No Surprises: Managing Risk in Family Portfolios

Creating portfolios that are customized to a family’s unique investment goals and risk tolerance requires ingenuity and flexible thinking. However, the execution of risk management should be more systematic. It depends on setting clear frameworks to monitor risks, consistently implementing those frameworks to ensure one’s understanding of the portfolio remains current, and regularly communicating the results of this work to all stakeholders. This last piece plays a crucial role in making sure buy-in and support for the portfolio remain intact, especially through periods of market volatility.

Ultimately, an effective risk management framework is one that accounts for potential risk at every stage of the investment process. Families and their advisors should employ a risk management discipline that considers four components: strategic risk, implementation risk, portfolio monitoring, and communication. By doing so, families will not only better understand the key mechanisms of successful risk management and what is at stake; they can also more effectively pursue their investment goals.

Strategic Risk: Knowing Your Objectives—and Your Expectations

Asset allocation is the top driver of portfolio returns, but it is also foundational to sound risk management. A solid allocation strategy guards a portfolio against its greatest existential threat—failure to meet its long-term return objective and preserve purchasing power by generating a return greater than spending, taxes, expenses, and inflation.

Usually, investors that find their portfolio has drifted off course have made one of three strategic missteps. The first is improperly setting—or failing to adjust over time—the portfolio’s return objective (e.g., the return needed to meet its long-term goals). Often, a portfolio’s return objective is misaligned due to an underestimation of taxes or spending. A second common misstep is failing to set an asset allocation strategy that can generate the return objective over the long term—for example, taking too little equity risk to drive sufficient returns. A third frequent strategic misstep is miscalibrating risk tolerance, including not fully understanding liquidity needs and appetite for volatility risk. Misaligned risk tolerance can result in poorly timed decisions and can impact long-term returns.

Three Common Strategic Missteps

- Improper setting (or adjustment) of return objectives.

- Asset allocation strategy misaligned with return objectives.

- Miscalibration of risk tolerance.

Taking action to avoid these missteps and to establish clear expectations for the portfolio is fundamental to managing strategic risk. Clarity here will help ensure the portfolio remains aligned with the amount of risk a family is willing to take to meet their goals and will increase the chances that the portfolio can be successfully managed through inevitable periods of market volatility. Establishing distinct objectives will also help investors avoid decisions born out of fear and uncertainty that can permanently destroy value.

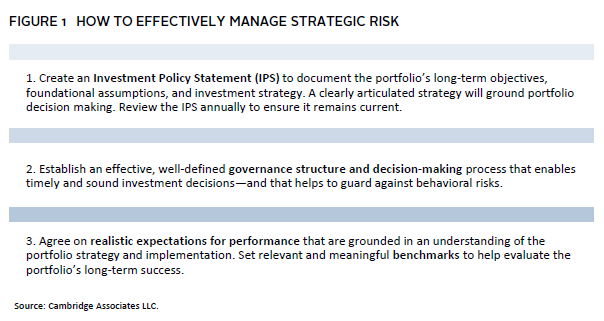

When managing strategic risk, the formulation of well-aligned portfolio objectives is step one. To increase the chances that a family sticks to its strategy, a few other steps are required (Figure 1).

Implementation Risk: Minding the Details

Most frameworks for measuring and monitoring risk center on investment implementation—how the portfolio is ultimately invested relative to the strategic asset allocation. The risk management framework a family employs should help them clearly understand how a portfolio is positioned and inform decisions on any needed adjustments. Although each family has its own priorities and preferences related to risk, all families should ask several key questions to make sure they appreciate—and are comfortable with—the level of implementation risk in their portfolio.

Does Our Portfolio Have Sufficient Liquidity?

Sound liquidity management is perhaps the most important element of risk management. Failing to plan sufficiently for liquidity needed to support spending, tax payments, capital calls, and expected (or unexpected) outsized withdrawals can result in selling assets at an inopportune time and permanent loss of capital. Awareness of portfolio liquidity risk is critical, and it must be carefully considered when setting the strategic asset allocation. Once set, portfolio liquidity must be consistently monitored to ensure levels remain adequate.

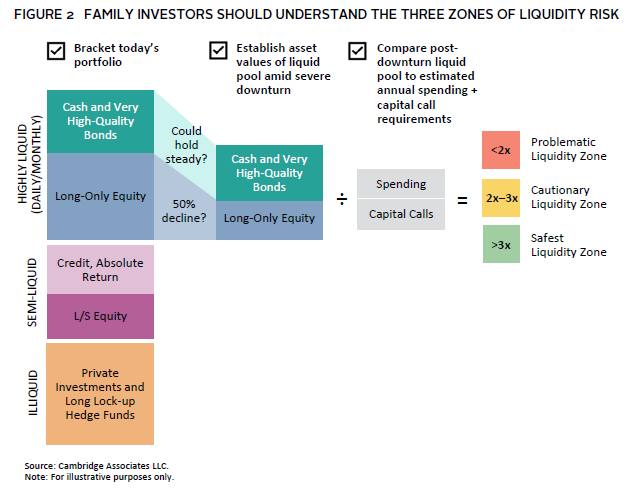

Investors can apply various rules to maintain a prudent level of liquidity, such as ensuring that cash and fixed income total at least two years’ worth (or similar) of estimated spending and capital calls. Portfolios should be stress tested periodically to ensure that portfolio liquidity remains adequate across a range of potential market environments. If this stress testing reveals a potential liquidity mismatch, families can take action before an actual market sell-off occurs, thereby helping to decrease their risk of capital loss (Figure 2).

For example, stress testing the current portfolio using asset class performance during the 2007–08 Global Financial Crisis, given that period’s particularly devastating impact on liquidity, may be helpful in assessing liquidity risk. The portfolio should be able to fund spending and private investment capital calls across all market environments without incurring significant damage to its overall balance and diversification. Measuring the percentage of unfunded commitments to funded commitments will achieve the most comprehensive reading of portfolio liquidity.

Remaining cognizant of manager liquidity windows (including lock-ups and side pockets), regularly running private investment commitment modeling, and having a line of credit in place to smoothly manage transactions are all steps families can take to maintain a healthy equilibrium.

Are We Comfortable With the Risks of Active Management and Confident in our Manager Due Diligence Process?

One of the foundational decisions a family must make is whether to invest passively, allocate capital to active managers, or take a combined approach. Investing passively means aiming for investment returns that closely mirror those of the benchmark, while active management seeks to generate market outperformance. Families should always evaluate the performance of active managers after fees and the impact of taxes.

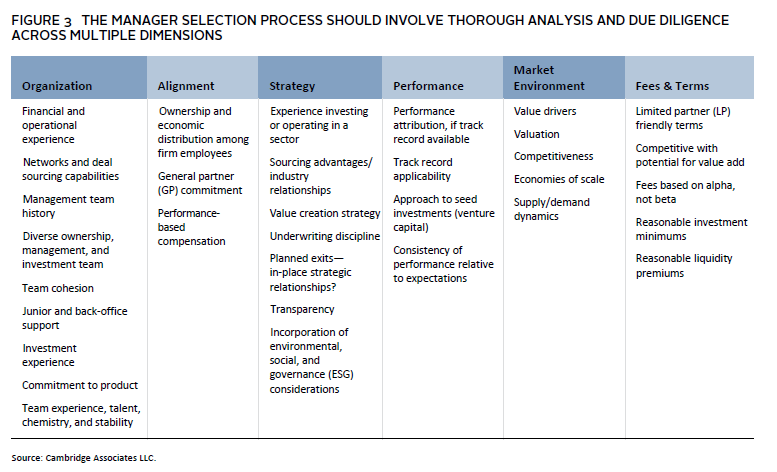

If a family chooses to invest with active managers, manager due diligence, selection, and monitoring will be key areas of focus. In the due diligence phase, investors will need to gain comfort with a manager’s investment strategy, investment team, strategy for generating outperformance, and portfolio and risk management abilities. In addition to thorough investment due diligence, investors must evaluate the organization and assess potential operational risks (Figure 3).

There is no such thing as an investment manager with zero inherent risk. However, allocating capital to a manager that is not able to execute its investment strategy—or, in the worst-case scenario, is operating fraudulently—represents a markedly greater risk of permanent loss or impairment of a family’s capital. Sufficient resources must be devoted to performing extremely thorough diligence on each potential investment manager to reduce such risks. Once an investment is made, managers must then be actively monitored to ensure nothing of note has changed organizationally or with their investment process that might warrant redemption.

Monitoring managers involves analyzing information distributed by the manager, including investment letters, monthly portfolio and risk summaries, and updates to due diligence questionnaires. At a minimum, prudent monitoring must involve annual direct communication with the manager to evaluate and confirm organizational stability, investment processes, and current investment opportunity set. Red flags to watch for are material organizational changes, such as changes in senior members of the investment team and/or operational team, changes in the investment process, a drift in strategy, and decreases in the asset, liquidity, or investor base that result in instability.

Although monitoring the investment team is often a central focus of investors, continuous monitoring of the operations team is just as important. Operational monitoring may include an annual review of service providers and their pricing policy as well as confirming that the overall operations platform is appropriately aligned with the complexity of the strategy.

Do Our Managers Complement Each Other Sufficiently?

In building a diversified portfolio, the goal is not only to find managers that can outperform over the long term, but also to create a portfolio that is greater than the sum of its parts. To accomplish this, certain allocations should mitigate the risk of others by being differentiated from each other, resulting in diversification benefits. Managers held within a portfolio must be looked at together, with statistical analysis conducted to determine how the proposed portfolio might behave. Investors should review correlation of returns and correlation of value-added to see how differently or similarly managers may behave to each other and to relevant benchmarks. Additionally, reviewing managers’ current holdings will highlight overlapping exposures that can lead to redundancy. These analyses must be undertaken regularly to confirm that historical behaviors and current manager positioning are in line with expectations and match the overall risk/return tolerance of the investor.

Are Our Managers Sized Appropriately in the Portfolio?

To ensure that high-conviction managers are sized appropriately, frequent analysis of the portfolio’s level of “active risk” is necessary. Active risk represents the potential impact on the performance of a portfolio relative to a policy benchmark. 1

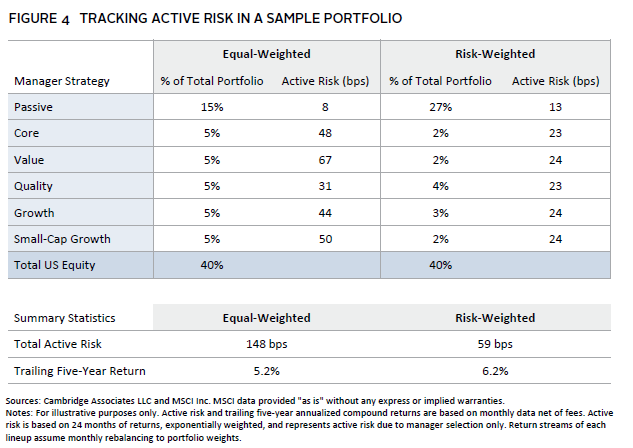

Active risk is the product of an investment’s capital allocation and the tracking error of that investment relative to its benchmark. Higher levels of active risk mean a manager is more likely to impact portfolio performance relative to the benchmark, either positively or negatively. The right level of active risk—per individual manager and total portfolio—will vary by investor. As a general guideline, we believe it is prudent for individual manager positions to be capped at 50 basis points (bps) of active risk (0.50%). For example, a manager with a 10% tracking error relative to its benchmark should be sized at a max of 5% of the portfolio. The important thing is to understand why individual managers are sized the way they are and to regularly monitor a portfolio’s active risk to ensure the sizing of individual positions remains aligned with conviction in the manager.

Regular analyses of a portfolio’s active risk should be conducted across all regions and asset classes. As an example, Figure 4 details a US equity manager portfolio that holds a passive index manager with limited active risk and four active satellite managers with significantly more active risk. The equal-weighted portfolio measures the four active managers equally by percentage of total portfolio. In this example, the risk-weighted approach instead attempts to equalize by active risk, resulting in a more optimal overall US equity portfolio that has higher trailing returns and lower active risk.

Are We Aware of Our Portfolio’s Unique Strategic Exposures?

Strategic exposures can take many forms in a portfolio—including tilts toward certain geographies, sectors, or style factors in equity portfolios, or duration positioning in fixed income. Investors should understand which exposures are intended as part of their portfolio strategy and be prepared to identify and act on any unintended exposures that surface. Most investment portfolios have clearly defined target parameters for various asset classes, making basic exposures relatively easy to track. However, style factors are less overt and are worth watching closely. Depending on manager selection, even a broadly diversified portfolio can have tilts toward various return drivers that can move in and out of favor, depending on the market cycle. Outsized style exposure, including to value, momentum, quality, or dividend yield, is not inherently bad, but overexposure may lead to a portfolio performing differently than intended.

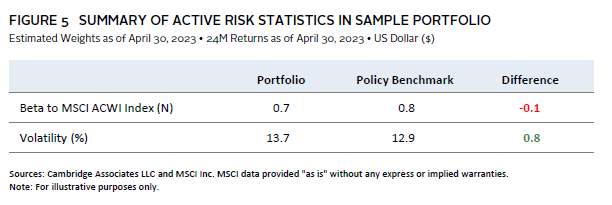

Additionally, measuring a portfolio’s volatility and sensitivity to market changes—its “beta” as compared to the “beta” of the policy benchmark—is essential to ensure the portfolio remains aligned with the intended risk level (Figure 5). If a portfolio, for instance, has a beta of 0.7 compared to a policy benchmark beta of 0.8, it may be “under risked” and may have to rely heavily on outperformance of its managers to match the return of the policy benchmark in a rising market—a big ask of active management. Conversely, if the portfolio beta is significantly higher than the policy beta, the portfolio may be exposed to larger potential drawdowns and higher volatility.

Are We Minimizing Risk Through All Steps of our Investment Execution?

Perhaps slightly less exciting—but certainly no less important—is that investment portfolio implementation must include a focus on the operational side of investing. The ongoing management of a portfolio requires the proper processes to support and execute trades, fund capital calls, manage stock distributions, handle subscription documents and subsequent manager communications, and enact the “know your customer” and anti-money laundering measures that are required for manager relationships. Families are susceptible to organizational risks, such as fraud or cyber risk, and having effective controls in place is essential to protecting a family’s wealth and privacy. Failure to adhere to any of these requirements can result in delays, trading errors, and/or missed deadlines, which can be detrimental to achieving desired returns. Having sufficient operational support—either within the family office or through outsourced partners—is key to effective investment execution and reducing execution risk. Family offices should consider engaging a third party to periodically review their internal controls and investment oversight procedures to minimize their risk.

Portfolio Monitoring: Watchful Vigilance

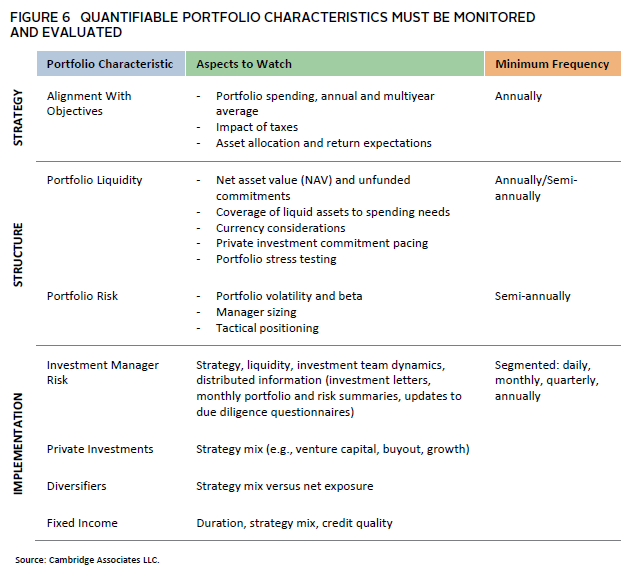

Portfolio monitoring is the unsung hero of risk management. It involves systematically reviewing each of the elements of the risk management framework a family has developed to ensure ongoing sound management of the portfolio. Whether you have a long lived or newly formulated investment strategy and implementation plan, their effectiveness over time will correlate directly to how well each is monitored on a yearly, quarterly, and daily basis (Figure 6). An investment portfolio is a complex machine—proactive observation is vital to ensuring it functions successfully.

Establishing a systematic process for monitoring a portfolio is a best practice. This should not be a “check the box” exercise, but rather should be focused on analysis that can actively inform decisions for the portfolio. Figure 6 provides an example of a framework that focuses on strategic alignment and informs each of the key questions discussed above. A family might emphasize different elements in their unique risk management framework. The important thing is to establish a process that is relevant to the family—and then to stick to it.

Communication: Keeping All Stakeholders in the Know

Proper management of strategic risk, implementation risk, and portfolio monitoring only goes so far if it happens in a vacuum that includes only investment staff or advisors. Regularly communicating the outcomes of a well-executed risk management framework to all stakeholders is an essential part of the process. Providing this transparency enables the family to remain confident that the portfolio is being implemented appropriately to achieve what it’s designed to accomplish. Establishing a cadence of communication as part of the risk management framework ensures that stakeholders will be informed, which can increase trust and help to reduce behavioral risks, especially through periods of market volatility.

Maintaining Long-Term Confidence

We believe the most effective investors are those that have a clear understanding of risk. What’s more, they understand that effective risk management is not a checklist of one-off measures, but an ongoing, highly disciplined process. Family investors should be clear-eyed about the resources needed to strategize, implement, monitor, and communicate about a portfolio for it to meet its goals over time. Working with an investment manager that can provide timely analysis and routine portfolio health checks should help families feel confident that their portfolio is well structured—and positioned to succeed.

Heather Jablow, Head of the Private Client Practice, North America

Mark Dalton, Managing Director, Private Client Practice

Scott Palmer, Senior Investment Director, Private Client Practice

Footnotes

- Active risk is defined as the size of the position multiplied by the standard deviation of excess returns over a benchmark. Active risk can be calculated for the total portfolio or any individual active position (e.g., manager performance in relation to the manager benchmark).

Mark Dalton - FootnotesActive risk is defined as the size of the position multiplied by the standard deviation of excess returns over a benchmark. Active risk can be calculated for the total portfolio or any individual active position (e.g., manager performance in relation to the manager benchmark).

Scott Palmer, CFA - Scott Palmer is a Managing Director for the Private Client Practice at Cambridge Associates.