Navigating the AI Revolution: Unlocking Productivity with AI Investment

Economic activity is fundamentally driven by the size of the labor force and the productivity of that labor. With working-age populations expected to stagnate or decline in many countries due to falling birth rates, future economic growth will increasingly depend on productivity improvements rather than workforce expansion. Yet, recent years have seen disappointing productivity gains, raising concerns about long-term prosperity. In this context, AI has emerged as a promising catalyst for revitalizing productivity, with advances in generative models and automation unlocking new efficiencies across sectors. As the second piece in a three-part series, we examine how AI may support productivity growth and how capital is being deployed to realize its potential.

The Productivity Puzzle

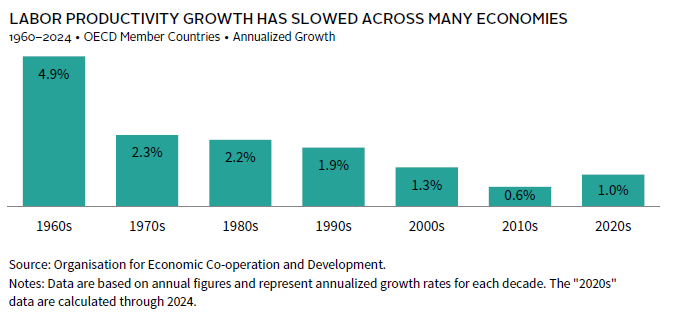

For much of the postwar era, rising productivity fueled economic expansion. However, since the 2000s, productivity growth has been notably weak across many economies. While the causes of this slowdown are complex and debated, the primary factors include the waning impact of the IT and internet revolution, weak investment and slow diffusion of innovation across firms, and demographic headwinds—particularly aging populations and slower growth in the working-age labor force, which can dampen economic dynamism and slow the adoption of new technologies. Although these are the most significant contributors, other factors, such as regulatory barriers and measurement challenges, have likely also played a role.

Amid these headwinds, AI presents a new avenue for boosting productivity. As highlighted in the first piece in this series, AI adoption rates have matched, or even surpassed, those of previous major technology cycles, underscoring the speed and scale of its integration into the economy. Unlike earlier waves of technological change, AI’s capabilities extend well beyond simple automation, enabling innovation in areas such as data extraction, research synthesis, and complex problem solving. Early evidence from industries like finance, logistics, and healthcare suggests that AI-driven tools are already delivering measurable efficiency gains, though it will likely be at least a couple of years before integration is widespread enough to meaningfully improve productivity growth at the economy-wide level.

These advances, however, are not without challenges. As AI automates a growing range of tasks, concerns about potential job displacement—particularly in routine or highly automatable roles—have come to the fore. While new opportunities are likely to emerge as AI creates demand for new skills and industries, the transition may be disruptive for certain segments of the workforce, highlighting the importance of thoughtful policy responses and workforce reskilling initiatives to ensure broad-based benefits. Against this backdrop, some of the most visible applications of large language models (LLMs) today include:

- Customer Service Chatbots: LLMs power conversational agents that handle customer inquiries, troubleshoot issues, and provide support across digital platforms, reducing wait times and freeing up human agents for more complex tasks.

- Content Generation and Copywriting: Businesses use LLMs to draft and optimize marketing copy, blog posts, and product descriptions, streamlining content creation and enabling rapid experimentation.

- Coding Assistance: LLMs assist software developers by generating code snippets, suggesting improvements, and automating routine coding tasks, accelerating development cycles.

- Document Summarization and Search: LLMs extract key information, summarize lengthy documents, and answer user questions, transforming legal research, contract review, and knowledge management.

- Language Translation and Text Correction: LLMs provide real-time translation and advanced grammar correction, enhancing communication and breaking down language barriers.

The Market’s Reaction

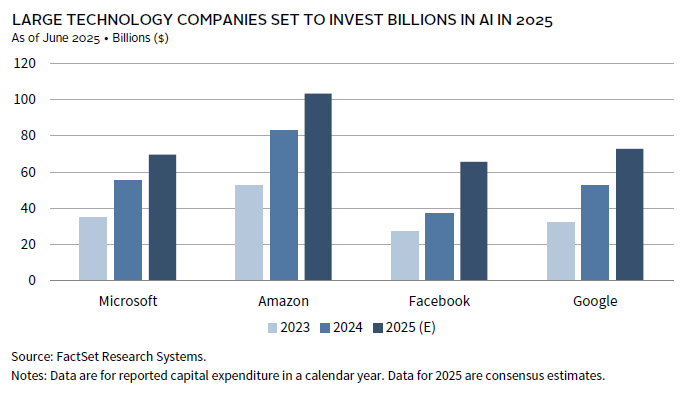

The promise of AI has ignited a surge of investment, with capital flowing into infrastructure, model development, and a wide range of applications. Large US technology companies are leading the way, committing record sums to data centers, specialized hardware, cloud platforms, and the research needed to build increasingly sophisticated models. These investments are essential to support the computational demands of modern AI and enable new applications across industries. The scale of these commitments reflects both the strategic importance of AI and the intense competition for leadership in the next wave of technological innovation. As models become more complex and data-hungry, robust infrastructure and ongoing model development have become defining features of this investment cycle.

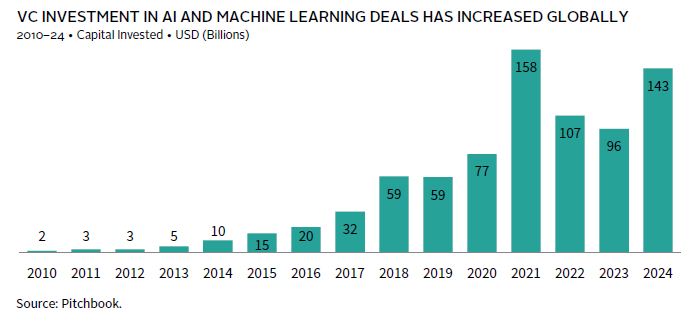

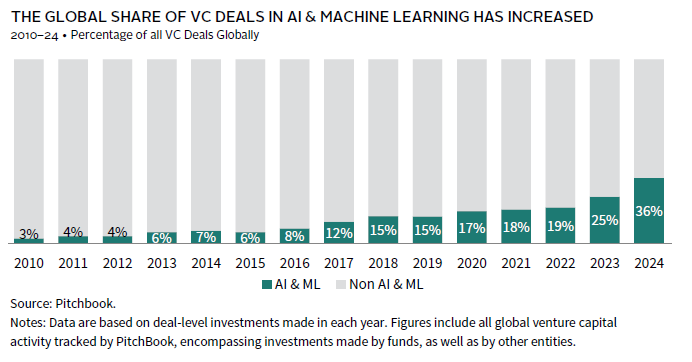

This wave of investment is not limited to major technology firms. Venture capital (VC) activity in AI and machine learning (ML) has also reached unprecedented levels. In 2024, VC deal-level investment in AI and ML totaled $143 billion, a dramatic increase from just $59 billion in 2019. This surge is not only a function of larger deal sizes but also a growing number of startups and scale-ups focused on AI-driven solutions across industries. The share of VC dollars allocated to AI and ML deals has risen sharply, from 15% in 2019 to 37% in 2024, underscoring the sector’s growing prominence within the broader innovation landscape. Investors are increasingly viewing AI as a foundational technology with the potential to reshape entire industries, driving a virtuous cycle of capital deployment and technological advancement.

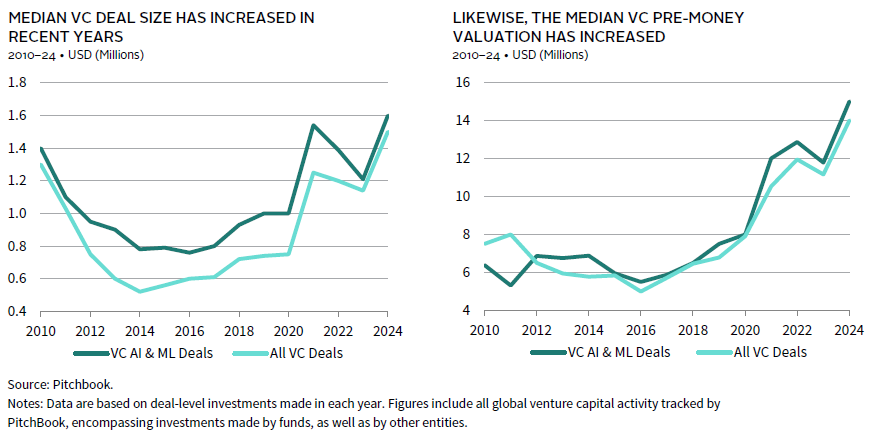

The competitive dynamics of the VC market are also evident in deal terms. Over the past five years, both the median capital investment and median pre-money valuation for AI and ML deals have risen, reflecting heightened investor enthusiasm and the perceived value of AI-driven business models. Notably, these metrics have increased in a comparable manner for all VC deals, suggesting that while AI and ML are attracting premium valuations, the broader VC market has also become more capital-intensive. This environment has enabled AI startups to access the resources needed to scale rapidly, invest in talent, and accelerate product development, further fueling the sector’s momentum.

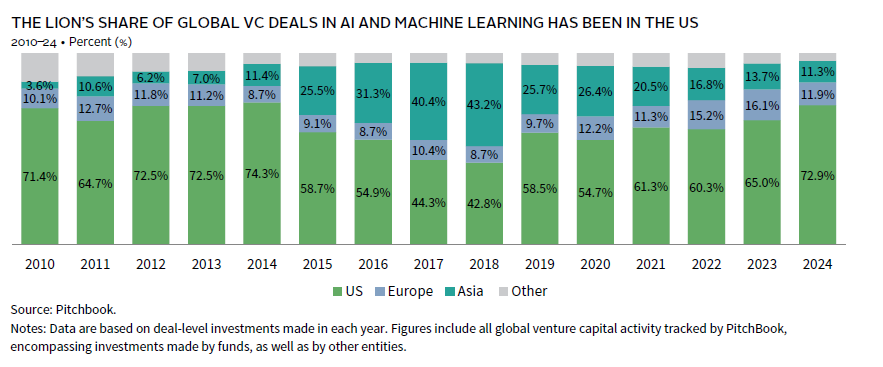

Geographically, the distribution of AI and ML investment has shifted significantly in recent years. According to PitchBook data, Asia—once a rising destination for VC capital in these fields—saw its share drop to just 11% in 2024, while the United States accounted for a commanding 73%. This change reflects concerns over Chinese state involvement in technology and the impact of Western regulations restricting capital flows into sensitive sectors. As a result, the United States has solidified its role as the global investment destination for AI innovation. However, it is important to note that PitchBook’s data may underrepresent the full scope of Chinese activity, as it is often more comprehensive for fund-based VC investments and may not fully capture direct investments by companies or government-backed initiatives in China. The recent release of advanced Chinese models, such as DeepSeek, underscores that China remains a formidable force in AI research and development, and leadership in the field remains contested.

While recent market attention has centered on tariffs and trade tensions, it is AI innovation and its integration into the economy that may ultimately prove far more transformative in the years ahead. Unprecedented investment by leading technology firms, together with strong VC interest in AI startups, is fueling rapid technological advancement and shaping the next wave of economic growth. While some observers have noted elevated valuations and questioned the durability of current trends, the underlying drivers—namely, the promise of productivity gains and the transformative potential of AI—suggest that investment momentum will persist, even if widespread productivity improvements take time to materialize. In the final piece of this series, we will examine how AI’s transformative potential is reshaping asset allocation opportunities across both private and public markets.

Graham Landrith and Mark Sintetos also contributed to this publication.

Kevin Rosenbaum, CFA, CAIA - Kevin Rosenbaum is Head of Global Capital Markets Research at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.