Advice in Brief

As economic growth slows and major central banks start to ease monetary policy anew, investors need to consider the options for governments and their respective investment consequences in the event this slowdown becomes a recession. With central banks running out of room to lower rates and use quantitative easing at a time that debt levels are high, use of coordinated monetary and fiscal policy—fiscal spending financed by debt monetization—seems inevitable in the next recession.

We look to the 1930s for some answers, understanding that intervening changes to the global financial system rule out an exact repeat of that period. Indeed, we are not calling for a severe, 1930s-style global recession, but rather it is useful to explore the similar policy constraints between then and now to understand where policymakers may head during the next recession.

Today, the risk of even moderate inflation is remote, but a recession could eventually set up conditions favoring a sustained period of elevated inflation in its aftermath if fiscal policy—aided by more-frequent debt monetization—is overused. The best plan forward is to use the next recessionary bear market as an opportunity to acquire select real assets when they go on sale due to economic stress.

WHAT RHYMES WITH THE 1930s? As economic growth slows, manufacturing contracts, and major central banks start to ease monetary policy anew, investors need to consider what policy options the world has left in the event this slowdown becomes a recession. Policy rates are approaching or have passed zero at a time in which many countries and regions have elevated levels of government debt. When these economies eventually head into a recession, what are the options for governments and what are their respective investment consequences?

In this edition of VantagePoint, we look to the 1930s for some answers, while realizing that intervening changes to the global financial system rule out an exact repeat of that period. Indeed, we are not calling for a severe, 1930s-style global recession, but it is useful to explore the similar policy constraints between then and now to understand where policymakers may head during the next recession. As we evaluate the period, we consider the useful aphorism (often attributed to Mark Twain): History doesn’t repeat itself, but it often rhymes.

Today, the risk of even moderate inflation is remote, but a recession could eventually set up conditions favoring a sustained period of elevated inflation in its aftermath. The prerequisites for such conditions are a recession in which monetary policy fails to produce the desired effect, followed by high levels of fiscal and monetary policy coordination—fiscal spending financed by debt monetization. Overuse of fiscal policy, aided by more frequent debt monetization, would boost the risk of eventual inflation. The best path forward is to use the next recessionary bear market (whenever it occurs) as an opportunity to acquire select real assets when they go on sale due to economic stress. Such investments, purchased at sufficiently discounted prices, should provide attractive returns even without inflation. In preparation, investors need to maintain adequate diversification to meet their obligations (e.g., spending, capital calls) and to finance opportunistic investments in real assets.

OVERVIEW OF TACTICAL CA HOUSE VIEWS

September 30, 2019

A Brief History of Policy Cycles

Fiscal and monetary policy regimes run in long cycles based on the ability of different policies to revive the economy. By the mid-1930s, economists increasingly viewed the global economy as stuck in a liquidity trap. As such, they turned to fiscal policy to stimulate growth and used various tactics to try to inflate debt away while pinning down short-term and long-term rates. Like today, short-term rates were pushed down to nearly zero and central bankers found the tools that had served their economies well for decades were no longer enough to revive demand. Following the aggressive policy response applied during and in the aftermath of the global financial crisis (GFC), major developed markets policymakers and central banks find themselves in a similar position to where they were in the 1930s; they have already engaged in some implicit monetary and fiscal policy coordination through quantitative easing (QE), yield curve control 1 , and forward guidance practices (e.g., price-level targeting 2 and commitments to maintain balance sheet size for “a considerable period”). And that is in the absence of a recession!

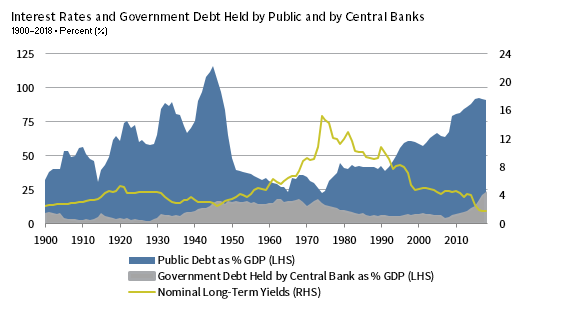

While economists disagree about the role of fiscal policy in ending the Great Depression, the scope and duration of fiscal policy were clearly insufficient until the large and sustained World War II–related stimulus. 3 Fiscal policy remained popular throughout the 1940s and early 1950s, with monetary policy only playing a supporting role in financing fiscal spending. These financing activities helped keep bond yields low in the face of soaring debt-to-GDP levels. During WWII, the US Federal Reserve’s main function was to execute Treasury decisions. The Fed monetized government spending by maintaining a cap on long-term Treasury bond rates of 2.5% and short-term rates of 0.375%, and by stepping in to buy bonds when rates approached these levels. Developed markets across the globe similarly used coordinated monetary and fiscal policy over the period. By the early 1950s, a healthier economy and an end to WWII led the way for central banks to begin reasserting their independence. However, dominant monetary policy didn’t return until after the high inflation of the 1970s, which also demanded truly independent central banks.

DEBT MONETIZATION WAS A CENTRAL FEATURE FROM 1930–50

Sources: Bank of England, International Monetary Fund, TS Lombard, and Thomson Reuters Datastream.

Notes: The “Public Debt as % GDP” series includes Australia, Canada, France, Germany, Italy, Japan, Korea, the United Kingdom, and the United States (i.e., the G20 advanced countries). “Public Debt” includes general government debt (debt from the central, state, and local governments), but excludes debt from public corporations and quasi corporations. The “Government Debt Held by Central Banks as % GDP” series data are based on the G20 advanced countries (excluding Korea) plus Belgium, Ireland, the Netherlands, Spain, and Sweden. The United States joins the series in 1916, the United Kingdom in 1920, Sweden in 1922, France in 1936, Canada in 1946, Australia and Germany in 1950, Ireland in 1959, and Spain in 1987. “Nominal Long-Term Yields” are UK Consols until 2016 and UK 30-Year Gilts thereafter.

A New Policy Regime

As in the 1930s, monetary policy today appears to be running out of room to deliver results when we enter the next recession; debt levels are similarly high, and economists and policymakers are again exploring creative means for stimulating economies in the event of a recession. Further, as was the case in the 1930s, income disparity has widened within many countries. The growing wedge in incomes has many causes, but one is that the aggressive monetary policy that helped us exit the GFC has disproportionately benefitted wealthy asset owners. Calls for income redistribution (largely through fiscal policy) are growing as political divisions widen. A consensus is building that come the next recession, fiscal intervention will have to do the heavy lifting and (like in the 1930s) the associated debt will be increasingly monetized. 4

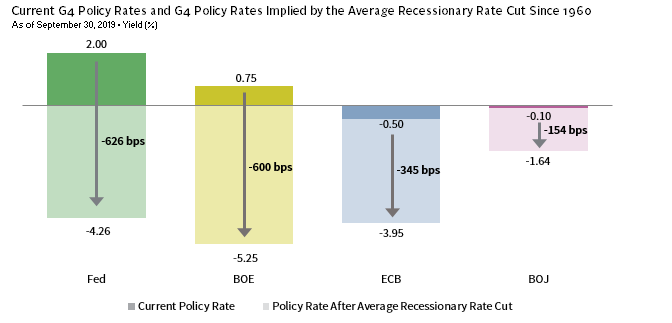

Running on Empty

Conventional monetary policy stimulation works through lower policy interest rates, which help boost demand by lowering the cost of borrowing. Given today’s low policy rates, if a recession were to occur in the near term and G4 central banks lowered rates by their average recessionary cuts since 1960, policy rates would become deeply negative. Such low rates are not feasible, as they would either decimate commercial bank profitability for those banks that don’t pass on negative rates to their retail customers’ deposit accounts (which has largely been the stance of European banks today) or would drive bank customers to prefer cash over deposits because the cost of deposits would outweigh the inconvenience and cost of holding currency. Once thought to be zero, the lower bound is now unclear but appears to be drawing near.

G4 CENTRAL BANKS LACK ROOM TO CUT RATES AT HISTORICAL RECESSIONARY LEVELS

Sources: Bank of England, Bank of Japan, Centre for Economic Policy Research (CEPR), Deutsche Bundesbank, Economic Cycle Research Institute (ECRI), European Central Bank, Federal Reserve, and Thomson Reuters Datastream.

Notes: Recessionary rate cut periods are determined based on the difference between the relative peak policy rate prior to, or during, a given recession and the relative low rate prior to the next significant tightening cycle. Recessionary periods are based on ECRI business cycle peak and trough dates. ECB recessions reflect ECRI business cycles for Germany, except for the 2011–13 recession, which uses CEPR business cycle dates for the Eurozone. ECB policy rates are based on the German deposit rate until December 1998 and the ECB deposit facility rate thereafter.

QE focuses directly on the quantity of money, but also relies on decreasing financing costs for consumers and corporations by lowering rates further out the yield curve and increasing equity prices. While the effectiveness of QE over the past decade is debatable, few would argue that a further expansion would be sufficient to stop a recession’s spread, given that rates are already quite low, yield curves are flat or inverted, and there’s not much left for central banks to buy in Japan and the Eurozone. In addition, all G4 central banks face structural, political, and legal constraints on QE expansion.

The Role of Fiscal Policy

A consensus is building that governments (especially those issuing debt in their own currencies) may have more fiscal space than had been thought feasible, and that austerity measures of the last decade have been misguided. Furthermore, fiscal policy has the potential to put money directly in the hands of households and corporations. In contrast, monetary policy lowers interest rates and uses commercial banks as intermediaries. However, fiscal policy has the disadvantage of increasing already high-debt loads, which could push up interest rates. It can take time to implement; and may still fail to boost economic growth if it is invested poorly or if fiscal spending (e.g., tax cuts) is largely saved rather than spent or invested. In short, fiscal policy can increase demand, but also poses risks, so proper implementation is critical.

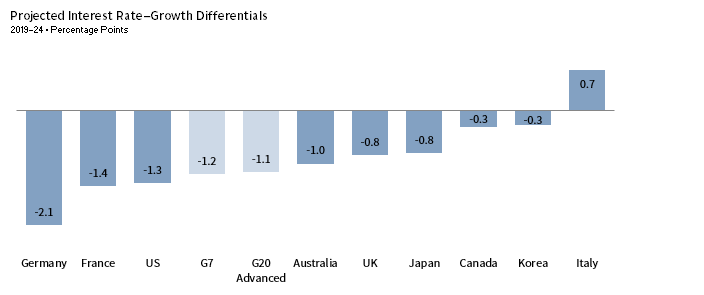

Such luminaries as former International Monetary Fund Chief Economist Olivier Blanchard, Ben Bernanke, and the Organisation for Economic Co-Operation and Development now accept that countries’ debt capacity may be greater than previously thought. Public debt may have little, or possibly no, fiscal cost if the interest rate on government debt stays below nominal GDP growth. This is the case for many countries today and has generally held true for most of recorded history. Further, Blanchard also goes on to suggest that if an economy enters a recession and policy rates hit the lower bound, then policymakers should increase the deficit as the relevant interest rate would be far below GDP growth. 5 With financing costs low, fiscal spending on investments in infrastructure, education, research and development, and other activities could offer a positive return on investment.

IMF SEES CONTINUED FISCAL SPACE AS PROJECTED GDP GROWTH EXCEEDS EXPECTED INTEREST RATES

Source: International Monetary Fund – Fiscal Monitor October 2019.

Note: The interest rate–growth differential is the effective interest rate on existing debt stocks minus nominal GDP growth, where the effective interest rate is interest paid in year T as a ratio-to-debt outstanding at the end of year T-1.

However, implementing fiscal spending is typically slow, and governments may allocate capital inefficiently. Tax cuts are faster, but the windfall might be saved rather than spent if households and corporations are concerned about the future. 6 Furthermore, fiscal policy may have less “juice” in countries with high debt/GDP ratios, as households and corporations may anticipate tax increases (according to Ricardian theory). Fiscal stimulus could be structured to overcome this impediment by encouraging spending by decreasing the benefit to recipients over time—use it or lose it.

Finally, while secular forces have kept debt increases from boosting yields during this cycle, debt cannot rise indefinitely, as a share of GDP, without an increase in the cost of debt. The term premium on bonds (the premium required to incentivize investors to hold longer-dated bonds over shorter-dated bonds) could also expand if debt-to-GDP levels climbed sharply. QE alleviates some of these challenges by providing a ready buyer for government bonds, but it does not eliminate the risks associated with rising debt levels and precautionary savings by households and corporations.

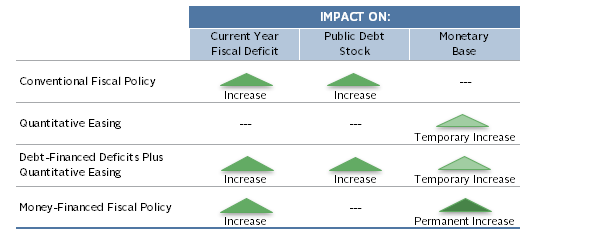

Some economists argue central banks should pursue “helicopter money,” or money-financed fiscal policy, to overcome these limitations. Indeed, we saw this move during the 1930s. Central banks push cash or deposits directly to spenders through tax cuts or public spending, with the expectation that the Treasury will never pay back the central bank and the monetary base is permanently increased. In other words, fiscal spending is financed by money creation (or monetized), rather than financed through debt issuance. These conditions improve the likelihood that money will be spent rather than saved, as households and corporations should not anticipate associated future tax increases or other fiscal tightening. Furthermore, the permanent increase in the monetary base helps keep interest rates down, limiting the “crowding out” of private investment. 7

The big risk associated with money-financed fiscal policy is inflation. Central banks need to create money to support fiscal policy, giving up the mandate of controlling inflation, at least for a time. In the past, under the gold standard or Bretton Woods system, authorities were able to re-establish inflation credibility, typically by re-pegging currencies to gold. In a world of fiat currencies, it is unclear where renewed credibility would come from if lost. 8 However, some economists, including Ben Bernanke,Stanley Fischer, and Philipp Hildebrand have proposed governance structures that could allow central banks to maintain their independence (and mandate to control inflation) and prevent overuse.

FISCAL AND MONETARY IMPLICATIONS OF ALTERNATIVE STIMULUS POLICIES

Source: International Monetary Fund.

Inflation Risk or the Boy Who Cried Wolf?

Some readers may ask if the risk of post-recession inflation is real, given the conditions over the past decade and after the 1930s. Since the GFC, inflation has been the dog that never barked. So, what’s different? During the 1930s and 1940s, the global financial system transitioned from a gold standard to the Bretton Woods system, which tied the dollar to gold prices and tied other currencies to the dollar. Today those links don’t exist. Now, central bankers are perhaps biased toward easy policy, both because of prior failures to boost inflation and because debt levels are high. Money-financed fiscal policy can create inflation when overused. 9 If the printed money just offsets the decline in credit and spending that happens in recessions, then it shouldn’t produce inflation. However, coordinated fiscal and monetary policy threaten central bank independence and raise the odds that fiscal policy will be overused, igniting inflation.

Investment Considerations

The experience of the 1930s through the early 1980s provides lessons for investors, but we must consider them in the current context. With central banks running out of room to lower rates and use QE at a time of high debt levels, use of coordinated monetary and fiscal policy through money-financed fiscal policy seems inevitable in the next recession, making inflation a risk worth considering.

Inflation could come about faster after the next recession than was the case in the earlier period, as the fiat currency system allows for faster currency adjustments. As in the past, any currency weakening is likely to result in gold appreciation provided real interest rates remain low, so a modicum of gold may prove helpful in this environment. While currencies may be volatile, any move toward competitive devaluations would only impact currency pairs when one country belongs to a more aggressive currency bloc than the other. Given the G4 economies are in a similar boat, it remains difficult to handicap which would be more aggressive, which central banks may have their independence compromised, and which are prone to policy error. Even in the Eurozone, where a lack of a fiscal union constrains the ability to increase fiscal spending, much less coordinate fiscal and monetary policy, it wouldn’t be impossible under periods of stress. However, the rich US dollar has more room to fall than the other G4 currencies. Given the currency volatility risk, investors should be careful about currency-related asset/liability matching, ensuring there is adequate room to fund liquidity needs over time in domestic currency.

While a sustained period of elevated inflation is a risk after the next recession, it is far from a foregone conclusion. In addition, policymakers will first try conventional measures, and only if those fail will they work toward more coordinated fiscal and monetary policy. If this thesis proves correct, investors will have a window of opportunity to pick up select real estate and infrastructure investments at recessionary prices.

Such investments cannot be expected to serve as inflation hedges, but they should perform relatively well (high-quality real assets should hold their value better than financial assets in such an environment). At attractive purchase prices, such investments would deliver competitive returns even without meaningfully higher inflation. While it is difficult to predict which real assets will prove more attractive, as returns across real asset categories can vary quite substantially during recessions, we would look to buy high-quality assets that have durable appeal. For example, look for high-quality core real estate and infrastructure opportunities sourced and operated by skilled managers. We are focused on investments aligned with secular themes, including urbanization, demographics, technological innovation, the shift from traditional energy sources to renewable sources, and climate-change resilience. Examples include healthcare facilities, senior housing, renewable infrastructure, and affordable housing. To take advantage of such opportunities, investors need to maintain adequate diversification and liquidity to finance opportunistic investments.

Celia Dallas, Chief Investment Strategist

Joseph Comras and TJ Scavone also contributed to this publication.

Footnotes

- For a discussion on quantitative and qualitative easing and yield curve control, please see, “New Framework for Strengthening Monetary Easing: Quantitative and Qualitative Monetary Easing with Yield Curve Control,” Bank of Japan Monetary Policy Meeting, September 21, 2016.

- For a discussion on price-level targeting, please see Ben Bernanke, “Evaluating Lower-for-Longer Policies: Temporary Price-Level Targeting,” The Brookings Institution, February 21, 2019.

- For example, please see J.R. Vernon, “World War II Fiscal Policies and the End of the Great Depression,” The Journal of Economic History, vol 54, no. 4 (December 1994): pp. 850–68.

- For a summary of key prior monetary and fiscal policy actions, including those pursued in the 1930s, see Ray Dalio, “A Template for Understanding Big Debt Crises,” Bridgewater Associates, 2018.

- For an overview of his perspectives on the cost of increasing public debt, please see Olivier Blanchard, “Public Debt and Low Interest Rates” (lecture, American Economics Association, January 4, 2015).

- If tax cuts increase savings, that would further depress rates, leading to even less return on savings and a further reduction in demand as households choose to save more to reach their savings goals (e.g., retirement, new home).

- The concept of crowding out is commonly defined as an increase in fiscal spending that increases interest rates. With higher rates, the cost of debt for the private sector becomes higher and borrowing shrinks as the cost of capital increases.

- Modern Monetary Theory is a type of money-financed fiscal policy that goes further in removing central banks’ inflation mandate and independence. Central banks in countries that can print their own money would function solely to facilitate fiscal policy, keeping interest rates low to make financing the debt sustainable. Fiscal policy would promote full employment, meet spending objectives, and manage inflation. The biggest risk is that the government, not central banks, would be responsible for curbing inflation. When have elected officials been eager to tighten policy?

- Some investors (ourselves included) were concerned about the potential for inflation given pervasive QE and the associated ballooning of central bank balance sheets. While QE increases base money through growing central bank reserves, it does not result in inflation. Rather, it is increased lending that expands the broad money supply and can lead to higher inflation. Central banks have the ultimate check on expansion and contraction by setting policy rates, which influence other key interest rates in the economy influencing the profitability of bank lending.