Market Response to US-Iran Escalation Limited So Far

Last weekend, the United States conducted airstrikes on three of Iran’s principal nuclear facilities—Fordow, Natanz, and Isfahan. This marked a further escalation in Middle East tensions, which had already intensified after Israel began airstrikes on Iran on June 13. In response, Iran has now directly targeted US interests, launching missiles at US bases in Iraq and Qatar. Despite these developments, markets have remained calm, with US equity prices rising in trading today and both the dollar index and near-dated WTI crude oil futures retreating after initial spikes. Given the fluidity of the situation and the uncertainty surrounding how events may unfold, we believe most investors should not make changes to portfolios in response to this event.

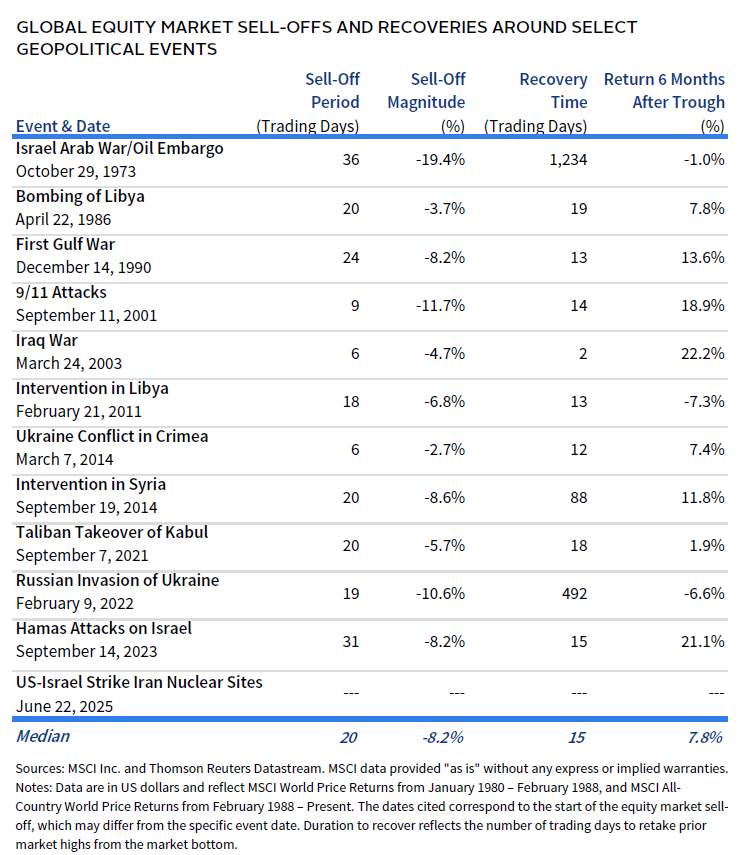

The measured market response appears reasonable, given the scale of Iran’s initial retaliation against the United States and the possibility that Iran may seek to limit future actions to avoid a broader conflict or risking its own regime’s stability. Historically, market sell-offs triggered by geopolitical shocks tend to be sharp but short-lived, with global equities often recovering most losses within a month (table below). A key risk is a potential global oil supply disruption if, for example, Iran blocks or impedes the Strait of Hormuz, which handles about a quarter of the world’s oil shipments. Since Israel attacked Iran earlier this June, insurance costs for shipping through the strait have surged by more than 60%. Even so, OPEC’s spare oil production capacity is currently relatively high, at around 5 million barrels per day or 5% of world oil demand, according to the US Energy Information Administration. This buffer could help offset potential supply disruptions, especially as the US Navy would likely act to ensure the continued flow of maritime traffic through the strait.

While the situation remains highly dynamic, we believe most investors are best served by maintaining their current diversified portfolios and relying on the resiliency that a diversified approach provides. Tactical shifts from policy should be sized modestly and reserved for instances where a broad and compelling set of market indicators meaningfully increases the probability of success. Regarding the current conflict, outcomes are largely dependent on the unpredictable decisions of political leaders in Iran, Israel, and the United States—an inherently uncertain basis for making portfolio adjustments. In our view, maintaining discipline and adhering to a well-defined investment process continue to be the most effective ways to manage risk and capture opportunities as they arise.

Aaron Costello, CFA - Aaron Costello is the Head of Asia and is responsible for the firm’s investment and research activities in the region.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.