Implementing Sustainable and Impact Investing in Investment Portfolios

Implementing sustainable and impact investing (SII) themes in investment portfolios can seem complex, leaving many investors new to SII wondering how to begin. This paper offers insight into building resilient portfolios that will contribute to and thrive in a more sustainable and equitable future. In today’s era of global health challenges, the stresses on our planet and natural resources, and the structural inequities in our socio-economic systems, we believe this discussion could not be more relevant. We offer three guiding principles for investors new to SII that encourage embracing active choices, seeking new perspectives, and protecting against cognitive bias. We encourage leaders in this space to reflect on these guiding principles as they deepen integration of SII into portfolios.

SII Is Financially Material

The terms sustainability and impact carry different meanings, revealing the relationship between financial returns and investor values. Many link sustainability to financial materiality, appreciating the significance of misunderstood environmental and social factors to an investor’s bottom line. Investors focused on integrating sustainability into portfolios are often also motivated by values or mission alignment. Impact investing is more specific, signifying “an investment made in an enterprise because [it] offers a market-based solution to an environmental or social challenge that the investor wishes to address.”

Values alignment and exclusionary screens drove the early stages of SII as a practice in the 20th century, which was valuable for elevating ESG concerns and understanding. Today, financial materiality is a more visible and key component thanks to a greater abundance of environmental, social, and governance (ESG) data and corporate disclosure. Structural trends, such as climate change, the rise of stakeholder capitalism, and technological innovation reinforce the materiality of sustainability and raise its profile in mainstream investing. For instance, many long-term investors view reducing carbon exposure throughout a diversified portfolio as not only a positive moral step to align with a low-carbon future, but also a prudent risk management tool as economies reduce dependence on fossil fuels. These investors are mindful of physical risks of climate change on vulnerable populations around the world and their impact on human health, human migration, consumer behavior, and other factors linked to asset prices in the long term.

A systems lens, which understands the linkages of these material SII factors to each other and to portfolios, can help investors distill this complex and growing landscape. We see an increasing supply of institutional quality investment products across asset classes that authentically and rigorously integrate material SII factors. With the proliferation of SII, however, comes a need for vigilance about greenwashing and potential alpha erosion as early mover advantages begin to fade in some subsectors.

Characteristics of SII portfolios

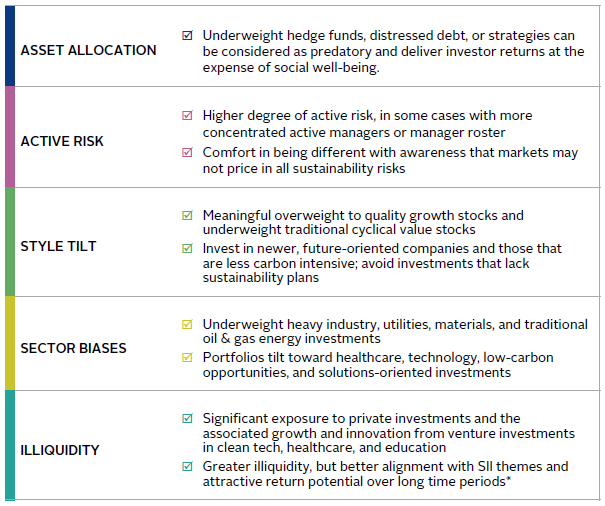

Integrating SII themes into a diversified portfolio is a viable, even necessary, approach to managing a long-term investment program. Within the broad field of SII, some investors choose to approach SII opportunistically, while others consider a variety of factors. Portfolios that integrate SII throughout tend to exhibit similar characteristics (Figure 1).

FIGURE 1 MANY SII PORTFOLIOS DISPLAY SIMILAR CHARACTERISTICS

* Please see Maureen Austin, William Prout, and David Thurston, “Private Investing for Private Investors: Life Can Be Better After 40%,”

Cambridge Associates LLC, 2018.

Source: Cambridge Associates LLC.

Some portfolio biases like growth tilts and sector preferences represent the opportunity set over the last several years. Other characteristics, like higher liquidity tolerance, were active choices to maximize alignment between SII themes and risk/return objectives. Many of the characteristics in Figure 1 have enjoyed performance tailwinds recently. Growth has outperformed value; the energy sector has suffered; technology has soared; many hedge funds have struggled; and more recent private investments fund vintages are beginning to bear fruit. While these themes and biases have helped to tell the story of past success, there may be other drivers of outperformance in the future. As the market evolves, we expect portfolios will also adapt.

For example, fundamental investors may use SII themes to identify attractive high-quality value stocks with mispriced risks or underappreciated opportunities. By leveraging climate science data to identify cyclical industrial and materials companies—typically associated with value investing—investors are beginning to allocate capital to low-carbon solutions or those on a pathway to become carbon neutral. They may also view companies along the value chain of battery or solar panel manufacturing, such as mining companies, as value exposure to the energy transition. Investors committing to net zero carbon goals in their portfolios may look to these types of investments to satisfy long-term targets. Cyclical companies with the awareness of and commitment to integrating sustainability factors into business practices will better manage risk and prevail in the long run.

SII investors grapple with how much to deviate from peers or broad indexes to capture long-term material SII themes not accounted for in current markets. We acknowledge the complexity of incorporating SII themes into long-term strategic planning and short-term tactical positioning. A long time horizon is a foundational aspect of a SII approach, as are an understanding of how future-oriented trends will develop and how to construct resilient portfolios in the face of long-term challenges and opportunities.

A Brief Commentary on Performance

Historically, investors have questioned whether applying an SII lens could generate attractive risk-adjusted returns. Today, the appropriate question is how to use SII to benefit portfolios, as prior studies have shown investors should not expect to give up returns by considering these factors. 1 Importantly, portfolio-level performance observations are anecdotal; there is little empirical data to draw from given the highly customized nature of integrating SII factors into diversified investment programs. Performance data for certain representative investments of SII portfolios, however, provide encouraging context.

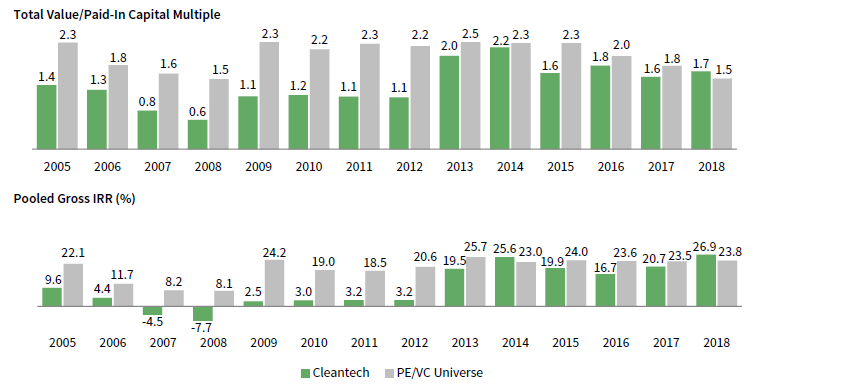

Private investments may offer closer alignment to SII themes and are particularly relevant to impact investors seeking both returns and measurable impact outcomes. Broad SII themes like clean technology have significantly improved in terms of absolute performance, supported by investments in technological innovation that have increased efficiencies, as well as companies rising to meet consumer demand for renewable energy (Figure 2).

FIGURE 2 PRIVATE INVESTMENTS IN CLEAN TECHNOLOGY OFFER BOTH RETURNS AND MEASURABLE

IMPACT OUTCOMES

As of September 30, 2020

Source: Cambridge Associates Private Investments Database.

Notes: Performance includes 1,463 investments and reflects gross deal level returns from 2005 to 2018. These investments comprise all company-level investments made by PE/VC partnerships assessed as eligible for the CA Clean Tech Company Performance Statistics. As of September 2020, Cambridge Associates (CA) screened more than 99,000 investments held by more than 8,100 funds to identify cleantech investments. CA includes companies and projects in the cleantech sector if they (1) develop non-fossil fuel energy sources, (2) promote industrial efficiency by conserving resources and replacing existing processes with less-polluting alternatives, (3) recycle waste efficiently, or (4) provide a product or service that creates an environmental improvement. The full report is published quarterly and can be found at https://www.cambridgeassociates.com/private-investment-benchmarks/.

Public investments can also align with specific SII themes or incorporate ESG factors broadly. A 2016 Cambridge Associates paper demonstrated the benefits of considering ESG factors in emerging markets public equities. In a 2020 report, Morningstar noted that ESG funds “have delivered superior returns, on average, relative to their traditional peers in the past ten years.” 2 While broad and end-point sensitive, returns associated with SII themes demonstrate how integrating these factors into portfolio management can enhance performance and mitigate risk. The past cannot predict the future, of course, and investors may find the following guiding principles helpful for decision making going forward.

Guiding Principles for Investors

Investors have demonstrated it is possible to build and manage sustainability and impact–focused portfolios successfully without sacrificing returns. Data, tools, and frameworks continue to improve our understanding of the linkages between SII factors and markets, ensuring that diversified portfolios capture upside potential and avoid pitfalls of global structural change. Ultimately, investors should embrace active choices, seek new perspectives, and protect against cognitive biases.

Embrace Active Choices

Trade-offs are a natural consideration for all investors and are in constant flux as new information gets absorbed by the markets. While we confirm that it is possible—and indeed easier than one might think—to build a portfolio through a SII lens without sacrificing an investor’s risk/return profile, in practice, we must embrace active investing decisions specific to an SII approach.

To avoid conflict between core portfolio management principles and SII objectives, investors should define their universe pragmatically and build flexibility into the investment policy. A broad view of SII, one that appreciates links between SII themes and capital markets, can shift or broaden the investment universe rather than limit it. Nonetheless, SII portfolios today may contend with fewer opportunities in certain areas, such as hedge funds, quantitative short-term trading strategies, and some private equity subsectors. We see signs of new opportunities in these hard-to-implement areas as the industry evolves to meet investor demand, SII data improve, and more investors, business leaders, and regulators authentically support these themes.

Additionally, SII portfolios are embracing private investments where there is a direct link between investments and solutions to global, social, and environmental challenges. With greater exposure to illiquid markets, particularly to early stage venture, where much of the SII landscape is focused today, comes a trade-off in overall portfolio liquidity and risk profile. Over time, we expect the later-stage private sector to participate in SII as the current cohort of early stage companies scale and mature. This greater tolerance for illiquidity can generate strong impact alignment and attractive long-term returns, though investors should remain mindful of spending and risk tolerance.

Seek New Perspectives

SII as a practice can emphasize value-based or values-based investing. Both strategies can play a role. SII as a practice encourages investors to consider how SII themes can uncover new ideas in familiar asset classes and reframe the concept of risk. Investors may find it useful to zoom out, examining the connections between themes like climate change and social justice. Zooming out may guide more effective decision making and identify high-conviction themes and specialist teams with domain expertise and a differentiated ability to execute. For instance, affordable housing investments provide differentiated, counter-cyclical returns and needed social infrastructure that may become more necessary due to migration from physical climate risks like increased wildfires and hurricanes. Similarly, workforce development solutions will contribute to living wages for many and to building the “next economy” founded on digitization, climate adaptation and resilience, and a just economic transition.

A systems-based view can also orient investors toward differentiated investment opportunities in familiar asset classes or investment styles. Sustainable real assets and natural resources, such as regenerative or organic agriculture, clean energy, and sustainable infrastructure, provide for fundamental human needs and can align with a low-carbon economy. These assets could offer inflation sensitivity, as can carbon credit markets or public infrastructure strategies. Green bond investments can diversify fixed income portfolios. Such opportunities can also balance a growth-oriented SII portfolio.

Though SII portfolios have favored growth-style investing in the past, investors should look for opportunities that integrate SII with value, linking attractive relative prices with future-oriented SII trends, positioning portfolios toward new opportunities or avoiding material risk. As SII data improve, investors could capture these factors meaningfully and cheaply through passive exposure, leaving room for larger bets on high-conviction active managers. Improving data availability should also benefit hedge fund investors as they develop SII strategies, supporting an increasingly differentiated investment universe.

An SII investment approach can also encourage investors to reconsider concepts of risk. Modern portfolio theory defines risk based on volatility, a short-term measure that uses historical data. If we define risk management as protecting portfolios against permanent loss of capital over long time horizons, then we must develop a more comprehensive set of metrics. Investors may find it useful to consider SII factors, which have not been traditionally considered in finance, as a material threat to long-term returns. For instance, physical risks of climate change, including wildfires, flooding, drought, and hurricanes, will impact global supply chains and are future-oriented rather than short-term and are backward-looking. Shifts in consumer preferences toward more sustainable products, increasing oversight of workplace equity, and the rising voice of stakeholders in the boardroom will require companies to be responsive and investment managers to be aware of, disclose, and manage these risks. While imperfect, an audit of underlying holdings in a portfolio can reveal low-hanging fruit for reducing SII-related risk, improving alignment with material SII themes and building resilience in portfolios.

Protect Against Cognitive Biases

We acknowledged in a 2020 paper, “The Materiality of Sustainability for Investors,” that cognitive bias can work against adopting SII in portfolio managing. In truth, we all have biases and certain ones could affect investment decision-making for leaders in SII and for those who are new to the space.

Confirmation bias, a tendency to view decisions through one’s pre-existing beliefs, could lead investors to misinterpret and perhaps dismiss alternatives. For instance, investors may think of SII as concessionary based on outdated assumptions that it requires giving up returns for values-based outcomes. On the contrary, the risk/return profile of an investment could be enhanced by considering material SII factors, given much-improved data sources, clear and powerful megatrends shifting the tectonic plates of our global economy, and a growing, institutional-quality opportunity set. By confronting confirmation bias with data, we may be able to view new sustainability information more objectively, benefiting long-term returns, and be less inclined to over-scrutinize SII opportunities.

Familiarity bias is the preference to stick with what is most comfortable and known. This tendency could lead investors to overlook opportunities that incorporate new datasets to the investment process or that are led by emerging teams with diverse or unconventional backgrounds, traits that are often key aspects of an SII approach. “New” does not mean “inadvisable,” as private investments and hedge funds were once new to investors, too. Investors may also be hesitant to adopt an SII lens because it may look different from peers. This narrative, however, is beginning to shift; it is now becoming more acceptable to integrate SII and, in some cases, unacceptable to ignore these factors.

Recency bias favors recent over historic events, which may lead investors prioritizing SII investments to follow recent outperformance. While past performance has been strong through manager selection, strategic asset allocation, and market tailwinds, it is important to think about other factors at play. Market dynamics are changing, and past returns do not predict future performance. Investors applying a SII lens should avoid the tendency to blindly follow what has worked, and instead consider non-mean reverting material trends that are shaping the markets of tomorrow.

Investors should navigate the growing SII universe carefully to identify authentic and differentiated opportunities, while being cautious not to compromise on standards or risk tolerance. Integrating a clear set of SII criteria in the manager selection process and thoughtful consideration of the specific opportunity, its structural market drivers, and its role in a portfolio can help mitigate the potentially limiting nature of our cognitive bias.

Way Forward

It is easier than one might think to build a diversified investment portfolio that meaningfully integrates SII themes while maintaining an attractive risk/return profile. SII will continue to prove a viable approach to long-term investing. By embracing active choices, seeking new perspectives, and protecting against cognitive biases, we can better define our investment universe, identify new approaches to familiar asset classes, and broaden our concept of risk to balance portfolios. It behooves all investors to consider how integrating material SII factors and sustainability megatrends can build more resilient portfolios that will thrive over long time horizons.

Sarah Edwards, Investment Director, Sustainable and Impact Investing

Dan Baran, Investment Associate, Sustainable and Impact Investing

Natalie Eckford, Simon Hallett, Natalie Herter, Keon Holmes, Coleman Long, Liqian Ma, Annachiara Marcandalli, Tom Mitchell, Chris Parker, Mike Pearce, Alex Readey, Chris Varco, and Wendy Walker also contributed to this publication.

Footnotes

- Please see Gunnar Friede et al., “ESG and financial performance: Aggregated Evidence from More than 2000 Empirical Studies,” Journal of Sustainable Finance & Investment 5, no. 4 (2015): 210–233; Guido Giese et al., “Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk, and Performance,” The Journal of Portfolio Management 45, no. 5 (2019): 68–93; and Tensie Whelan et al., “ESG and Financial Performance: Uncovering the Relationship by Aggregating Evidence from 1,000 Plus Studies Published Between 2015–20,” Rockefeller Asset Management and NYU Stern Center for Sustainable Business, 2020.

- Hortense Bioy and Dimitar Boyadzhiev, “How Does European Sustainable Funds’ Performance Measure Up?” Morningstar Research, 2020.