VantagePoint: Electrifying Returns in the AI Era

Artificial intelligence (AI) is not just transforming business models and economic growth—it is contributing to a step change in global electricity demand, with far-reaching effects on energy markets, utility infrastructure, and investment portfolios. This shift is creating both acute challenges and compelling opportunities. Grid reliability, infrastructure bottlenecks, and decarbonization pressures are intensifying, while the scale and urgency of required capital investment are unprecedented. Solutions that address these challenges—modernizing the grid, expanding clean and reliable power, and improving efficiency—offer the most appealing prospective returns.

Yet, as with any technological revolution, uncertainty remains. The pace of AI adoption, the trajectory of energy efficiency, the availability of labor and materials along the electricity supply chain, and the ability of policy and capital to keep up with demand will shape the investment landscape. Investors must allocate capital thoughtfully, balancing optimism about the scale of the opportunity with discipline and selectivity.

In this edition of VantagePoint, we examine how the rise of AI is reshaping the global energy landscape and highlight the most compelling opportunities and risks for investors. We analyze the drivers of surging electricity demand, the infrastructure and supply chain constraints that threaten to limit growth, and the comparative merits of emerging power solutions. We conclude with actionable investment implications and recommendations for navigating this rapidly evolving landscape. The winners will be those who can identify and invest in the infrastructure and technologies that enable the next era of digital and energy growth.

The global demand surge

Hyperscale data centers powering advanced AI workloads are proliferating rapidly, as technology firms race to secure power contracts and build new capacity. This surge in AI-driven demand is layered atop powerful secular trends: digitalization, electrification of transport and industry, and manufacturing reshoring.

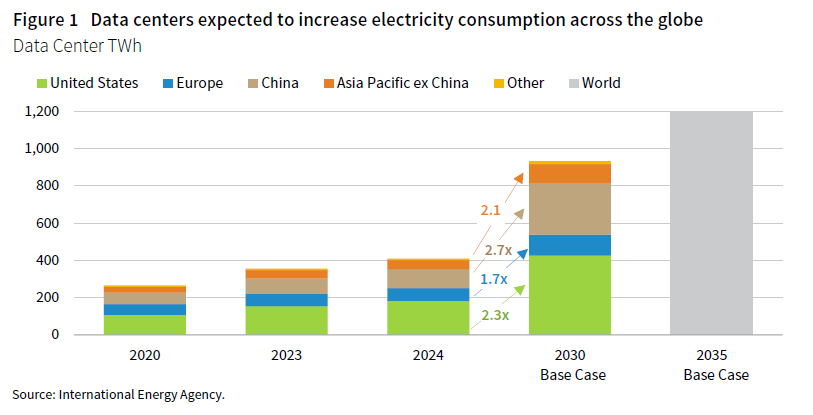

Projections from the International Energy Agency (IEA) suggest global electricity demand could grow 1.5x to 3x by 2050 (2%–4% annually), with data centers alone expected to double their share of global consumption by 2030 to nearly 3% (Figure 1). In the United States, data centers may account for as much as 12% of total power demand by 2028, up from 4.4% in 2023.

Historically, technology platform shifts have made demand forecasting difficult. For example, the move to cloud computing delivered dramatic efficiency gains that tempered earlier projections of data center power use. Today, advances in AI hardware, software, and cooling are again driving efficiency improvements, but the sheer scale and intensity of AI workloads mean that aggregate demand is likely to rise sharply. Further, should AI electricity demand fall short, other demand drivers should support investments in expanding electricity capacity.

These forces are converging at a time when many power grids are already strained by aging infrastructure, intermittent renewable generation, and extreme weather events. The result is a widening gap between projected demand and available, reliable supply—creating acute challenges for grid reliability and decarbonization.

For investors, this environment presents a generational opportunity. Those who target infrastructure and efficiency solutions that address the scale and urgency of this transformation are best positioned to benefit.

Data center differences

AI workloads in data centers fall into two distinct categories: training and inference. Training large models involves short, intense bursts of computation, requiring ultra high–density hardware and advanced cooling systems. These workloads typically occur in specialized, hyperscale facilities, often sited in remote locations where abundant, low-cost power is available.

Inference, by contrast, is a continuous and distributed process. While each query is less demanding, the aggregate electricity use can surpass that of training due to the sheer volume of real-world applications. Inference workloads require data centers to deliver reliable, low-latency performance, often necessitating proximity to population centers and robust network redundancy. This locational preference ensures rapid response times for end users and supports a wider range of commercial and consumer applications.

From an investment perspective, inference-oriented data centers offer broader applicability and more predictable demand profiles, while training centers—though critical for AI advancement—are more speculative and concentrated in fewer, remote sites. Understanding these distinctions is essential for evaluating infrastructure needs, strategies for sites, and long-term value creation in the evolving AI data center landscape.

Supply and infrastructure constraints

The surge in electricity demand driven by AI and digitalization is colliding with significant supply-side and infrastructure challenges. These constraints are not only slowing the pace of new capacity additions but also creating critical investment opportunities for solutions that can unlock growth and reliability.

Aging grid infrastructure and grid modernization needs

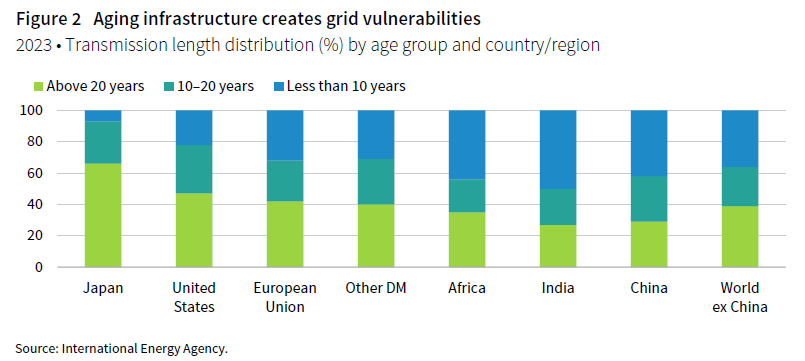

In advanced economies, more than 40% of transmission and distribution assets are more than 20 years old and were designed for centralized, fossil fuel–based generation (Figure 2). The shift toward distributed and intermittent renewables requires a more flexible and intelligent grid. As infrastructure modernizes and digitizes, the risk of cyberattacks and operational disruptions rises, making robust cybersecurity frameworks and resilience planning essential for long-term asset value and risk mitigation.

Supply chain strains: Equipment, labor, and permitting

Lead times for essential grid components—transformers, switchgear, and high-voltage cables—have extended from months to years. In the United States, transformer delivery times routinely exceed two to four years, with similar delays in Europe and Asia-Pacific. Transformer costs have doubled since 2020, and the backlog for new orders is at a record high. These delays are driven by surging demand, limited manufacturing capacity, and persistent labor shortages, especially in electrical engineering and construction trades. Tariffs and inflation in materials and logistics are also impacting project economics and timelines, requiring flexible procurement strategies and risk-sharing mechanisms in contracts.

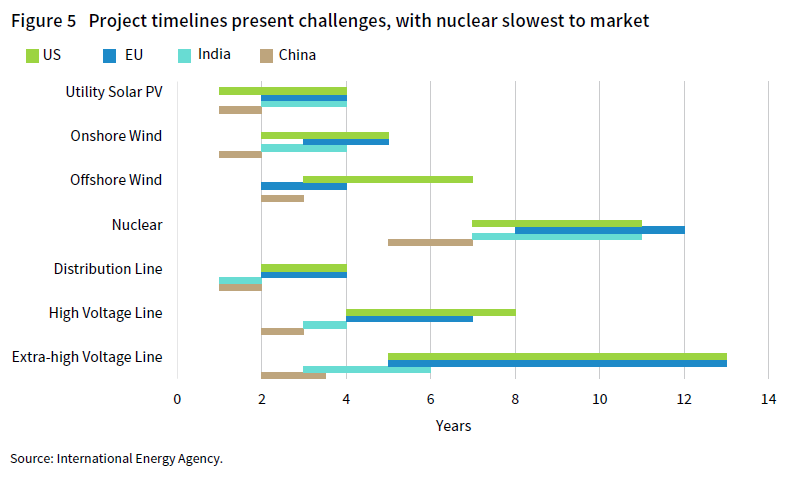

Permitting and regulatory hurdles compound these challenges. In many jurisdictions, transmission projects face multi-year approval processes. In the United States, the average transmission line takes seven to ten years from planning to completion—a timeline fundamentally misaligned with the rapid buildout of data centers, which can be completed in under two years. This lag is creating acute supply bottlenecks, with some projects forced to rely on local generation or on-site solutions (i.e., battery storage or microgrids) to bridge the gap. Grid-enhancing technologies—such as dynamic line rating and advanced power flow control—can increase the capacity and flexibility of existing infrastructure, offering attractive risk-adjusted returns and faster deployment.

Figure 3 illustrates the dramatic increase in generation and storage projects waiting in interconnection queues, as well as the average time projects spend in these queues before coming online. This bottleneck is a key factor limiting the speed at which new capacity can be added to the grid. In some jurisdictions, average time in queue is now seven to ten years (e.g., Northern Virginia, Germany, the Netherlands), and in Dublin, new activity is expected to be paused until 2028. Even projects ready to proceed can face multi-year delays, amplifying the risk of supply shortfalls and stranded capital.

Grid congestion and reliability risks

Utilities and grid operators warn that rapid load growth and aging infrastructure could trigger supply shortfalls, price spikes, and curtailments, especially where transmission upgrades lag demand. In major US markets like California, Northern Virginia, and Texas, data center clusters are straining local grids, causing connection delays and even moratoriums. The North American Electric Reliability Corporation (NERC) has flagged data center expansion as a near-term risk to reserve margins. Loudoun County, Virginia—the world’s largest data center hub—is experiencing grid and land constraints, escalating prices, and growing community opposition.

In Europe, grid saturation in Amsterdam, Dublin, Frankfurt, London, and Paris is limiting the availability of reliable power to new facilities and prompting temporary moratoriums on new data centers. Asia-Pacific faces similar issues, with rapid urbanization and uneven renewable supply causing grid instability.

Navigating the bottlenecks

Supply chain and grid constraints are central for investors, raising the risk of project delays, cost overruns, and stranded assets—especially in congested or slow-permitting markets. These bottlenecks also create opportunities for investment in enabling infrastructure and advanced grid solutions.

Investors should prioritize regions and projects with clear pathways to grid interconnection, strong utility partnerships, and proactive risk mitigation strategies. As the AI revolution accelerates, the winners will be those who can navigate the bottlenecks—deploying capital not just to meet demand, but to unlock the infrastructure and supply chain solutions that make growth possible.

Grid and generation solutions

Before investors can identify the most attractive opportunities in the evolving electricity landscape, it is essential to understand the strengths, limitations, and deployment realities of major generation and grid technologies. Each solution offers a distinct profile in terms of cost, reliability, scalability, and environmental impact. The optimal mix will depend on local market conditions, regulatory frameworks, and the specific needs of end users. The following overview provides a comparative assessment of key technologies, highlighting factors that drive investment value and the challenges to delivering reliable, low-carbon power at scale.

Generation technologies

Natural gas

Natural gas remains the most flexible and scalable dispatchable resource in many markets, offering rapid ramping and high reliability for peak demand and grid stability. However, supply chain bottlenecks (e.g., gas turbines), carbon intensity, and exposure to fuel price volatility present risks, especially as decarbonization policies tighten. Investors should weigh the near-term reliability benefits against the potential for stranded asset risk as emissions standards evolve.

Renewables (wind and solar)

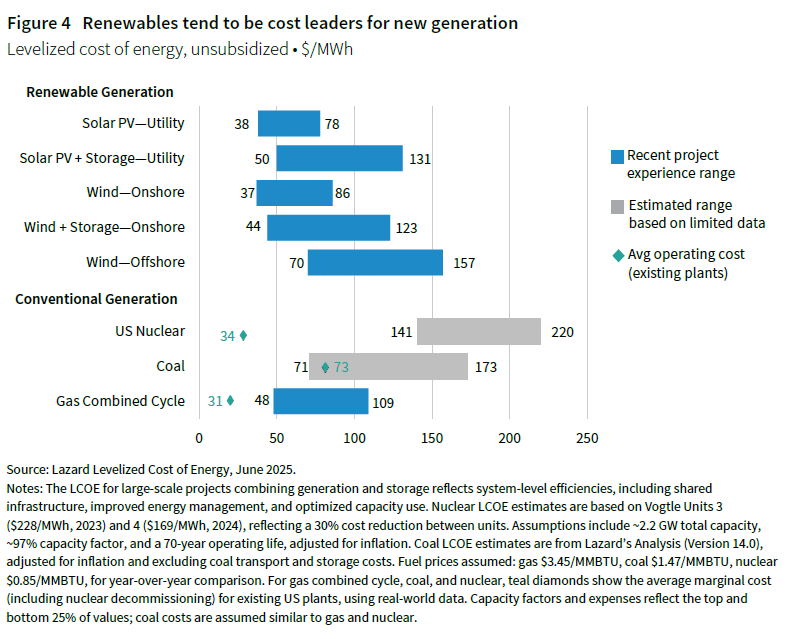

Wind and solar are now the lowest-cost sources of new generation in many regions, but their intermittency creates challenges for grid reliability and requires complementary investments in storage, flexible generation, and advanced grid management. Siting and permitting can be significant hurdles, particularly for large-scale projects. AI can help streamline solar permitting and project management, while evolving battery technologies (e.g., ion-air, flow) offer potential medium-term storage solutions. Investors should consider both the cost advantage and integration challenges.

In the United States, scaled-back tax credits may depress long-term development, while near-term safe harbor requirements could accelerate construction and create supply shortages and cost increases (Figure 4). Developers with healthier balance sheets will more effectively bring forward project timelines, while liquidity-constrained developers will be more challenged, potentially igniting a buyers’ market for high-quality assets at distressed prices.

Battery storage

Grid-scale battery storage is rapidly gaining traction for balancing variable renewables and providing ancillary services. Costs have declined and as previously mentioned, battery technologies are improving but are not yet a full substitute for long-duration or seasonal storage. Supply chain constraints and raw material sourcing remain key risks. The investment case is strongest where storage can capture multiple revenue streams or where grid congestion is acute.

Nuclear

Nuclear power offers zero-carbon, baseload generation with high reliability. While new large-scale projects face high capital costs, long lead times, and regulatory complexity, interest in small modular reactors (SMRs) is growing (Figure 5). However, a challenge for investors is the proliferation of SMR technologies—more than 80 different designs across four main models—which makes it difficult to achieve standardization and bring down cost curves. Commercial deployment of SMRs remains several years away, and the path to cost competitiveness is uncertain.

Extending the lifetime of existing nuclear plants is already being done in several markets and can be a cost-effective way to maintain reliable, low-carbon power. These life extensions typically require less capital and regulatory risk than new builds and can deliver attractive returns for investors focused on operational upgrades and maintenance. Meanwhile, fusion nuclear energy is attracting considerable private investment but remains in the research phase.

Geothermal (Next-Generation)

Geothermal energy is evolving rapidly, with enhanced geothermal systems (EGS) and closed-loop geothermal expanding the addressable market. EGS leverages oil & gas technologies to unlock geothermal potential in new geographies. Closed-loop systems reuse water and eliminate the need for a continuous supply. Both approaches offer very low-carbon energy and 24/7 output, with a small land footprint attractive for data centers. Despite high upfront capital requirements, resource risk, extensive transmission infrastructure needs, and long permitting timelines, next-generation geothermal could drive costs lower and enable deployment in new regions. Investors should weigh the long-term potential against these barriers, focusing on projects and platforms that can mitigate development risk and capitalize on technological advances.

Hydropower

Hydropower remains a significant source of reliable, low-carbon electricity in many regions. While new large-scale projects are constrained by geography and environmental concerns, upgrades to existing facilities and pumped storage continue to play an important role in grid flexibility and decarbonization strategies.

Hybrid systems

Increasingly, developers and utilities are deploying hybrid systems that combine multiple technologies—such as solar and battery storage, wind and gas, or renewables with on-site generation—to deliver firm, flexible power. These integrated solutions help address intermittency, improve grid reliability, and optimize project economics.

On-site and distributed solutions

To address grid constraints and reliability risks, many large power users are investing in on-site generation—such as gas turbines, fuel cells, microgrids, and behind-the-meter storage. These distributed solutions can accelerate project timelines, enhance resilience, and reduce dependence on the broader grid. While they may come at a premium cost and require specialized operational expertise, they are increasingly attractive for data centers and critical infrastructure seeking 24/7 reliability.

Grid and data center efficiency innovations

Efficiency is a key lever for addressing supply constraints and decarbonization goals. Innovations in grid management and data center operations are unlocking significant value:

- Advanced grid management: Technologies such as dynamic line rating, advanced power flow control, and real-time grid analytics can increase the capacity and flexibility of existing infrastructure, enabling more efficient use of transmission assets and faster integration of renewables.

- Virtual power plants (VPPs): VPPs aggregate distributed energy resources—such as batteries, backup generators, and flexible loads—across multiple sites, enabling coordinated participation in grid services. For data centers, VPPs can lower energy costs, generate new revenue from demand response, and enhance resilience. Regulatory support and advances in AI-driven orchestration are accelerating adoption.

- Data center efficiency: AI-driven energy optimization, liquid cooling, modular design, and waste heat recovery are reducing the energy intensity of data centers. Leading operators are achieving power usage effectiveness (PUE) ratios well below industry averages, translating into lower operating costs and reduced grid impact.

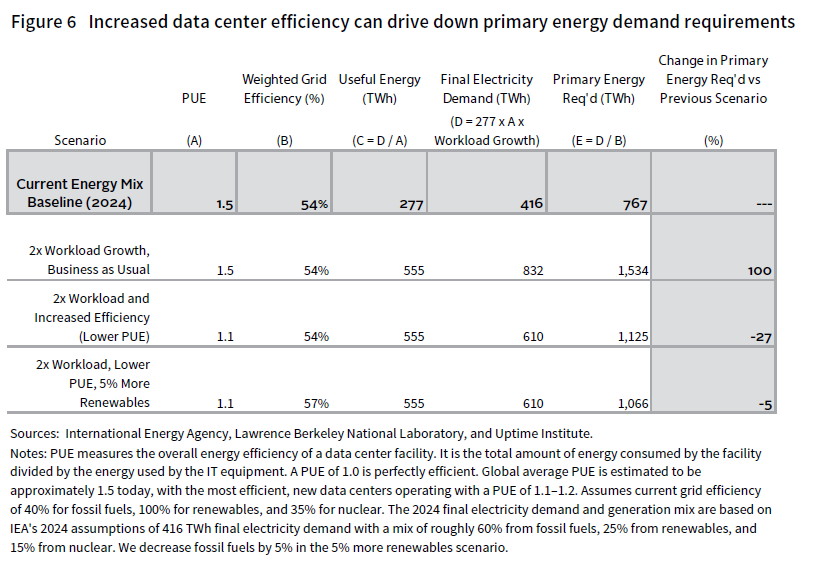

Improving grid efficiency and data center PUE can be powerful. For example, improving PUE from the industry average of 1.5 to 1.1 can reduce primary electricity demand by 27% compared to business-as-usual projections (Figure 6). Combined with a more efficient grid mix, the reduction in primary energy demand is even more pronounced. This compounding effect lowers operating costs and carbon emissions, and enhances the resilience and scalability of digital infrastructure, making efficiency investments highly attractive in the context of rising AI workloads and electrification.

Opportunity and caution in the power of AI

BloombergNEF (BNEF) investment projections show that a broad set of drivers are adding to global electricity demand (Figure 7). While data center–driven electricity demand growth is rapid, it starts from a low base and accounts for a relatively small portion of projected demand growth. The electrification imperative, boosted by AI and digitalization, is creating a generational investment opportunity. If net-zero objectives are met, investment in all but fossil fuel power is expected to increase materially from BNEF’s base case.

The scale and urgency of required capital, combined with the pace of technological change, are drawing significant attention from both strategic and financial investors. Mergers & acquisitions activity in the sector has been robust, spurred by opportunities to build efficiency and scale in a highly decentralized market. With nearly 3,000 electric utility companies in the United States alone, transaction typically target the middle market.

Sectors tied to power infrastructure, grid modernization, and efficiency solutions have already seen strong performance, and the long-term demand outlook remains robust. However, this enthusiasm brings risks.

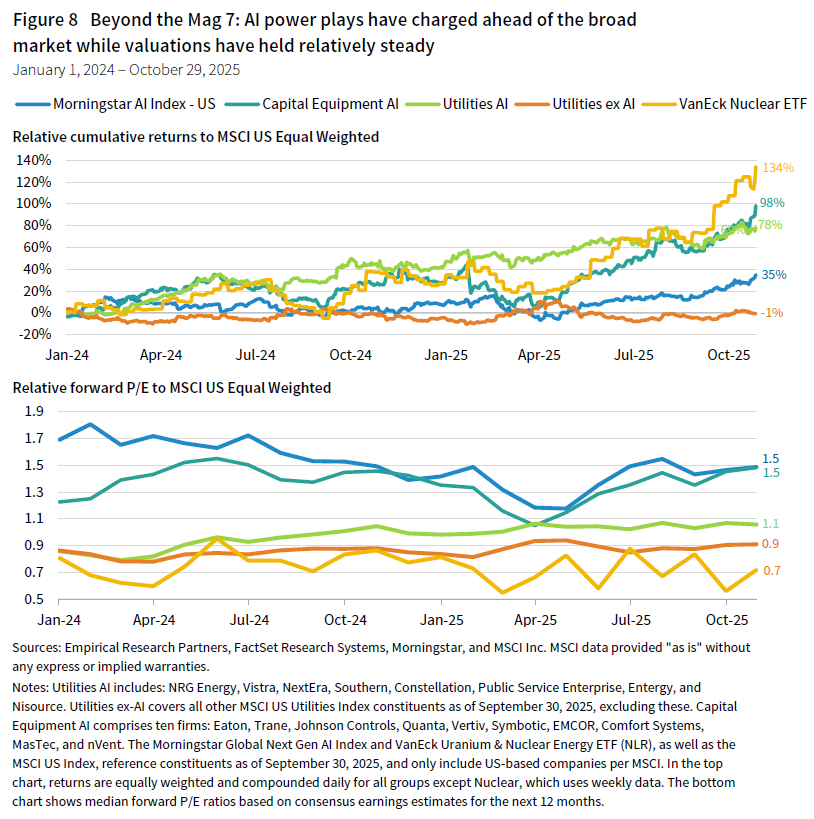

Recent market performance highlights both the promise and risks of AI-adjacent power investments, or AI enablers. Since the start of 2024, nuclear, utility, and capital equipment power AI plays have meaningfully outperformed broad US equities and broader AI plays as defined by the Morningstar AI Index (Figure 8). Importantly, this outperformance has not been driven by indiscriminate multiple expansion—relative valuations have remained stable, suggesting returns have been grounded in improved relative fundamentals based on expected earnings outperformance. The exception is capital equipment AI plays, which have seen relative valuations increase from a 20% premium at the start of the period to a 50% premium. This rerating reflects expectations that prices for critical hardware—such as gas turbines and transformers—will remain elevated amid continued shortages and limited investment in expanding manufacturing capacity.

For investors, the imperative is to balance optimism about the scale of the opportunity with discipline and selectivity. Rigorous underwriting, a focus on operational excellence, and a clear understanding of technology and regulatory risk will be essential to capturing attractive, risk-adjusted returns in this dynamic environment.

Investment implications and recommendations

The convergence of AI and electricity is reshaping the investment landscape, creating both acute challenges and compelling opportunities. As demand for reliable, scalable, and low-carbon power accelerates, investors must navigate infrastructure bottlenecks, technology uncertainty, and market exuberance with discipline and selectivity.

Foundational power and efficiency investments—such as long-term Power Purchase Agreements (PPAs), grid upgrades, distributed energy resources, advanced cooling, and efficiency innovations—apply broadly to infrastructure supporting both training and inference data centers. For inference workloads, emphasize urban grid enhancements and network redundancy; for training, focus on transmission capacity and high-density hardware. Aligning capital with these differentiated needs helps balance innovation potential with stability and scalability.

Investors should include exposure to AI power themes in portfolios. Opportunities span public utilities, private infrastructure funds, hybrid private equity/private infrastructure funds, venture capital, and growth equity. In navigating these opportunities, investors will benefit from the six following priorities in helping to identify winning strategies and managers.

- Prioritize enabling infrastructure

Investments in grid modernization, transmission upgrades, and advanced grid management technologies are essential to unlock new capacity and support the integration of renewables and distributed resources. Projects and platforms that can accelerate permitting, streamline interconnection, and deploy grid-enhancing solutions are positioned for premium returns. Many infrastructure projects offer multiple revenue streams, such as PPAs with data centers and utilities, and the ability to sell excess electricity back to the grid. - Target efficiency innovations

Efficiency improvements in grid operations and data center management offer attractive, risk-adjusted returns and can often be deployed more rapidly than large-scale generation projects. Investors should seek managers focused on companies and assets that leverage AI-driven optimization, advanced cooling, and modular design to reduce energy intensity and operating costs. - Embrace technology diversification

No single technology will solve the power challenge. Portfolios that combine renewables, storage, flexible generation, on-site solutions, and hybrid systems—tailored to local market conditions—will be best positioned to deliver reliable, cost-effective, and low-carbon power. - Account for regulatory uncertainty

Shifting policy, permitting requirements, technology standards, tariffs, domestic content rules for tax incentives, subsidies, and other regulatory incentives or deterrents can materially impact project timelines, costs, and returns. Investors should prioritize assets and managers with strong regulatory expertise, proactive risk management, and supply chain flexibility. - Monitor valuations and execution risk

Elevated valuations in certain segments—coupled with supply chain, permitting, labor, and regulatory challenges—require rigorous underwriting and operational due diligence. Investors should focus on managers and platforms with proven execution capabilities and a track record of navigating complex environments. - Stay alert to emerging opportunities

Advances in next-generation geothermal, SMRs, and hybrid systems are expanding the investable universe. Selective exposure to innovation, with a focus on scalability and cost competitiveness, can enhance long-term portfolio resilience.

Conclusion

In short, investors should focus on managers investing in:

- Generation assets with clear pathways to grid interconnection, strong utility partnerships, and regulatory support.

- Platforms and companies that combine multiple solutions—balancing cost, reliability, and decarbonization—and demonstrate operational excellence.

- Efficiency and enabling infrastructure as near-term levers for value creation.

Such managers should use the following risk controls:

- Maintain discipline on valuation and risk, especially in segments experiencing rapid capital inflows.

- Incorporate regulatory due diligence and scenario planning into investment processes, especially for projects in regions with evolving policy frameworks, tariffs, or complex incentive structures.

- Monitor and adapt to changes in domestic content requirements, tax incentives, and subsidy regimes to optimize project economics and compliance.

- Stay informed on policy, regulatory, and technology developments to anticipate shifts in market opportunity.

The winners in this new era will combine vision with discipline—deploying capital to solutions that enable the next wave of digital and energy growth, while managing risk in a rapidly evolving, policy-driven landscape.

Justin Hopfer and Graham Landrith also contributed to this publication.

Celia Dallas - Celia Dallas is the Chief Investment Strategist and a Partner at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.