VantagePoint: Banking Crisis Implications for Asset Allocation

More than a month has passed since Silicon Valley Bank (SVB) and Signature Bank failed, kicking off ripples of concerns across much of the globe. To look at the performance of risk assets, you would never know what transpired, with global equities returning 2.4% during March and 7% in the first quarter in local currency terms. While much of what transpired appears idiosyncratic, and policymakers moved quickly to ring fence banking sector risks, prospects for contagion cannot be ruled out.

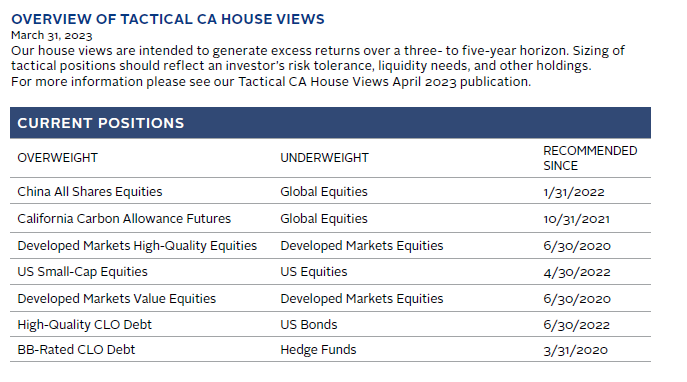

In this edition of VantagePoint, we share our views on the macroeconomic backdrop, including a discussion of the banking sector risks and implications for central bank policy. We entered 2023 with a view that a recession in some economies, namely the United States and much of Europe, was likely this year, and the recent banking sector stresses reinforce our confidence in this view. As a result, we have not made wholesale changes to our asset allocation perspectives. We discuss where we see elevated risks and opportunities in a higher rate environment, should it persist, and the beneficiaries of recent banking stresses.

From Tight to Tighter

Leading into the banking crisis, a variety of factors indicated the probability of a recession in the United States and Europe was on the rise. For example, yield curves have been deeply inverted, consumer spending has been slowing, various financial indicators reflect tightening conditions, and European Central Bank (ECB) and Federal Reserve surveys reveal an increasing proportion of banks have been tightening lending standards and reporting weaker demand for credit.

The probability of tighter credit conditions has increased, even if the banking crisis remains contained. Tighter credit conditions precede a slowdown in lending and rising default rates associated with recessions. While we see a decline in lending in some segments of the global economy overall (e.g., US consumer credit card and auto loans), aggregate loans are still rising at a decelerating pace. We anticipate current conditions will slow lending further as banks become more conservative to shore up balance sheets in response to anticipated tightening regulations and oversight on smaller US banks. Lending in the euro area is already contracting.

No, It’s Not 2008 or the 1980s/90s

While we cannot rule out further contagion in the banking system, we do not believe the current banking situation is comparable to the 2008 Global Financial Crisis (GFC) or even the Savings & Loan (S&L) crisis of the 1980s and 1990s. There are certainly some parallels that can be drawn, but the differences stand out more. For example, the GFC involved considerable opacity on the value of assets, high leverage, and a breakdown of trust across the banking system, while the current situation thus far has been driven by the impact of rising rates on transparent, liquid Treasuries and Agency mortgage-backed securities. The S&L crisis had more similarities, in that it ran into trouble amid rapid asset growth fueled by a sharp increase in deposits during a period of sharply rising interest rates. However, it would be a mistake to take the comparisons too far, given considerable differences in the regulatory environment and the ability and willingness of policymakers to respond to banking sector stress more aggressively today.

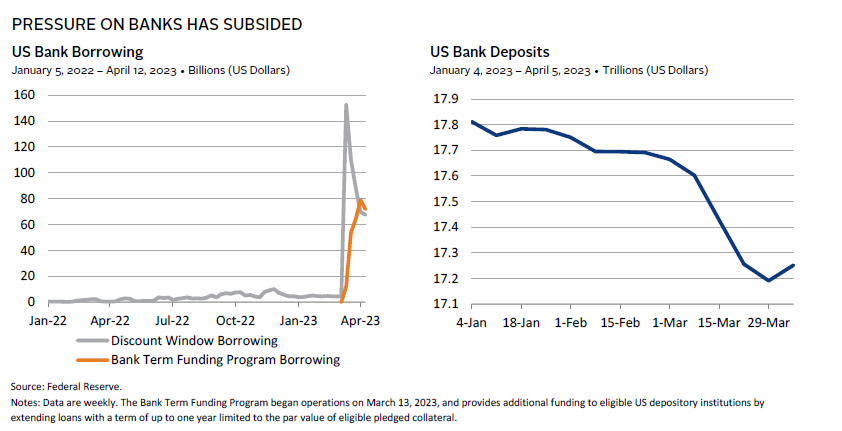

To that point, we expect any further bank stress to be met with a swift government response to ring fence risk, as was the case with SVB, Signature Bank, and Credit Suisse. In addition, large banks are likely to play a continued role in stabilizing the system either voluntarily (as a consortium of large banks did with First Republic) or with encouragement (as UBS did with Credit Suisse). Finally, policy makers have tightened regulations since the GFC, which has caused many banks, especially globally systemically important banks, to maintain higher capital ratios and improved risk management practices. For now, these conditions—particularly the strength and speed of the policy response—have helped to stabilize banks, as reflected by banks’ use of the new Bank Term Funding Program and moderating deposit outflows.

Still, we would not be surprised to see more bank stress on the horizon, including some more regional or small bank failures, even as much of the risk thus far appears to have been somewhat idiosyncratic. Overall, US banks with meaningful deposits that are not insured by FDIC, banks with unrealized losses in security portfolios, banks with poor risk management practices, and banks with relatively undiversified depositors face increased risk of deposit flight. Further, as economic growth slows, what appears to largely be a liquidity crisis could turn into a credit crisis.

Banks, especially small- to mid-sized banks that hold significant levels 1 of commercial real estate (CRE) loans, could create pockets of stress in the banking system. Recent years have seen record CRE loan originations (roughly 35% of outstanding CRE loans), implying borrowing at extremely low rates. This year is also on track for a record number of commercial mortgages held by banks to expire in 2023 and 2024 (about 42% of CRE loans held by banks). Naturally, there is concern that CRE companies may not be able (or willing) to absorb higher refinancing costs and that the risk of defaults is inching higher. These cyclical challenges in the real estate sector will likely lower banking profits in the quarters to come. While write-downs for some properties are likely, we do not expect this to impact banks in the same fashion as the GFC. Bank lending policies are much more stringent now, with CRE loan-to-value ratios of approximately 65% at regional banks providing a cushion to absorb some deterioration in value.

We are monitoring various measures of banking sector liquidity stress (e.g., deposit flows, funding spreads, overnight reverse repurchase volume, and borrowing through the Fed and FHLB lending programs) and solvency (e.g., credit contraction, credit spreads, TED spreads, default rates, non-performing loans, and bank CDS spreads) to understand if conditions are changing and whether stress in the banking sector appears more widespread. For now, conditions appear to be stabilizing.

Central Banks in a Pickle

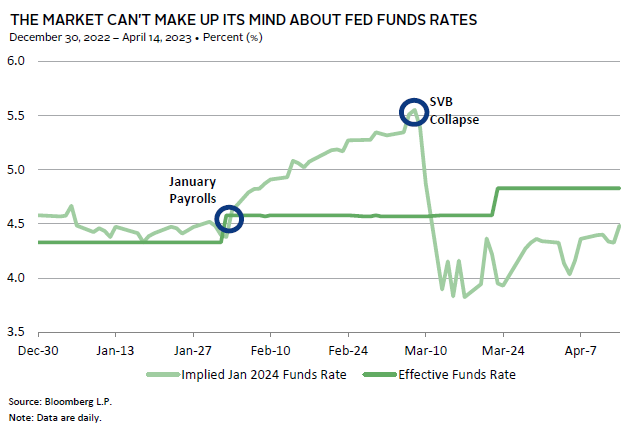

Central bankers are facing difficult decisions—inflation remains high, while economic growth is showing signs of softening and higher policy rates are starting to “break things.” The first major sign of stress related to higher rates came from the United Kingdom as falling gilt values created a wave of selling pressure from leveraged pensions schemes seeking to hedge liabilities. Pressure in the US banking system followed, and the long-troubled Credit Suisse soon succumbed. In the absence of inflationary pressures, recent banking stress would have undoubtedly prompted central banks to cut rates to steepen the yield curve and take the pressure off the banking system. However, central banks don’t have that leisure today and are more likely to pause than to cut, in contrast to market expectations.

Indeed, market expectations have been exceptionally volatile this year. As US payrolls data came in surprisingly strong in January, markets priced in increased expectations for tightening this year. Comments from central bankers, including Fed Chairman Jerome Powell in subsequent months, increased expectations further until SVB collapsed, sending Fed funds rate expectations down as investors priced in rate cuts.

Our view on central bank priorities has not changed. We believe central banks, still concerned about persistent inflation, will set a high bar for cutting rates this year. However, as the US economy moves closer to a recession and inflation pressures ease, a pause in tightening is likely to come soon. Central bankers are now talking about “the separation principle,” in which they seek to use rates to fight inflation while using other tools (including lending facilities and asset purchases) to promote financial stability.

Taking Stock of Risks and Opportunities

The banking sector turmoil reinforces our view that recessions in the United States and Europe are on the horizon, yet the timing and impact are always uncertain. In such environments, investors should carefully monitor and manage portfolio exposures to maintain broad policy targets. Our focus has been on consideration of winners and losers from the risks associated with stress in the banking system and its key underlying driver, higher interest rates. We review our thoughts on the interest rate sensitive areas of CRE and private investments and as well as value stocks, given their overweights to banks and financials. We also review high-quality stocks and private credit, which we regard as prime beneficiaries in this environment.

Commercial Real Estate—Be Patient and Focused

We view current cyclical pressures to particularly weigh on the CRE sector, pushing property prices down and cap rates higher. However, it is important to remember that CRE portfolios tend to be diversified, and not all CRE sectors face the same challenges. Office and retail properties are more sensitive to economic activity and relatively more vulnerable to a recession. While not immune to recessionary pressures, segments such as industrials still enjoy secular tailwinds, whereas the storage segment tends to be more defensive. Managers with deep expertise in real estate that build diversified portfolios are best positioned to distill unique opportunities during challenging times. Managers that enjoy the flexibility of investing via equity or credit are even more attractive during these times, as they can invest opportunistically depending on available deal structures. While challenging times are afoot for real estate, investors should remember that the sector tends to outperform 2 the broader market in the early recovery period of an economic cycle.

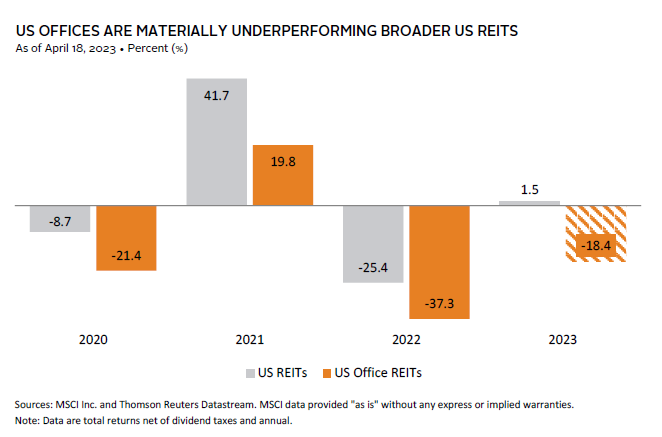

Beyond the challenges faced by the entire CRE sector during recessions, the office sector looks particularly vulnerable, as it also faces a secular decline. Deal volume for offices fell 25% in 2022—the most across major property types. As corporate policies regarding working from home evolve, vacancy rates have risen to almost 17%, 3 compared to approximately 12% prior to the pandemic. Adding to vacancy challenges is tenants’ preference for modern buildings with better amenities. Lower demand has pushed valuations down, with the performance of public-market REITs implying a 30%–40% decline in office property prices.

However, CRE portfolios are unique, with idiosyncratic characteristics driving valuations, so not all offices face headwinds. Geographic location matters: offices in cities such as San Francisco and New York are facing significant headwinds, 4 while offices in Austin and cities in Florida remain relatively strong, as businesses migrate to these locales. Overall, it will take time for the office segment to work through structural headwinds, but new and Class A offices will likely fare better.

Embrace Discipline in Private Markets

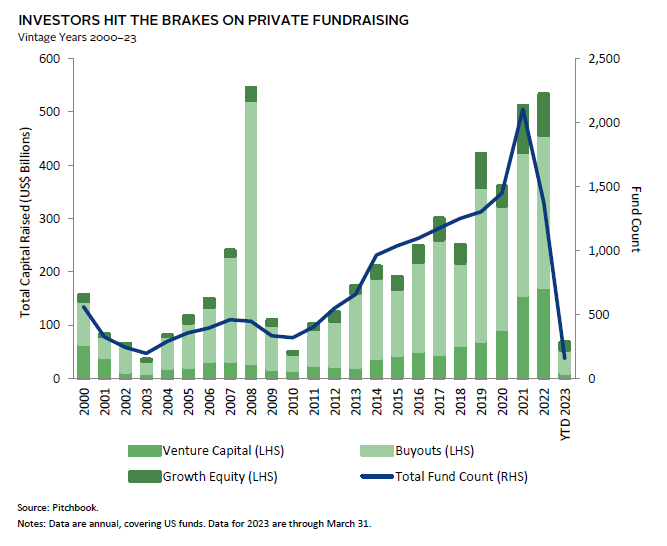

Although private investment valuations tend to exhibit considerable lag to public equities, they are not immune to tightening financial conditions. Recent vintage year pooled returns for US private equity and venture capital funds have declined an average of 1,600 basis points (bps) and 2,000 bps, respectively, in 2022 based on the most recent data through third quarter. Private investments have enjoyed extraordinary fundraising in recent years; in fact, one-quarter of the $3 trillion raised in private investments since 2010 was raised during the COVID-19 period. 5 However, activity (and valuations) began to soften in mid-2022 and has further stalled this year.

We expect private market valuations to continue to correct on the back of higher discount rates and tighter financial conditions. However, this adjustment could take some time; recent data show that while there has been some pressure on growth and venture capital funds, buy-out strategies have remained flat to slightly up. We expect limited access 6 to funding will continue to weigh on the private sector.

The banking crisis has also shone a spotlight on manager’s cash management and treasury risk management practices as a critical part of operational due diligence. Larger funds are advantaged, as they can negotiate better banking terms and diversify the syndicate underwriting their credit facilities. For smaller funds that might not have adequate staff to manage diversified banking relationships, we now more strongly advocate for use of third-party administrators to mitigate risk.

In the current environment, managers that are disciplined in deploying capital to pursue profitable growth and value creation will be rewarded. Gone are the days of relying on the “growth at any cost” approach. Indeed, funds raised since 2017 deployed capital during the COVID-19 period at peak valuations. These funds will take longer to build value compared to funds that can deploy meaningful capital in today’s more disciplined environment. Given this outlook, investors should maintain a commitment pace consistent with investment policy targets to take advantage of opportunities that will arise. We continue to look toward emerging managers, resisting the temptation to limit new commitments to well-established managers. Support of emerging managers (including diverse managers) is critical in the pursuit of top-quartile managers of the future.

Value for the Long Run

In our last edition of VantagePoint, we reviewed the ability of developed markets value stocks to outperform broad developed markets equities, given our perspective that a recession is highly likely this year—an environment in which value stocks tend to underperform. We concluded that at this still-nascent stage of the value cycle, value has considerable potential to outperform over a three-to-five-year horizon, even if it experiences a setback during a recession. We expect the forthcoming recession to be relatively mild and are comfortable with the risk/reward proposition of holding value today. We maintain this view even in the face of banking sector stress, given that the globally, systemically important banks make up the bulk of the exposure and appear healthy even as profit margins should come under some pressure from a higher cost of capital and slowing economic growth. 7

Ramp Up Quality

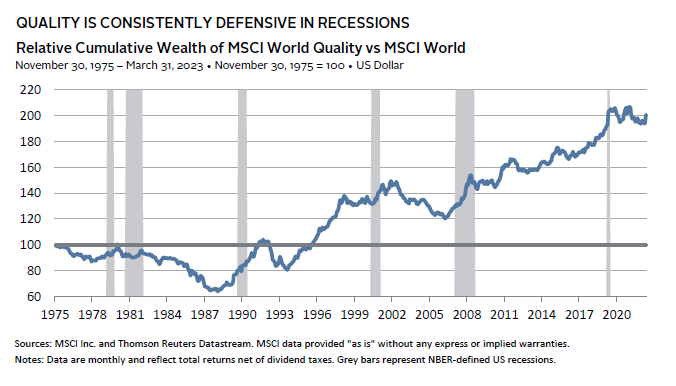

To increase the defensive character of portfolios while still maintaining value tilts, we recommend adding to quality equities. Quality strategies have bested broader markets in each of the six recessions since 1980, delivering a median of roughly 600 bps in excess returns. Indeed, developed markets quality equities have already outperformed broader developed markets by 280 bps this year. Quality companies’ outperformance can be attributed to these shared traits: wide moats (a strong competitive advantage making them market leaders or operate in competitive structures with high barriers to entry), strong management teams with a track record of sound governance, low-leverage ratios, high-pricing power, and lower earnings volatility, alongside the ability to self-fund their growth plans.

Traditionally, deeply cyclical sectors—such as energy, materials, and financials—are underweighted in quality strategies, whereas the more defensive consumer staples and healthcare sectors are overweighted. However, overweights to technology and industrials sectors also appear in quality strategies; these do not seem intuitively defensive but can exhibit many of the quality traits outlined above (market leaders of essential ecosystems, for instance). Recent regulations—such as the Infrastructure Act, CHIPS Act, and Inflation Reduction Act in the United States—help generate a strong investment cycle, supportive of the industrials sector. It is possible that technology stocks may come under pressure again if rates continue to rise pressuring valuations or if earnings disappoint expectations. However, a well-diversified quality portfolio should be able to weather these conditions.

Quality’s sector biases may evolve over time, requiring active quality managers to be diligent in hunting for stocks that exhibit high-quality traits, regardless of the sector, while remaining vigilant on valuations. Thus, quality managers that maintain a consistent process may occasionally have unexpected sector bets.

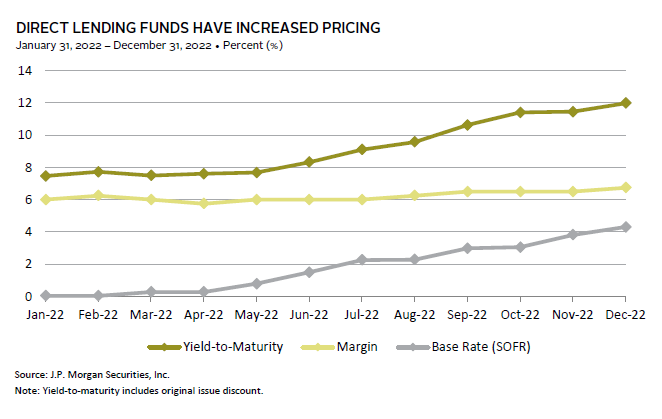

An Opportune Time for Direct Lenders

Opportunities in direct lending appear particularly ripe for the picking in the current environment. Over the last year or so, issuance in public leveraged finance markets has slowed and now bank lending is also growing at a slower pace. Tighter supply relative to demand has enabled direct lenders to increase credit spreads, which, combined with higher interest rates, means first-lien senior-secured debt offers yields in the low double digits. Simultaneously, we are seeing improved terms, such as covenants requiring maintenance of certain financial ratios and restricting collateral movement, all with less transaction leverage.

Direct lending investments are not immune to price risk from proliferation of direct lending strategies or recession risk. Higher yields and stronger terms will help mitigate these risks as will manager and strategy selection. We prefer managers focused on less-commoditized areas of the market, which minimizes exposure to areas such as sponsor-backed middle market lending and plain-vanilla leverage buyouts and focuses more on areas such as non-sponsored, lower-middle market. Further risk mitigants come from investing with experienced teams that have sufficient scale to manage a well-diversified portfolio and have resources to work out problem loans.

Investors without private credit allocations often struggle to find an appropriate funding source. With direct lending offering such rich yields and improved terms, performance of current vintages could be competitive with those of equity-oriented private investments. However, we cannot confidently assert this to be the case given both private credit and equity funds make investments over several years, during which pricing conditions and opportunity sets will evolve. We are confident that direct lending can be additive to private investment portfolios at current pricing through its diversification properties, as income distributions allow for J-curve mitigation. Also, its seniority in the capital structure (first lien senior secured) has allowed for attractive recovery rates in bankruptcy. Another approach is to fund direct lending investments from a diversifier allocation that often includes investments with similar liquidity and risk characteristics, such as more illiquid hedge funds.

Conclusion

It remains to be seen if stress in the banking sector will evolve into a broader crisis or remain contained. While we wouldn’t be surprised to see a handful of small banks fail, we do not expect a large-scale crisis to unfold. We do expect banks to further rein in lending, increasing prospects for recession this year. Investors should be disciplined in maintaining policy targets broadly, remembering the role allocations to stocks, bonds, and cash play in portfolios. Within these broad asset classes, we remain disciplined and strategic in private equity and real estate, while leaning into strategies like high-quality equities and direct lending that we expect will benefit in the current environment.

Celia Dallas, Chief Investment Strategist

Sehr Dsani, Investment Director, Capital Markets Research

Graham Landrith and Kristin Roesch also contributed to this publication.

The FTSE® NAREIT All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property.

MSCI US Index

The MSCI US Index is designed to measure the performance of the large- and mid-cap segments of the US market. With 625 constituents, the index covers approximately 85% of the free float–adjusted market capitalization in the United States.

MSCI World Index

The MSCI World Index represents a free float–adjusted, market capitalization–weighted index that is designed to measure the equity market performance of developed markets. As of December 2017, it includes 23 developed markets country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

MSCI World Quality Index

The MSCI World Quality Index is based on MSCI World, its parent index, which includes large- and mid-cap stocks across 23 developed market countries. The index aims to capture the performance of quality growth stocks by identifying stocks with high quality scores based on three main fundamental variables: high return on equity, stable year-over-year earnings growth, and low financial leverage. The MSCI Quality Indexes complement existing MSCI Factor Indexes and can provide an effective diversification role in a portfolio of factor strategies.

MSCI World Value Index

The MSCI World Value Index captures large- and mid-cap securities exhibiting overall value style characteristics across 23 developed markets countries. The value investment style characteristics for index construction are defined using three variables: book value-to-price, 12-month forward earnings-to-price, and dividend yield.

Footnotes

- Goldman Sachs estimates show that in the United States, banks account for approximately 40% of outstanding CRE loans, of which approximately 75% is held at small- to mid-sized banks.

- Data starting in 1975 show the FTSE® NAREIT All Equity REITs has outperformed the MSCI US Index 83% of the time during the early recovery period.

- This includes estimates of space available to sublease.

- According to Bloomberg, office prices per square foot have fallen more than 30% in San Francisco and Manhattan from peak levels experienced within the last five years.

- The COVID-19 period is defined as July 2020 to June 2022.

- Estimated capital demanded from startups outstripped supply by 2.1x in fourth quarter 2022.

- The MSCI World Value Index has a significant overweight to the financials sector (8.1 percentage points [ppts]) and banks (4.7 ppts) relative to the MSCI World Index. However, much of this overweight is in globally, systemically important banks that have been held to higher regulatory standards and generally engaged in better risk management practices than smaller regional banks. Such banks account for 3.6 ppts of MSCI Value Index’s overweight to financials and 2.8 ppts of its overweight to banks. Note that GICS® defines banks as retail banks, treating investment banks as “Capital Markets.”