Hospitals Seek Liquidity to Get Through Crisis

Before the novel coronavirus (COVID-19) most hospitals generated liquidity from their operating model. As we have discussed in earlier posts, the pandemic has inflicted significant stress upon the operational and financial situations of nonprofit healthcare systems. The crisis has increased costs and reduced profitable procedures that subsidized hospital enterprises and their capital needs. In Cambridge Associates’ May 2020 survey of 27 hospital systems, we learned that COVID-19 has driven hospitals to search for liquidity from multiple sources, including, for some, the investment portfolio. The degree of disruption and the view on its longevity vary amongst our respondents. The following highlights are excerpted from a more detailed study conducted for participating hospital systems.

Sources of Liquidity

Of the responding hospitals, 88% already had a line of credit (LOC) in place going into 2020 and nearly half of them have drawn on those lines this year. Of the three hospitals that did not have a LOC in place, one does not intend to turn to a LOC or debt for liquidity; one has issued new debt; and one has established a LOC during 2020.

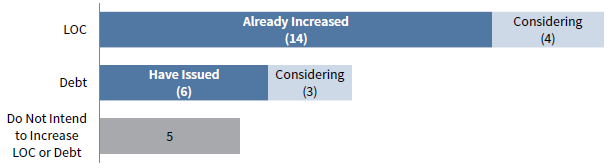

The LOC has been the most popular source of liquidity for the group. Most respondents (14) have increased their access to a LOC, and four more systems are considering increasing their LOC. Six hospital systems have already issued debt in 2020, and three more are considering issuing new debt. Only five respondents do not intend to increase their LOC or issue debt this year.

SOURCES OF LIQUIDITY

As of May 2020 • n=26

Source: Cambridge Associates LLC.

Notes: One institution did not provide information on sources of liquidity. Institutions were allowed to select more than one response.

The Role of the Investment Portfolio

In 2020, we are seeing more hospital systems relying on the long-term investment portfolio as a source of liquidity. Ten respondents (38%) reported that they are spending from the portfolio this year, with seven of them reporting that the spending is in response to the COVID-19 crisis. Only three respondents had originally budgeted to spend from the portfolio.

Only one institution in our study reported that they have changed the target risk profile of the portfolio. Nearly 60% of the participants have rebalanced their policy since mid-February, indicating that the majority of hospitals are sticking to long-term policy targets despite the near-term enterprise disruptions.

Looking Ahead

Eighty-four percent of the hospitals surveyed are planning for a resumption of elective procedures within the next three months. The remainder expect to resume elective procedures in three to six months. This group includes hospitals in New York, Massachusetts, and Minnesota. The resumption of revenue-generating activities will be key to stabilizing hospital cash flows and balance sheets. ■

Tracy Abedon Filosa, Head of CA Institute

William Prout, Senior Investment Director, CA Institute

Tracy Filosa - Tracy is a Managing Director and Head of CA Institute.