Select hedge funds have provided attractive long-term returns with reduced equity beta and can be integral to pension investment strategies

- Continuously low interest rates have driven funding levels lower for many defined benefit pensions over the past seven years, highlighting plan trustees’ continued need to allocate funds to risk-controlled growth strategies that can help close the deficit.

- Low beta hedge funds may help pension schemes generate excess returns with limited directional equity exposure, thereby diversifying the portfolio, improving risk-adjusted returns, and reducing potential funding level drawdowns.

- Including hedge funds in a de-risking strategy is especially attractive in the current environment, as record low bond yields and overvalued equity markets present limited return opportunities and increased risk across traditional assets.

- Given the significant dispersion in hedge fund manager and strategy returns, effective manager selection and portfolio construction are critical.

For a more comprehensive view of our holistic de-risking approach, please see David Druley et al., ‘Pension De-Risking in a Low-Rate Environment—A Better Solution’, Cambridge Associates Research Report, 2013.

As many defined benefit plan trustees seek to overcome lingering funding deficits, a clear need exists for investments in the growth portfolio that can deliver excess returns without meaningfully increasing the pension scheme’s risk profile. Low beta–high alpha hedge funds may help trustees achieve this objective. With equity and bond valuations stretched, select hedge funds’ focus on alternative sources of return, including alpha, makes an allocation even more compelling today.

This research note explores the role hedge funds can play in pension investment strategies and why they may be additive – particularly in the current environment – to a holistic pension risk management strategy. We also discuss key areas for consideration as trustees contemplate implementing a hedge fund allocation.

Funding Level Call-to-Action

Prior to the global financial crisis, trustees had realised a hard fought, yet steady, improvement in funding level. After a rapid recovery in 2013, many schemes then suffered a significant setback and once again face daunting deficits. The recent collapse in gilt yields in the face of the UK referendum result has further compounded the pension deficit problem.

Figure 1 shows the estimated aggregate funding level of UK defined benefit schemes, as measured by the Pension Protection Fund. The funding level has fallen from 101% on 31 December 2013 to 78% as of 30 June 2016. Market volatility has played havoc with funding levels since the global financial crisis, driving changes of as much as 23% in periods as short as 13 months. From a volatility perspective, funding levels had an annualised standard deviation of 13.0% from March 2009 through June 2016, 1 placing an added strain on financial statements and making the jobs of trustees much more difficult. The recent collapse of yields has led to an enormous growth in the unfunded status of many schemes. Closing such a gap is an increasing challenge. When faced with over-valued equity markets and low to negative yields, trustees face a greatly narrowed opportunity set within which they can target acceptable risk-adjusted returns.

Figure 1. Historical Aggregate Funding Level of UK Defined Benefit Pension Schemes

31 December 2004 – 30 June 2016 • Percent (%)

Source: Pension Protection Fund.

Note: Funding level reflects the PPF 7800 Index, which is the estimated funding level of all defined benefit schemes in the UK, on a s179 basis, as calculated by the Pension Protection Fund.

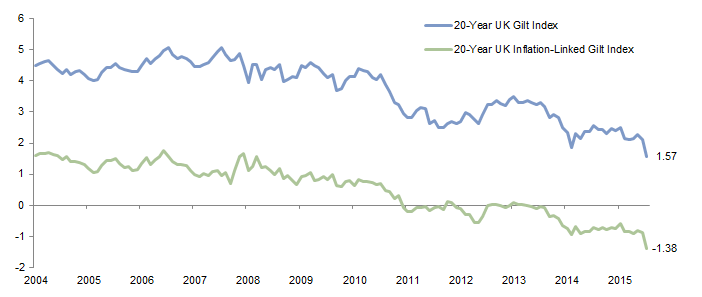

Falling interest rates have been the primary culprit for recent funding level deterioration, as lower discount rates have caused liabilities to grow faster than assets. As Figure 2 shows, the recent drop in discount rates was driven by plunging UK gilt yields. As at 30 June 2016, 20-year nominal yields were at record lows at 1.57%. Moreover, 20-year inflation-linked gilts traded at a negative real yield of -1.38%.

Figure 2. UK Government Nominal and Inflation-Linked Gilt Yields

31 December 2004 – 30 June 2016 • Percent (%)

Source: Bloomberg L.P.

The recent funding level deterioration presents a challenge for trustees. On one hand, generating growth in excess of liabilities is now more important than ever to close the funding gap and pay for future benefit accruals. On the other hand, lower funding levels do not inherently increase trustees’ risk tolerance.

Clearly, moderating the extremes of pension funding level volatility and closing the gap would benefit both plan trustees and beneficiaries. But how can trustees do so while marrying their need for excess return with their limited risk tolerance?

Trustees should focus on investment areas under their control since interest rates are the realm of the central banks. Areas where trustees can have an impact on the success of the scheme include asset allocation, portfolio construction, and manager selection – areas where a diversified implementation of low beta–high alpha hedge funds could play a compelling role in helping to solve the dilemma faced by trustees.

Hedge Funds Have Reduced Risk

A select group of low beta–high alpha hedge funds could help schemes generate excess returns while significantly reducing volatility relative to traditional assets such as long-only equities, which often dominate pension growth portfolios.

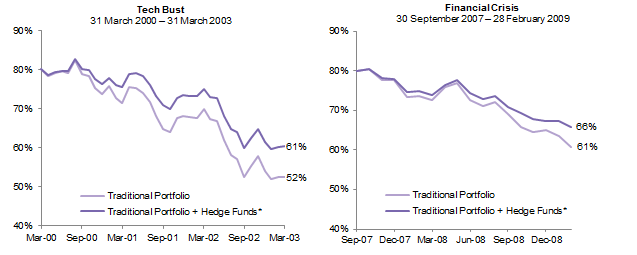

Controlling equity market exposure is especially important for pension schemes because stock market drawdowns often coincide with periods of sharply declining interest rates. This dynamic can create ‘perfect storms’ for plan trustees, with scheme assets falling while liabilities rise. Figure 3 presents a funding level stress test based on two well-known perfect storms: the 2000–03 tech bust and the 2007–09 financial crisis. Assuming an initial funding level of 80%, which is reflective of many schemes today, similar crises would be devastating for a traditional investment strategy of 60% global equities and 40% long-duration bonds. Diversifying one-third of the equity allocation into high-conviction hedge funds would have reduced the scheme’s funding level drawdown in each scenario by approximately 9 and 5 percentage points, respectively, relative to the traditional portfolio. For a £1 billion scheme, this represents a reduced drawdown of £113 million during the tech bust and £65 million during the financial crisis, 2 thereby significantly decreasing the size of required shortfall contributions from the plan trustee.

Figure 3. Funding Level Preservation: Benefits of Adding Hedge Funds to a Traditional Portfolio

Assumed Initial Funding Level of 80% • GBP Terms

Sources: Cambridge Associates client database, FTSE, MSCI Inc. and Thomson Reuters Datastream. MSCI data provided ‘as is’ without any express or implied warranties.

Note: The Traditional Portfolio is comprised of 60% MSCI All Country World Index (Net), 20% FTSE British Government Over 15 Years Index, and 20% FTSE British Government Index-Linked Over 5 Years Index. The Traditional Portfolio + HF is comprised of 40% MSCI All Country World Index (Net), 20% CA Advisory Hedge Fund Composite (50% GBP-hedged), 20% FTSE British Government Over 15 Years Index, and 20% FTSE British Government Index-Linked Over 5 Years Index. All portfolios are rebalanced monthly and do not include any contributions or benefit payments. The change in liability is proxied with 50% FTSE British Government Over 15 Years Index return and 50% FTSE British Government Index-Linked Over 5 Years Index return. MSCI ACWI returns use returns gross of dividend taxes prior to 28 February 2001, and returns net of dividend taxes thereafter. All returns are in GBP.

* Please see the Performance Disclosure at the end of the publication for information about the composite.

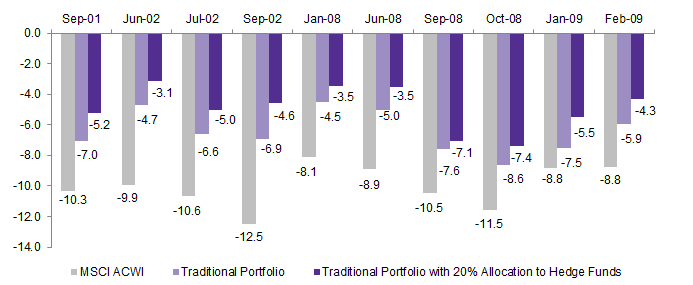

In Figure 4, we show the 10 market corrections of at least -8% from January 2001 through 31 March 2016. In each of these corrections, a portfolio with a 20% allocation to hedge funds would have reduced the drawdown meaningfully relative to a traditional 60/40 portfolio. The smaller loss in the portfolio with the hedge funds improves the scheme’s funding level relative to the traditional portfolio option at a time when the plan trustees are unlikely to want to contribute additional funds, which it needs for its business operations, to the scheme.

Figure 4. One-Month MSCI ACWI Corrections of at Least -8% in the Past 15 Years

As of 31 March 2016 • Percent (%)

Sources: Cambridge Associates LLC, FTSE International Limited, MSCI Inc., and Thomson Reuters Datastream. MSCI data provided ‘as is’ without any express or implied warranties.

Notes: The Traditional Portfolio is made up of 60% MSCI All Country World Index (Net) and 20% FTSE British Government Over 15 Years Index, and 20% FTSE British Government Index-Linked Over 5 Years Index. The Traditional + Hedge Fund Portfolio is made up of 40% MSCI All Country World Index (Net), 20% CA Hedge Fund Advisory Composite (50% GBP Hedged), and 20% FTSE British Government Over 15 Years Index, and 20% FTSE British Government Index-Linked Over 5 Years Index. All portfolios are rebalanced monthly and do not include any contributions or benefit payments. The change in liability is proxied w ith 50% FTSE British Government Over 15 Years Index return and 50% FTSE British Government Index-Linked Over 5 Years Index return. MSCI ACWI returns use returns net of dividend taxes. All returns are in GBP.

* Please see the Performance Disclosure at the end of the publication for information about the composite.

Hedge Funds Are Difficult to Define

The term ‘hedge fund’ encompasses numerous strategies that may offer diversification benefits to pension investment strategies. In diversifying a scheme’s hedge fund allocation across different opportunities, plan trustees should benefit from smoother returns over time. Strategies that may appear volatile in isolation, such as managed futures and global macro, can be strong diversifiers in the context of a traditional scheme portfolio due to their zero-to-low correlation with traditional asset classes.

The fluid nature of certain hedge fund strategies and their ability to actively manage exposures across instruments and opportunistically shift positioning towards less exploited areas can also help protect portfolios. Global macro, quantitative, multi-strategy, open mandate, and event-driven funds all are examples of strategies with mandates flexible enough to rotate to areas with the most attractive risk-reward characteristics.

Additionally, high conviction, low beta long/short equity strategies can generate significant alpha and play an important role in risk reduction and return enhancement. When considered in the broader portfolio context, certain strategies and managers can generate meaningful improvements in portfolio efficiency through careful selection.

Long-Term Hedge Fund Returns Are Compelling

Capital preservation during bear markets enables low beta–high alpha hedge funds to capture the long-term benefits of compounding returns. Historically, we have seen talented hedge funds produce much smaller drawdowns than long-only equities and recover more rapidly from any losses, in part due to two reasons. First, because they lost less, they need to recover less. Second, they have greater flexibility to increase exposure when valuations are cheaper. Low beta–high alpha hedge funds generally lag equity market performance when equities are in a bull market, but viewed over the long term, risk-adjusted returns remain compelling.

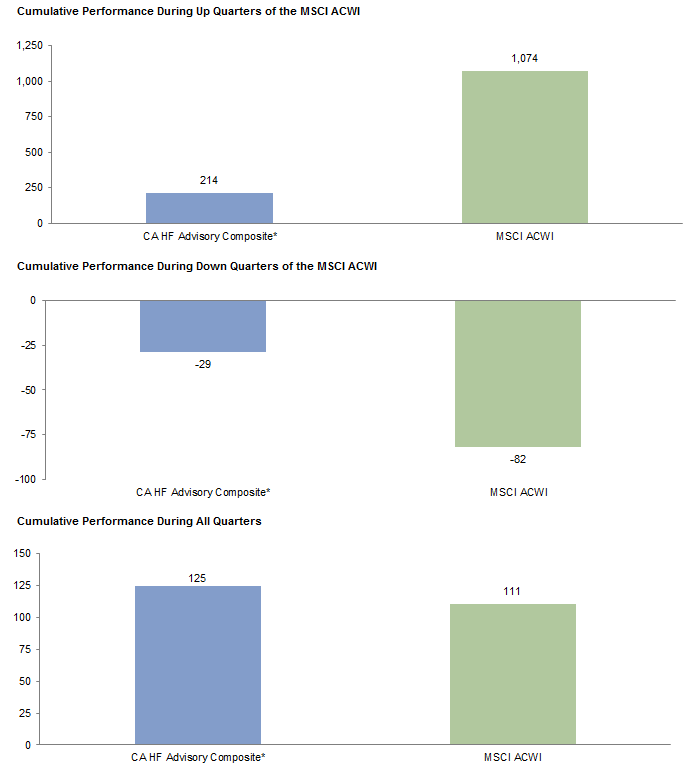

As Figure 5 shows, superior downside protection has helped Cambridge Associates (CA) advisory clients’ hedge fund programmes outpace global equity markets by 14% cumulatively over the last 15 years, with one-third the beta of public markets. The higher return and lower volatility of CA advisory clients’ hedge fund programmes results in superior risk-adjusted returns as measured by a Sharpe ratio of 0.60, compared to the MSCI ACWI’s Sharpe ratio of 0.28, an improvement of 111%. 3

Figure 5. Hedge Fund Performance in Up and Down Equity Markets

Second Quarter 2001 – First Quarter 2016 • Basis Points

Sources: Cambridge Associates LLC and MSCI Inc. MSCI data provided ‘as is’ without any express or implied warranties.

Notes: Calculations are based on quarterly data, net of fees. MSCI ACWI returns use returns gross of dividend taxes prior to 31 March 2001, and returns net of dividend taxes thereafter.

* Please see the Performance Disclosure at the end of the publication for a description of the composite.

Given the breadth of strategies pursued, hedge funds generate returns through a variety of strategies that often perform well at different times from one another and the broader equity markets. Trustees should consider the role (e.g., growth driver or portfolio diversifier) that each strategy and manager serves in the context of the scheme’s total portfolio to create a hedge fund allocation tailored to their goals.

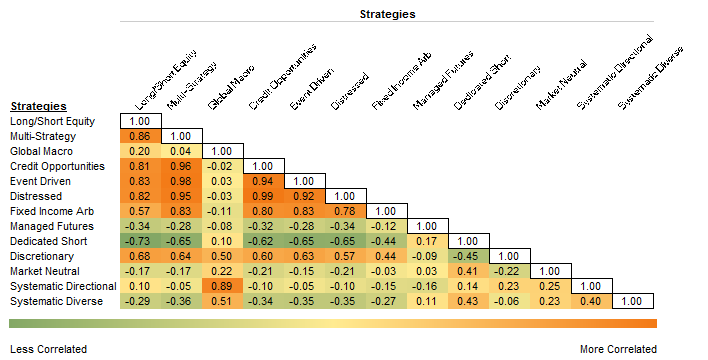

Figure 6 shows the range of correlations among hedge fund strategies based on funds in the CA investment manager database, and highlights the importance of diversification and thoughtful portfolio construction. Certain global macro and quantitative strategies, for example, present opportunities to generate uncorrelated returns, regardless of market direction – and decrease portfolio volatility as well.

Figure 6. Hedge Fund Strategy Correlation Matrix

Second Quarter 2001 – First Quarter 2016

Source: Cambridge Associates LLC.

Notes: Calculations are based on quarterly data from Cambridge Associates LLC’s proprietary Investment Manager Database. Performance results are generally reported net of investment management fees and performance fees. Performance results do not include returns for managers that exclude reserves (cash) from reported total return. Returns for inactive (discontinued) managers are included if performance is available for the entire period measured.

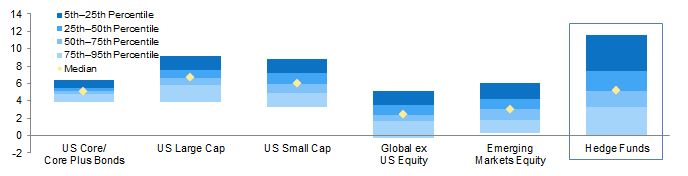

In addition to the variability in hedge fund strategy returns, manager performance dispersion is significant. Performance dispersion is notably larger among hedge funds than among long-only equity or bond managers (Figure 7). This level of dispersion indicates that most hedge funds are not compelling value propositions but that select funds add significant value. Manager selection is paramount due to such wide dispersion of returns; the ‘average’ return will not do.

Figure 7. Manager Return Dispersion

Second Quarter 2001 – First Quarter 2016 • AACR (%)

Source: Cambridge Associates LLC.

Notes: Calculations are based on quarterly data from Cambridge Associates LLC’s proprietary Investment Manager Database. Percentile rankings are based on a scale of 0–100, where 0 represents the highest value and 100 the lowest. Data are based on managers with a minimum of $50 million in assets. Performance results do not include returns for managers that exclude reserves (cash) from reported total return. Returns for inactive (discontinued) managers are included if performance is available for the entire period measured. For hedge funds, returns are reported net of fees. For other strategies, we have subtracted a fee proxy from returns reported gross of fees as follows: US core/core plus bonds, 33 bps; US large cap, 69 bps; US small cap, 93 bps; global ex US equity, 80 bps; and emerging markets equity, 98 bps. Managers for which product asset data were unavailable were excluded. All of the manager universes have survivorship bias, so while the distribution may include better performance, the comparison across strategies is valid. Past performance is not necessarily a guide to future performance.

While investors naturally gravitate towards equities during bull markets such as the one that began after the global financial crisis, the need to generate risk-controlled returns across full market cycles requires plan trustees to keep a longer-term perspective in mind. This perspective is particularly important when equity valuations are stretched, as they are currently, because valuations underpin long-term expected returns. We believe that US equities in particular are overvalued, having set new all-time price level highs in August 2016. Trustees thus may benefit by focusing on alternative and differentiated sources of return while managing downside risk. With rising dispersion within equity markets and prospects for increased market volatility due to ongoing uncertainty following the UK referendum, the risk of contagion in other European countries and diverging global growth prospects and interest rates, the environment is well suited for talented hedge fund managers to add value. Long/short funds can add value on both sides of their portfolios, and multi-strategy and event-driven funds are well placed to take advantage of pricing discrepancies. Less correlated/uncorrelated strategies such as global macro and quantitative-oriented managers offer ballast against market volatility.

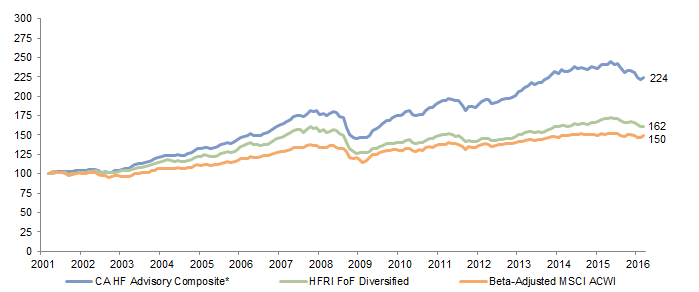

Trustees’ ability to extract maximum value from hedge funds depends on one of two paths. They can either hire experienced staff, or partner with an experienced, well-resourced hedge fund advisor with a history of identifying and accessing best-in-class managers and of building portfolios that complement the rest of a pension scheme’s strategy. By emphasising rigorous manager selection and diversified portfolio construction, CA clients’ hedge fund programmes realised a total cumulative return of 124% over a period of 15 years (Figure 8). 4

Figure 8: CA Hedge Fund Advisory Composite Cumulative Performance

Second Quarter 2001 – First Quarter 2016 • Cumulative Wealth Rebased to $100 on 31 March 2001

Sources: Cambridge Associates LLC and Hedge Fund Research, Inc., and MSCI Inc. MSCI data provided ‘as is’ without any express or implied warranties.

Note: Beta-Adjusted MSCI ACWI is based on 0.27 global equity beta realized by the CA HF Advisory Composite over the period. The Beta-Adjusted MSCI ACWI return is calculated on a monthly basis as (MSCI ACWI * 0.27) + (T-Bills * 0.73).

*See the Performance Disclosure at the end of the publication for a description of the composite.

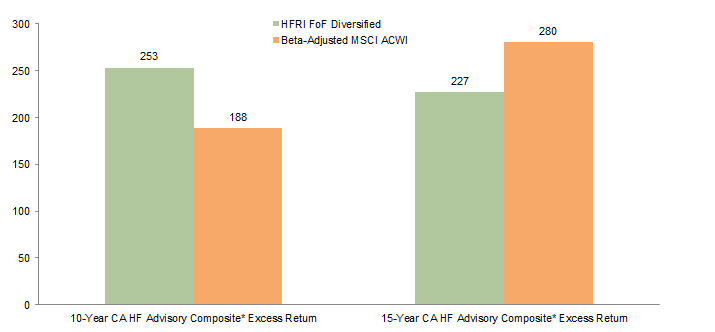

This amounts to an excess annual return over the HFRI Fund-of-Funds Diversified Index of 227 bps per annum over the last 15 years with similar volatility and equity beta. Moreover, when compared with a risk-equivalent, beta-adjusted equity index, the CA client hedge fund composite has outperformed by 280 bps per annum (Figure 9). 5

Figure 9. CA Hedge Fund Advisory Composite Outperformance Against Benchmarks

As of 31 March 2016 • Average Annual Excess Return (bps)

Sources: Cambridge Associates LLC, Hedge Fund Research, Inc., and MSCI Inc. MSCI data provided “as is” without any express or implied warranties.

Notes: Beta-adjusted MSCI ACWI is based on 0.25 global equity beta realized by the CA HF Advisory Composite over the period. The beta-adjusted MSCI ACWI return is calculated on a monthly basis as (MSCI ACWI * 0.25) + (T-Bills * 0.75). MSCI ACWI returns use returns gross of dividend taxes prior to 28 February 2001, and returns net of dividend taxes thereafter.

* Please see the Performance Disclosure at the end of the publication for more information about the composite.

Addressing Concerns

While low beta–high alpha hedge funds may be attractive from a risk/return perspective, investors often raise concerns about issues such as fees, liquidity, transparency, and leverage.

Fees. Investors are right to be concerned about fees, as the hedge fund universe in aggregate charges high fees and generates very little value add. This is why we constantly remind trustees that if they are only going to receive the returns of the universe at large (or the average hedge fund return), they should not make the investment in the first place. However, if a scheme can retain the resources or staff that allows it to identify and invest in the select group of managers that generate significant net-of-fee alpha with low market exposure, then paying the higher fees is merited. A positive recent development in the hedge fund industry is greater flexibility of fees across a range of strategies. We firmly believe investors should not pay inflated fees for market returns. Higher fees are only justified for real talent in alpha generation in areas that cannot be replicated in more liquid, cheaper structures.

Liquidity. Trustees rightfully want to ensure that any illiquidity assumed in hedge fund investments is required to execute the strategy and is adequately compensated with excess returns. Avoiding mismatches between a fund’s liquidity terms and the liquidity of the strategy and its underlying holdings is paramount.

That said, longer lock-ups may be warranted to access certain alpha-generative strategies that take longer to play out, such as distressed, credit, or short-biased or activist investments. These strategies require patience and can be undermined if significant capital is redeemed at the wrong time; hence, more illiquid terms are justified and serve to protect the interests of long-term investors. Trustees should question funds that offer limited liquidity when the underlying assets are liquid.

As with fees, hedge funds’ liquidity terms have come under scrutiny and evolved over time. After the 2008 global financial crisis, many hedge funds stopped investing in illiquid assets entirely. Funds that still invest in illiquid securities often pursue private investments in separate lock-up vehicles. Most hedge funds now allow investors to opt out of illiquid side pockets as well.

More recently, liquid absolute return funds, which span the gap between traditional assets and alternatives, have launched. These absolute return vehicles tend to invest across asset classes in a directional manner and benefit portfolio diversification. They offer highly liquid terms and lower fees. These funds may have a place alongside more traditional hedge fund structures.

From a portfolio construction perspective, a diversified portfolio of hedge funds with sufficient scale should provide trustees with staggered liquidity points to facilitate rebalancing, especially after a market sell-off that creates compelling valuations in long-only equities. A well-constructed hedge fund portfolio containing a select group of high conviction managers should enable plan trustees to enjoy the risk/return benefits that hedge funds offer without significantly compromising overall portfolio liquidity.

Leverage. Leverage is inherent in many hedge fund strategies and can influence risk and returns. As part of a due diligence process, the impact of leverage on each manager’s returns alongside other return drivers such as market beta and alpha should be considered. Returns driven by leverage should not warrant the same fees and illiquidity as returns sourced from alpha-generative security selection. With continually increasing transparency, investors and advisors have ample opportunity to assess hedge funds’ leverage and identify managers that demonstrate repeatable skill and do not rely on borrowed capital to deliver returns.

Transparency. Investors also raise questions about hedge fund transparency. Transparency is important, and the less transparent approach adopted by some hedge funds can be a source of frustration. Adequate disclosure is necessary to evaluate whether a manager is truly skilled and what risks the fund is taking. Fortunately for investors, transparency has improved over the past decade as a result of regulation and increasing investor demands. Developing strong long-term manager relationships, particularly through face-to-face meetings, can also help experienced investors and advisors fill any information gaps.

Conclusion

Assets that can deliver attractive long-term returns with beneficial effects on funding level risk have clear value to trustees, particularly as schemes seek to recoup recent funding losses. Low beta–high alpha hedge funds may fulfil this role and contribute meaningful diversification to equity-biased growth portfolios, which is especially important in today’s markets where many traditional assets are overvalued and yields hover near historical lows. High conviction hedge funds that generate returns uncorrelated to long-only equities are particularly attractive.

Successfully implementing a hedge fund allocation is challenging. Significant performance dispersion among managers in the same strategies, and dispersion across strategies based on ever-changing market opportunities, makes manager selection and customised portfolio construction essential. Of the approximately 11,000 hedge funds worldwide, we believe less than 5% merit institutional capital. Additionally, trustees must consider important issues such as fees, liquidity, transparency, and leverage when selecting individual managers. Building a diversified and differentiated portfolio of strategies and managers that complement the rest of a scheme’s assets represents a significant hurdle. These challenges notwithstanding, an allocation to low beta–high alpha hedge funds can play a powerful role in enhancing a scheme’s risk-adjusted returns, and should be emphasised in the context of pension risk management strategies.

Performance Disclosure

The CA Hedge Fund Advisory Composite includes 366 full advisory hedge fund programme returns for Cambridge Associates’ clients who received hedge fund performance reports as of 31 March 2016. Clients are added to the sample over time based on their advisory contract start date and are included for those periods during which they are advisory clients. ‘Cambridge Associates’ comprises five investment consulting affiliates established for the purposes of providing investment management, advisory, and related services around the globe. Annualised mean returns are calculated based on a monthly equal-weighted client composite return. Returns shown are net of manager and CA fees. In some instances, CA fees are estimated based on a model fee calculation using the highest CA fee schedule appropriate for the client type and service provided. In these cases, the model fee deducted was equal to or greater than actual fees paid by that client to CA. Past performance does not guarantee future returns. Returns may include investments made prior to becoming clients of CA, and performance may be attributable to factors other than CA’s advice because of the non-discretionary nature of advisory consulting. Returns are in USD terms.

Hypothetical Performance Disclosure

This research note contains hypothetical performance. Hypothetical performance results have many inherent limitations, some of which are described below. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular investment programme. Hypothetical results do not involve financial risk, and no hypothetical record can completely account for the impact of financial risk in actual investing. For example, the ability to withstand losses or to adhere to a particular investment programme in spite of losses are material points, which can also adversely affect actual performance results. There are numerous other factors related to the markets in general or to the implementation of any specific investment programme, which cannot be fully accounted for and all of which can adversely affect actual results.

Index Disclosures

Broad-based securities indexes are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment funds. Investments cannot be made directly in an index. Past performance is no guarantee of future results.

FTSE® British Government Over 15 Years Index

The FTSE® British Government Over 15 Years Index consists of securities with over 15-year maturity from the conventional index family of the FTSE® Actuaries UK Gilts Index Series, which includes all British Government Securities quoted on the London Stock Exchange. Undated gilts are excluded. The over 15-year maturity sub-index is one of 13 sub-indices within the conventional gilts index family and tracks the market for long-term government debts.

FTSE® British Government Index-Linked Over 5 Years Index

The FTSE® British Government Index-Linked Over 5 Years Index is composed of securities with over five-year maturity from the index-linked family of the FTSE® Actuaries UK Gilts Index Series, which includes all British Government Securities quoted on the London Stock Exchange. The over five-year maturity sub-index is one of ten sub-indices within the index-linked gilts index family and tracks the market for long-term debts.

HFRI Fund-of-Fund Diversified Index

The HFRI Fund-of-Funds Diversified Index is a non-investable product of diversified fund of funds. The Index is equal weighted (fund weighted) with an inception of January 1990.

MSCI All Country World Index

MSCI ACWI captures large- and mid-cap representation across 23 developed markets and 23 emerging markets countries. With 2,464 constituents, the index covers approximately 85% of the global investable equity opportunity set.

PPF 7800 Index

Since July 2007 the Pension Protection Fund has published the latest estimated funding position, on a s179 basis, for the defined benefit schemes in its eligible universe.

Joseph Marenda, Managing Director

Trudi Boardman, Senior Investment Director

Footnotes

- Annualised standard deviation of the monthly differences in funding level of the PPF 7800 Index from 1 March 2009 through 30 June 2016.

- Assumes the plan entered each period with £1 billion in assets and £1.25 billion in liabilities, implying an 80% funding level.

- Please see the Performance Disclosure at the end of this publication for information about the clients included in the composite.

- Please see the Performance Disclosure at the end of this publication for information about the clients included in the composite.

- The excess annual returns over the HFRI FoF Diversified Index and beta-adjusted MSCI ACWI Index are calculated by taking the average annual compound return (AACR) of the CA HF Advisory Composite minus the AACR of the HFRI FoF Diversified Index and the beta-adjusted index. Information for both the 10- and 15-year periods is captured in Figure 9.