Portfolio Liquidity

The last major equity market downturn ended more than a decade ago, and today investors worry about slowing growth and worsening trade wars. Whether the next downturn is a few months away or a few years away, this is an excellent time to prepare portfolios to successfully navigate equity stress. We believe the best way to navigate an equity market downturn is to enter it with a plan in place. Thoughtful decisions—not rash actions—during these chaotic environments are what separate the top-performing investors from everyone else. In this series, we review five important topics that should inform any plan to manage portfolios through equity market downturns:

- Market History

- PORTFOLIO LIQUIDITY

- Diversification Challenges

- Behavioral Roadblocks

- Playing Offense

While many institutional investors have the luxury of a long-term orientation, most periodically need to source cash from their portfolios for spending, capital calls, or rebalancing needs. Today, extracting cash is easy, with hedge fund gates virtually non-existent and secondary-market purchases of private equity limited partner (LP) interests increasingly common. 1 However, these trends are cyclical. The ability of investors to source cash from highly diversified portfolios will decline as the next downturn hits. Investors that have not recently stress-tested their portfolios to determine whether they will support spending and permit rebalancing in a sharp downturn, should do so now.

Investors whose allocations to private investments have soared in recent years, while bond holdings have shrunk, should pay close attention to their portfolio’s liquidity. Larger allocations to private equity boost the potential for strong portfolio returns; we continue to recommend that investors with spending requirements that are modest in relation to their overall portfolio, such as many family offices, consider building chunky allocations to well-chosen private investment funds. However, they also force investors to calibrate how illiquid their portfolios could become in a future downturn, and perhaps, whether the institution would have any spending flexibility in a severe downturn. In this piece, we provide guidance to institutions on stress-testing a portfolio’s liquidity, a few thoughts on liquidity sources, and a handful of near-term portfolio modifications that could boost liquidity.

Although this piece doesn’t focus on the harmful systemic impacts that downturns can have, investors should be mindful of them when considering their own liquidity needs. For some bond issuers, steep equity downturns can impact credit ratings or increase the risk of debt covenant breaches; either of these can boost borrowing costs or make borrowing very difficult. In addition, institutions that rely on charitable giving or cyclical operational revenues could see contributions decrease during a sustained downturn, which is right when spending may be most needed.

One key action that we propose is for investors to sum up the portfolio assets that are liquid on a monthly or more-frequent basis. Then, they should stress-test that sum to determine the total value of these assets after market declines comparable to the global financial crisis (GFC). If that market-stressed value is less than three times the sum of annual required spending and capital calls, investors should consider taking immediate steps to boost their portfolio liquidity. 2

Portfolios Have Become Structurally Less Liquid

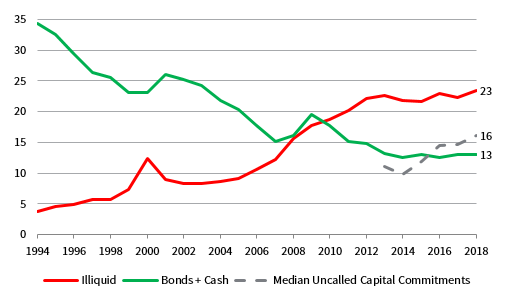

As investors have become more pessimistic about future returns from traditional stock and bond markets and more enamored with venture capital and buyouts, they have steadily boosted allocations to private investments. Endowments with greater than $500 million in assets hold an average of 23% in private investments now, up from just 8% 15 years ago, according to Cambridge Associates data. Allocations to fixed income and cash have fallen by nearly half over that time, to 13%. And the median of these institutions has uncalled capital commitments amounting to more than 16% of the portfolio. 3

MEAN ASSET ALLOCATION BY INVESTMENT TYPE (ASSET SIZE >$500M)

1994–2018 • Percent of Total Assets (%)

Source: Cambridge Associates LLC.

Notes: Annual data are as of June 30. Illiquid assets include non-venture private equity, venture capital, distressed securities (private equity structure), private oil & gas/natural resources, private real estate, and timber. Uncalled capital is the amount committed, but not yet paid in, to private investment funds as a percentage of the long-term investment portfolio.

While this is a sensible shift for many institutions, a larger allocation to privates should be accompanied by an increased focus on liquidity planning. Large private investment allocations have significant implications for liquidity management, particularly for institutions with meaningful annual spending requirements that also hold hedge funds or other investments with lock-ups.

Stressed Out

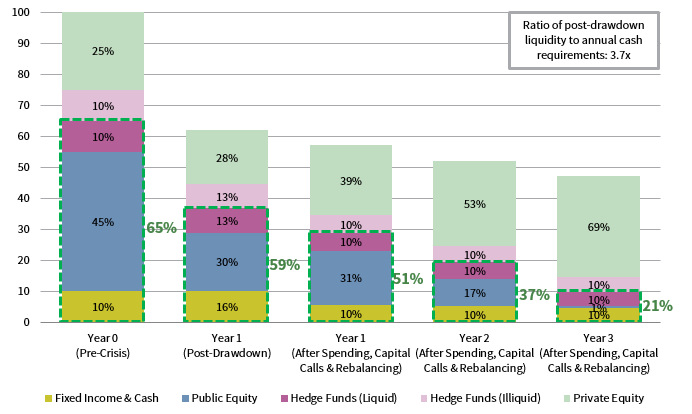

During a downturn, institutions are often unable to slow spending or limit capital calls. To illustrate the liquidity pressures for an institution with 25% of its assets in private investments and meaningful annual spending requirements, we developed a sample portfolio and stressed it with declines equivalent to those experienced during the GFC. We also assumed that markets would not rebound for three years. 4 In this scenario, the sample portfolio could see its privates allocation swell to nearly 70% of the total portfolio, as spending and capital calls eventually consume much of the portfolio’s bonds, stocks, and hedge funds. Only the private investment portfolio rebounds in market value as general partners call capital. Assuming the investor attempted to hold the overall equity allocation (listed equities plus privates) relatively static, the allocation to listed equities would be entirely consumed by the end of three disastrous years, even though it started out as 45% of the portfolio.

ASSET ALLOCATION AND AVAILABLE LIQUIDITY IN A CRISIS ENVIRONMENT

USD Terms

Source: Cambridge Associates LLC.

Notes: Green dotted lines represent liquid assets, and the relationship of these to total assets is shown in green as a percentage. Relatively liquid portfolios generally have a ratio of post-drawdown liquid assets to total annual cash requirements (spending + capital calls) of at least 3.0x. Totals may not sum to 100% due to rounding.

Liquid assets available on a daily or monthly basis for this hypothetical $100 million portfolio began the scenario at $65 million or 6.5 times the institution’s annual cash requirements. The initial impact of the market decline shrinks this total to $37 million, or 3.7 times the institution’s annual cash requirements for spending and capital calls. By the end of Year 3, liquid assets are scant in USD terms, amounting to less than the next year’s spending and capital calls. 5

While there is not necessarily an optimal ratio of post-stress liquid assets to annual cash needs, we think that 3x is a reasonable (albeit conservative) minimum level. Why 3x? When Kevin Rosenbaum examined each of the post-1970 US equity bear markets for his companion piece “Market History,” he found that the longest downturn lasted more than two years from peak-to-trough, so ensuring that liquid assets would cover three very lean years is a conservative yet prudent measure.

Changing any of the many assumptions used in this simple model would change the simulated results, of course, 6 and institutions should consider their own portfolio’s allocation to less-liquid assets, ability to adjust spending, and comfort level in substituting private equity with public equity in a pinch (a topic we examine next).

Subbing Private Equity for Public Equity?

We have previously suggested in some venues that investors maintain a combined allocation to bonds and cash that is at least equal to one year’s expected cash requirements from spending and capital calls. This is a good liquidity rule of thumb for investors that are not willing to consider public and private equity exposure to be somewhat fungible. Investors that are comfortable with the possibility that private equity could take the place of some of their portfolio’s public equity can then incorporate public equity exposure into their liquidity planning. However, there are a few important caveats to this. First, while both are equity, they will perform quite differently. The returns of broad private equity benchmarks differ meaningfully from public equities, and performance dispersion across individual private managers will magnify return differences even more. To the degree that an investor’s portfolio allocation becomes more heavily allocated to privates than to public equities, this will boost the portfolio’s tracking error versus its benchmark (unless the investor boosts the total-portfolio benchmark’s exposure to privates simultaneously). Second, investors planning to use their public equity as a funding source must plan for the available amount to shrink meaningfully in a severe downturn. For example, if an institution has $100 million in liquid equities pre-downturn and is counting on that pool to cover future capital calls, it must recognize that market stress could easily shrink the value of public equities to $50 million or less. Third, the “equity is equity, whether public or private” approach requires an institution to sell listed equities to fulfill capital call needs, even when equity valuations may be quite depressed. To do so, investors need to have faith that the private equity managers calling capital have identified very cheap private investments to correspond to the bargain-basement stocks that are being liquidated. Investors that are uncomfortable treating public equities as a liquidity source will likely need to hold large allocations to bonds and cash, which tend to have an opportunity cost relative to risky assets.

Sourcing Liquidity Yesterday, Today, and Tomorrow

Beyond the basics of simply using portfolio cash and liquidating public equities and bonds to raise cash, we will touch on a few more nuances.

First, investors with large allocations to funds that have gating provisions should assume that managers will lower those gates during a stress scenario, 7 as managers will likely find few reasonable bids for their assets and will receive more redemption requests than usual. Gates were employed by many hedge fund managers in 2008 and 2009, and they impacted UK property funds in the aftermath of the 2016 Brexit vote. Gates and floating net asset values (NAVs) may also be employed within “prime” money market funds in the United States, though money market fund gates would likely not be employed for an extended period.

Second, while investors could use the secondary markets to liquidate private investments during a severe downturn (and some prominent institutions did that during the GFC), we would not incorporate this into liquidity planning. In the first half of 2009, the median secondary market bid was just 35% of NAV!

And, third, some institutions may consider using the liability side of their balance sheet to manage liquidity. For example, organizations may secure a line of credit from a financial institution. However, many such lines can be withdrawn or curtailed at the discretion of the bank unless the institution pays a fee for a committed line. During the GFC, a few institutions issued bonds; however, market conditions may not always support this, even for highly appealing issuers. And investors can use futures or total return swaps to maintain targeted exposure to listed equities, but the appetite of many organizations to use leverage during a crisis is probably limited, especially if they don’t regularly use derivatives.

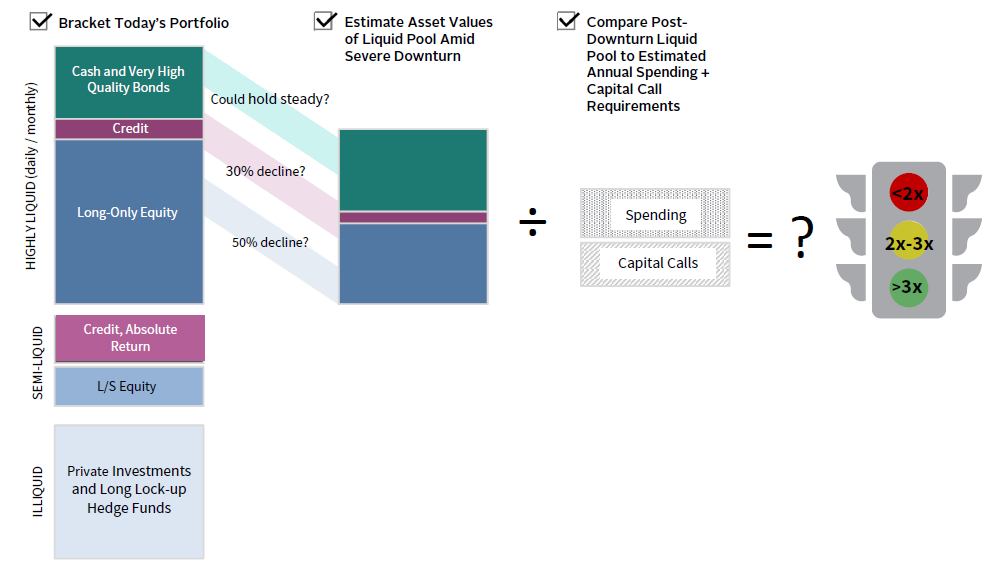

Today’s To-Do List

Investors with meaningful allocations to illiquid and semi-liquid funds should engage in some stress testing, and should develop a plan for sourcing and using available liquidity during the next downturn. First, they should determine the assets that can be sold within a matter of weeks. Next, investors should simulate the impact of market stress by assuming extreme market conditions, such as the peak-to-trough declines of the GFC. Finally, they should compare the size of that hypothetical post-downturn liquidity bucket to the expected annual sum of spending and capital calls.

If the stress-scenario liquidity bucket is below 3x projected annual cash requirements, then it’s time to start making changes to build liquidity. When investors have many avenues open to them, it is better to act deliberately than to wait until markets force one’s hand. Depending on how dire a picture the stress scenario paints, the investor may need to employ several measures, or they may be able to choose only the least disruptive options. Specifically, investors can sharply limit future capital commitments to private investments, or at least can substitute shorter-fuse investments like secondaries funds for very long-term commitments like early-stage venture capital. 8 Portfolios with hefty allocations to vehicles employing multi-year or multi-quarter lock-ups (or with gating provisions) may want to submit redemption notices now if their stress-scenario liquidity bucket is inadequate, switching to vehicles that offer more flexibility. Disrupting a well-thought-out manager structure is unappealing, but so is selling locked-up funds on the secondary market for pennies on the dollar during a crisis.

LIQUIDITY TO-DO LIST

For Illustrative Purposes Only

Source: Cambridge Associates LLC.

Conclusion

Allocations to private investments have ballooned in size over the past 15 years, which has the potential to boost returns and is prudent for many investors. However, investors that have inflexible spending needs 9 and large allocations to illiquid assets should plan how they will tackle the next downturn’s liquidity challenges.

If they are planning to use their public equity holdings (and perhaps safe-haven assets described in Sean Duffin’s “Diversification Challenges”) as part of their liquidity reserve to support spending and capital calls in the next downturn, they should stress-test their liquidity bucket. Next, they should calculate the value of the portfolio’s liquid assets in a scenario where asset classes fall to GFC lows. Then, compare that stressed sum to the institution’s annual cash demand (required spending and capital calls). If the former is less than three times the latter, investors should consider taking steps now to boost liquidity. It’s best to inflate the raft before the river rises. Investors that have planned well and have adequate liquidity will be positioned well to go on offense when the next market meltdown offers appealing opportunities, as outlined in Wade O’Brien’s “Playing Offense.”

Sean McLaughlin, Head of Capital Markets Research

David Kautter also contributed.

Read part 3: Diversification Challenges

Footnotes

- Secondary transactions were a record $72 billion last year, according to Coller Capital. We note today’s benign environment and refer to prior freeze-ups not because institutions are using secondary sales for liquidity today, but rather to dissuade investors from baking them into their liquidity plans for future downturns.

- We address the genesis of the 3x multiple later in this piece. Boosting liquidity does not mean selling risky assets to boost cash. Rather, the focus is on holding risky assets in more-liquid vehicles.

- Institutions with smaller portfolios hold lighter allocations to private investments on average; however, many with far less than $500 million have meaningful private stakes.

- In this stylized and arguably extreme stress scenario, we assume Year 1 returns for each asset class are equal to the asset class’s peak-to-trough drawdown during the 2007–09 period, with zero returns assumed in Years 2 and 3. Spending in this scenario is held constant at $5 million annually (5% of the original portfolio value). The annual pace of capital calls is set at 20% of the initial allocation to private investments; this is highly variable in practice; given that the average level of unfunded commitments is 70% of the average private investments NAV in Figure 1, 20% of beginning NAV may be on the high end of the range of annual capital-call expectations. We assume both cash outlays occur at year-end. In the GFC, capital calls slowed materially, due to pushback from liquidity-challenged LPs, large bid-ask spreads for assets, severe debt funding challenges, and some general partners’ reluctance to buy severely impaired assets amid a financial crisis. While the next downturn could see a repeat of this slowdown, it would be risky for LPs to assume that capital calls will again dry up in the next downturn. Spending in the scenario is drawn from asset classes in a way that targets a consistent level of portfolio exposure to equity (private and public combined), and is generally consistent with liquidity terms employed by the types of managers used by Cambridge Associates clients to invest in each asset class.

- We assume that half of the portfolios’ hedge fund allocation was available for redemption in a given year, and none of the portfolios’ traditional equity allocation is in lock-up vehicles such as long-only vehicles run by hedge fund managers (even though these are common across institutional portfolios). When choosing which vehicles to spend from within a given asset class, we assume the investor chooses the more-liquid vehicle first until it is fully depleted, and tries each year to maintain a 70% total allocation to listed equities plus privates and to maintain a constant ratio of hedge funds to bonds and cash.

- In a Fall 2008 article in The Journal of Portfolio Management “Alternatives and Liquidity: Will Spending and Capital Calls Eat Your ‘Modern’ Portfolio?,” Laurence B. Siegel (the research director at that time of the Ford Foundation, and now at the CFA Institute Research Foundation) created a similar exercise, but with different assumptions. For an institution that spends 6% annually and whose portfolio began with a 50% allocation to alternatives (split 50/50 into hedge funds and private investments), the allocation to alternatives grew to 80% and 87% in three-year bear market and catastrophic market scenarios, respectively.

- When we refer to gates being lowered, we mean that managers are employing temporary restrictions to prevent investors from withdrawing assets from the fund.

- While secondary markets currently offer robust demand for private investment stakes, with discounts to NAV that are narrower than they have been during market downturns, most investors would find secondary sales unappealing unless they are severely overallocated to privates.

- Or indeed, spending requirements that could expand during a recession.

Sean McLaughlin, CFA - Sean McLaughlin is the Head of the US Southeast & Mid-Atlantic Endowment & Foundation Practice at Cambridge Associates.