Capital Flows to Cryptoassets Increase, Despite Volatility

Digital assets 1 saw considerable inflows in recent years as investors searched for alternative sources of return amid excessive equity and bond valuations. We expect this momentum will continue next year as regulators increasingly approve easy-to-access cryptocurrency exchange-traded funds (ETFs). Still, global regulatory challenges persist, and cryptoassets will remain highly volatile until there is more clarity on future regulation.

The arrival of the first US futures-based bitcoin ETF marks a milestone for cryptocurrencies. Investors previously had to hold these assets directly or through crypto exchanges, limiting their accessibility and broader adoption. The futures-based ETF structure, which is costlier and not backed by actual bitcoin, offers investors daily liquidity and can be held in traditional brokerage accounts. Clearly, there was plenty of pent-up demand for bitcoin exposure in ETF form. In fact, the debut of the ProShares Bitcoin ETF saw $1.03 billion in inflows in its first two trading days, the fastest pace that any ETF has ever reached $1 billion in assets under management. Still, futures-based ETFs are not an attractive way to gain exposure to cryptoassets due to their high fees and cost of rolling contracts. But more alternatives are rapidly emerging. At least 30 additional cryptocurrency ETFs are currently seeking SEC approval, including those that are “physically” backed by bitcoin and those that track other cryptocurrencies like Ethereum.

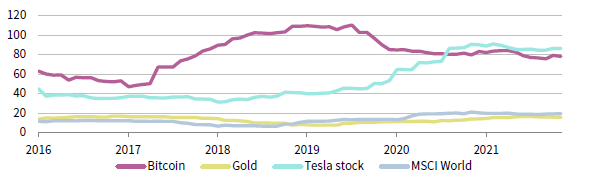

While we expect additional Securities and Exchange Commission approvals to boost capital flows into the space, a broader cloud of regulatory uncertainty still hovers over the asset class. Throughout 2021, China’s intensifying crackdown on cryptoassets contributed to major volatility in bitcoin prices. Unexpected surprises or outright bans on cryptoassets by global policymakers could have similarly negative impacts next year. As long as the threat of tighter regulation looms, we expect bitcoin and other cryptocurrencies to remain highly volatile.

BITCOIN’S VOLATILITY IS STILL MORE LIKE INDIVIDUAL STOCKS

January 31, 2016 – November 30, 2021 • US Dollar Terms • Rolling 2-Yr Annualized Standard Deviation (%)

Sources: LBMA, MSCI Inc., and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Overall, as cryptocurrencies become accessible through ETFs, it stands to reason that capital flows will increase. Beyond cryptocurrencies, funds that seek to capitalize on blockchain technology are also likely to see increased flows. However, investors should carefully watch regulatory developments and brace for continued volatility in the space.

Sean Duffin, Investment Director, Capital Markets Research