2024 Outlook: Sustainability & Impact

We expect more companies will set science-based targets to reduce their emissions and develop credible transition plans to meet their targets. We believe funds raised by natural capital strategies will hit a new record and that California carbon allowances will outperform global equities.

2024 Should Be the Year of the “Transition Plan”

Simon Hallett, Head of Climate Strategy

Last year we forecast that net zero–oriented investors would shift from portfolio decarbonization toward driving real world change. As they do so, the hunt is on for data that can help them prioritize their effort, for example tracking whether companies have aligned their business plans with net zero by setting science-based targets (SBTs).

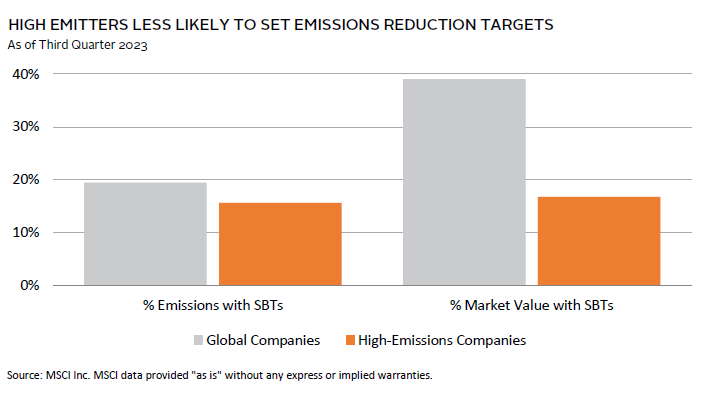

More and more companies are setting SBTs, but they may not be the right companies; it is easier to set an ambitious target if your core activities are not emissions intensive to start with. What really matters for the climate is that the most emissions-intensive companies adopt SBTs. A key portfolio metric is not what portion of companies have SBTs but what portion of emissions come from those companies.

The aggregate data are striking: 39% of MSCI ACWI market value is represented by companies that have set SBTs, but these companies represent only 19% of index emissions. The vast majority (81%) of emissions come from companies with no plans to align with net zero. We, therefore, expect to see investors increasingly prioritize persuading their highest emission holdings to adopt SBTs.

Setting targets is one thing; delivery is another. As more companies set SBTs, investors will then want to hold them accountable for executing a credible strategy—a

“transition plan”—to deliver their targets. Transition plans are not the same as SBTs but will explain how those targets will be met. The International Sustainability Standards Board, the United Kingdom’s Transition Plan Taskforce, and Glasgow Financial Alliance for Net Zero are advancing a standard for transition plans and cooperating closely with one another to ensure inter-operability. These will give investors the opportunity to judge companies by the credibility of their plans.

We expect 2024 will see more companies setting SBTs, including a growing portion of the higher emitters. This will be accompanied by those same companies starting to publish transition plans. Investors will start to evaluate those plans and incorporate them into investment decisions using good old-fashioned fundamental analysis.

California Carbon Allowances Should Outperform Global Equities in 2024

Celia Dallas, Chief Investment Strategist

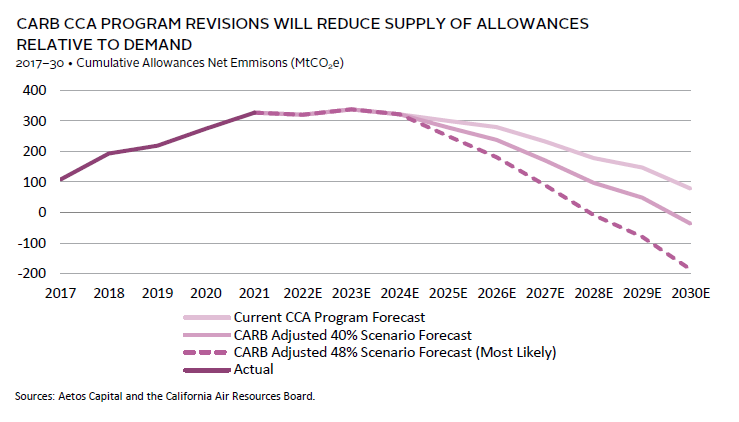

In 2024, we expect supply of California carbon allowances (CCAs) to decline and demand for such allowances to recover. In late July, the California Air Resources Board (CARB) made it clear that it expects to reduce CCA supply to meet the state’s 2030 emission reduction targets. Furthermore, demand for CCAs is expected to improve in 2024. Such conditions reinforce our recommendation to overweight CCAs relative to global equities, as carbon pricing is driven by supply and demand dynamics.

Cap-and-trade programs seek to reduce carbon emissions by putting a price on carbon and requiring covered entities to purchase allowances to offset emissions. The most attractive time to invest in these markets has been as supply starts to fall short of demand, pushing up prices. The California cap-and-trade program budgets a 4% annual CCA supply reduction. CARB’s review revealed that it would need to reduce CCA supply by 7.7% annually from 2025–30 to meet its current 2030 emissions reduction target of 40% relative to 1990. Should CARB raise the bar to a 48% reduction, as some analysts think is likely, supply would need to fall by 11.1% a year.

The magnitude of proposed cuts surprised investors, propelling CCA prices 11.4% between late July and its November 16 peak. CARB expects that tightening supply will push up prices and will likely increase price containment and price ceiling levels that exist to slow down the pace of price increases. The program is expected to be in deficit this year. The expected supply cuts will also draw down the cumulative excess supply relative to demand.

Demand for CCAs is tied to economic growth and progress in transitioning the economy away from carbon. Late 2022 and early 2023 data for the state are consistent with recessionary conditions of falling employment, incomes, and consumer spending. While it is unclear when conditions will recover, weak demand will simply slow down the pace of CCA supply tightening relative to demand, not eliminate it.

Fundraising by Natural Capital Strategies Should Hit a Record High in 2024

JP Gibbons, Senior Investment Director, Sustainable & Impact Investing

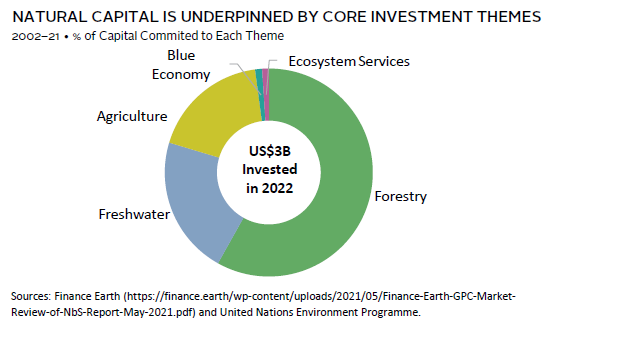

Natural capital strategies support land-based investments in sustainable agriculture and forestry, oceans and fresh waters, and other ecosystem services. These investments support a healthier planet and are needed to fight climate change. We expect fundraising for natural capital investment strategies will hit a record level in 2024 due to government and public demand, which continues to strengthen the opportunity set.

Government policy, particularly in developed markets, is creating attractive investment environments. A new framework adopted by 196 countries at the 2022 United Nations Biodiversity Conference put forth several ambitious environmental commitments, complementary to the climate change goals of the 2015 Paris Agreement. Targets include the restoration and protection of 30% of the earth’s land and sea, substantial reductions in harmful subsidies for agriculture and fishing, significant financial support to developing countries, and new reporting requirements regarding corporate influence on nature. Changes in policy should follow to stimulate momentum toward the commitments and create favorable investment opportunities.

Additional momentum has come from the general public’s demand for healthier food, cleaner waters, and thriving natural landscapes. Particularly in jurisdictions where regulation is opaque, the private sector has filled the gap through market-based tools that influence business decisions toward nature-positive projects. Feeling the urgency to act, responsible corporations have bolstered mechanisms through investment in voluntary carbon and biodiversity credits, water conservation, and organic premiums.

Recognizing the value of nature is not a new concept, but until recently it wasn’t clear how to monetize that value. These are still early days for natural capital investments, and challenges (i.e., measurement and valuation) need to be navigated. However, investment in the sector—estimated at $3 billion per year in 2022 according to the United Nations Environment Programme—is realizing significant growth, boosted by tailwinds like regulation and market demand. Managers are converting more traditional strategies to nature positive and identifying new investment themes. Investors are leaning into the favorable investment environment while mitigating exposure to nature-related risks. The amount of investment dollars raised for natural capital will grow significantly from years past as the world recognizes the need and value in protecting our natural resources.

High Emitters Less Likely to Set Emissions Reduction Targets

Global Companies are companies within the MSCI All Country World Index. High-Emissions Companies are companies in the energy, materials, and utilities sectors within the MSCI All Country World Index.

Simon Hallett - Simon Hallett is the Head of Climate Strategy and a Partner at Cambridge Associates.

Celia Dallas - Celia Dallas is the Chief Investment Strategist and a Partner at Cambridge Associates.

JP Gibbons - JP Gibbons is a Senior Director for the Sustainable and Impact Investing Group at Cambridge Associates. JP joined Cambridge Associates in 2019 and has more than ten years of industry experience. His investment research focuses on natural capital and private diversifiers. Prior to joining Cambridge Associates, JP worked at USAID’s Development Credit Authority where he […]

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.