An Investment Perspective on Healthcare System Mergers

Merger & Acquisition Activity and Implications for Long-Term Investment Pools

During the past decade, nonprofit healthcare providers have undergone a wave of accelerating consolidation. The trend toward mergers and acquisitions (M&A) has been driven by growing capital intensity of the healthcare industry, significant benefits of scale negotiation with payers and vendors, operational synergies, and technological demands. We believe this trend will persist, as smaller systems are compelled to align or merge with larger systems, and larger systems contemplate “mega M&A transactions” to expand their geographic footprint by forming large systems with expansive regional or intra-state coverage. Fiduciaries of systems during an M&A transaction should take a refreshed analysis of how the long-term investment pool (LTIP) is structured post-consolidation based upon the known financials of the combined entity.

LTIPs exist in most healthcare systems, representing the aggregation of free cash flow generated by the system, as well as endowed assets, but are kept distinct from healthcare systems’ working capital. Many LTIPs have increased through effective growth in margins and compounding of returns. The LTIP represents critical capital that the healthcare system can tap in future years for operational needs, capital improvements, debt support, and other needs for the enterprise.

We highlighted the importance of developing thoughtful risk/return profiles for LTIPs in prior publications, depending on objectives, risk tolerance, financial strength, and other factors. But how should a profile change if an acquisition is underway? Because every transaction and system are unique, we offer key considerations that guide answers to that question. Integration risks that may arise when healthcare systems undertake M&A transactions must be evaluated carefully, not only operationally, but also in terms of the potential impact the transition may have on the structure of the LTIP and the role it plays in the combined entity. 1 To help specify how an M&A transaction might impact the structure of LTIPs, we offer two hypothetical scenarios later in this paper.

System Finances and LTIP Implications of an M&A Transaction

Given the importance of debt for healthcare systems, how the rating agencies assess an M&A transaction is crucial. Questions around the transaction that may impact agencies’ analyses include:

- Is there a cash outflow or inflow to the LTIP from the acquisition?

- What is the track record of the management team in mergers?

- Are there sizable unfunded pension liabilities?

- Will the combined entity fully consolidate balance sheets and income statements or keep them separate; and will there be separate governing bodies?

In some instances, the target entity retains authority on how to invest its specific LTIP and manage its specific income statement. This is all dependent upon the terms of the transaction. Ratings agencies sometimes view consolidation of governance and assets as offering stronger decision making, efficiencies, and scale. However, each system has a different perspective on the best solution and timing around any consolidation.

Some mergers have caused the acquirer to issue taxable debt to enhance days cash on hand (DCOH) 2 and other key metrics supporting debt ratings. At the same time, an acquisition may require the acquirer to expand working capital funds kept outside of the LTIP. There are many operational variables that dictate how successful an acquisition will be in fulfilling the expected financial strength of the new combined entity.

To distill the impact of a transaction on the combined LTIP, a thorough understanding of the acquired system is needed.

- What are the key financial metrics of the target entity and how large is the system relative to the acquirer? (i.e., margins, days cash, market share, debt and related covenants, and any contingent debt such as swaps)

- How do these financials compare to the acquirer?

- What are the long-term goals of the combined entity related to capital plans, future growth and/or acquisitions, borrowing needs, margin expectations?

Although the long-term prospects for the combined entity post-merger may be strong, it may be prudent to reduce risk in the acquirer’s LTIP if the financials of the target entity are weak. This would be most relevant in a merger of similarly sized entities. At the same time, if the financials of both systems are roughly the same, no change may be needed. If the financials of the target entity are stronger, greater risk could be taken in the LTIP to seek stronger returns. Therefore, differing sizes of the merging entities, as well as the financial strength of each entity impact the risk/return profile of the LTIP.

Re-evaluating the LTIP Post-Transaction

Once a holistic financial view of the integrated entity has been assessed, those overseeing the LTIP should estimate how quickly a net benefit will be expected from this combined entity if it is consolidating LTIPs. Projected net inflows/outflows into the LTIP post-merger, as well as broader enterprise considerations, will likely necessitate a re-evaluation of the LTIP’s investment strategy, including appropriateness of the strategic asset allocation and liquidity needs. Also, the portfolio should be evaluated to determine if return seeking/illiquid holdings should be added or if it’s more effective to de-risk and hold greater positions in fixed income or hedge funds to moderate return and volatility. In the current environment, return prospects are slim for LTIPs heavily weighted in defensive fixed income with moderate yields. We observe that the larger LTIPs (AUM more than $1 billion) during the past five years have added exposure to equities, both public and private, while reducing exposure to lower-returning fixed income and hedge funds. If systems can add illiquid holdings without impairing their debt ratings, they have often also expanded their targets in private investments across asset classes. We expect that trend will continue absent worsening financial situations.

These concepts may seem highly theoretical. Therefore, we offer two hypothetical scenarios to show specificity around how this might work in the real world.

Hypothetical Scenario 1: Two Large Systems Merge Where One Is Stronger Than the Other

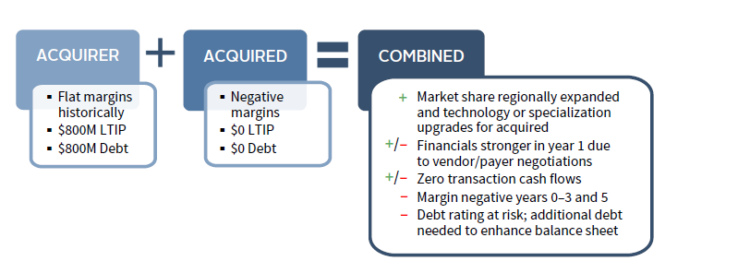

What would happen to the LTIP if a large system with moderate financials acquired an equally large, financially distressed system within its region? Although the transaction might provide benefits in terms of expanding regional market share and operating synergies (due to beneficial vendor/payor improved terms), the combined entity may have weaker combined financial metrics, at least in the initial years after the merger (Figure 1). In this case, the target entity likely has few assets accumulated in its LTIP, given it has operated with negative margins for years. The acquirer LTIP in this scenario may need strong liquidity ratios and moderate volatility to support debt. Therefore, lower allocations to private investments and hedge funds may be warranted. At the same time, the LTIP positioning may require a more modest risk/return profile to maintain DCOH. As a result, this transaction may require the acquirer’s LTIP to increase its fixed income position to moderate volatility. In this scenario, it is likely that few, if any, board members or managers of the acquired system will sit on the Board of the new combined entity.

FIGURE 1 TWO LARGE SYSTEMS MERGE; ONE IS STRONGER THAN THE OTHER

Source: Cambridge Associates LLC.

Hypothetical Scenario 2: Two Financially Strong Systems of Different Sizes Merge

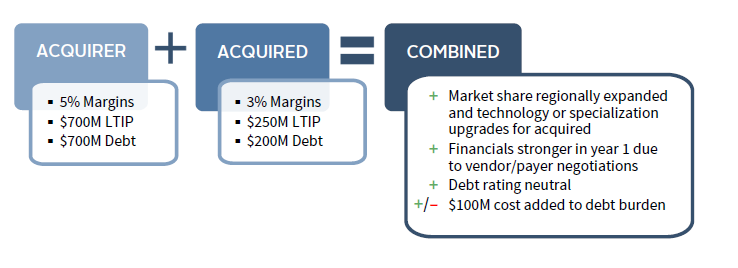

Another scenario is the acquisition by a large system of a similar rated, yet smaller system within its region that has financial metrics similar to the acquirer. Because the target system has cash flows that have contributed to their own LTIP, the new combined entity emerges from the transaction financially healthy. It is usually beneficial to combine the LTIPs to reduce oversight costs on the combined, larger LTIP. Benefits from combining in LTIP include adding exposure to higher returning illiquid strategies and ensuring growth sizing is appropriate with corresponding volatility (Figure 2). The expectation is that growth in market share, as well as synergies and scale, will benefit the new combined entity. It will be reasonable in this scenario to expect some Board members to join the combined entity Board but with minority voting power. In this case, the LTIP may lean into risk with the expectation that financial metrics will improve. A larger portion of the portfolio may hold growth assets, both liquid and illiquid private partnerships. The expectation of additional debt will need to be considered, which might mitigate this higher growth positioning.

FIGURE 2 TWO FINANCIALLY STRONG SYSTEMS OF DIFFERENT SIZES MERGE

Conclusion

Every M&A transaction is unique, and every healthcare system has specific strengths and weaknesses financially. When systems combine, the new entity created will have new financial health metrics. A fresh review of how a transaction will impact the newly combined LTIP is crucial. Transactions are undertaken for thoughtful and additive financial reasons to the enterprise in the long term. It is important to re-underwrite how the LTIP is structured post-consolidation based upon the known financials of the combined entity. The portfolio is a strategic component in the process. The industry continues to evolve, and Cambridge Associates stands alongside our clients navigating this complex environment.

Bridget Sproles, Managing Director

Jeff Blazek, Head of Healthcare Practice

Hamilton Lee, Managing Director

Footnotes

- Nonprofit healthcare providers may call a transaction a membership substitution, merger, or acquisition. For the purposes of this paper, we will simplistically call it a merger.

- Days Cash on Hand (DCOH) is calculated by dividing unrestricted cash and investments by the system’s average daily cost of operations (excluding depreciation).