In recent years it has become trendy to eschew policy benchmarking as anachronistic and irrelevant in today’s world of dynamic portfolio construction, complex alternative investments, and different risk and liquidity profiles. We disagree. Policy benchmarking is a critical component of building and managing a successful investment program.

Of course, that doesn’t change the fact that benchmarking ranks as many people’s least favorite investment activity, akin to visiting the dentist. Dreaded and cold-sweat inducing as it may be, thinking proactively about your portfolio’s benchmarking is better than the alternative—finding a cavity after years of neglect. In this paper, we share our latest thinking on best practices in benchmarking.

At its root, a benchmark is nothing more, or less, than a measure employed as a reference point to compare to actual investment results. What question do you want to answer by making that comparison, and over what time frame is that comparison relevant and appropriate?

In our years of work with institutions, families, and pensions, we have heard several common questions related to the performance of the total portfolio. Have we achieved our long-term return objective? Would we have been better off with a simple/naïve investment approach? Have our managers outperformed their respective market indexes? Have our choices improved results over those achieved by our peers?

After laying out a broad framework that classifies these and other common questions about portfolio performance into categories with appropriate benchmarks and time frames, we zero in on the policy benchmark. The policy benchmark, usually reflected in an Investment Policy Statement as the total portfolio benchmark, should be the primary reference point for evaluating your investment decisions. We recommend all investors develop a policy benchmark that is directly linked to investment strategy, and we discuss considerations and tradeoffs in doing so.

A Comprehensive Benchmarking Framework

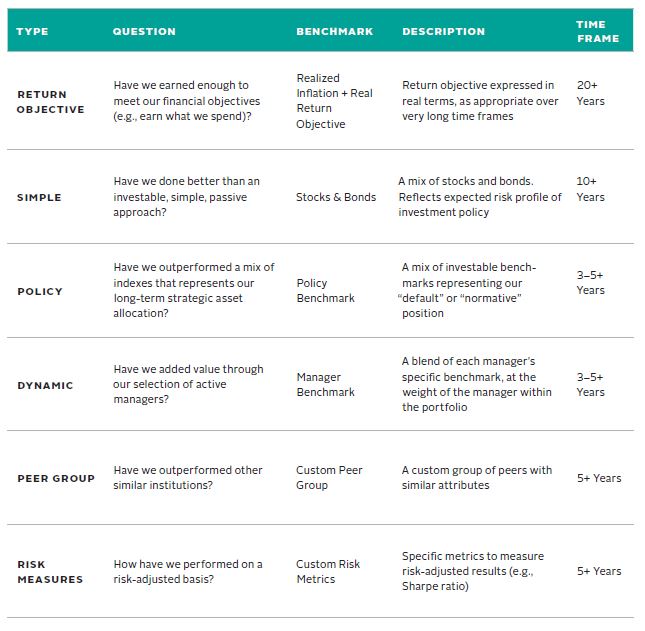

Properly evaluating a portfolio requires a variety of reference points, as investors have no shortage of ways in which they want to understand how the portfolio has done. No single benchmark can answer all questions over all time frames. In Figure 1, we group common questions asked about portfolios, and recommend a type of benchmark that can serve as the baseline for answering these questions, over appropriate time frames.

We have previously written about the use of peer comparisons as a reference point, and the importance of carefully constructing a peer universe. See William Prout and Grant Steele, “Finding Proper Perspective for Peer Comparisons,” Cambridge Associates Research Report, 2016.

Each of these benchmarks provides a piece of the mosaic of understanding portfolio performance. A well-rounded evaluation of performance would include a review across most or all of these reference points to lead to an understanding of what has influenced results—the choice to diversify beyond stocks and bonds, the particular asset allocation of the portfolio, or the selection of managers, among others. Any of the components can be customized to match the specific context of the portfolio.

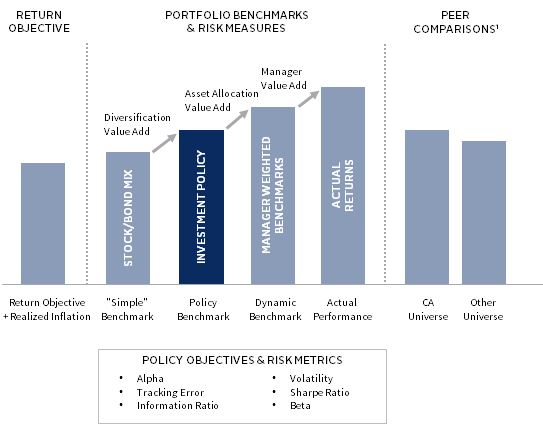

Figure 2 arranges the categories of evaluation into an overarching framework for understanding portfolio performance. Each reference point in this framework addresses a specific question, and when used in combination can provide insight into value add from diversification, asset allocation tilts, or manager performance. We’ve highlighted the policy benchmark as the reference point we will focus on for the rest of the paper.

Best Practice #1: Incorporate benchmarking as a key component of your investment process. Define a comprehensive benchmarking framework that includes a variety of reference points, each with a specific purpose and appropriate time frame.

The Total Portfolio Policy Benchmark: The Primary Reference Point

A comprehensive framework should include a variety of reference points, but it’s certainly not practical, or useful, to review all reference points and conduct attribution on each item every month or even quarter. While no single reference point can address all needs at all times, a primary reference point is necessary to focus day-to-day management of the portfolio. We recommend that the centerpiece of a comprehensive benchmarking framework be a total portfolio policy benchmark, as this benchmark has the most practical time frame, is fully related to market forces, and is appropriate as a day-to-day reference point for the portfolio.

An appropriate policy benchmark for a portfolio achieves the following:

- Establishes the Investment Mandate. In any context, strategy is the specific plan of attack to accomplish a desired objective. In investing, the strategy is typically defined by the policy asset allocation, which reflects the default portfolio positioning intended to achieve the desired investment objective. The policy benchmark therefore memorializes the default investment strategy. As a result, a proper policy benchmark is the simplest translation of an investment objective into a clear mandate for day-to-day management of the portfolio.

- Evaluates Performance Relative to the Mandate. A policy benchmark answers the perennial question, “how are we doing?” Additionally, if properly constructed, it can provide attribution of “what worked and what didn’t?” and measure the magnitude of the impact of specific decisions relative to the default policy portfolio.

- Provides a Reference for Decision Making. A policy benchmark establishes a clear reference point against which to measure investment decision making that deviates from that default position, including attribution of results, sizing of bets, etc. It helps to focus decision making and measurement of tilts against the default strategy.

- Creates a Tool for Communication. The policy benchmark establishes a clear and consistent reference point to discuss portfolio management decisions and results. When established at the beginning of an investment program, as the default starting point, it becomes a critical communication tool in the ongoing management of the portfolio, including tactical asset allocation tilts or even major changes to the strategy, expressed through changes to the policy benchmark.

While performance evaluation is the most traditional and common purpose for a policy benchmark, we believe that a policy benchmark can and should play a significantly more integral role as a tool to help define and manage investment strategy on a day-to-day basis.

Best Practice #2: Make the total policy portfolio benchmark the centerpiece of your comprehensive benchmarking framework. The total portfolio policy benchmark has the most practical time frame, is fully related to market forces, and is appropriate as a day-to-day reference point for the portfolio.

Designing a Total Portfolio Policy Benchmark

There is no single right answer on how to design a total portfolio policy benchmark, only a series of choices with associated tradeoffs.

Over the last decade, as part of the trend to eschew a focus on benchmarking, a range of approaches has emerged, including a return to very simple broad reference points (mix of stocks/bonds), a shift to the use of broad economic factors (growth, inflation sensitive, etc.), as well as a continuation in the use of a “traditional” benchmarking approach that selects benchmarks based on asset classes. As part of this growing menu of options, the investment community has expended significant time debating the pros and cons of each, and trying to determine which is the best approach. Our view is that any could be the appropriate approach for your portfolio—which one is most appropriate depends entirely on your investment strategy.

In simple terms, the policy benchmark should be a direct expression of the “default” portfolio positioning. One helpful analogy is to think of the policy benchmark as the equivalent of a “five-year business plan” that represents the agreed-upon plan to execute the desired strategy. Different investment philosophies or approaches might yield different policy benchmarks, but each would be appropriate and directly linked to the chosen investment strategy.

As a result, it is best to develop the benchmark in conjunction with the investment strategy work that occurs at the start of an investment program, and to conduct reviews in conjunction with periodic strategy reviews.

Questions to ask to create/assess the link between the benchmark and the investment strategy include:

- Does the benchmark reflect the investment approach? Are you following a traditional capital allocation asset class–based strategy, a factor-based investment approach, or an unconstrained “go-anywhere” approach?

- Does the benchmark reflect what was modeled in the expected risk/return and stress-testing modeling done during strategic asset allocation discussions?

- Does the benchmark reflect a default portfolio against which decisions can be discussed, measured, and evaluated? Would you “buy” the policy benchmark?

- What are your expectations of the time frame of evaluation for your chosen benchmark? If it’s long term (a 25+ year benchmark), what will you use for next quarter’s discussion?

- What are the expectations for the tracking error (ongoing deviations) relative to the selected benchmark? How will you evaluate decisions over the short- and intermediate- term if the selected benchmark is expected to have large deviations from actual results?

Best Practice #3: Develop the policy benchmark in conjunction with your portfolio’s investment strategy so that the two are directly linked from the outset. The policy benchmark can be thought of as the five-year business plan for the portfolio, and as such, memorializes the investment strategy as agreed upon with the investment committee, advisor, etc.

Broad or Detailed?

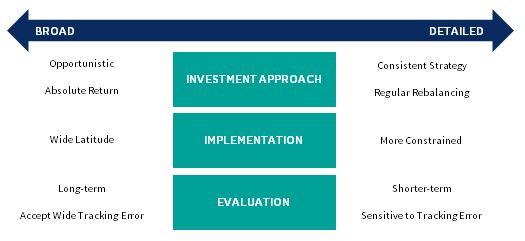

How broad or detailed your policy benchmark should be is a function of three key factors: your overall investment approach; how much latitude you, your staff, advisor, or outsourced CIO will have in implementation; and the time frame over which you are comfortable evaluating portfolio performance, as shown in Figure 3.

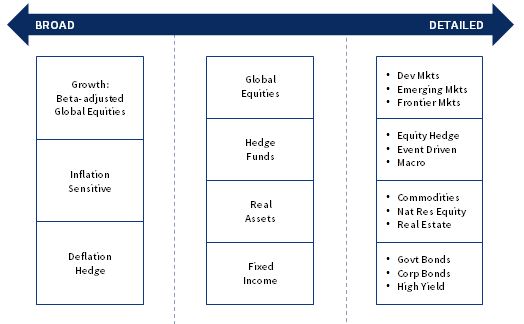

Because the policy benchmark should be driven by your investment strategy and philosophy, it could reflect only a few broad categories or be highly detailed, down to even, perhaps, the sector or strategy level. In Figure 4 we depict conceptually the spectrum of approaches, from a simpler factor-type benchmark on the left to more detailed strategy benchmarks for sub–asset classes on the right.

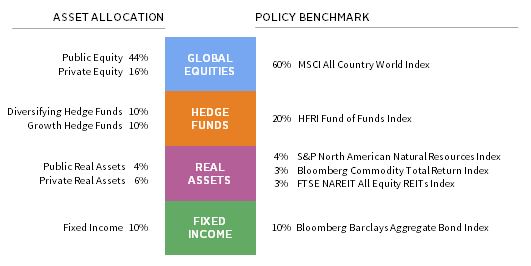

We suspect that the middle option will resonate with many investors as it is appropriate for a capital asset allocation model of investing, an investment philosophy that underpins many portfolios, and offers a reasonable number of categories to evaluate while providing some flexibility in implementation. Taking this option forward, in Figure 5 we show how this approach could translate into a policy benchmark.

On the left-hand side is the policy strategic asset allocation—the default asset allocation targets memorialized in the Investment Policy Statement. These represent what was modeled during the investment strategy discussions to determine the long-term risk/return profile of the portfolio, and are categorized into broad groups.

On the right-hand side is the proposed policy benchmark, which reflects the intended investment strategy, has six categories, and uses widely available and well-defined indexes for comparison across each category. It is simple, understandable, and practical for comparison to actual portfolio performance.

We expect some readers are now saying, “I don’t like that approach, that’s not what I use!”; “I don’t like those asset class categories!”; “I don’t like that index for that asset class!”; “HFR indexes are not investable!”… and the list of protests could go on.

Gladly, we agree. There is no single right answer in benchmarking, only a series of choices, each with associated tradeoffs. To illustrate this issue further, in the sidebar we review hedge funds as an example, outlining choices and associated tradeoffs in selecting a benchmark for hedge funds.

We propose the example in Figure 5 as an appropriate starting solution for many (perhaps most) investors following a traditional asset allocation approach. The exact categories and indexes should, of course, be customized to reflect the specific strategy and preferences of the investor. Overall, wherever you fall on the spectrum, we advise selecting a policy benchmark that reflects your default positioning for the long term.

Case Study: Hedge Fund Benchmarking

Ideally, an asset class benchmark should represent a passive investment in the broad opportunity set defined by that asset class. Unfortunately, this does not exist for hedge funds—which are really a collection of different strategies rather than an asset class—leaving investors to select from a menu of imperfect choices.

Broad Universe: One alternative is to find an index that represents the broad universe of managers, even if it’s not passively investable. Several index providers gather data from hedge fund managers and aggregate their performance into an index that is intended to reflect their overall performance. Options include the HFRI Fund-of-Funds Index and the Credit Suisse Hedge Fund Index, among others. Any of these indexes can be reasonable reference points, but all have some downsides, including various layers of fees included in performance and unknown details regarding the types of underlying hedge funds and their weighting in the index.

Specific Strategies: Another option is to use indexes for particular types of hedge fund strategies, essentially creating custom mixes of long/short, macro, event-driven, etc., fund manager indexes to get something closer to one’s intended hedge fund strategy allocations. This is also a reasonable approach, but also suffers some drawbacks. Beyond those highlighted above, strategy indexes often include a narrow set of managers, and managers may have strategies that are difficult to categorize so narrowly and/or shift over time.

Risk Equivalent: Other alternatives include defining a risk proxy that represents the intended risk profile or factor exposure of the allocation (e.g., 0.3 beta-adjusted ACWI as an example of a single factor approach). Another even simpler approach focuses on sources of capital used to fund the hedge fund allocation (e.g., 50% equities + 50% bonds). These have the benefits of being much simpler and are passively investable for a very low cost. However, they also have drawbacks in that they are quite different from the underlying exposures of actual hedge funds and are expected to have very significant tracking error. For example, while a benchmark of 0.3 beta to ACWI (global equities) approximates the risk profile expected from many hedge fund portfolios, one of the primary reasons investors are allocating to hedge funds is to be uncorrelated to equities. Why then create an equity-oriented benchmark?

These three choices represent some of the most common approaches used in benchmarking hedge funds, but there are others as well, each with their own benefits and challenges. Investors should consider the tradeoffs carefully and select an alternative most appropriate for what they would like to measure, and the construction of their portfolio. We propose that broad hedge fund indexes, like the HFRI Fund-of-Funds Index and other equivalents, represent a straightforward option that is common across the industry, is linked to the intended actual exposure, and can serve as a good starting point for many investors.

Best Practice #4: Design a policy benchmark by following the approach you modeled during investment strategy, seek a reasonable number of categories (which typically number no more than six), and select straight-forward, well-defined indexes or manager universes for each category. Monitor and adjust as appropriate.

What About Benchmarking Private Investments?

See Jill Shaw et al., “A Framework for Benchmarking Private Investments,” Cambridge Associates Research Report, 2014.

Astute readers will note that Figure 5 does not appear to incorporate private investments in the policy benchmark. Private investments (buyouts, venture capital, private credit, private real estate, etc.) are categories for which passively investable benchmarks are not available, and even performance reporting is downright challenging. This is a highly complex corner of any portfolio—indeed, we dedicated an entire research paper to the topic of best practices for private investment benchmarking in 2014.

What we will focus on here is how to incorporate private investments in the total portfolio policy benchmark. We recommend benchmarking private investments to public market indexes (e.g., a global equity index) in the total portfolio benchmark.

The rationale for our recommendation is rooted in the belief that although private investment performance measurement and benchmarking can be complex, the approach employed at the total portfolio level should be simple. Using public market proxies for private investments is a simple, practical, and appropriate solution for the total portfolio policy benchmark, when coupled with a more nuanced and complex analysis specifically focused on private investment performance elsewhere.

The primary complexity arises from the fact that returns in total portfolio performance reports are typically expressed as time-weighted returns (e.g., the performance of a dollar invested over time) while the performance of private investments is typically measured in money-weighted returns (effectively, the performance of specific cash flows over time, including additions and distributions). These two types of returns are fundamentally different, which complicates the ability to reflect the performance of private investments in a total portfolio report. It is particularly difficult to translate performance of manager universe medians, which might be used as the asset class benchmark, from money-weighted to time-weighted returns. Additionally, because private investment allocations require years to build, shifting slowly as commitments are made, the actual allocation rarely matches the policy target to private investments.

Shifting to using a public market proxy can address some of these difficulties. Continuing with our example policy benchmark in Figure 5, the MSCI All Country World Index (ACWI) is used as the benchmark for global equities, both public equity and private equity (including buyouts and venture capital).

The public index represents the opportunity cost and benchmark for the source of funding for private equity, is available in time-weighted methodology, and can be easily included in the total portfolio benchmark. Use of a public benchmark can also help to address the dynamic nature of the private investment allocation. From a benchmarking perspective, if the public and private equity allocations are both benchmarked to MSCI ACWI, the index represents the aggregate allocation across both and does not need to be adjusted due to any under/overweight of the actual private investment exposure. Any underweight in private equity (in the actual portfolio) would likely be invested in public equities while the capital awaits deployment, and the broad MSCI ACWI benchmark applies to the entire package regardless of which sub-category is under/overweight currently. This example focuses on private equity, but can be extended to other sub-categories such as private energy, private real estate, etc., using a similar public market equivalent approach.

Critics might focus on the fact that public investments are not equivalent to private investments. Investors allocate to private investments, and lock up their capital for ten or more years for a reason—to increase returns above public investments. Benchmarks of private managers or adding premiums on top of the public indexes might be more appropriate, some suggest. These alternatives are problematic within the context of the policy benchmark. Using private investment manager universes is not appropriate for time-weighted return calculation methodologies, while adding a premium introduces non-market forces that distort comparison—a premium is always positive and has no volatility. As a result, while certainly imperfect, using public indexes as the point of comparison for private investments in the policy benchmark is a simple and straightforward solution from a menu of difficult choices.

Of course, this is just at the policy/total portfolio level. It is appropriate and necessary to conduct a more detailed analysis specifically focused on private investments, using the appropriate money-weighted returns and other metrics (internal rates of return, multiples, public market equivalents, etc.) to measure performance versus the required illiquidity premium. But this should be done distinctly from the total portfolio benchmark context.

Best Practice #5: Benchmark private investments to public market indexes for evaluating total portfolio performance. Avoid adding premiums to public indexes or using private investment manager universes in the total portfolio benchmark. Couple this with specialized evaluation of private investment exposure, which can employ a variety of methodologies unique to measuring performance of these assets.

Conclusion

While policy benchmarking is a complex subject, it is a critical component of building and managing a successful investment program. We conclude with a summary of benchmarking best practices for use as a reference when developing your own benchmarking approach.

Benchmarking Best Practices

- #1 Establish a comprehensive framework with multiple reference points applicable over various time horizons.

- #2 Focus on the policy benchmark as your primary reference point.

- #3 Link your policy benchmark directly to your investment strategy.

- #4 Design your policy benchmark to match intended default positioning, keep it to 5 or 6 categories, and use straightforward, well-defined indexes.

- #5 Assess the performance of your private investment allocation within the total portfolio policy benchmark on a public market equivalent basis, and shift detailed evaluation of private investment exposure to a specifically designed private investment performance report.

André Abrantes, Managing Director