Healthcare Systems Describe Mounting Pressures & Investment Remedies: 2019 Survey Results

In “Mission Critical: Maximizing the Impact of Hospital Investments” we discussed how generally favorable conditions over the last decade have enabled many health systems to accumulate sizable capital pools, and how the mounting pressures in the healthcare industry are expected to slow, or ultimately reverse, these capital accumulations. As a result, many hospitals will likely need to rely on spending from reserves to support operations. In March 2019, we surveyed our healthcare clients on this topic, and how this may be reflected in their investment portfolios. The results, which we detail in the following pages, confirmed our expectations.

Mounting Pressures

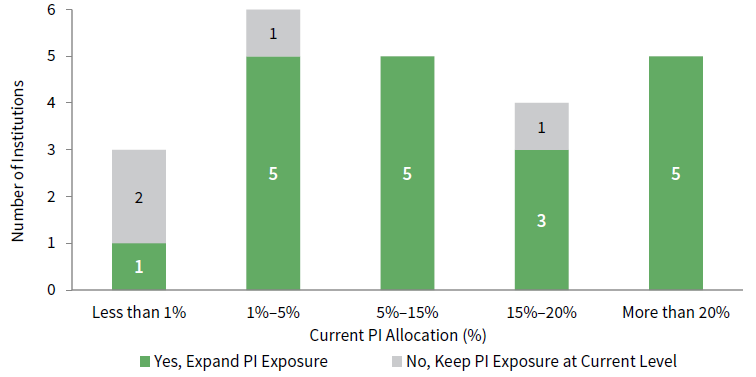

In the survey, 1 44% of respondents expressed concern that they will need to draw upon funds more rapidly than they have in the past. A striking 88% of respondents also indicated that they are somewhat or very concerned that their long-term investment pool will not generate sufficient returns in the coming few years.

HEALTHCARE SYSTEMS’ PRIMARY LONG-TERM INVESTMENT POOL PRESSURES

As of March 2019 • n=25

Source: Cambridge Associates LLC.

Clearly these two concerns are interrelated. In a time when the industry and investment environment are placing an added strain on available capital, the ability to optimize investment returns is becoming increasingly critical to the success of a healthcare mission.

Balancing Risk and Return

Two primary risk factors to consider when investing are the short-term risk of significant near-term losses and the long-term risk of failing to achieve sufficient returns over long periods of time. While certain types of health system assets are appropriately focused on the former, many systems can shift some assets to a long-term investment portfolio to address the latter risk.

One-third of survey respondents expressed concern that they may need to de-risk their investment program to respond to the changing healthcare landscape, however another one-third plan to take on more risk to respond to cash demands.

A comprehensive enterprise review is the first step to developing an optimized investment strategy that is aligned with an institution’s needs and mission. This review provides an in-depth understanding of how the hospital’s various pools work together to support the enterprise. It may also identify opportunities for hospitals to allocate assets across investment pools with different time horizons and objectives. The enterprise review considers the appropriate risk and liquidity profile for the long-term investment portfolio.

Building Private Investment Programs

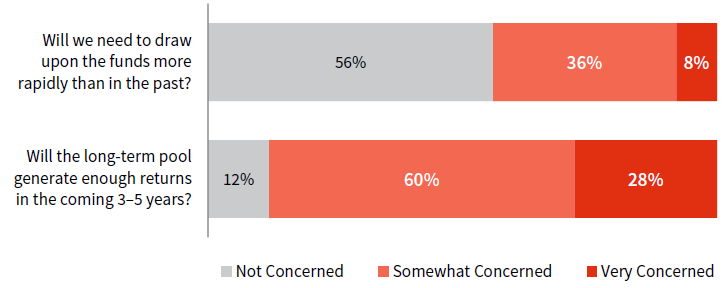

To help meet critical return targets in this more challenging environment, our survey revealed that most health systems plan to take on more illiquidity in the investment program. Survey data show that 84% of respondents are building and expanding their exposure to private investments.

Private investments, if implemented well, may generate a return premium above traditional public equities and, therefore, are an important tool for generating long-term higher returns overall. Cambridge Associates’ survey shows that health systems at various levels of private investment exposure plan to build on their existing program to expand private investments. Interestingly, even those institutions with more than 20% already allocated to private investments (approximately 20% of survey respondents) intend to add to their private investment exposure.

MAJORITY OF INSTITUTIONS ARE BUILDING OR EXPANDING THE LONG-TERM POOL’S EXPOSURE TO PRIVATE INVESTMENTS, REGARDLESS OF CURRENT ALLOCATION SIZE

As of March 2019 • n=25

Source: Cambridge Associates LLC.

Long-Term Financial Health

Hospitals and health systems are keenly aware of the mounting pressures in the industry, and recognize that a successful investment program is a critical component to long-term financial health. They also recognize that their operating conditions and investment opportunities will continue to evolve, which is why a customized investment strategy that is aligned with the enterprise will be essential to optimizing investment assets and achieving long-term goals. ■

Tracy Abedon Filosa, Managing Director

Meredith Wyse, Associate Investment Director