VantagePoint: Second Quarter 2018

Advice in Brief

- The global economy and capital markets are constantly evolving. From the industrial revolution in the 1700s, to information technology in the last 45 years, waves of innovation have had profound implications for society, the global economy, and investors. At the same time, debt cycles, demographics, and productivity trends all have a slow-moving, yet powerful, impact on markets and on society over time.

- As the world around us changes, we always need to revisit our assumptions, evaluate implications of new developments, and, where sensible, determine how to adapt to change. How will disruption and evolution change the investment opportunity set of the future? Will the common heuristics that investors have come to rely on in constructing portfolios over recent decades hold in years to come?

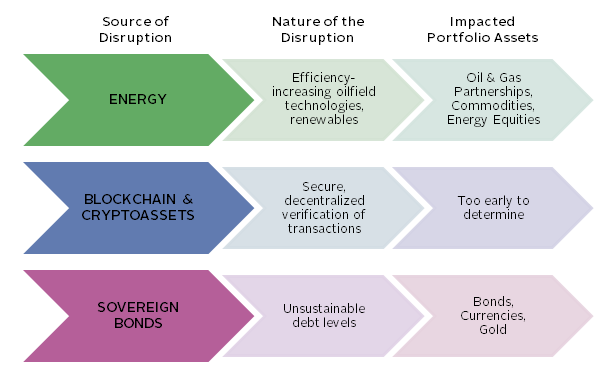

- Many areas of change (in various stages of development) are worthy of exploration, but we focus here on the potential investment implications of technological developments in energy and blockchain. In addition, we explore the role of high-quality sovereign bonds in portfolios in light of elevated and rising government debt and unfunded liabilities, demographic challenges, and limited capacity for monetary policy to respond to deflationary risks by traditional means in major developed markets.

Adapting to change. The global economy and capital markets are constantly evolving. From the industrial revolution in the 1700s, to railroads and electrification in the 1800s, mass production in the 1900s, and information technology in the last 45 years, waves of innovation have had profound implications for society, the global economy, and investors. At the same time, debt cycles, demographics, and productivity trends all have a slow-moving, yet powerful, impact on markets and society over time. As the world around us changes, we always need to revisit our assumptions, evaluate implications of new developments, and, where sensible, determine how to adapt to change. How will disruption and evolution change the investment opportunity set of the future? Will the common heuristics that investors have come to rely on in constructing portfolios over recent decades hold in years to come?

In this edition of VantagePoint, we look at some of the questions we believe will be critical to evaluate and understand over the next decade. We will be researching these issues further and sharing our findings in future publications. Many areas of innovation (in various stages of development) are worthy of exploration, but we focus here on the potential investment implications of technological developments in energy and blockchain. 1 In addition, we explore the role of high-quality sovereign bonds in portfolios in light of elevated and rising levels of government debt and unfunded liabilities, demographic challenges, and limited capacity for monetary policy to respond to deflationary risks by traditional means in major developed markets.

Energy Evolution

Private oil & gas investments have been a strong source of diversification and value added in investor portfolios for decades. Private and public investments in energy equities have also been included in inflation-sensitive allocations, as they historically have offered some positive real returns in periods when inflation surprises to the upside (providing valuable diversification, because most portfolio assets suffer during these periods). Has the advent of superior oilfield technologies 2 and the increasingly competitive pricing of wind and photovoltaic solar electricity generation changed this calculus? What roles will energy efficfiency improvements and structural changes in economic production (e.g., from energy intensive manufacturing to energy-light services) play in reducing the amount of energy used to produce economic activity?

Rising competitive pressures, technological advancements, and renewable energy have fundamentally altered the energy landscape. Advances in oilfield services technology have mitigated some geologic risk and lowered production costs, leading to a sharp increase in US oil & gas production and lower hydrocarbon prices. US shale producers have the ability to ramp up production and bring on new capacity relatively quickly and cheaply compared to conventional oil & gas producers in response to rising prices and increases in demand. A faster supply response function, combined with a decrease in OPEC’s ability to influence prices by controlling supply, should shorten energy’s boom/bust cycles and decrease their amplitude. What does this mean for the potential for fossil fuel prices to appreciate sharply during periods of rising inflation? If rising prices elicit a relatively rapid supply response, the market will balance more quickly than during prior price spikes, potentially dampening the price appreciation during inflationary periods.

And how will the increase in renewable generation impact demand for hydrocarbons? According to asset manager Lazard, the unsubsidized levelized cost of energy 3 of utility-scale solar photovoltaic energy has plummeted by 86% and wind by 67%, since 2009, making it cost-competitive with conventional generation technologies in some circumstances. Indeed, wind and solar account for an increasing share of new capacity expansions. How rapidly will renewable fuels gain share? With electricity accounting for just 17% of energy consumed globally, transportation and industrial energy use are more central to energy dynamics. What impact will electric vehicles have over the medium and long term? When will wide-scale deployment of low-cost batteries be available? The answers to these questions are being hotly debated, and the range of industry projections is divergent, but these dynamics are critical for energy investors to watch.

Finally, energy efficiency and structural economic shifts (e.g., from more energy intensive activities like manufacturing to less energy intensive activities related to services), are also playing an important role in shaping the energy landscape. According to data from the International Energy Agency, global energy intensity—or energy used per unit of output—has been on the decline recently. Between 2010 and 2016, energy intensity has fallen at an average annual rate of 2.1%, a faster clip than the 1.3% annualized decline seen between 1970 and 2010. 4

For further discussion, please see “Outlook 2018: Stick Around for Dessert,” Cambridge Associates Research Report, 2017.

As we evaluate the sweeping changes in the energy sector, we need to consider both the opportunities and challenges this disruption is creating, as well as the changing role that energy-related investments may play in portfolios. Such investments may become weaker diversifiers with less sensitivity to inflation should current dynamics continue to play out. Further, understanding these dynamics will be important in evaluating managers investing in this area. These long-term considerations do not change the current attraction of natural resource equities from a tactical perspective, as we’ve discussed in a number of publications, but they warrant continued diligence.

Blockchain and Cryptoassets

Development in blockchain and cryptoassets (also commonly referred to as cryptocurrencies and tokens) is at a very early stage, making it exceedingly difficult to determine how these technologies will shape the global economy. The development of blockchain to this point amounts to a proof of concept of distributed databases that create a decentralized, secure, and permanent record of transactions. The technology allows for a peer-to-peer network that cuts out the middle man, distributing payments directly to participants who provide content and services, without the need to pay commissions or fees to intermediaries. Software developers, entrepreneurs, venture capitalists, and other investors active in this area liken the current stage of development to the internet in the early 1990s (just after it was privatized). In other words, it’s the Wild West, with vast upside potential, but also substantial uncertainty and significant implementation hurdles. As with railroads and electrification in the 1800s, mass production in the 1900s, and the internet in the 1990s, the majority of early ventures are likely to go bust. They may not be the best investments, but rather, they pave the way for the next iteration of entrepreneurs that benefit from the efforts of the pioneers. Still, given the scope of potential opportunity and disruption, this is an important area to actively monitor.

Blockchain and cryptoasset technologies have the potential to be vastly disruptive to many economic sectors if developers and regulators can overcome considerable hurdles. The biggest impediments relate to governance, regulation, functionality, and scalability. As the internet evolved, various bodies established standards and policies, including the Internet Engineering Task Force and Internet Governance Forum. Similar governance bodies have not yet developed within the blockchain ecosystem. In fact, centralized governance cuts against the grain of the decentralization many developers are seeking to preserve. It remains to be seen if the current process of setting incentives for market participants to act in their own best economic interest will provide adequate governance. Regulatory uncertainty is also an important concern for investors. In the United States, for example, the Securities and Exchange Commission, the Commodity Futures Trading Commission, and in some cases the Financial Crimes Enforcement Network have all claimed jurisdiction over regulating this market. Investors would benefit from greater clarity over regulatory jurisdiction. A crackdown on fraud would be particularly beneficial to investors, as many initial coin offerings exist solely to raise funds without any intention to deliver on the business. This harms the environment for legitimate fledgling businesses. Even for legitimate blockchain startups, the functionality of many of these initial businesses is very limited. This is in part due to the difficulty in scaling these businesses, as transaction times are long and it takes a long time to reach consensus among participants as to the latest transaction. With scale, internet firms see network effects that can help to support future growth.

Potential applications touch nearly every economic sector, from the traditional (banking and insurance, auditing, data storage, and music) to newer sharing-economy businesses such as ride sharing and peer-to-peer apartment rentals. Some of the best, most creative developers and other professionals have flocked to blockchain and cryptoassets, lured by the opportunity to build creative software solutions to blockchain’s challenges. We will continue to monitor this area for real developments and progress against hurdles, so that we can identify risks and opportunities for investors and can understand whether today’s market leaders are adapting to the changing environment. Such an understanding should inform our investment strategy and manager selection, should digital assets gain traction.

The State of Sovereign Bonds

While blockchain is quite new, even ancient investment types can be dynamic. Sovereign bonds have been issued since the medieval period, and for decades, institutions have used them for liability matching and diversification, often relying on such bonds as a funding source for spending and capital calls during equity bear markets. But what if bonds failed to appreciate in periods of equity stress? Could elevated debt levels drive investors to require a materially higher risk premium to own major developed markets’ bonds (potentially even US Treasuries)? And what would be the consequences for currencies?

Levels of government debt-to-GDP, at 91.5% for the G20, are the highest they have been since the end of World War II. The picture for the United States looks similar, with debt-to-GDP at 105% and rising. These statistics vastly understate the actual level of debt obligations, including many social insurance promises that don’t show up on the official balance sheets. In the United States, according to the Congressional Budget Office, the net present value of the 75-year future liability for Medicare and Social Security exceeds the present value of tax receipts over the same period by more than $45 trillion, with some economists estimating that unfunded liabilities are closer to $200 trillion. 5 Demographics complicate matters, as government revenues are likely to decrease as baby boomers retire and draw on Social Security and Medicare benefits, putting more strain on government finances. Developments in automation and robotics, by replacing labor with capital, could pressure consumer demand and GDP growth. Such trends could further aggravate popular dissatisfaction with the status quo, enhancing the trend toward populist leaders that tend to spend more, not less, adding to the debt load.

At some point, governments may decrease entitlements, perhaps grandfathering in current and soon-to-be future recipients, as has been done with the lifting of the retirement age in the US Social Security program. However, as debt levels increase and unfunded liabilities come due, the United States would most likely issue more debt to meet obligations. Would this debt be able to clear without higher rates? How would higher rates and elevated risk premia impact government finances and investment portfolios? For now, the impact of a 100 basis point (bp) increase in the cost of credit might be tolerated by investors. With more than $20 trillion in debt outstanding, the cost of credit would increase by $200 billion, representing an increase of about 45%, but driving up interest expense to a still manageable 2% of GDP. If bond investors began to worry that a major sovereign issuer’s claims are greater than its ability to meet them, this could set off a scramble for “bulletproof” debt and currency, however given that most major developed markets are in the same boat, gold or even high-quality corporate bonds could benefit in this scenario.

And how would central banks react? Central banks typically ease 500 bps to 600 bps in a recession, but they have much less headroom today, even when moving into negative rate territory. Central banks will consider a broader set of tools including purchase of riskier assets, price-level targeting, 6 and other strategies currently under discussion. How should we think about the defensive character of sovereign bonds in light of these complications? What other unexpected consequences might these conditions bring?

While the risk of a buyer’s strike due to fear of over-indebtedness is higher today than it has been in recent decades, it is still unlikely. Despite these challenges, we expect quality sovereign bonds, and especially US Treasuries, will continue to provide useful ballast to portfolios when economic growth contracts and nominal yields fall. Even Japanese government bonds have appreciated during periods of economic stress despite much higher debt as a share of GDP than the United States.

Evaluate and Adapt

Much change is afoot that has potential to influence how we think about portfolio construction. These changes are wide-ranging, spanning from technological developments, to debt levels and demographics, and policymaker flexibility (or lack thereof). Technology developments are creating disruption, and perhaps will lead to destruction and replacement of some market segments, creating both risks and opportunities. Even established market leaders with business models that promise strong, stable earnings as far as the eye can see may fall victim to these forces. Demographic developments and limitations in policymaker options have important implications for growth prospects and portfolio risk management. We will be engaging in further study and evaluation of these trends, sharing our observations, conclusions, and where appropriate, changes in our investment views and practices to adapt to the changing environment.

Footnotes

- We use the term blockchain throughout, as it is the most common form of distributed ledger.

- Improvements in oilfield technologies have been widespread, including fracking, horizontal drilling, longer laterals, multi-pad drilling, and improved completion technologies such as increased proppant volumes and optimization of spacing and stacking.

- Please see “Lazard’s Levelized Cost of Energy Analysis—Version 11.0,” Lazard, November 2017, https://www.lazard.com/media/450337/lazard-levelized-cost-of-energy-version-110.pdf. The levelized cost of energy is the net present value of all the costs over the lifetime of developing and operating the asset, divided by its total electrical energy output.

- Please see “Energy Efficiency 2017,” International Energy Agency, 2017.

- For example, see Laurence Kotlikoff, “17 Nobel Laureates and 1200+ Economists Agree with Ben Carson re U.S. Fiscal Gap,” Forbes, May 13, 2015.

- Price-level targeting is the concept of targeting a rate of inflation over the long term, such that below-average inflation in one period would require commitment to above-average inflation in the subsequent period, such that inflation would average the target level over time.

Celia Dallas - Celia Dallas is the Chief Investment Strategist and a Partner at Cambridge Associates.