VantagePoint: Asian Equities Revisited

Two years ago, we explored the shifting landscape of Asian markets amid geopolitical tensions and evolving global supply chains. Since then, we have continued to revisit our original themes and test our assumptions with input from colleagues and asset managers based in the region. As we reflect on how our outlook has evolved over the past two years, enough has changed to warrant a holistic update.

This edition of VantagePoint offers a practical update on recent developments and highlights the most compelling opportunities for investors. We begin with a summary of the key shifts that have shaped Asian markets over the past two years, then outline our current views and how our thinking has evolved in response. We continue with outlooks for China, India, Southeast Asia, and Japan followed by cross-market themes: the spread of shareholder value and Asia’s role in the global artificial intelligence (AI) buildout. We conclude that while Asia has demonstrated resilience to economic and geopolitical challenges, risks remain, and we expect economic growth and equity beta prospects to moderate as the region faces headwinds from slowing export growth and cooling consumption. The most compelling opportunities lie in alpha generation rather than broad market exposure. The evolving opportunity set, and the potential for active managers to generate alpha are more favorable than they have been in years.

Evolution of key investment views on Asian public and private markets

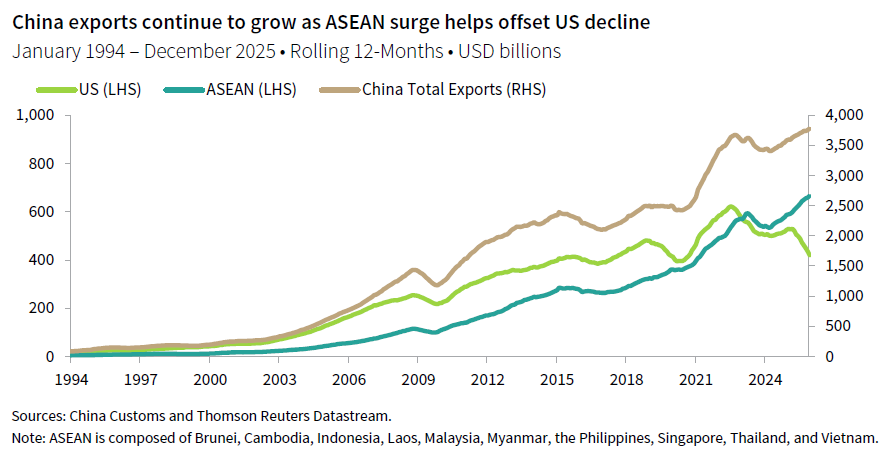

Asia has weathered the US tariff shock better than feared, with China’s exports remaining resilient and regional growth holding up. The Trump administration’s stance on China has softened, with the October 2025 “trade truce” signaling a shift from abrupt decoupling to strategic de-risking. Meanwhile, the rise of AI has reshaped market leadership, creating new winners and losers across the region, while the push for greater shareholder value is creating new sources of alpha potential. Persistent US equity outperformance and dollar strength have given way to Asian market outperformance and USD weakness. A continuation of last year’s rotation away from US assets could create a positive cycle of Asian asset outperformance and currency appreciation. Nevertheless, these positive developments come as regional growth momentum is expected to moderate, with both China and India facing cooling growth, while export-dependent economies remain vulnerable to slower US consumption.

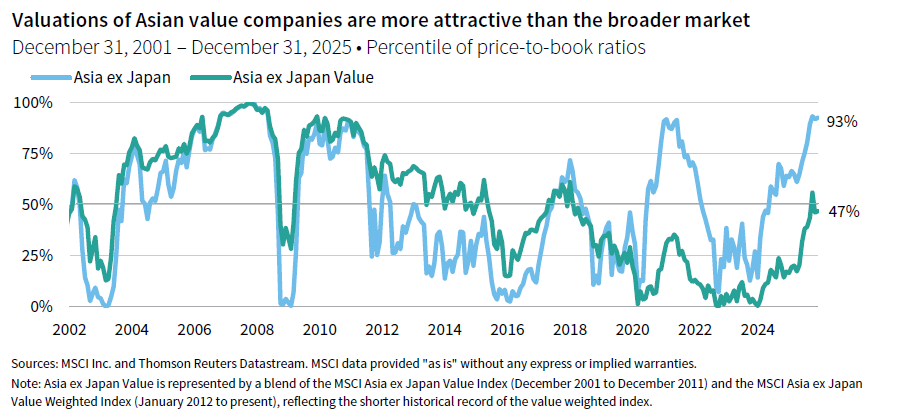

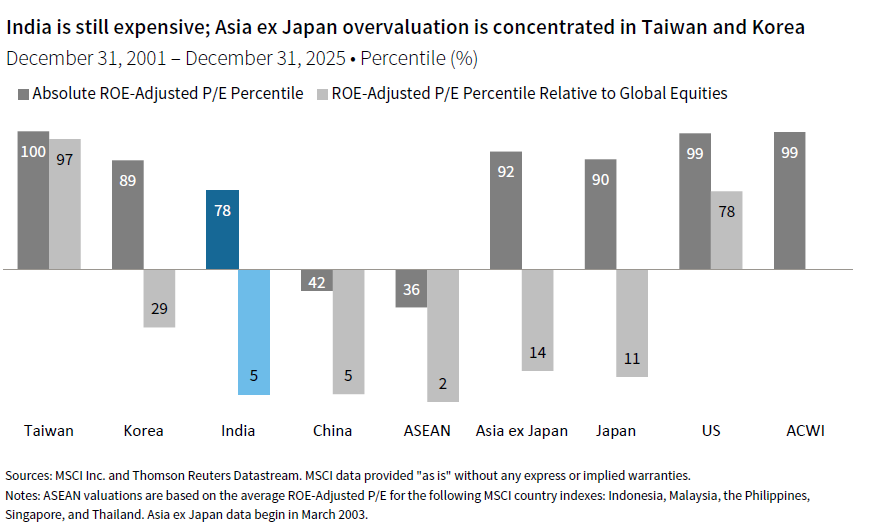

These developments have prompted us to recalibrate our positioning. We are now neutral on China public equities, reflecting a more balanced assessment of risk and reward, and remain neutral on Asian public equities overall. However, we have become more constructive on active management themes as the focus on shareholder value and corporate governance—initiated in Japan and now spreading to Korea and beyond—has broadened and deepened. This shift is creating fertile ground for active managers, especially those pursuing activist, event-driven, and small-cap strategies. While valuations are elevated relative to their own history, Asian equities still trade at a discount to global peers, particularly the United States, and value stocks offer active managers more reasonable valuations. Undervalued currencies add another layer of potential return for USD investors on an unhedged basis.

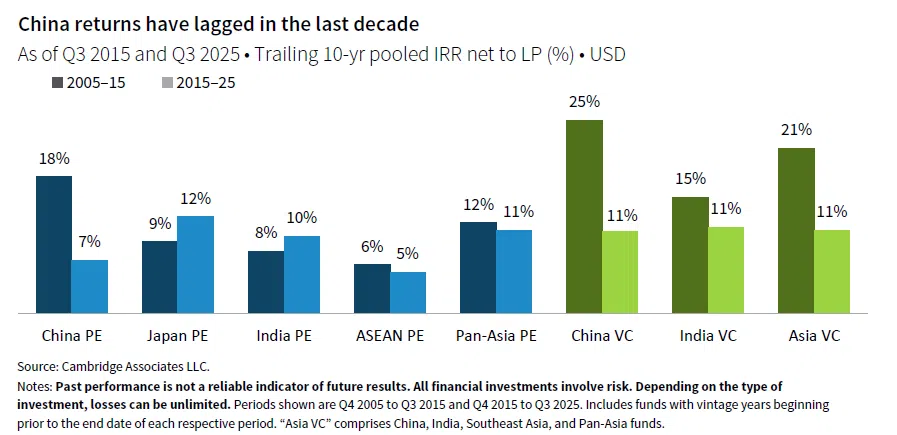

On the private side, we believe there are opportunities in China’s technology-focused venture capital (VC) and healthcare. However, we recognize that the geopolitical and regulatory risks may be too much to tolerate for some, especially US-based investors, and may be more available for global investors less sensitive to these risks. Our outlook for Indian private equity (PE) has grown more constructive as generational ownership transitions create new opportunities in traditional sectors, while we remain enthusiastic about Japanese buyouts, where corporate reform and a growing emphasis on shareholder value continue to unlock value. Across the region, local expertise and rigorous due diligence are essential to identifying and capturing the most promising investments.

Country and regional outlooks

China: Coming in from the cold

China has weathered the US tariff storm by redirecting exports through other markets and using stimulus judiciously to support the economy. As we noted two years ago, the depressed equity market was poised to respond sharply to increased stimulus, and the government’s clear shift toward a more pro-business stance in September 2024 set the stage for strong returns in 2025. China’s “DeepSeek moment” in early 2025 further reinforced its position at the forefront of tech innovation.

Following a roughly 60% rally from 2024 lows, Chinese equities are no longer depressed or cheap, but they remain under-owned, particularly by non-Asian investors. Most inflows to Hong Kong–listed Chinese equities have come from onshore investors via the South-Bound Stock Connect program. While emerging markets (EM) and Asia-dedicated funds have narrowed their underweights to China, they remain, on average, below benchmark weight, leaving scope for further inflows. However, earnings have not kept pace, as persistent deflationary pressure has hurt margins. Easing deflation is critical for sustained earnings growth and outperformance, but this may not materialize in 2026. The government continues to prioritize export and tech-driven growth over boosting domestic consumption. We remain neutral as the balance of risks do not justify avoiding or explicitly underweighting the market, especially given the Trump administration’s less hawkish stance.

Turning to Chinese private markets, we are more constructive on China VC and healthcare-focused funds than China buyouts and growth equity. Fundraising is showing tentative signs of recovery, supported by robust IPO activity in Hong Kong. In 2025, China’s approval for companies to list abroad helped Hong Kong lead the world in IPOs, with over 100 companies raising more than $35 billion and another 300 in the pipeline. Healthcare IPOs reached 14 in 2025 (up from 4 in 2024), with 73 biotech and medtech companies in the pipeline, and multinational pharmaceutical companies have been making acquisitions and in-licensing deals with Chinese drug producers. While China VC fundraising remains tepid due to concerns about US restrictions on investing in AI, semiconductors, and quantum computing, managers raising new funds are highlighting broader opportunities in robotics, advanced manufacturing, clean energy/electric vehicles, and companies applying AI, rather than developing it. Additionally, funds seeking international capital have developed structures to comply with US investment restrictions, keeping the asset class actionable.

Traditional China PE fundraising and deal activity, however, remain depressed despite low valuations and interest rates. China PE funds have lagged returns in other regions, while Pan-Asia PE funds are investing less in China, favoring opportunities elsewhere with less geopolitical baggage. Although there are opportunities for domestic funds to acquire the China operations of multinationals exiting the market, the overall opportunity set for China PE seems limited, and few managers appear to be returning to market in 2026.

India: Disappointing the bulls and the bears

India’s growth has moderated from 8% to around 6% over the past two years, as government spending and business investment cooled. Despite still-solid growth, Indian equities have underperformed broader emerging markets, with high valuations remaining a persistent headwind. The positive macro story was already priced in, and valuations remain disconnected from economic reality.

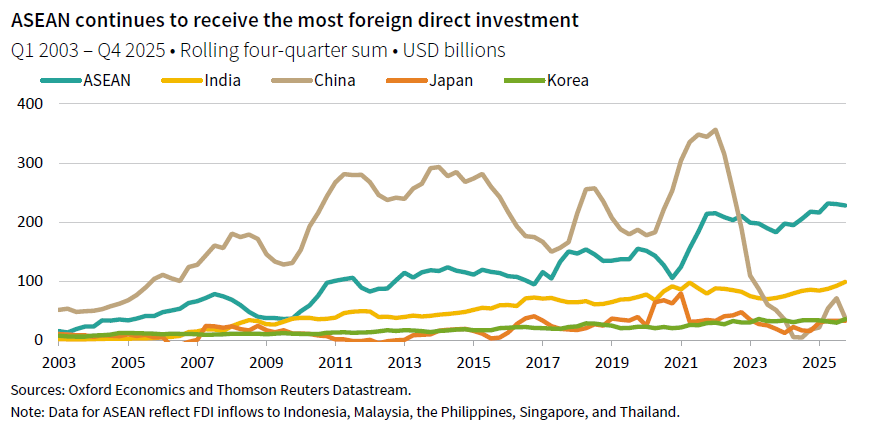

A major surprise has been the United States’ abrupt shift from pro-India policies to imposing a 50% tariff, among the highest in Asia, threatening India’s manufacturing ambitions and contributing to stagnation in foreign direct investment (FDI) since 2021. While these tariffs may be negotiated lower, especially in the event of an end to the war in Ukraine and ban on Russian oil imports, the impact on sentiment and capital flows is clear. The successful IT outsourcing sector faces new risks from AI, though it may also find ways to harness the technology.

Slower growth and cooling inflation have allowed the Reserve Bank of India to cut rates to support growth, but this has helped drive the rupee to new lows, making it the worst-performing Asian currency in 2025. The weak currency risks stoking inflation pressure and may limit further rate cuts, complicating the monetary policy outlook.

Foreign investors remain net sellers of Indian public equities, especially as they seek to close China underweights, but domestic capital now drives the market—a structural shift unlikely to reverse. Regional managers remain bullish long term but are selective, given challenging valuations. Most managers, both public and private, focus on domestic demand themes rather than export plays and cite a deepening opportunity set in India.

Said differently, India is experiencing a soft patch, not a reversal and thus continues to disappoint both bulls and bears. We remain neutral on public equities due to elevated valuations and slowing earnings growth but see more attractive opportunities in private markets (PE and VC), particularly in traditional sectors undergoing generational ownership changes.

Southeast Asia: Politics getting in the way

Two years ago, we highlighted Southeast Asia’s rare combination of rising FDI, trade flows from China decoupling, and attractive equity and currency valuations. Yet, small market size and illiquidity led us to maintain a neutral stance and favor exposure through regional funds, both public and private. This view remains unchanged. The region has continued to underperform, hampered by limited tech/AI exposure and political instability in Indonesia, the Philippines, and Thailand. These concerns have driven foreign investors to pull back, resulting in valuation de-ratings and capital outflows. Singapore stands out as a beacon of stability, attracting the bulk of FDI and capital, while Vietnam remains a bright spot, though its market is still small. 1

The region was caught off guard by the 2025 US tariffs, which initially targeted rerouted Chinese exports. Although the tariffs were painful, especially after prior US encouragement to shift production from China, subsequent negotiations have eased the burden, and Southeast Asia has weathered the shock relatively well.

Managers remain disappointed with the region’s overall performance but continue to find idiosyncratic and company-specific opportunities. Low valuations in select markets and sectors keep managers engaged, though they remain highly selective in both public and private markets. Additional Federal Reserve rate cuts and resumed USD weakness should provide some relief by enabling domestic rate cuts and currency stability, but a sustained re-rating will require greater political stability and pro-growth policies.

Japan: Corporate reform, market opportunity, and the activism advantage

Japan appears to be emerging from decades of deflation. Expectations of further fiscal easing under new Prime Minister Sanae Takaichi—who has called for snap elections on February 8 to strengthen her legislative support—has seen Japanese equities rally amid renewed yen weakness. For foreign investors, yen weakness has eroded unhedged returns, offsetting otherwise strong local currency performance in recent years. We anticipate that continued growth and inflation will exert pressure on the Bank of Japan to normalize policy and raise rates, which should support the yen, now at depressed valuations. While a stronger yen would benefit foreign investors through positive currency translation, it has historically been associated with weaker returns for large-cap Japanese equities, which tend to be negatively correlated with the currency. This dynamic is particularly relevant now, as large-cap valuations are starting to look expensive relative to their own history. By contrast, small-cap Japanese equities have more attractive valuations and are less sensitive to movements in the currency given their domestic focus.

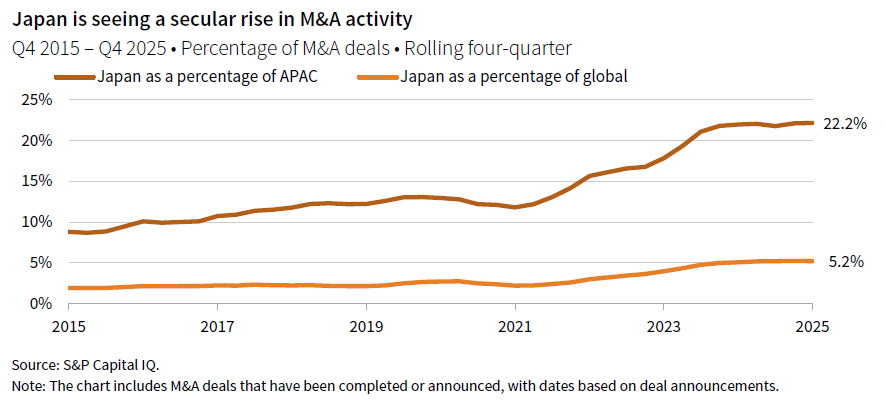

Japan continues to stand out in Asia for expanding alpha opportunities tied to its corporate governance revolution. Public and private regional managers are committing more capital, citing rising mergers & acquisitions (M&A), buybacks, payout ratios, and improved capital management. Investor engagement and activism are becoming mainstream, benefiting activist, event-driven, and small-cap public equity strategies, as well as buyout managers.

Japanese PE returns have improved over the last decade, closing the gap with US and European peers despite pronounced yen weakness. M&A activity accelerated in fourth quarter 2023 after new guidelines required boards to consider credible offers and engage independent committees. While global M&A also improved, it remained relatively soft.

Challenges persist, such as slow progress on board diversity and uneven corporate governance enforcement, but the trajectory is positive. Japan’s experience is now a reference point for the region, and Pan-Asia PE managers are committing more capital, confident that ongoing improvements in governance, macro fundamentals, and shareholder returns will continue to drive opportunity across the market-cap spectrum.

New Asia themes

Beyond the individual country outlooks, several structural themes are reshaping the investment landscape across Asia. Chief among these is the region’s accelerating focus on shareholder value and its evolving role in the global AI ecosystem. These cross-cutting themes are creating new opportunities and risks for investors.

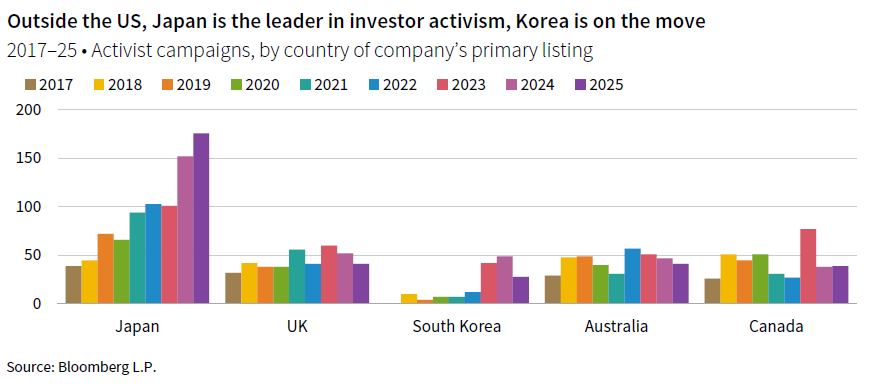

Korea and the spread of shareholder value

Korea’s transformation was remarkable in 2025. After years of skepticism and persistent valuation discounts, investor sentiment has shifted decisively with the equity market returning an eye-catching 100% in USD terms—driven by AI enthusiasm, especially in Samsung Electronics and SK hynix. However, the market’s inflection point arguably began in April, as foreign investors poured in following the impeachment of President Yoon Suk Yeol, ending the constitutional crisis that followed the failed attempt to declare martial law in late 2024. Fresh elections allowed investors to refocus on Korea’s strategic position in the global tech supply chain and meaningful corporate governance reforms.

The South Korean Corporate Value-Up Program, launched in 2024, followed by legislative changes to the Commercial Code in July 2025 have been central to this shift. These initiatives, backed by all major regulators, aim to boost shareholder returns, strengthen board independence, enhance transparency, and increase minority shareholders’ voting power. The South Korean Corporate Value-Up Program was fully voluntary, while more recent legislative changes have real consequences for non-compliance, making directors legally accountable for protecting shareholder value and treating all shareholders equally.

While these changes alone won’t fully align chaebol 2 interests with minority shareholders, progress is evident. Activist campaigns have surged, and board independence and transparency are improving. Further reforms, such as tax changes and stewardship code updates, will be needed to sustain momentum. Skepticism remains about the depth and durability of reforms, but the market’s response has been overwhelmingly positive.

The focus on shareholder value is spreading, though unevenly, across Asia. In China, the government’s February 2024 “9 rules” policy signaled intent to improve governance and shareholder returns, especially among state-owned enterprises and large listed companies. There are isolated cases of increased dividends, buybacks, and responsiveness to investors, but these are not yet widespread or market-defining. Activism remains rare, and most engagement is “soft” and behind the scenes.

Elsewhere, especially in Southeast Asia, the shift is more subtle. Managers report that companies are more receptive to investor suggestions on how to improve efficiency and returns, often through collaborative engagement rather than hardline activism. This is most evident in markets with deepening capital markets and a growing institutional investor base.

Overall, the shareholder value “playbook” is most advanced in Japan and Korea, with China showing selective progress and Southeast Asia demonstrating increased openness to investor input. For investors, this means alpha opportunities from governance reform and event-driven strategies are expanding but remain concentrated in North Asia.

Asia’s role in the AI tech stack

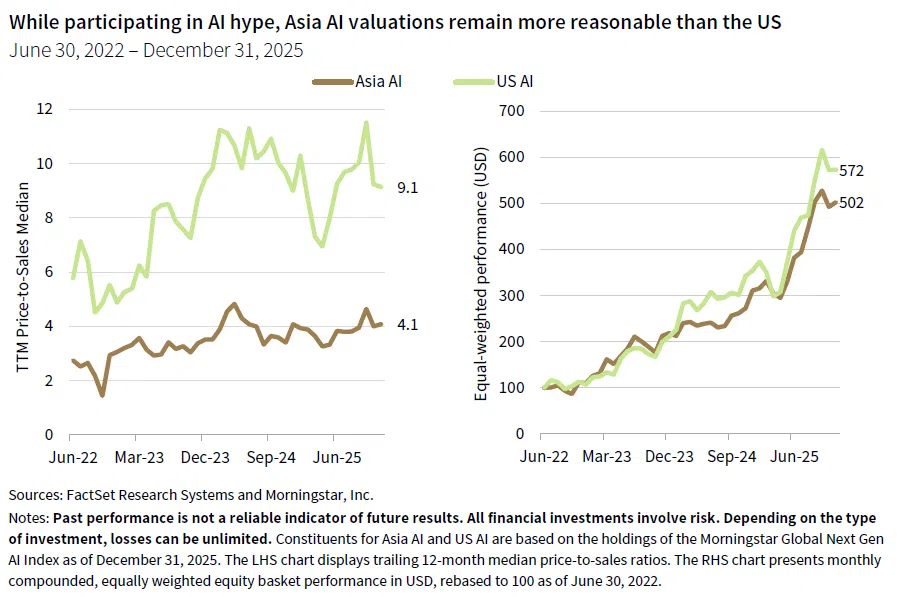

Asia has become indispensable to the global AI ecosystem. While the United States and China dominate the headlines and the development of foundational AI models, the rest of Asia plays an important role. Taiwan and Korea anchor advanced chip and memory production, with TSMC, Samsung, and SK hynix critical players. Japan is a leader in robotics and “physical AI,” as well as industrial applications. Singapore, Malaysia, and Indonesia are rapidly scaling data center infrastructure, while India’s AI opportunity is primarily in applied AI, especially in data-rich sectors like fintech, health tech, logistics, and SaaS.

For investors, an allocation to Asia now brings considerable exposure to AI. In fact, some Asian markets, especially Taiwan and Korea, are even more concentrated in AI-related names than the US market, which is home to the Magnificent 7. While Asian AI equities are somewhat less expensive than their US peers, they are not immune to the risks: if the AI trade falters, Asian AI stocks will also be vulnerable.

We are not recommending an overweight to Asian AI themes but highlight that investing in Asia provides meaningful exposure to the global AI buildout. For most investors, Asia offers a way to round out AI exposure, diversify beyond US-centric portfolios, and access the hardware, infrastructure, and applied innovations that underpin the sector’s growth.

Conclusion: Alpha and activism are alive and well

Asia is surviving the tariff storm better than expected. With the Trump administration striking a “trade truce” with China and shifting focus away from Asia, the outperformance of most Asian markets in 2025 was well supported. Still, economic growth will likely face headwinds in 2026 as export growth slows after front-running tariffs, and US consumption growth moderates. China and India are both likely to see growth cool further, while Taiwan and Korea remain leveraged to the AI spending cycle. Japan is both exposed to exports and is the odd man out facing rising interest rate pressures, albeit from a low base. Growth in Southeast Asia remains constrained by political headwinds.

After a strong year, Asian valuations are higher than two years ago, but outside of pockets like India and AI-related sectors, they are not excessive. The impact of a weaker US dollar on capital flows to Asia remains uncertain, but managers consistently reference increased investor interest in the region. While Asia is not immune to a US slowdown or a deflating AI bubble, the region is well positioned to weather volatility and may benefit if US AI enthusiasm fades and capital rotates to less expensive markets.

Even as growth and equity beta prospects moderate, alpha opportunities have improved, driven by rising activism and a stronger focus on shareholder value.

We reiterate the following investment views:

- China is not “uninvestable.” While we are neutral on Chinese equities, we would not shun this market, especially as part of regional Asia or EM funds. While China PE faces increased headwinds, China VC and healthcare merits closer attention for those willing to bear the geopolitical/regulatory uncertainty.

- India public markets remain expensive as earnings growth expectations still seem too high, leaving us neutral on public equities, but private market opportunities (both PE and VC) focused on domestic demand and business succession are attractive for long-term investors.

- Asia overall, particularly India, Taiwan, Japan, and Korea, look expensive. As such, Asia value strategies, which are more fairly valued in absolute terms, can tilt exposure toward less expensive, less tech-centric segments.

- Pan-Asia PE may be more effective than single country or regional approaches for China and Southeast Asia, and most Pan-Asia managers are also increasing their exposure to India and Japan.

- Japanese large-cap public equities are expensive and vulnerable to yen strength. We believe buyouts, activist strategies, and small- to mid-cap equities are better ways to access Japan’s ongoing governance and M&A themes.

- Asia event-driven strategies offer exposure to the activist/shareholder value trend, while renewed capital markets activity in Hong Kong has created opportunities for Asia hedge funds, which outperformed regional peers in 2025.

- Asia provides meaningful AI exposure, rounding out global portfolios and providing differentiated opportunities beyond US-centric AI plays. However, investors should not expect this diversification to provide much ballast during an AI downturn, as Asian AI equities are likely to be affected alongside their global peers.

- Asian currencies are cheap and could boost returns for Asia assets if USD weakness persists. Leaning into non-USD assets, including Asian equities, may be a way to benefit.

Justin Hopfer and Graham Landrith also contributed to this publication.

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 24 emerging markets (EM) countries. With 2,558 constituents, the index covers approximately 85% of the global investable equity opportunity set. DM countries include Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. EM countries include Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

The MSCI Asia ex Japan Index is a free float–adjusted, market capitalization–weighted index that is designed to measure the equity market performance of Asia, excluding Japan. The index consists of the following developed and emerging markets countries: China, Hong Kong, India, Indonesia, Korea, Malaysia, the Philippines, Singapore, Taiwan, and Thailand.

The MSCI Asia ex Japan Value Weighted Index is based on the MSCI Asia ex Japan Index, its parent index, which includes large- and mid-cap securities across developed and emerging markets in Asia, excluding Japan. The Value Weighted Index reweights all the constituents of the parent index according to four fundamental accounting factors: sales, book value, earnings, and cash earnings. The index aims to reflect the performance of securities with higher fundamental values.

The MSCI Indonesia Index is a free float–adjusted, market capitalization–weighted index designed to measure the performance of the large and mid-cap segments of the Indonesian market.

The MSCI Malaysia Index is a free float–adjusted, market capitalization–weighted index designed to measure the performance of the large and mid-cap segments of the Malaysian market.

The MSCI Philippines Index is a free float–adjusted, market capitalization–weighted index designed to measure the performance of the large and mid-cap segments of the Philippine market.

The MSCI Singapore Index is a free float–adjusted, market capitalization–weighted index that is designed to measure the equity market performance of Singapore.

The MSCI Thailand Index is a free float–adjusted, market capitalization–weighted index designed to measure the performance of the large and mid-cap segments of the Thai market.

The MSCI US Index is designed to measure the performance of the large- and mid-cap segments of the US market. With 626 constituents, the index covers approximately 85% of the free float–adjusted market capitalization in the United States.

Footnotes

- Vietnam is still considered a frontier market by MSCI. If the MSCI Vietnam Index market cap of $58.5B were included in the MSCI ASEAN Index, Vietnam would only account for 7.4% of the index.

- Large, family controlled conglomerates that dominate South Korea’s economy, often characterized by complex cross-shareholdings among affiliated companies.

Celia Dallas - Celia Dallas is the Chief Investment Strategist and a Partner at Cambridge Associates.

Aaron Costello, CFA - Aaron Costello is the Head of Asia and is responsible for the firm’s investment and research activities in the region.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.