Small-Cap Stocks Present Large Opportunity

US small-cap stocks have underperformed large-cap peers in recent years, opening a significant valuation discount that seems hard to justify based on relative earnings strength or balance sheet health. Looking ahead, the sector exposure of small-cap stocks may make them better positioned for the current environment of rising interest rates and high commodity prices. While the bar for tactical decisions during volatile market conditions should be high, we believe investors should lean into US small-cap equities. Using an active manager or a passive approach with a quality bias may further boost investors’ chances of success.

Performance & Valuations

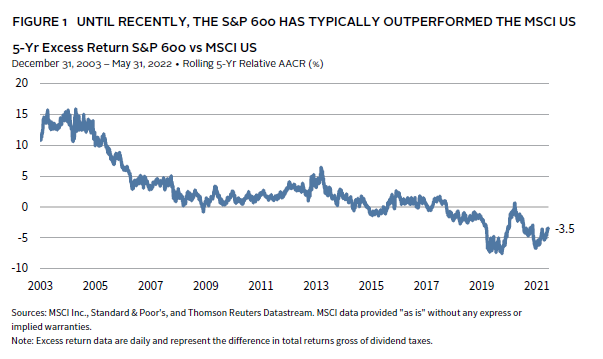

The S&P SmallCap 600® Index (S&P 600) has outperformed the large-cap MSCI US Index for most of its history until recently (Figure 1). Small caps have trailed by around 830 basis points (bps) over the past year and by more than 350 bps annualized during the last five years—in the bottom decile of relative underperformance. This underperformance was, in part, linked to first quarter 2020, when small caps underperformed large peers by around 1,300 percentage points.

Recent small-cap underperformance was likely connected to the perception that they are more vulnerable to recessions and to concerns about their lower index weights for technology (and tech-like) companies, which were expected to benefit from COVID-related increases in demand. Still, while this may have been the expectation, small-cap earnings growth has turned out to be much stronger. In fact, S&P 600 earnings growth over the past five years was nearly twice that of global large-cap stocks (Figure 2). Put another way, despite the expected boost to revenue for companies in areas like hardware, software, and broadband from pandemic-related shifts in demand (e.g., e-commerce, work from home), it turned out smaller companies gained ground, given robust economic growth and a swift rebound in employment.

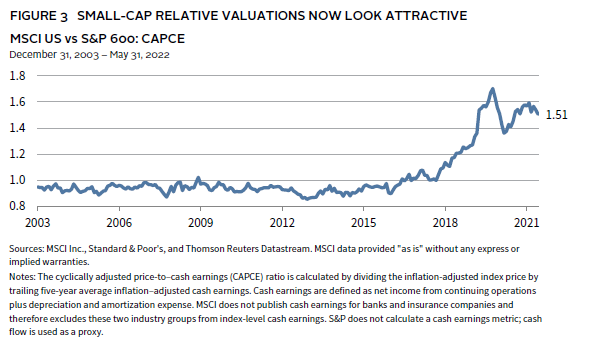

The result is that small-cap valuations now look attractive both from an absolute and relative perspective. Using our preferred normalized price-earnings ratio (P/E), which uses cash earnings, the current 51% premium for large caps has only been this rich around 9% of the time (Figure 3). Focusing on short-term valuations, the current forward P/E of around 12.5 times for small caps is at an all-time low (based on data since 2005), starkly contrasting with the 17.9 times (81st percentile) for large caps.

Looking Ahead: Prospects for the Macro Environment

The bar for making tactical decisions is high in the current environment of elevated geopolitical uncertainty, rising interest rates, and slowing economic growth. Equity investors should assess what these conditions mean not just for company fundamentals but also the equity styles favored by markets. There are different ways of answering this question, including looking at how small caps have performed historically across similar economic environments, the current health of small-cap balance sheets and operating models, and how the sector mix may (or may not) benefit small-cap investors.

While no two economic environments are exactly the same, small caps have historically fared relatively well during periods of elevated inflation. Looking at recession risk, the track record is spottier with, for example, small caps faring similar to large caps during the global financial crisis (GFC) but underperforming during the (extremely short) economic downturn in first quarter 2020. Still, valuations come into play, and we’d note that during the GFC small caps traded at a premium to large caps, whereas today they trade at a steep discount. Overall, our confidence in relative prospects for small caps is more firmly rooted in this type of valuation analysis and prospects for specific sectors than an analysis of previous historical economic environments, especially as periods of elevated inflation have been limited in recent decades.

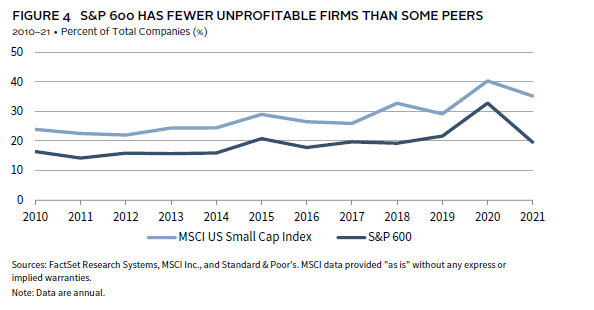

In a similar vein, while historically small caps have not fared as well during periods of Federal Reserve tightening as large-cap peers, we are less sure that past is prologue for several reasons. One is the historically large valuation differential mentioned earlier. Another is that the S&P 600 (our preferred US small-cap index) by design has a quality bias and fewer unprofitable firms than other small-cap indexes (Figure 4), making it less vulnerable to higher discount rates than certain peers. (The S&P 600 only adds companies that have reported a negative earnings result for either the last quarter or trailing four quarters.) Finally, small-cap company leverage levels have come down and interest coverage levels are elevated, making them less vulnerable to the expected rise in interest costs. 1 Russell 2000® Index interest coverage stands at 5.3 times, well above levels seen during the depths of COVID-19 and the highest since 2014. (Please see Elias Krauklis and Venu Krishna, “Small Caps Keep Sliding,” Barclays Equity Research, May 6, 2022.)

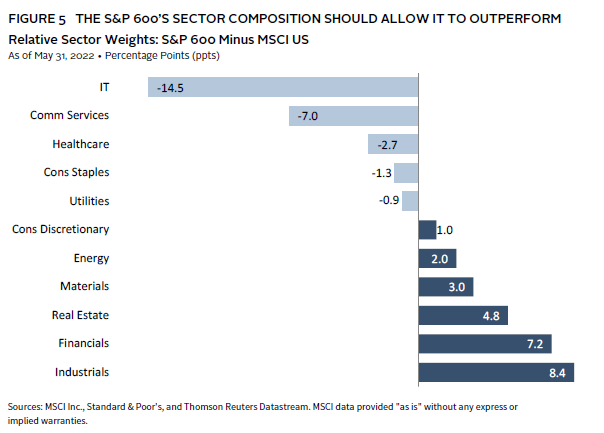

The sector composition of the small-cap index should reinforce its ability to outperform in the current environment (Figure 5). The S&P 600 has a significantly lower weight than the MSCI US in sectors like technology and communications services that may have seen demand (and thus earnings) pulled forward by the pandemic. The risk for these large technology companies is that normalizing demand will see earnings growth roll over, and there is at least anecdotal evidence of that already occurring in the first quarter earnings reports. Conversely, the small-cap index has higher weights for financials—which should benefit from rising interest rates—as well as energy and mining companies that are seeing earnings upgrades, given the recent rise in commodity prices.

Where Could We Be Wrong?

The market is currently being whipsawed by the prospect of central bank hikes and soaring inflation, while at the same time, other recent growth drivers (including fiscal stimulus) are fading. The result has been a sharp devaluation for higher multiple growth stocks, and in particular those with fading earnings momentum, while previously out-of-favor styles—such as value—play catch-up. We think the valuation discount currently on offer from US small caps is such that they should outperform in most economic environments. However, in the (perhaps) unlikely event inflationary pressures suddenly disappear, the Fed changes its tune, and markets again bid large-cap growth stocks higher, small caps could struggle to keep up. In an extreme risk-off scenario (where for example the war in Ukraine spills beyond its borders), small caps could also underperform, though this might be mitigated by (a) the higher weightings for natural resources stocks and thus inflationary hedging aspects of small caps, and (b) the quality tilt of the S&P 600, which limits weights for the most vulnerable companies.

Concluding Thoughts

After outperforming large-cap peers for most of their history, small caps have trailed in recent years. Investors should ask whether something has changed, and if not, what the catalyst might be for a reversal of this trend. Looking at earnings, balance sheets, and possible performance during periods of rising rates and inflation, we don’t see data that supports ongoing large-cap dominance. If anything, we see relative valuations that are stretched close to historical peaks, and a sector mix (not to mention more domestic exposure), which should insulate small caps from ongoing macro vulnerability. While small caps should always be a part of investors’ tool kits, now is an especially opportune time to add exposure, given historically low valuations. Investors doing so should consider an active approach (or a quality-biased passive index such as the S&P 600), as these managers (and this index) are likely to underweight companies with weak earnings and stretched balance sheets that might be most vulnerable in the current environment.

Footnotes

Wade O’Brien - Wade O’Brien is a Managing Director for the Capital Markets Research team at Cambridge Associates.