Right-Sizing Private Investments for the Evolving Pension

Most defined benefit plans—including public, multi-employer, and even frozen corporate plans—can benefit from private investment (PI) strategies. It is fairly common knowledge that private investments offer important value in the form of increased expected investment returns, and that they can be instrumental in improving funded status and achieving other plan goals. Despite this, many plan sponsors still abruptly cut off PI commitments or do not optimize their usage as the plan matures. This paper explores how plan sponsors should use PI strategies within their toolkit and customize their composition over time to reflect a plan’s evolving goals.

Our discussion begins with a review of the various types of PI strategies and their different characteristics and roles. We then outline factors to consider in determining the appropriate PI strategy for a given plan. Finally, recognizing that pension PI programs vary greatly depending on each plan’s circumstances, we conclude with some real-world case studies that demonstrate how PI can be adapted to meet specific plan needs.

Understanding PI Strategies

Broadly speaking, PI strategies encompass three types of assets:

- Private equity (PE)—buyouts, growth equity, and venture capital (VC);

- Real assets—real estate, private energy, natural resources, and infrastructure; and

- Private credit—direct lending strategies, opportunistic credit, and structured finance.

An array of strategies exists within this universe, each with its own attributes and objectives.

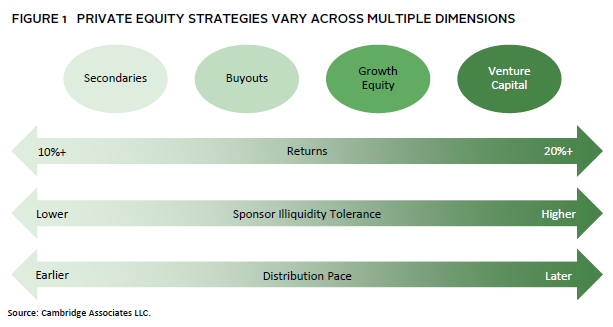

Private Equity. PE strategies focus on capital appreciation through investments in all types of businesses, from seed and early-stage start-ups (VC) to high growth companies achieving scale (growth equity) and mature companies with revenue and EBITDA (buyouts). PE structures typically have a fund life of 12 to 14 years. The types of PE strategies and their returns, illiquidity profiles, and distribution pace are presented for reference in Figure 1.

PE is commonly categorized as a growth and total return strategy and serves as the part of a portfolio’s growth allocation. While the underlying stage of investment and economic sectors vary greatly across PE, these strategies have the potential to earn a healthy premium over public equity benchmarks and exhibit lower volatility, creating an attractive complement for a portfolio.

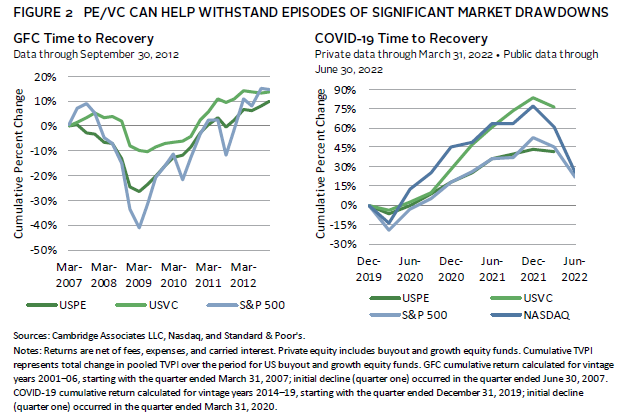

What’s more, PE/VC strategies have the capacity to help pension portfolios better withstand episodes of market volatility. Based on data from historical major equity market drawdowns over the past 25 years, buyouts and VC have experienced less severe drawdowns compared to public market equivalents (Figure 2). This lower volatility and valuation smoothing effect can be valuable for a plan that is sensitive to funded status volatility and whose sponsors wish to maintain or improve funding status.

As plan sponsors think about their plan’s lifecycle and investment goals, they should keep in mind that PE funds usually have “J-curves”—or periods of negative returns and cash flows as investments are made and developed before they are in a position to be sold. Investors can use seasoned secondaries and co-investments to help mitigate the J-curve impact on their portfolios.

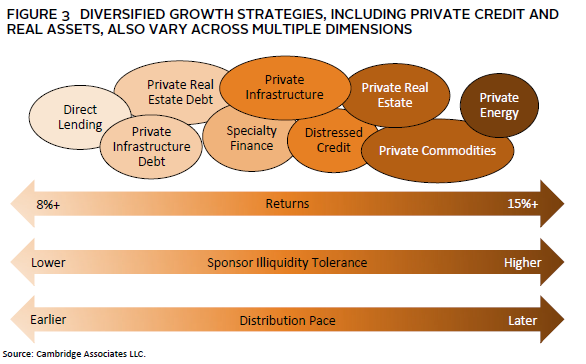

Private Credit. Private credit contributes to a total pension portfolio by providing higher returns than traditional fixed income and possibly hedge funds. Thus, we categorize it as diversified growth (Figure 3). It can also help diversify total plan risk because, unlike equity investments, many credit strategies are not dependent on capital appreciation for returns. Many private credit strategies carry floating interest rates, which can help to counterbalance the duration risk of traditional fixed rate credit that is present in many corporate defined benefit (DB) plans and act as an inflation hedge as nominal rates rise. With a shorter fund life of five to ten years typically, private credit strategies range widely across three core types: capital preservation, capital appreciation, and opportunistic/specialty finance.

- Capital preservation strategies include direct lending and specialty finance where the capital deployed is typically senior in the capital structure and collateralized by the assets of the borrower, providing for downside protection.

- Capital appreciation strategies typically involve an element of both debt and equity, to enable further upside appreciation. Examples include mezzanine and/or subordinated debt.

- Opportunistic private credit strategies can include a wide variety of investments. Exposures can be a combination of discounted traded bank debt, bespoke customized financings, non-sponsored lending, real estate loans, and non-performing loans, as well as aircraft leases, intellectual property, pharmaceuticals, and other types of specialty finance. Some of these strategies—such as royalties, 1 insurance, and asset-backed credit—can provide low correlation to traditional markets, while strategies like distressed credit 2 can provide more capital appreciation for the total portfolio.

Private Real Assets. Private real assets strategies can be similar to private credit in that they can provide both income as well as capital appreciation, depending on the strategy. As a result, we would also categorize private real assets under diversified growth (Figure 3). However, the underlying assets include tangible real assets, such as property (i.e., office buildings, logistics centers), infrastructure projects (i.e., airports, toll roads, power plants), and commodities (i.e., oil & gas fields, mining investments, timber, agriculture). Given the variation of the types of underlying assets, return and risks differ greatly. Similarly, the terms and structures of real assets funds vary by strategy. Plan sponsors should note that commodities, such as energy sources, can have more direct beta to inflation. However, they can also be more volatile, driven by the underlying commodity price movements. Thus, these allocations are differentiated in their potential to deliver portfolio growth and diversification benefits during high inflationary periods. These characteristics can be particularly meaningful for plans with a large active population.

Key Inputs: Formulating the Right PI Program

Plan sponsors looking to determine what PI strategies might be right for them should consider a range of factors, many of which are closely linked. These include:

Liquidity Needs. Given the illiquid nature of most PI strategies, developing a clear understanding of a plan’s liquidity needs and determining where the plan is in its lifecycle are important first steps in deciding how private investments might be allocated within the portfolio. Most pensions—except those actively engaged in termination—may be able to tolerate some level of illiquidity, which can be expressed in the form of an allocation to private investments.

Funded Status. Both fully funded and underfunded pension plans can benefit from a PI allocation. Underfunded plans in need of high-return opportunities to close their funding gap—and with the appropriate risk and illiquidity tolerance—can consider PE, especially if they have an open plan with a long-time horizon. On the other hand, plans that are approaching—or looking to maintain—fully funded status may be better served by private credit and real asset allocations, as these can provide interim cash flows needed to meet benefit payouts, as well as offer some incremental returns along with inflation hedging characteristics.

End-Game Planning. For frozen plans or increasingly more highly funded plans, the end game is an important consideration for many corporate sponsors. If a plan termination or larger risk transfer transaction is a more intermediate goal (i.e., five years out), certain private credit strategies can offer the advantage of shorter maturities, as well as the more income-oriented characteristics that may be appropriate in the final stages of a plan’s lifecycle.

Client Case Studies

Each of the following four case studies explores how a tailored PI allocation can meet distinct pension plan investment goals. These hypothetical examples are based on the real-world experience of Cambridge Associates (CA) clients who have used PI programs to help meet a range of plan objectives over time.

Case Study 1

A recently frozen corporate DB plan that is approximately 80% funded.

Challenges:

-

- Need for additional contributions;

- Increasing expenses; and

- Historical PI program was overdiversified with fund-of-funds and produced mediocre results. Future commitment to PI is in question.

Goals:

-

- Improve funded status; and

- Refit existing PI allocation to meet the plan’s current needs.

Background: Although no new benefits will be accrued within the plan, the liabilities will continue to increase as the plan matures. An enterprise study looking at the relationship of the pension to the broader corporation and an asset liability review established the plan’s limited ability to make additional contributions beyond required minimums. The corporation is also sensitive to increasing pension expenses and their impact on its financial statement. The decision of whether to complete a risk transfer or maintain the plan in-house (post–fully funded status) has not been made. The existing portfolio has a large PI program and the plan leaders stopped committing additional investments to it once the plan became frozen.

Solution: Due to the current plan’s underfunded status and limited ability to make meaningful additional contributions, the plan’s assets need to generate strong returns. In this situation, PI should remain a part of the portfolio, but new commitments should be tailored towards a more mature liability stream. Rather than commit to many new managers and diversify exposures across strategies, consolidating the manager line-up—especially in growth-oriented areas, such as buyouts and growth equity—is more appropriate. Further, some PI strategies with particularly long investment horizons and a more diversified and numerous manager approach—early-stage VC, for example—may need to be cut back. The excess commitment budget from a more consolidated PE allocation should instead be tilted toward the addition of income-oriented strategies, such as private credit, to improve the portfolio’s cash flow profile and meet more near-term liabilities. Certain private real asset strategies, such as real estate and private infrastructure, could also be attractive to further diversify returns from equity valuations and/or generate yield. PE secondaries strategies may also be able to provide more liquid, shorter duration return opportunities that simultaneously enhance overall portfolio diversification.

Case Study 2

An open public pension plan, currently underfunded but cash flow positive with regular contributions.

Challenge:

-

- Increasing funded status while providing benefits to new and existing participants.

Goal:

-

- Improve returns and funded status.

Background: The plan is open, with growing liabilities from new participants and existing participants accruing benefit payments. The plan does not expect to freeze or close to new participants. Currently, benefit payouts are more than met with regular contributions, with excess annual contributions amounting to approximately 2% of total assets.

Solution: This plan can consider capitalizing on the portfolio’s long investment horizon by investing in PI strategies in a consistent, systematic fashion to pursue return while enhancing portfolio diversification. The illiquidity budget should prioritize total return over other investment characteristics, such as income or inflation hedging. PI strategies with the highest return profile include VC, growth equity, and buyout (inclusive of special situations and distressed for control). To achieve top-tier returns within these strategies, a more focused manager line-up is necessary—one designed to gain exposure to sector specialists, smaller funds, and emerging managers (defined by CA as GPs raising Funds I–II). Risk management can be achieved through strong underwriting, portfolio construction, and multifaceted diversification (by strategy, geography, sector, or vintage year).

Case Study 3

A multi-employer plan with a cash flow negative profile aiming to improve funded status.

Challenges:

-

- Annual payout is greater than annual contributions; and

- Volatility risk.

Goals:

-

- Improve cash flow; and

- Improve funded status and PPA Zone Status.

Background: The plan needs to improve its funded status but with little appetite to increase contributions from members. The current payout is high at 10% of total assets on an annual basis, which is more than the total of annual contributions. The plan is also sensitive to significant asset price volatility, given its weaker funding status. Current status is in the Yellow Zone.

Solution: The plan has the opportunity to use most total return–oriented PI strategies, but can consider supplementing buyout, growth equity, and VC with income-producing strategies, such as direct lending, specialty finance, and private real assets. This combination of income and diversifying sources of return from private credit and real assets can help the plan reach its risk-adjusted return objective while meeting near-term benefit payout requirements. The plan’s sensitivity to asset volatility is another reason to lean into private investments. In this scenario, PI strategies have the potential to help maintain or improve funding status while helping to insulate the portfolio from episodes of market volatility.

Case Study 4

A frozen corporate DB plan that recently became 100% funded.

Challenges:

-

- Need to build in slight surplus to cover ongoing pension costs; and

- No termination decision has been made yet.

Goals:

-

- Maintain fully funded status; and

- Maintain flexibility with plan assets to reserve future pension risk transfer as an option.

Background: Having achieved fully funded status, the plan’s asset allocation is being implemented under a glide path, with a rotation of more assets to liability hedging strategies and de-risking away from public growth assets, such as equities and hedge funds. Currently, the sponsor is undecided on whether to terminate the plan or complete a risk transfer, but it wishes to maintain termination as a future option.

Solution: Given the plan’s current 100% funded status, it is appropriate for the portfolio to emphasize liability hedging strategies. In this scenario, it is not advisable to commit to new private strategies, especially those with a long fund term, deep J-curve, and longer payback period.

However, until the sponsor has decided whether a complete risk transfer transaction is right for them, the plan can still benefit from the return diversification benefits of certain income-oriented PI strategies, including direct lending and specialty finance. The private credit allocation can also complement any existing liquid liability hedging allocation, such as long duration credit and Treasuries. More niche, asset-backed credit strategies can further diversify the portfolio, which will now have more credit spread risk than equity risk. If a pension risk transfer is enacted, most high-quality private funds with visible projected distributions have the potential to be sold in the secondaries market.

Not All Private Investments Are Created Equal

Private investments may seem at first glance like a relatively uniform allocation type that capitalizes on an illiquidity premium over traditional markets. The risk of poor implementation can be daunting for plan sponsors, especially given the long lock-up nature of many PI strategies. However, the benefits to plans in the form of strong returns and lower volatility than public equities, as well as income, are hard to ignore. For pensions interested in investing in PI, the best approach is not a blanket “yes” or “no,” but one that is capable of changing over time as a plan’s needs evolve. Whether a plan has an established PI allocation or is considering implementing one for the first time, the optimal mix should be customized to help meet its challenges and goals. Pension plan sponsors should work with a skilled advisor to ensure their approach to PI allocations evolves appropriately over time, with the aim of adding absolute and relative value in accordance with the portfolio’s evolving objectives.

About the Cambridge Associates LLC Indexes

Cambridge Associates derives its US private equity benchmark from the financial information contained in its proprietary database of private equity funds. As of December 31, 2021, the database included 1,387 US buyouts and growth equity funds formed from 1986 to 2021, with a LP/GP value of $1,303 billion. Ten years ago, as of December 31, 2010, the index included 757 funds whose LP/GP value was $427 billion.

Cambridge Associates derives its US venture capital benchmark from the financial information contained in its proprietary database of venture capital funds. As of December 31, 2021, the database consisted of 2,203 US venture capital funds formed from 1981 to 2021, with a LP/GP value of $586 billion. Ten years ago, as of December 31, 2010, the index included 1,323 funds whose LP/GP value was $106 billion.

The pooled returns represent the net end-to-end rates of return calculated on the aggregate of all cash flows and market values as reported to Cambridge Associates by the funds’ general partners in their quarterly and annual audited financial reports. These returns are net of management fees, expenses, and performance fees that take the form of a carried interest.

About the Public Indexes

The Nasdaq Composite Index is a broad-based index that measures all securities (over 3,000) listed on the Nasdaq Stock Market. The Nasdaq Composite is calculated under a market capitalization–weighted methodology.

The Standard & Poor’s 500 Composite Stock Price Index is a capitalization-weighted index of 500 stocks intended to be a representative sample of leading companies in leading industries within the US economy. Stocks in the index are chosen for market size, liquidity, and industry group representation.

Footnotes

- Royalty financing allows a lender the opportunity to provide a single, up-front fixed cash loan to a company in return for a percentage of its future revenues or profits.

- Distressed credit refers to loans and/or bonds purchased from companies that are undergoing financial stress and/or are either in bankruptcy or on the verge of bankruptcy.

Ming Yan - Ming Yan is a Managing Director at Cambridge Associates, a global investment firm.

Kelly Jensen - Kelly Jensen is a Managing Director for the Pension Practice at Cambridge Associates. Kelly builds customized private investment portfolios including private equity, venture capital, private credit, real estate, infrastructure, and natural resources for her clients. In addition to her work with clients, she leads due diligence efforts across private asset classes. Kelly began her career […]