Business Ownership at a Crossroads: Key Questions for Planning What’s Next

Private business owners who hold the majority of their wealth in one company are different from other investors. They face unique challenges when making investment decisions, including the fundamental question of whether to retain a concentrated position in their business. After all, concentrated positions can create wealth, but they also increase portfolio risk. Because of this reality, the question of whether to retain or divest from a family-owned business is often debated by family members. In this paper, we share some key questions business owners can ask themselves to help arrive at answers best suited to their own unique needs.

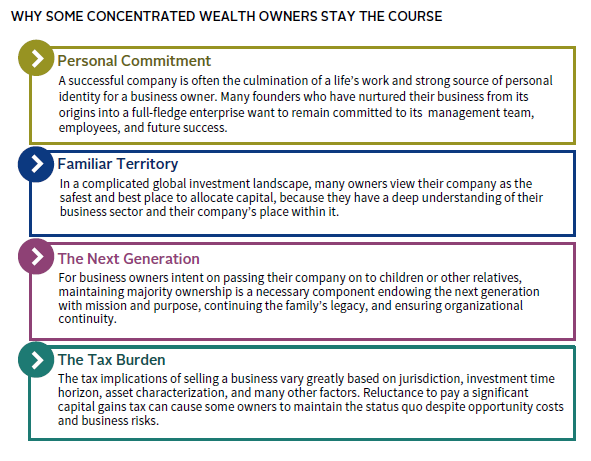

As we explain below, a company represents much more than just an asset for many business owners. Consequently, their reasons for continuing to hold their business go well beyond the purely financial.

Asking the Questions That Matter

Although business-owning families have foundational reasons for staying invested, most at some point will contemplate whether, when, and how to divest. The questions that follow address some of the key insights that Cambridge Associates’ (CA) own clients have uncovered in their effort to formulate the right plan for their future.

1. Am I an Insider and Do I Have Control Over Business Decisions?

In working with business owners, we have seen that an objective assessment of insider status and control can help to determine whether or not the time is right to divest and diversify. Those whose insider status is at risk or in decline may want to ask themselves if it’s time to consider selling their controlling interest.

Most company owners are insiders with control over key management decisions. This affords them better insight into the inner workings of the company and its future trajectory; they know the return potential of the business, the current demand for its goods or services, and the needs and goals of its workforce.

By contrast, a person who has a large holding in a business but lacks control over the company’s capital allocation and other business decisions may be putting their investment at risk. This can result in an increasingly passive concentrated investment position that is gradually exposed to more undue risk over time—including a change in market conditions or an unforeseen downturn in the health of the business.

2. What is My Relative Opportunity Cost in Holding My Concentrated Position?

To estimate the opportunity cost of holding or divesting from any investment position, it’s important to weigh the risk and return profile of the current position versus other investment opportunities. The same best practice holds for those maintaining large single-company holdings.

As we have noted, the risk and return benefits of a concentrated position are both financial and personal. With this in mind, risk and return profiles can be best analyzed using two dimensions: objective and subjective.

Objective Risk and Return. Objective risk and return refers to the financial influences that every company and business owner is exposed to. Macro risks include industry or sector developments, demographic shifts, or currency fluctuations. Micro risks are more industry-specific and can include product or service obsolescence, changing consumer preferences, or regulatory challenges. Both types of risks can negatively impact an owner’s investment holdings over time and be difficult to recognize in advance without proper analysis. Meanwhile, a more diversified portfolio is likely to incur less volatility and risk of capital loss and can also enable access to a broader range of investment opportunities.

Appraising a company’s current market valuation and how it compares with history, competitors, and broad market averages can be a good first step toward analyzing its objective return profile. While public company investors regularly weigh a company’s future expected returns against those in its cohort, this mindset is less common among owners of private companies. Evaluating the return on capital invested in the business versus returns on other investments is a crucial component of determining whether to maintain a concentrated holding. Of course, this assessment should be made net of the estimated capital gains tax costs of a business sale.

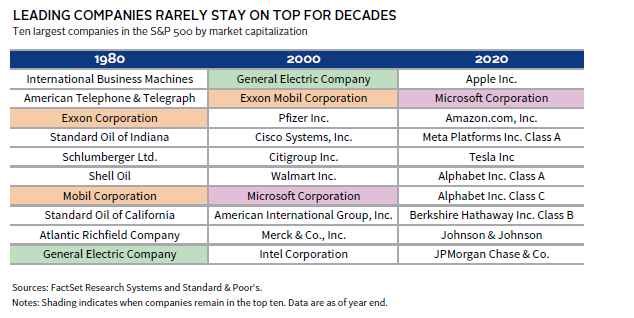

Many owners overestimate the market leadership permanency of their business. Consumer preferences, technological advancements, and the rise and fall of competitor firms create variability across all business sectors. This dynamic holds true for firms of all sizes. The table below demonstrates, for instance, that it is rare for a company to remain among the top ten largest companies in the S&P 500 by market capitalization for more than two decades.

Subjective Risk and Return. Personal and family goals, retirement objectives, and planning around generational wealth transfer can also influence decisions related to large single-company holdings. Instead of tying directly to the health of the business, these subjective risks pertain to how an individual feels about their overall financial health.

For some business owners, the question of retaining or diversifying a concentrated position is connected to how they subjectively value their involvement in their company’s incremental gains. The marginal utility—or the feeling of satisfaction with each additional gain—can vary as the business grows. Is an additional $100 million generated by retaining a large equity holding as attractive as the first $100 million achieved in a previous risk environment? Owners need to weigh the satisfaction of potential growth against changing market preferences and leadership. Considering the opportunity set outside of their business is also important. Are they strongly committed to growing their wealth through their business, or are they interested in pursuing other projects, passions, and investment opportunities? In these scenarios, “reward” may be a better term to use in analyzing the subjective return. How rewarding might continued involvement in the company be compared to other opportunities? The answer will vary from person to person and can sometimes override more objective concerns.

Holding or selling a large position in a single company is not always an “either/or” proposition. In some cases, founding owners invest the profits from their business in other investments while maintaining substantial holdings in the company they created. This decision is commonly driven by the expected return on capital and diversification opportunities. For example, consider a family that owns a business in a relatively steady, but slower, growth industry. In this case, it’s worth assessing the return on capital reinvested into the business versus the potential returns of a diversified investment portfolio. After-tax earnings can also be invested in industries or sectors that have a low correlation to their business, allowing them to take advantage of growth and diversification opportunities.

By considering both objective and subjective risk and return, owners can achieve clarity around how committed they are to retaining their business, or if it’s time to protect the gains they have accumulated over time. In addition, revisiting these questions regularly is important, given how often—and unexpectedly—business, market, and personal dynamics can change.

3. Does My Succession Plan Align With My Vision?

Owners at the later stage of their careers face the choice of either a generational transition or sale of the business. These choices are frequently a key driver of an owner’s decision to sell. However, several important questions should be asked before any changeover decisions are made, including the interest and ability of the next generation to take over, the transition time needed, and how changes might be viewed both within and outside of the company.

Organizational stability should also be a main consideration for generational changes. The period between generational shifts needs to be sufficiently long in order to pass down institutional knowledge. A proper governance plan to oversee management and decision making can provide critical structural support the new generation will need to be successful.

Owners should also consider how leadership changes might be received both inside and outside the organization. How might the current management team react to a shift in ownership? Will they be supportive or resistant to a transition? Customers and other investors are likely to have questions surrounding the change and the future of the company. Thinking about how this change may impact all of these players will help prepare owners for the prospect of transitioning away from the company and their ability to sell.

4. Do I Want Control Over the Sale of My Company?

Most business owners want control over the decision to sell, the sale price, and the sale timing, but unexpected events such as changes in personal health, a downturn in company performance, or shifts in the broader business environment can remove this control from their hands. No business owner wants their divestment decisions to be determined by circumstances beyond their control—or dictated by anyone with interests different from their own. Thus, to maximize control over outcomes, business owners should undertake advance planning, identifying what factors—including time, valuation, and leadership—might prompt a move toward selling.

5. Do I Have a Plan for What’s Next?

Every business owner has goals for their company, but they may have less clarity about their goals for life after business ownership. Without a clear plan, some put off selling their business because they fear a loss of identity or purpose, or because they worry—like many retirees—about the boredom that could follow. These concerns require careful deliberation and should be addressed.

Particularly for entrepreneurs who are ambitious by nature, formulating a clear plan for the future can help position them for a post-business life that presents new and rewarding challenges. Many former owners have expressed to us that lacking a clear “second act” plan kept them entrenched in their business for too long or left them feeling unfulfilled after a sale. Future planning should incorporate what the business owner wants to do with their time and talents after exiting their business, so that the next act is as rewarding as the first.

Some of the most satisfied former business owners CA has worked with use the knowledge and skills they’ve built in their business life for their next chapter, whether applying those strengths to charities, investments, or new businesses. For instance, some use a portion of sale proceeds to fund a foundation, join a corporate or charitable board, work with a nonprofit, or pursue personal passions. Conversely, less desirable outcomes can occur if owners enter unfamiliar businesses or inadequately managed investing endeavors, which can be personally unfulfilling and financially damaging.

For owners who are comfortable moving forward with the sale of their business, it’s also important to tackle the complex question of how to handle the resulting proceeds. This involves establishing an asset allocation and diversified investment strategy. Significant wealth events can also involve broader governance questions, such as whether to form a family office or how to involve other family members in ongoing stewardship. A full family enterprise review can help lay out the right long-term investment strategies for those looking to manage the proceeds of a sale.

Planning for the future is imperative, but circumstances can change quickly and make such plans less relevant. We believe that stepping back occasionally to reframe your vision and goals—and establishing the events or milestones that might prompt a shift in strategy—is a valuable practice.

Planning for Preferred Outcomes

There are a range of opinions about the pros and cons of maintaining concentrated ownership in a business. Many owners believe strongly in maintaining control, particularly when they continue to have an integral role in influencing their business’s success. Whether a private business owner decides to hold their concentrated position or unwind all or a portion of it, they can make decisions with greater confidence by asking themselves a few key questions. These include assessing their control over day-to-day business decisions and the relative opportunity costs of diversifying. Moreover, a clear sense of a generational succession plan, a desired level of control over the sale of the company, and a set of plans and objectives for post-business ownership life can help to illuminate short- and long-term wealth management decisions. Our experience with business owners has proven that making these assessments helps them execute a sale of their business successfully if and when they feel it’s the right time to do so.

Doug Macauley, Managing Director, Private Client Practice

Nicole Nava, Investment Director, Private Client Practice

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.

Learn how we work with private clients & family offices.

Doug Macauley, CFA - Doug Macauley is a Partner for the Private Client Practice at Cambridge Associates. Doug has over 25 years of investment experience. At CA, he works with a number of private clients and institutions ranging in size from $125 million to over $5 billion. He has also worked with non-profit entities, including family foundations that originated […]

Nicole Nava - Nicole Nava is a Senior Investment Director at Cambridge Associates.