The Foundation of Good Governance for Family Impact Investors: Removing Obstacles and Charting a Path to Action

Before incorporating impact investments into their portfolios, we encourage families to define the overall context for their impact investments. Our contextual framework—focused on purpose, priorities, and principles—establishes the base of impact strategy and guides the development of governance structures. These elements will help ensure that family values and decision-making processes are advantages rather than obstacles in pursuing impact investing goals and objectives.

Family offices and family foundations are among those leading the movement to integrate values and investment strategy through impact investing. 1 Families pursue impact investing for a variety of reasons, ranging from alignment with personal values and philanthropic goals to risk mitigation and long-term outperformance to a desire to influence broader social and environmental challenges facing society.

Impact investing can also be a means to engage younger family members in the broader philanthropic and investment activities of a family and ensure continuity in the stewardship of assets across generations. We have seen increased interest in impact investing among “Next Gen” and millennial investors, and previous generations are not turning a blind eye to impact efforts either. A 2015 survey by US Trust Bank of America Private Wealth Management found that one in three high net worth investors either owns or is interested in owning impact strategies, and 85% of millennial investors believe social impact is important to investment decisions. 2

Yet the aspiration to pursue impact investments can and often does run into challenges. Expecting all members of a family to share the same values and goals is often unrealistic; some compromise may be needed to help the family unite behind a shared focus for its impact investments. Working through differences and having conversations about values and goals can help ensure the broadest possible buy in, more unified decision making, and ultimately a more effective and satisfying investment experience.

In this paper, we outline a framework to help families set the context for their impact investments, highlight several governance approaches that families can consider when integrating impact strategies into their investment portfolio, and offer a variety of implementation models a family might use for impact investments.

Defining a Contextual Framework for Impact Investing

Once the decision has been made to pursue impact investing, families will benefit from spending some time defining three pillars of strategy that will underlie their impact investments: purpose, priorities, and principles. Each family is different, but all families will benefit from unified decisions regarding values and goals.

An early focus on purpose is important: family members need to understand their personal motivations and objectives for pursuing impact investments. Lack of immediate consensus among family members can be expected, making open discussions that allow all stakeholders a voice critical. Education around impact investing is important and can get families to a common understanding of what they are embarking upon, making it easier to ultimately articulate values, shape strategy, and drive discussion forward. Family office staff and external advisors can facilitate education and communication, and help achieve consensus where there are areas of disagreement. The goal of these conversations is to define the core values driving the family’s movement toward impact investing. The end result is a defining statement of purpose for the impact investing program that can incorporate both financial and return objectives, as well as specific impact goals.

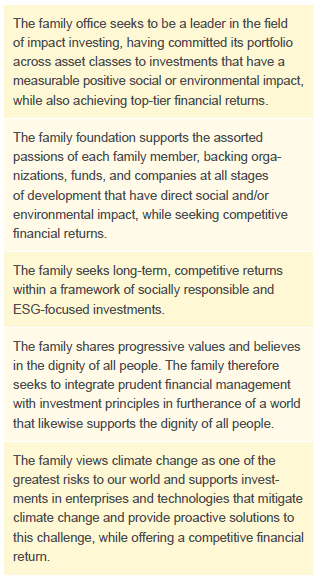

Sample Statements of Purpose

As the impact investing landscape has grown, so too have the opportunities for impact investment on a global scale. Families should determine where their passions lie across different impact themes and sectors (e.g., the environment, financial inclusion, education) as well as regions (ranging from a narrow community focus to a more global view that includes both developed and developing regions). By articulating the family’s impact investment priorities, the family can link its broad motivations and objectives to investment themes and then specific investment opportunities to address these themes.

Family members might have existing expertise they can bring to bear in addressing particular issues, and/or might already be engaged with certain causes by way of chosen career fields or personal philanthropic gifts. Any impact investment should be considered in tandem with a family’s broader philanthropic activities and ideally will complement—perhaps even enhance—any prior or existing efforts on the part of the family to address specific social or environmental issues. For example, a family that provides gifts to support education programs might complement these efforts with direct investments in early-stage education technology companies. In this case, supporting education is a priority for the family within the wide-ranging universe of impact themes. A qualitative and quantitative assessment of a family’s existing impact activities can be extremely valuable in helping define a family’s priorities.

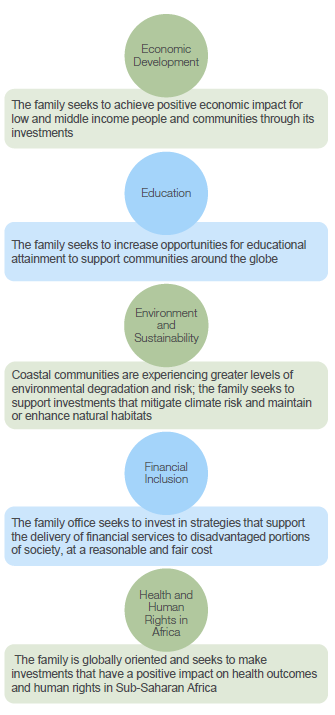

Sample Impact Investment Priorities

Finally, the family needs to articulate the principles that will ensure alignment and inform all investment decisions. Defining impact principles ensures that the purpose and priorities just described are well integrated with the family’s existing investment criteria. For example, a principle could be that the family will not sacrifice returns in its pursuit of impact investments. In most instances, the principles expand and/or clarify the list of key decision criteria for family members as they assess investment opportunities. The principles ultimately help guide the implementation of the impact investing program.

In developing all three pillars of strategy for setting the contextual approach for impact (purpose, priorities, principles), we encourage families to seek the counsel of others with impact investing experience. Impact investing is an emerging field with a growing number of implementation models and investment options. Impact-minded families can learn from each other—engaging in peer networks, forums, and conferences to understand how other families are approaching impact investing in their portfolios can be extremely valuable. Similarly, many families choose to work with an external investment advisor with expertise in impact investing. Both of these resources can be helpful as the family reflects on its values and objectives and formalizes them through the purpose, priorities, and principles framework.

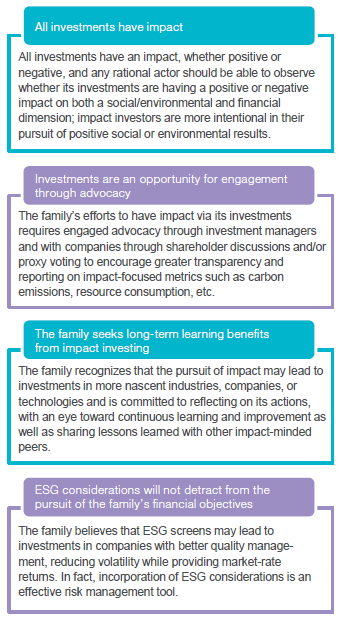

Sample Impact Principles

Creating a Governance Structure

Once a family has reached agreement regarding purpose, priorities, and principles, family members can turn to the task of creating a governance structure or adjusting existing governance structures to incorporate impact considerations. Governance is a structure that provides a roadmap for effective decision making. There is no one solution for all families and we have seen many different governance approaches implemented successfully.

Thinking about governance of the entire portfolio broadly, families should start by asking themselves four key questions when establishing a new or reassessing an existing governance approach. These include:

- Who are our stakeholders (e.g., multiple generations of family members, family office staff, external investment advisors, impact constituents, other)?

- What are the appropriate roles and responsibilities of each stakeholder? What expertise or experience is needed (skilled board member, in-house or external impact expert)?

- Does the current governance structure (if applicable) enable effective decision making on investments, managers, philanthropy, etc.? Does the current structure enable or inhibit the pursuit of impact investments?

- Has the family established an efficient communication process—meetings or otherwise—by which family members are informed of performance, impact, or other considerations, and have an opportunity to be heard?

From there, the family can determine which governance approach might best serve its needs. For example, families can choose to designate and empower an individual decision maker or to engage in a committee process where each family member has an equal vote. There are pros and cons to each approach and many approaches that lie in between. Below we highlight four different governance models and some potential challenges and benefits to each.

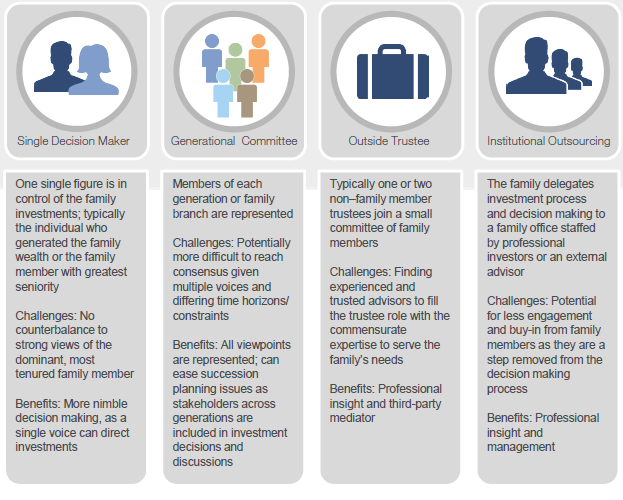

Governance Structure: Four Models

These models apply broadly to overall family investment portfolio governance and are structures that can accommodate and support an impact investing program. A family may choose to have a separate and different governance model for its impact program than what is employed for the broader portfolio. For example, a family that governs its portfolio via a generational committee may want to designate a single decision maker when it comes to the family’s impact investments. While this may allow for timely decision making and accountability for specific impact investments, it can also lead to potential conflicts regarding the integration of impact investments with the rest of the portfolio. Again, this is an area where external advisors can help guide discussions and tease out what makes sense for the family given its unique objectives. Ultimately, having open communication channels and an understanding of goals and objectives at the outset will ensure that the family employs the best approach for its given situation.

Another approach is to establish an impact “champion” or even an impact sub-committee within the family, someone or a small group of family members who can integrate into the existing governance approach. Those designated for this type of role should care deeply about impact investments and will liaise with other family members and stakeholders to ensure effective communication and implementation of the family’s impact portfolio. Often, this is a good role for family members who are increasingly involved in the stewardship of the family’s assets (i.e., Next Gen family members).

One challenge of the impact champion approach comes when other family members are not as aligned with the direction of the impact program and feel that their perspectives are not being adequately represented. It is essential for those most engaged with the impact program to update and inform other family members of objectives and metrics so all stakeholders remain involved and supportive. The decision-making authority, or lack thereof, of the impact champion should be clearly defined to ensure he or she is operating effectively within the family’s governance framework. Some families go as far as to have the impact champion act akin to the single decision maker model, while others opt to have that person serve as the key advocate and voice for impact within one of the other structures. Regardless of the approach used, the role should be well defined.

Overall, an effective governance structure helps a family develop consensus on a variety of issues, including an impact investing program. A clear decision-making process that is well aligned with the family’s objectives and values ensures long-term success.

Taking Action: Implementation

With the pillars of strategy and a governance structure in place, a family may be ready to take more actionable steps toward making its first impact investment. Pulling together the elements of purpose, priorities, principles, and governance/decision making into an investment policy statement can be a valuable first exercise. Drafting this document together can ensure family members are truly on the same page and provide transparency to other stakeholders.

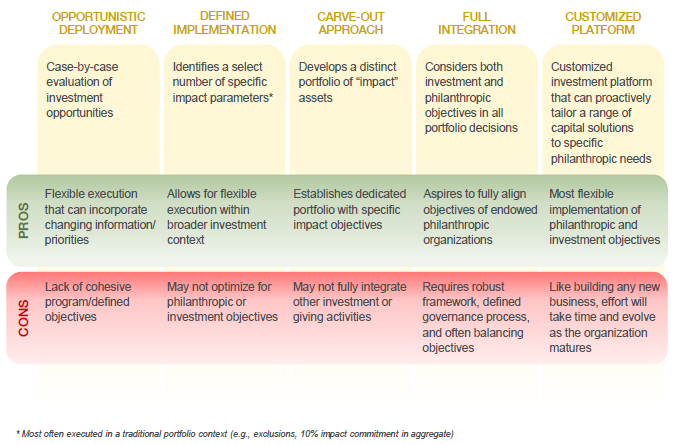

Regarding implementation, impact investors can choose from a variety of strategies. There is no “one size fits all” approach, but below we discuss key considerations for select methods of implementation.

- In opportunistic deployment, the family makes a case by case evaluation of impact investment opportunities. This more flexible execution can allow for changing priorities but often lacks cohesion. This implementation approach can work well with existing governance and decision-making structures in that each investment can be reviewed and approved under the current decision-making framework. A potential challenge of this approach, however, is how to assess each impact-oriented investment against non-impact investments where the criteria for evaluating success may be very different.

- With defined implementation, a family determines a specific set of impact parameters, often executed within the traditional, non-impact portfolio of investments. For example, the family might establish a specific target to impact commitments, in aggregate, for the portfolio (e.g., 10% target) or use exclusionary screens to avoid objectionable exposures (e.g., restrict fossil fuel investments from the portfolio). This approach can be relatively easy to implement within a family’s existing governance structure once the parameters are set. While this approach offers flexibility, it may not optimize for broader philanthropic and/or investment objectives.

- With a carve-out approach, the family develops a distinct portfolio of impact investments. Under this approach, a separate impact governance structure might be preferred, as the investments are evaluated separately from the rest of the portfolio and can be held to their own separate decision-making structure. However, the dedicated impact portfolio may not fully integrate with other family investments.

- In full integration, impact investments and attendant considerations are part of the total portfolio approach to investments, an approach that aspires for full alignment with ESG principles. A fully integrated implementation plan might be best served within the existing governance structure, with few modifications, or it may require a complete overhaul of the governance structure given the different nature of an impact portfolio. One potential challenge lies in sourcing investments across all asset classes; for example, there have historically been fewer ESG/impact-oriented hedge funds available for investment, making it difficult for investors to construct portfolios with that specific exposure. With full integration, the family has to decide whether it is more important to be fully compliant with impact parameters or to have a broader range of investment options.

- With a customized platform, families tailor a range of capital solutions to meet their entire spectrum of philanthropic needs. For example, the family might seek to integrate a private family foundation with a limited liability company that invests in for-profit entities into one cohesive philanthropic platform—the Omidyar Network 3 offers a good example of this approach. This model offers the most flexibility and creativity in implementation but does require extensive costs to build a new business model and likely requires a more bespoke governance approach.

Implementation Options

Conclusion

Families are at the vanguard of impact investing—challenging conventional philanthropic models, embracing flexible capital, and increasing the integration of their values and investments. The purpose, priorities, principles framework we articulate in this paper can help families embark on their impact investing program with increased rigor and structure to better enable success.

Using the process we have outlined, families can create an actionable entry point for impact investing while also remaining open to further refinement of their processes and decision making. Implementing the first impact investment—perhaps starting with an investment that complements existing philanthropic activities or leverages existing networks—will allow the family to assess its process and outcome, benefit from lessons learned, and refine the impact portfolio objectives and structures accordingly over time.

All families evolve, as do investment opportunities. Ensuring both continuity and new perspectives is important. We therefore encourage families to periodically revisit their purpose, priorities, and principles as well as their governance structures to ensure continued alignment with the values and realities of the family. Strong communication, clear decision making, and a unified, long-term perspective will ensure that the family can effectively meet its impact objectives.

Erin Harkless, Senior Investment Director

Rebecca Carland, Investment Director

Footnotes

- Impact investing typically refers to investments through which capital is allocated to market-based solutions to social and environmental challenges. Impact investing is one leg of broader social investing, which also includes exclusionary screens and environmental, social, and governance (ESG) integration. We find families are most interested in impact investing, and hence use this term throughout the paper, while recognizing that families may use any of the approaches to social investing.

- US Trust Bank of America Private Wealth Management, US Trust Insights on Wealth and Worth Survey (2015), 31-32. Available at http://www.ustrust.com/publish/content/application/pdf/GWMOL/USTp_ARTNTGDB_2016-05.pdf. Millennials are defined as those ages 18-34.

- https://www.omidyar.com/