A New Approach: How ERISA-Covered US Pension Plans Can Save on PBGC Premiums

Saving on Pension Benefit Guaranty Corporation (PBGC) premiums has long been at the forefront of many pension risk management decisions. When interest rates were near historic lows during 2019 and 2020, many single-employer plan sponsors changed their methodology for calculating these premiums to reduce their tax obligation to the federal government. Although it appeared like a good idea at the time, that decision is now resulting in adverse consequences for many.

PBGC regulations stipulate that, once changed, a plan’s method of calculation is locked in for five years. Due to the significant increase in interest rates during 2022, many plan sponsors now find themselves stuck with much higher premium amounts until at least 2024. The pain is especially acute for plans that maintained high liability-hedging allocations, which have resulted in a decline in asset values without a corresponding impact to PBGC liabilities. The good news is that plans of most types, sizes, and funded status using the Alternative Method premium calculation can potentially reduce their PBGC premiums and simplify the pension risk management process. How? By using the Full Yield Curve approach to calculate their discount rate.

Understanding PBGC Premium Methodologies

The PBGC premium calculation is based on participant counts (flat rate premium) and any unfunded liability (variable rate premium). The PBGC allows two methods to calculate the liability used to determine variable rate premiums. The first is the Standard Method, which is based on a one-month average of discount rates. The second is the Alternative Method, which aligns the PBGC liability with the PPA liability that typically uses a longer averaging period.

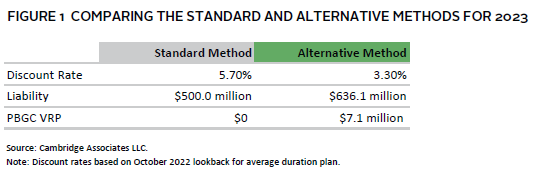

Figure 1 compares the two methods for the 2023 plan year for a plan that is fully funded on an accounting basis. Based on the difference in discount rates produced by these methods, the Alternative Method can result in a more than $7 million premium for a plan that is $500 million in size.

Comparing Liability Calculations

ERISA-sponsored pension plans are required to calculate liability based on high-quality corporate bond yields stipulated by the Internal Revenue Service (IRS). This liability is used to determine minimum contribution requirements, adjusted funding target attainment percentages (AFTAPs), and other metrics. This liability is sometimes referred to as the PPA liability, 1 which established many of today’s liability calculation rules for regulatory purposes. For most plans, the PPA liability is based on a 24-month average of discount rates, broken down into three segments, known as Segment Rates. Various funding relief regulations have bound the Segment Rates around a 25-year average, but this relief does not apply to the PBGC premium calculation. The longer smoothing period was advantageous prior to 2021 as it resulted in a higher discount rate and lower liability, hence the switch to the Alternative Method for many plan sponsors.

The Full Yield Curve approach is also allowed. It ignores the Segment Rates altogether and only considers bond yields over a one-month period.

Reducing PBGC Premiums Using the Full Yield Curve

To reduce PBGC premiums for plans on the Alternative Method, one option is to change the PPA discount rate methodology from the Segment Rate approach to the Full Yield Curve approach, which considers only recent bond yields. This will automatically apply to the liability used to determine PBGC premiums, resulting in a significant reduction or elimination of variable rate premiums. The IRS grants automatic approval for this change but plan sponsors should know it is generally considered a one-way street. A reversion in methods requires IRS approval.

Another advantage of the Full Yield Curve approach is that it produces a discount rate similar to a market discount rate produced for accounting purposes. Many corporate pension plans’ investment strategies focus on hedging their accounting liabilities. By switching to the Full Yield Curve methodology, the liability calculations can all mimic each other, better hedging all three liability calculations (PPA, PBGC, and accounting) and simplifying the risk management process. The difference between using a one-month average or no average, as well as the types of bond yields in the calculations, may result in slightly different liability calculations. However, they should all be much more similar than if the methodology is not switched. The alignment of liabilities also reduces the pension plan complexity, allowing plan sponsors to focus on a single funded status metric.

Which Plans Can Benefit?

Ideal candidates for this premium reduction method are those that are near 100% funded and are 100% hedged to interest rates. For these plans, there are very few disadvantages from making the switch. Yet our analysis indicates that many other plans could benefit from this approach, even those that are underfunded and may be more exposed to interest rate risk

The biggest potential disadvantage for the Full Yield Curve approach would result from a falling rate environment, as that would maintain lower contribution requirements under the Segment Rate calculation. For plans that are well funded and hedged, this environment shouldn’t pose a challenge, as the growth allocation is generally not large and both fixed income assets and liabilities would likely move in tandem. For other plans, there is less certainty, but beneficial cost and risk reductions may still exist. Every pension plan is unique and other plan components—such as credit balances, benefit accruals, and AFTAP restrictions—could impact the risk/reward of this strategy. Plan sponsors considering use of the Full Yield Curve approach should perform comprehensive liability and asset modeling to gauge the impact of any change in methodology.

Conclusion

Many pension plans that opted to switch to the Alternative Method of calculating PBGC premiums during the era of ultra-low interest rates now find themselves in a bind—one they may be able to turn into an opportunity. As of June 2023, interest rates have reached 5% or more, while the 24-month average of rates are stuck near 3%, resulting in higher premiums for plan sponsors using these rates under the Alternative PBGC premium method. However, making a little-known change to their PPA methodology may help solve this predicament. By changing the PPA discount rate methodology to the Full Yield Curve approach, plans can significantly decrease or eliminate their variable rate premiums. Additionally, we believe this change will reduce complexity and simplify the pension risk management process.

Serge Agres, Managing Director, Pension Practice

Footnotes

- The Pensions Protection Act (PPA) was signed into law by President George W. Bush in August 2006, with the purpose of improving the pension plan funding requirements of retirement plans.

Serge Agres, CFA, FSA, EA - Serge Agres is a Managing Director and Investment Actuary at Cambridge Associates.