Shelter from the Storms: Diversification and Opportunity for Pensions in Insurance-Linked Securities

The importance of portfolio diversification gained new currency following the down market of 2022, which showcased the frailties of the traditional 60/40 portfolio and left many investors scrambling for protection. For pension funds looking to meet this need, we believe insurance-linked securities (ILS) can be a good fit. While implementation and benchmarking are less straightforward than some other strategies, the asset class’s recent underperformance has left the yield spread over expected losses at attractive levels relative to history. Given ILS can also diversify other portfolio holdings well, we think pensions should re-examine this asset class. This paper discusses the potential merits and drawbacks of ILS and aims to equip sponsors with the tools to confidently underwrite and implement them in their portfolios.

What Are Insurance-Linked Securities?

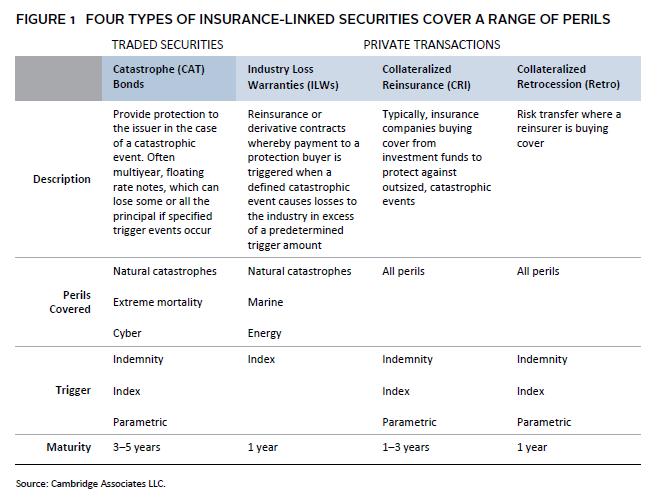

ILS are financial instruments through which investors take on risk of loss from insured natural catastrophes, such as hurricanes and earthquakes. 1 They can also cover risks related to “man-made” adverse events, such as marine, energy, and cyber-related incidents, but these are a much smaller part of the market. A capital market alternative to traditional reinsurance, 2 ILS are designed to provide investors with interest income in the form of insurance premiums, plus repayment of principal, so long as the insured event does not trigger a material financial loss. The most common types of contracts include catastrophe (CAT) bonds, industry loss warranties (ILWs), collateralized reinsurance (CRI), and collateralized retrocession (retro) (Figure 1).

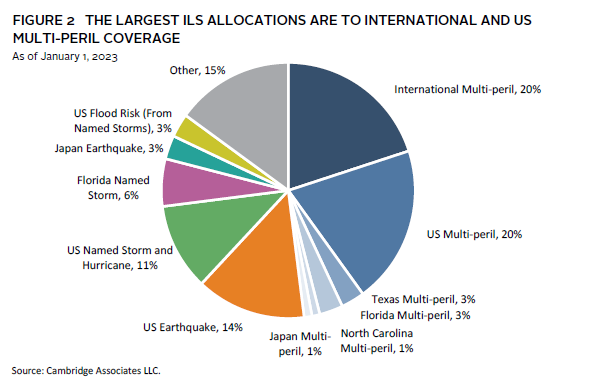

Peril exposures vary by event type and location, and include earthquakes, floods, hurricanes, and wildfires. The industry’s largest allocations are to international and US multi-peril coverage, which include insurance against a specific combination of potential events. Large amounts of capital have also been allocated to specific US states, including Florida, Texas, and North Carolina. Figure 2 breaks down the market by type of risk (or peril).

ILS Historical Performance

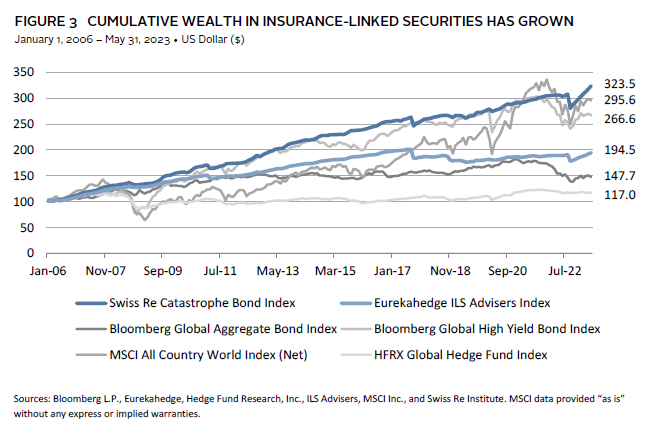

The historic track record of ILS is relatively limited, as third-party investment only became more prevalent around the year 2000. A representative measure of subsequent performance is available from the Eurekahedge ILS Advisers Index, although it is far from a perfect benchmark, given the breadth and intricacies of the ILS universe. 3 The average ILS manager depicted in Figure 3 earned an annualized net return of 3.9% since the Eurekahedge inception in January 2006, compared to 7.0% for the Swiss Re CAT Bond Index 4 and 2.3% for the Bloomberg Global Aggregate Bond Index during the same period. 5

Potential Advantages for Pensions

An Uncorrelated Asset Class

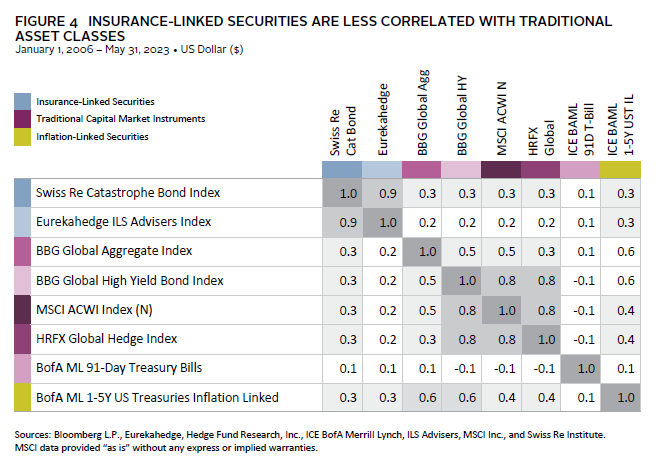

Most ILS are exposed to a fairly narrow definition of natural catastrophe risk: loss due to residential property damage caused by natural disasters. Correlations were higher in years prior to 2010, due to widespread use of leverage and collateralization with securitized debt in the lead up to, and during, the 2008 Global Financial Crisis (GFC). Such widespread use of leverage is no longer common practice (Figure 4).

Even in the face of a systemic financial turmoil such as the GFC, ILS have proven to be resilient. Absent Hurricane Ian—one of the strongest hurricanes in the last 20 years—2022 would have been a year of positive results despite the inflation and interest rate shocks that stressed most asset markets.

An Inflation Hedge

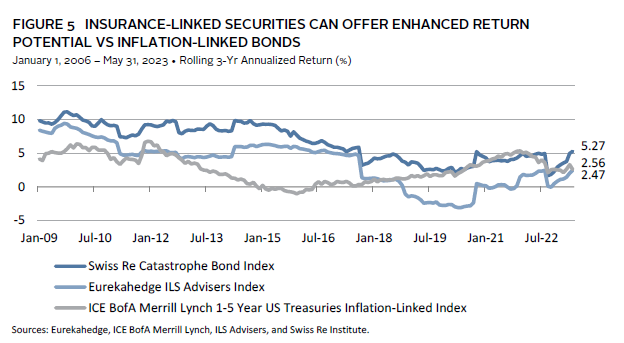

Broadly speaking, ILS are a floating rate, low duration asset class: collateral backing contracts are invested in short-term US Treasury money market funds, so higher interest rates feed directly to higher prospective investor returns, offering an attractive inflation hedge. This protection comes with an additional (weather-related) risk profile, but the enhanced return compared to inflation-linked bonds makes ILS well worth considering for many pensions (Figure 5).

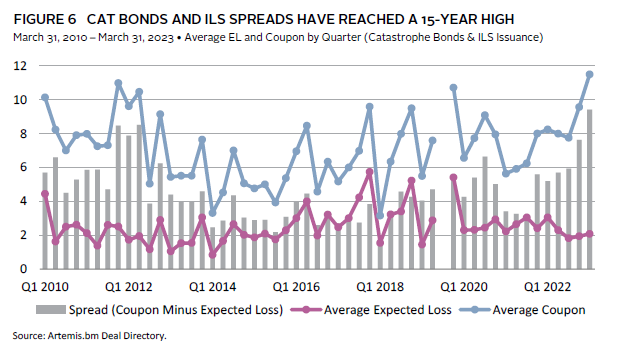

Today’s market offers a compelling entry point for ILS. The bond market losses of 2022 reduced reinsurers’ balance sheet capital and—coupled with the last five years of loss events (culminating with Hurricane Ian)—generated one of the best risk-adjusted yield environments since Hurricane Katrina in 2005.

Current Market Opportunities

The losses from Hurricane Ian have eaten into reinsurers’ capital reserves and ability to write new business in a meaningful way. Contractual conditions were already getting tighter, particularly around secondary perils (e.g., wildfires and severe thunderstorms). These trends—plus several previous storms and extensive losses in traditional asset values as interest rates increased—have all contributed to an estimated reinsurance capital supply gap of $80 billion to $120 billion, driving yields significantly higher.

Coming in to 2023, CAT bond spreads—defined as coupon minus average expected loss (EL)—reached their highest levels in more than 15 years. New issues offered yields of cash +10%, the best on offer since Hurricane Katrina in 2005 (Figure 6).

Potential Disadvantages for Pensions

Impacts of Recent Events

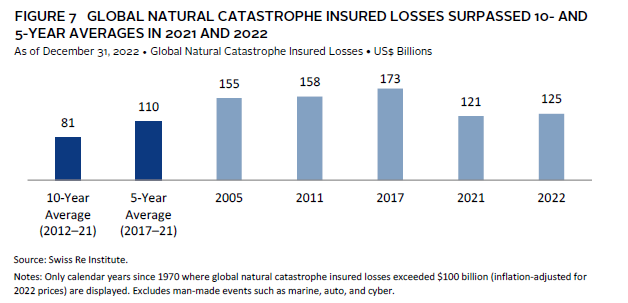

Global reinsurer Swiss Re has estimated natural catastrophe economic loss of $284 billion and $125 billion of insured loss for 2022. This year saw the fourth-highest losses since 1970 and, for the first time ever, insured losses exceeded $100 billion for two years running (adjusting for inflation). Insured annual loss totals from natural catastrophes have surpassed the $100 billion mark five times since 1970, and three times in the past six years (Figure 7).

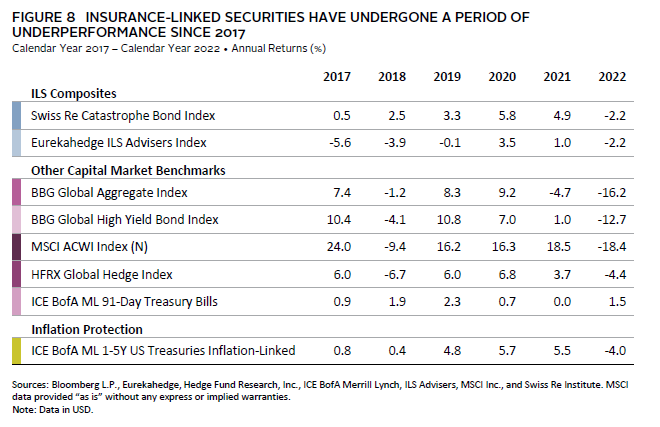

Natural catastrophes in 2021 included winter storms in Texas, floods in Europe, and Hurricane Ida, whereas Hurricane Ian was the main contributor in 2022. These losses impacted total returns for Eurekahedge and resulted in episodes of relative underperformance for ILS (Figure 8).

Headline Risk

The headline risk surrounding individual catastrophe events and climate change often serves as a deterrent for pensions. For example, the buildup and aftermath of a Category 5 hurricane in Florida is likely to garner days or weeks of media coverage. Consequently, the ILS asset class requires proactive education for board members and other stakeholders to reduce behavioral risk. Otherwise, demands to redeem may be loudest just after periods of highly publicized loss—which are often the most attractive times to invest—due in part to rate increases and tighter contractual terms. Pensions need to be prepared for these risks and opportunities. The best ILS managers consistently share their knowledge to help pensions maintain a longer-term commitment to the asset class and avoid attempts to time the market.

In 2022, investors bared their teeth on pricing and showed much less appetite for vaguely worded aggregate cover contracts or secondary perils such as wildfire. Several transactions failed to close due to a lack of investor support. For 2023, this has greatly increased ILS managers’ influence over terms and conditions, leading to cleaner structures and contracts.

Climate Change

An ever-present factor related to ILS is, unsurprisingly, climate change. Empirical evidence suggests that the severity and frequency of some meteorological events have increased over time. 6 Extreme rainfall and wildfires are two examples. Other primary natural catastrophe perils, such as earthquakes and hurricanes, do not seem to have been affected thus far, but climate attribution research is ongoing. Climate change–related adjustments to underwriting practices are a central interest of the ILS community. Researchers are continuing to analyze how the effects of anthropogenic global warming and climate change will unfold, both in the form of long-term trends and sudden, unpredictable shocks. Indeed, the standard practice of yearly contract underwriting can give investors comfort, as the long-term impact of climate change becomes more observable.

Portfolio Construction Guidance

Portfolio implementation and benchmarking of ILS can be challenging. On the former, investors that don’t intend to formally include insurance in their asset allocation may wish to implement it as part of a diversifying hedge fund portfolio or within an alternative credit allocation. On the latter issue, pensions already exposed to ILS outside of the catastrophe space (e.g., life settlements) can construct a dedicated insurance bucket with specific return targets based on cash plus. Benchmarking to cash plus might represent a viable option for catastrophe risk too. Pensions aiming to use the Swiss Re indexes ultimately need to be wary of their uninvestable nature, as mentioned above. In either case, an investment in ILS is likely to drive active risk at the portfolio level, due to the asset class’s diversification profile versus other capital market instruments. Decision makers need to be comfortable with this potential outcome.

ILS provides allocators with reasonable flexibility with regard to key portfolio construction criteria. Liquidity profiles range from monthly to semi-annual. Return targets may vary from mid-single digits to mid-teens, although higher return requirements will be associated with lower attachment points (i.e., higher likelihood to bear losses following catastrophic events) and potentially more complex structures. In the case of multi-manager implementation, risks can be diversified by balancing funds’ preferred areas of exposure. Some strategies may present an embedded tilt toward specific areas and perils (e.g., >70% of CAT bond notional outstanding representing contracts covering against US hurricane risk) that investors may wish to complement with managers with exposure to broader books of business.

Manager Selection Is Important

The frequency and severity of catastrophic events between 2017 and 2022 have inevitably led to side pocketing and trapped collateral issues throughout the industry, causing less capital available for renewals, decreased ILS liquidity, and diminished expected returns. As a result, a crucial element of ILS manager selection is the ability to identify managers with appropriate capital reserving techniques, necessary in the immediate aftermath of large catastrophic events.

The ongoing effects of climate change also play a key role in ILS manager selection. Investors should know, for example, if an ILS manger takes a more conservative, longer-term approach to warming global temperatures. Furthermore, understanding a manager’s peril exposure and the reasoning behind these allocation decisions is crucial. Is a manager taking on Florida wind due to higher premium opportunities? Is it diversified because of a bias away from peak perils? How does its stance on climate change affect its allocation strategy?

Pension Portfolio Opportunities in ILS

ILS represent an opportunity for pensions to back an often-overlooked asset class at an attractive entry point, one that can complement a pension portfolio’s existing risk factors with an uncorrelated return stream. To gain the most advantage from ILS, pensions should commit to medium-term holding periods rather than be tempted to time the market by capturing dislocations as they occur. More experienced ILS investors may size their investments up or down, depending on a hardening or softening cycle. Increased volatility and uncertainty in both the market environment and the natural world have helped to position ILS as an allocation worthy of consideration by pensions as they work to accomplish their long-term goals.

Joe Tolen, Investment Director, Credit Investment Group

Index Disclosures

Bloomberg Global Aggregate Index

The Bloomberg Global Aggregate Index is a flagship measure of global investment-grade debt from 28 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate, and securitized fixed-rate bonds from both developed and emerging markets issuers. There are four regional aggregate benchmarks that largely comprise the Global Aggregate Index: the US Aggregate, the Pan-European Aggregate, the Asian-Pacific Aggregate, and the Canadian Aggregate indexes. The Global Aggregate Index also includes Eurodollar, Euro-Yen, and 144A Index-eligible securities, and debt from five local currency markets not tracked by the regional aggregate benchmarks (CLP, COP, MXN, PEN, and ILS). A component of the Multiverse Index, the Global Aggregate Index was created in 2000, with index history backfilled to January 1, 1990.

Bloomberg Global High Yield Bond Index

The Bloomberg Global High Yield Index is a multi-currency flagship measure of the global high-yield debt market. The index represents the union of the US High Yield, the Pan-European High Yield, and Emerging Markets (EM) Hard Currency High Yield indexes. The high-yield and emerging markets sub-components are mutually exclusive. Until January 1, 2011, the index also included CMBS high-yield securities. The Global High Yield Index is a component of the Multiverse Index, along with the Global Aggregate, Euro Treasury High Yield, and EM Local Currency Government indexes. It was created in 1999, with history backfilled to January 1, 1990.

Eurekahedge ILS Advisers Index

The Eurekahedge ILS Advisers Index is ILS Advisers and Eurekahedge’s collaborative equally weighted index of 26 constituent funds. The index is designed to provide a broad measure of the performance of underlying hedge fund managers that explicitly allocate to insurance-linked investments and have at least 70% of their portfolio invested in non-life risk. The index is base weighted at 100 at December 2005, does not contain duplicate funds, and is denominated in local currencies. The Eurekahedge ILS Advisers Index is tracked by ILS Adviser’s “ILS Diversified Ltd,” a fund of hedge funds solely invested in insurance-linked securities (ILS).

HFRX Research Global Hedge Fund Index

The HFRX Global Hedge Fund Index includes all eligible hedge fund strategies including, but not limited to, convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

ICE BofA Merrill Lynch 1-5 Year US Inflation-Linked Treasury Index

The ICE BofA Merrill Lynch 1-5 Year US Inflation-Linked Treasury Index is an unmanaged index consisting of US TIPS with a maturity of greater than one year and less than five years. It is a is a subset of the ICE BofA Merrill Lynch US Inflation-Linked Treasury Index including all securities with a remaining term to final maturity less than five years.

ICE BofA 91-Day Treasury Bill Index

The ICE BofA 91-Day Treasury Bill Index consists of US Treasury Bills maturing in 90 days.

MSCI All Country World Index (ACWI)

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets and 24 emerging markets countries. With 2,947 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Swiss Re Catastrophe Bond Index

The Swiss Re Catastrophe Bond Index provides a widely used benchmark for the total returns delivered by the outstanding cat bond market.

Footnotes

- For this paper, ILS refers to “non-life” ILS instruments and excludes “life” ILS instruments, such as life policy settlements securitization, extreme mortality securitization, and longevity swaps.

- Reinsurance is the insurance that an insurance company purchases to insulate itself from the risk of a major claims event.

- The Eurekahedge ILS Advisers Index is an equally weighted index of 26 constituent funds designed to provide a broad measure of the track record of managers explicitly allocating to ILS and having at least 70% of their portfolio invested in non-life risk.

- The Swiss Re CAT Bond Index itself is not investable. Anecdotally, ILS investors seeking a total return swap arrangement with Swiss Re (the benchmark’s issuer) on the Swiss Re CAT Bond Index would face a cost of ca. 300 basis points (bps) per annum, in exchange of the return of the index. This effectively represents the charge for an investor wishing to replicate the return and volatility of the widely quoted Swiss Re benchmark.

- All data in USD as of May 31, 2023.

- NOAA Severe Weather Data Inventory (SWDI), 2023.

Joseph Tolen - FootnotesFor this paper, ILS refers to “non-life” ILS instruments and excludes “life” ILS instruments, such as life policy settlements securitization, extreme mortality securitization, and longevity swaps. Reinsurance is the insurance that an insurance company purchases to insulate itself from the risk of a major claims event. The Eurekahedge ILS Advisers Index is an equally weighted […]

Subscribe to our insights to learn more.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates.