many families, also can affect asset allocation strategy, as well as implementation. In addition, family portfolios are inextricably linked to life cycles, which highlights the need for effective governance, and for regular review of the assumptions underpinning the investment strategy as generations transition and objectives change.

To build a portfolio that is best positioned to meet a family’s long-term goals, a deep understanding of the influencing factors unique to each family is required. Without this, a family risks establishing a strategy that miscalibrates key elements such as risk tolerance or liquidity needs, or that ultimately has low buy-in and support among family members—this can be detrimental, especially during times of market stress. Investing the time to set up a strong foundation grounded in the unique needs and preferences of the family is critical to driving better portfolio outcomes over the long term.

This paper explores the influencing factors and special considerations that are key to successful portfolio construction for private investors and wealthy families, and that are fundamental to the work that we undertake for our clients. We discuss the elements of a Family Enterprise Review and how it informs the establishment of a Policy Portfolio. We then describe how customized implementation and ongoing oversight support success. By following the blueprint we lay out, families are best positioned to establish an investment strategy that is suited to their unique circumstances and built for long-term success.

The Foundation: Investment Principles for Long-Term Investors

Before describing the factors that most significantly influence investment strategy and implementation for families, it is worth revisiting the core principles of Cambridge Associates’ overarching investment philosophy. This philosophy espouses these fundamental elements:

- A long-term investment horizon;

- Diversification, not only to reduce variability of returns, but also to protect against permanent loss;

- Limited use of tactical deviations from long-term asset allocation targets, primarily informed by extreme valuations;

- Use of active managers where we expect they will add long-term value, after fees and expenses; and

- A focus on risk-adjusted returns and active oversight of portfolio risk factors.

Family portfolios of sufficient size and scale can leverage this foundation of institutional investment management principles. 1 However, a number of issues can make family portfolios significantly more complex than those held by institutions, and these influencing factors must be considered as part of a holistic portfolio construction process.

Influencing Factors for Families

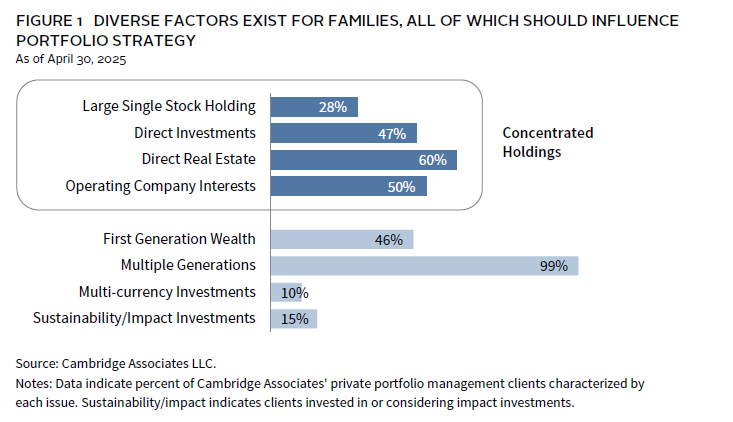

It is often the case that the diversified investment portfolio is simply one part of the total wealth of a family. In addition, many factors that are unique to family and individual wealth can impact both portfolio objectives and strategy. (Figure 1 illustrates, by way of example, the predominance of some of these issues among Cambridge Associates’ private clients.) For these reasons, a holistic approach to portfolio construction—one that considers a family’s entire ecosystem inclusive of its distinguishing factors and holdings—sets the foundation for success.

Concentrated Holdings

Cambridge Associates works with many families to invest their liquid assets after the sale of a business or some other liquidity event. However, in many cases, families maintain significant exposure to a concentrated holding after such an event. For example, at least 50% of the firm’s private clients own one or more operating companies. In addition, more than 40% invest in direct real estate, and a significant percentage hold concentrated stock positions—often from the original source of wealth—within their total portfolio.

Concentrated wealth in its myriad forms must be considered when developing an asset allocation for the diversified investment portfolio. In many cases, such concentrations can result in a lack of sufficient diversification, which can present significant risks. Some concentrations, such as real estate or exposure to a specific industry, may be obvious; however, “hidden” concentrations, such as country- or region-specific overweights, might not be fully recognized. When developing a portfolio for families, an awareness of these concentrations and an intentional approach to managing them—or around them—is an important element of risk management.

Spending Needs

Families often have different needs from their investment portfolios, which can result in a much wider range of investment objectives and spending requirements than is the case for their institutional counterparts. For instance, endowments and foundations’ annual spending is typically tied to grantmaking activities or the level of required operational support—for example, the required 5% that private foundations must distribute each year, or the typical target spending range of 4% to 5.5% for colleges and universities. Because more varied objectives and needs often exist within a single family, a customized approach to managing each family member’s wealth is called for.

When developing an asset allocation for families, it is essential to understand the level of spending the diversified investment portfolio (or each portfolio, if there are multiple family members) must support. Typically, this draw may be for annual personal spending and taxes and to meet capital calls when building an allocation to private investments.

Beyond these typical needs, other events also can increase a family’s reliance on the diversified investment portfolio. The portfolio might be called upon to support a family’s operating business or a real estate investment in need of cash. Or, it could be tapped as a source of capital for a compelling direct investment in a sector where the family has deep expertise. Alternatively, a family whose annual spending needs are funded by a family business or leased property might need to increase the draw from the diversified portfolio if these cash flow sources were to dry up unexpectedly.

Families that carefully plan for a range of spending scenarios and manage portfolio liquidity with spending in mind are better prepared to navigate unexpected events and better positioned to act when compelling opportunities arise. Well-prepared families can also reduce the risk of permanent loss of capital by avoiding unplanned spending that must be met during a market decline.

Investment Objective and Risk Tolerance

Many families behave similarly to institutions—they have a multi-generational mindset and a similar desire to grow the portfolio net of any spending, inflation, and taxes (a big influencer, discussed below). These families must be comfortable taking risk to meet their long-term objective.

But some families take a more conservative approach, with an eye toward balancing growth and preservation of capital. For these families, the value of “sleep at night” liquidity and preservation on the downside in volatile markets is more important than participating in the final uptick of a market rally.

The role the diversified portfolio plays in the total family ecosystem is an important determinant of investment objective and risk. For example, a family that takes significant risk outside the portfolio with higher-risk real estate development projects or a substantial investment in an early-stage business may desire a more conservative posture for the diversified investment portfolio.

Aligning the portfolio with a family’s investment objective and tolerance for risk is essential to managing through inevitable periods of market volatility and avoiding decisions born out of fear and uncertainty, which can result in permanent destruction of value.

Taxes and Estate Planning

The only constant for most families is that taxes matter. However, the extent to which they matter and exactly how specific tax rates and tax considerations affect each investor and portfolio strategy will vary greatly. In the United States, for example, the fact that families are generally subject to taxes has widespread implications on portfolio construction. Our general experience is that taxes can cost the portfolio somewhere around 1% to 2% each year; minimizing this drag is an important element of meeting a family’s long-term wealth preservation and growth goals.

All else equal, the consideration of taxes should impact both asset allocation and implementation decisions. For instance, families that can tolerate the illiquidity can be well served by allocations to private equity and venture capital. These investments, in addition to offering significant return potential over time, can offer the dual tax benefits of deferred returns and long-term capital gain treatment. In addition, taxable portfolios will often use managers that exhibit lower portfolio turnover and will generally have lower exposure to most quantitative strategies that trade positions more frequently, or to strategies that derive a large portion of their return from yield (versus more tax-efficient capital appreciation). Of course, the use of municipal bonds in lieu of taxable fixed income is a major differentiator between endowment and family portfolios. Families in many other countries outside the United States, such as those in Canada, can also be subject to income taxes. Even for families and entities in jurisdictions with no income tax, taxes are still an important factor in vehicle selection, as potential withholding and other investment-level taxes must be taken into account.

Most families have undertaken sophisticated estate planning to transfer assets as efficiently as possible to the next generation. This planning may include the establishment of a wide range of trusts or other entities or the use of strategies such as intrafamily loans. The terms of each of these types of trusts, entities, or other arrangements must be understood, as they may have important implications for asset allocation and portfolio implementation. For example, distribution requirements or limitation of a trust may impact the liquidity or income needs of a portfolio, which could, in turn, impact the asset allocation or implementation decisions.

Currency

Many global, multi-generational families have family members spread across countries, all of whom may be spending in different currencies subject to fluctuations in global exchange rates. For instance, more than 40% of Cambridge Associates’ non-US clients invest across multiple currencies. For such investors, it is crucial to consider a portfolio from a multi-currency perspective. Issues such as spending rate, currency adjustments, and currency-hedging strategies will be heavily affected by the country of domicile of individual family members, calling for a highly customized approach that accounts for how fluctuating currency values can impact myriad aspects of the portfolio.

Sustainability and Impact

For certain families, aligning investments with their values is of paramount importance. Some families, for instance, often consider sustainability and impact—frequently focused on the environment or on social justice—when making investment decisions. However, for multi-generational families, the level of interest in making impact-related investments may vary greatly across generations. Working through differences about values and goals and clarifying priorities can help ensure alignment among family members. In many ways, building a portfolio that incorporates impact investments to meet the goals of all stakeholders involved is emblematic of the need for a customized approach in working with family portfolios.

Portfolio Construction for Private Investors

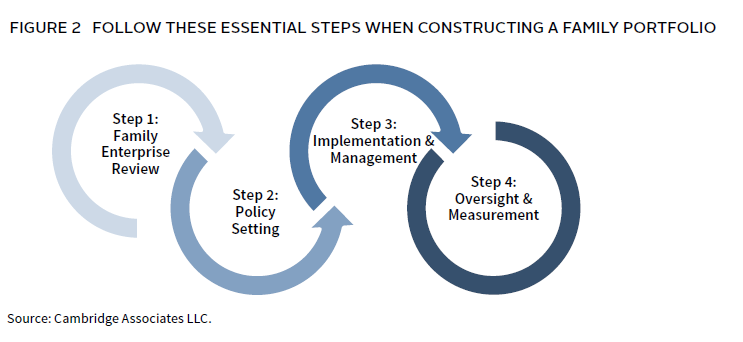

The factors described above are influential in developing the right long-term investment strategy for a family. Armed with this information, and following several essential steps, a portfolio strategy that serves each unique investor can be built (Figure 2).

Step 1: The Family Enterprise Review

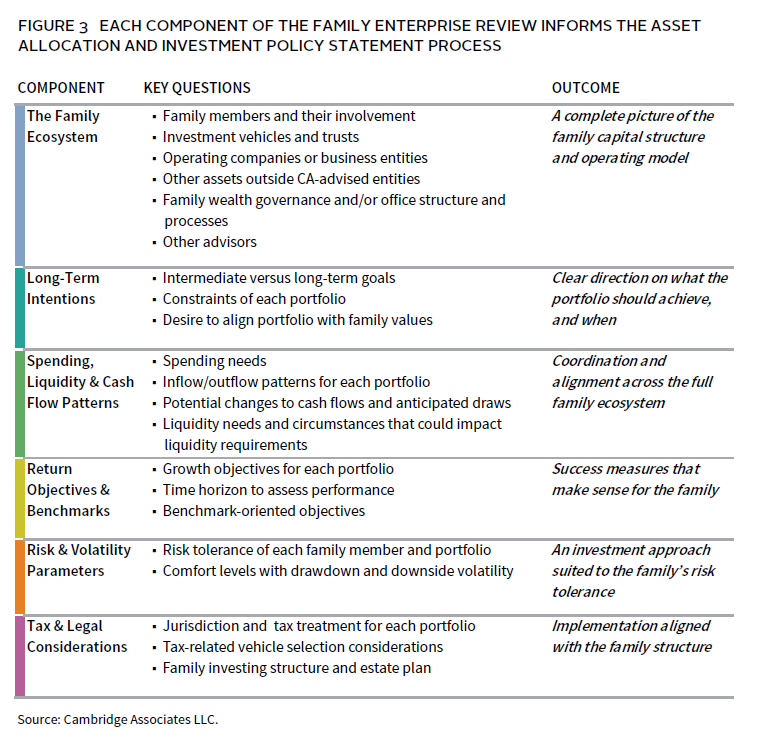

To fully understand and incorporate each family’s complexities into the long-term investment plan and ensure that the diversified investment portfolio meets the needs of all stakeholders involved, a Family Enterprise Review is the crucial first step in portfolio construction.

This review, which draws on best practices of institutional portfolio management, entails working with each stakeholder to gain a full sense of the key issues that will inform investment policy setting and, later, implementation. The broad scope and nature of the topics covered in this Review are summarized in Figure 3.

The expected key findings from the Family Enterprise Review include:

- An understanding of the appropriate purpose and structure for the investment portfolio;

- Short- and long-term financial objectives, spending and liquidity requirements, and time horizon(s) for the portfolio(s);

- A return objective and risk tolerance for the portfolio(s); and

- Additional parameters (e.g., the impact of assets held outside of the portfolio, tax considerations, the desire to engage in impact investing, themes of interest, biases, exclusions, etc.).

While these issues may seem straightforward, the specifics may differ for each member of the family. For example, a first-generation family member may have a low risk tolerance and a desire to use portfolio cash flows to support current living expenses. Meanwhile, a fourth-generation family member may be more comfortable with risk and illiquidity. The Enterprise Review can help families understand the range of objectives and risk tolerance among family members.

Knowledge of these differences can serve as an important factor in determining the optimal investment structure for the family. For example, family members that have similar long-term goals, spending, and risk tolerance, and can coalesce around a single asset allocation, might employ a relatively straightforward investment structure. In contrast, a family that has very different needs among family members might require an investment structure that can accommodate customized asset allocations. Of course, customization breeds complexity and expense and can reduce the benefits of scale, so families should consider the optimal balance in meeting each stakeholder’s needs.

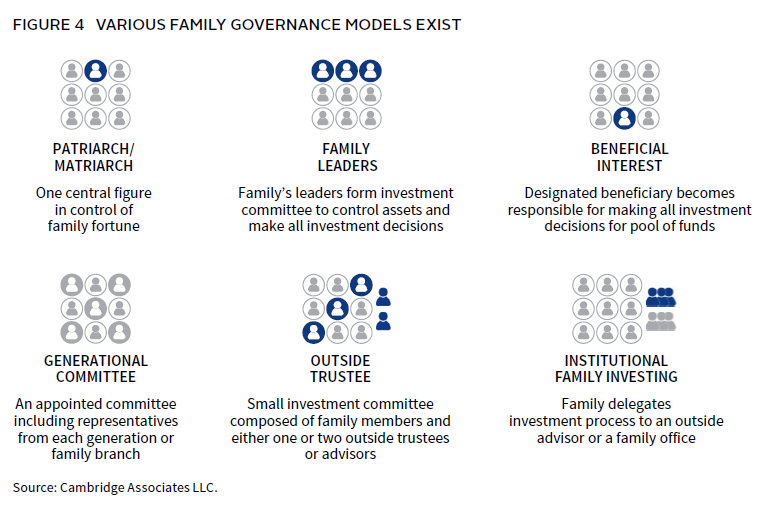

Finally, the Family Enterprise Review can help families gain insight into the most appropriate family governance structure. Who will be the primary decision maker(s)? Who has defined authority to make decisions on behalf of the family? Is there a succession plan so that decision-making authority can evolve over time? Is there a plan to provide investment education to younger family members? Answers to questions such as these often are key outputs of a comprehensive Review and are integral to formulating the appropriate governance model.

A well-defined and transparent decision-making process is essential for the long-term success of both the client-advisor partnership and the investment portfolio. While critical, there is no single way to create this structure. On one end of the spectrum, for instance, a family could establish a board of trustees to oversee portfolio decision making. On the other hand, one individual could act as the sole decision maker. Various models exist between these two extremes, reflecting the preferences of each family, as reflected in Figure 4. The key is to decide on the most effective governance structure for the family, with clear roles and responsibilities.

Step 2: Policy Setting

At the conclusion of the Family Enterprise Review, the purpose of the portfolio(s), return objectives, and tolerance of risks will be established, which then allows policy setting at the asset class level to begin. Generally, the overarching goal for most portfolios is to maximize returns for an appropriate and pre-determined level of risk. To do so, the right balance must be struck between assets focused on capital appreciation, diversification, and protection against macroeconomic risks. Thus, the process for setting a portfolio’s investment policy generally includes:

- Reviewing the roles of various asset classes in the portfolio and establishing an asset allocation;

- Evaluating portfolio liquidity needs; and

- Drafting an Investment Policy Statement (IPS).

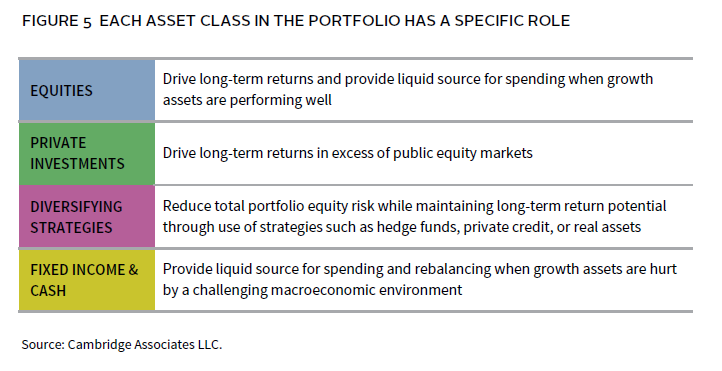

Asset Allocation. Asset allocation is the primary driver of long-term returns. For families and institutions alike, the basic building blocks of portfolio construction are similar. Fundamentally, how these building blocks are assembled and the balance between them are key factors in meeting an investor’s long-term investment objectives.

As depicted in Figure 5, each asset class has a different risk/return profile, and each plays a distinct purpose in the portfolio. The long-term target allocation for each asset type is thus set based on the strategic role that it should ultimately play in the portfolio. In addition, an allowable range for each asset class enables discipline around rebalancing and gives guidelines for potential tactical positioning. The combination of asset classes, and an awareness of their underlying risk factors, also creates the foundation for a crucial tenet of portfolio management: diversification.

Families that are subject to taxes additionally should consider after-tax returns when setting their asset allocation policy. For example, as discussed previously, higher allocations to tax-efficient private investments may be appropriate for families that can tolerate the illiquidity. Further, allocations to investments which derive a large portion of total return from current income (e.g., high-yield bonds, corporate bonds, private credit strategies, and bank loans) are typically less desirable due to the tax consequences, unless extreme valuations merit considering a tactical allocation or the investments offer diversification or other important benefits to the overall portfolio, notwithstanding their higher tax drag.

Portfolio Liquidity. Often overlooked—but just as crucial as the actual asset allocation—is a full evaluation of portfolio liquidity. Some assets will be highly liquid, while others (e.g., some hedge funds and private investments) will be semi-liquid to highly illiquid. Striking the right balance between the two is vital, and a good policy- setting process will include a stress test of the portfolio’s construction to ensure that liquidity will be sufficient—in both good times and bad.

The Investment Policy Statement. The policy-setting process concludes with the construction of a well-defined Investment Policy Statement (IPS). This statement provides a roadmap for all investment decisions and is highly personalized to the individual goals of the diversified investment portfolio. An IPS should include the portfolio’s long-term return objectives, allowable risk levels, time horizon, liquidity provisions, and spending needs, along with the policy asset allocation targets and policy benchmarks. If the family wishes to incorporate sustainability or impact objectives, these also should be included in the IPS. To allow for easy reference by all decision makers, a streamlined IPS that excludes extraneous language is recommended.

An IPS is intended to be a long-term plan that should withstand various market and macroeconomic gyrations. Properly set, it should rarely be adjusted. However, when the facts change, an adjustment in the plan may be warranted. Unlike perpetual institutions, families contend with human life spans, shifting family dynamics, and generational transitions. Events within the family ecosystem—for example, a sale of a business or an alteration to an estate plan—can also occur. For these reasons, an annual review of the IPS, with a focus on any changes to the foundational assumptions which ground it, is a best practice to ensure the IPS continues to reflect the family’s objectives.

Step 3: Implementation & Management

After the portfolio asset allocation policy has been set and the IPS completed, the focus can shift to implementation and management, which, yet again, should entail a customized approach.

For instance, while we typically make phased investments in newly constructed family portfolios, the details of the implementation process, including the timing and size of investments, will vary greatly from family to family, depending on multiple factors.

Once a portfolio is fully implemented, best practices for risk management and active monitoring of managers apply to both institutions and families. However, some differences exist in practice.

For instance, rebalancing is an important aspect of portfolio risk management, yet the cost of doing so can be particularly high for tax-paying families, depending on embedded taxable gains and their character. Thus, while it remains an important discipline, taxable families may in practice be better served by rebalancing less frequently or by using portfolio inflows to rebalance allocations without realizing taxable gains.

On a related note, making a manager change can be costlier for tax-paying families. To make a switch, one must have confidence that the newly selected manager is likely to outperform the existing manager, net of any taxes paid on realized gains at exit.

Finally, when allocating capital to an investment manager, families must pay heightened attention to selecting the vehicle or share class that is appropriate for their tax status, currency, and domicile. Given the complexity of the financial ecosystem for many global families, vehicle selection requires careful review.

Step 4: Oversight & Measurement

Finally, ongoing oversight and measurement against stated objectives is critical. All family portfolios should have well-defined policy benchmarks against which investment results will be measured. These benchmarks should represent the overall portfolio strategy and are useful not only in holding family principals, staff, and external advisors accountable over the long term, but in enabling families to effectively evaluate the success of their portfolio strategy against relevant, meaningful, and understandable metrics.

While they are essential to all portfolios, benchmarks will vary for each investor and often are expressed differently for institutional versus private investors. Institutions, for instance, can be highly sensitive to performance against established industry benchmarks and may measure their investment portfolios against comparable peers. In contrast, some families may focus less on returns relative to a benchmark but instead measure success in absolute returns. While the appropriate measure will vary by investor, the selected benchmark—as described in our paper on the subject—serves as the primary reference point for evaluating one’s investment decisions. Thus, establishing the investment policy benchmark is an important final step in portfolio strategy construction and warrants ample focus.

An Enduring Structure, Adapted Over Time

The investment philosophy we have applied to portfolios for over forty years grounds our approach to investing portfolios for families of substantial wealth. But it is only the foundation. To fully frame and build long-term, successful portfolios for private investors and families, a deep understanding of each family’s distinct goals, influencing factors, and ecosystem is required. By incorporating these unique dimensions—gained through the Family Enterprise Review—within a deliberate process of highly customized portfolio design and implementation, the most effective portfolio for each unique family can be built. This portfolio blueprint, however, must continue to evolve over time as the influencing factors underpinning a family’s investment strategy and implementation shift. A deep commitment to diligent monitoring and ongoing recalibration can promote continued relevance and enduring success as markets, needs, and generations change.

Footnotes

- While there is no definitive asset size at which institutional investment practices are appropriate for individual investors and families, specific portfolio and investment strategies are most effective at investable asset levels above $100 million. For a point of reference, Cambridge Associates’ average private client portfolio size is $350 million. This figure comprises the assets under advisement for private clients worldwide that use the firm for portfolio advice or management and receive performance reporting from Cambridge Associates.

Scott Palmer, CFA - Scott Palmer is a Managing Director for the Private Client Practice at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.