For many investors, 2024 started where last year left off. Hopes of an economic soft landing are growing, inflation is slowly receding, and last year’s winners (e.g., mega-cap growth stocks) continue to rip higher. Credit markets have seen more muted gains after a gangbuster fourth quarter 2023, but strong demand and rising confidence mean issuance is soaring.

When we wrote last summer about fertile conditions for credit opportunities funds, we didn’t anticipate how fast risk appetite would rebound as inflation receded. This has allowed borrowers to refinance maturing debt and some to obtain lower spreads on new loans or bonds, but signs of stress still exist. Fundamentals for highly leveraged credits have weakened and credit downgrades continue apace. Whichever way the economy turns during the remainder of 2024, investors in private credit have a growing opportunity set as tailwinds for many strategies remain and, in some cases, are strengthening. Competition from banks and other markets is declining, regulators are blessing new deal structures, and strong historical returns are attracting more capital.

This paper provides an update on recent developments in private credit and highlights several opportunities that investors should explore for the remainder of 2024. We continue to favor direct lending and credit opportunities funds. For investors willing to take more focused bets, we highlight additional strategies that benefit from the ongoing bank disintermediation, such as fund financing—also known as net asset value (NAV) lending—as well as credit risk transfer and real estate loans.

Growth of Private Credit Markets

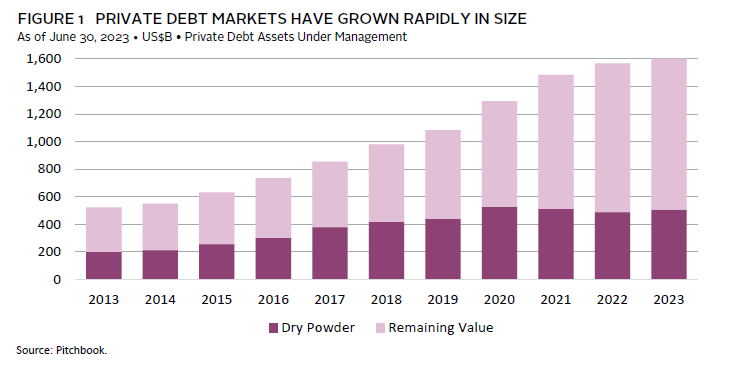

Private credit markets continue to increase in size and importance. PitchBook estimates they currently stand at around $1.6 trillion (including around $500 billion of dry powder). The US market accounts for the lion’s share (around $1.1 trillion), with Europe accounting for most of the remainder (Figure 1). Just more than half of this sum is invested in direct lending, with distressed and credit opportunities each accounting for around 20%. While fundraising slowed in 2023, this cooling off was welcome as general partners (GPs) and limited partners (LPs) digested record commitments from earlier vintages.

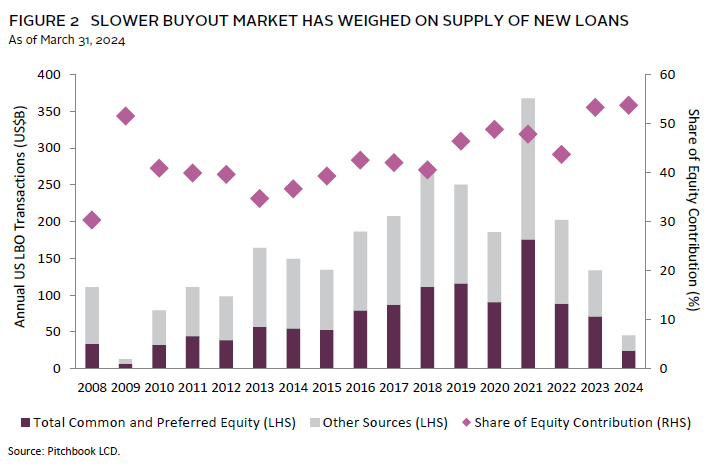

Despite 2023’s slower fundraising pace, transaction levels in some categories held up reasonably well. Direct lending volumes held steady at around $150 billion in 2023, 1 with refinancing activity accounting for about half of this volume, given diminished buyout activity reduced demand for new loans. This tended to favor incumbent lenders to companies instead of new entrants, while the average transaction size grew as choppy syndicated loan market conditions created an opportunity for funds to write larger checks (Figure 2). 2

Private Credit Returns

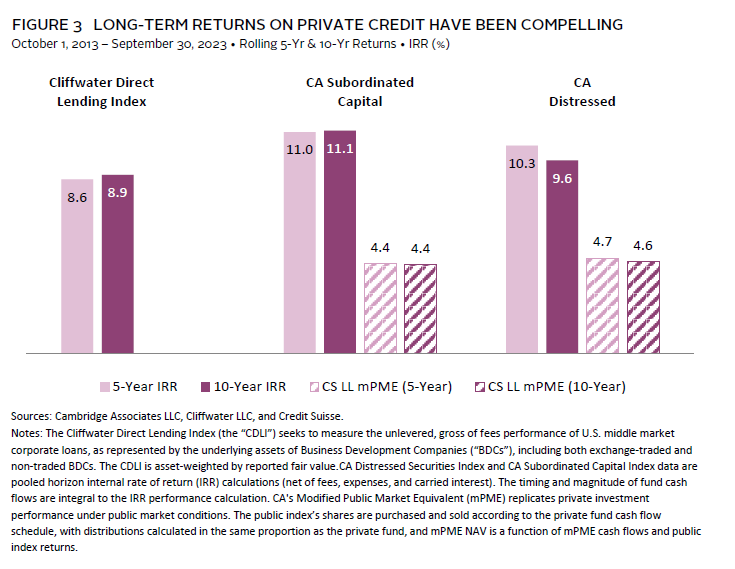

Recent and longer-term private credit returns have been healthy despite the headwind from near-zero interest rates that existed until central banks started hiking rates in early 2022. Through September 30, 2023, US direct lending funds returned more than 11% over the preceding 12 months, while mezzanine debt funds posted even higher returns (Figure 3). Looking back further, over the past decade senior lending has returned nearly 9% on an annualized basis, roughly twice the return on public loans, and has outperformed global equities. 3 Looking forward, the tailwind from higher base rates and reduced competition from banks should mean recent vintages generate even higher returns, though manager selection will become increasingly important if the economic backdrop deteriorates.

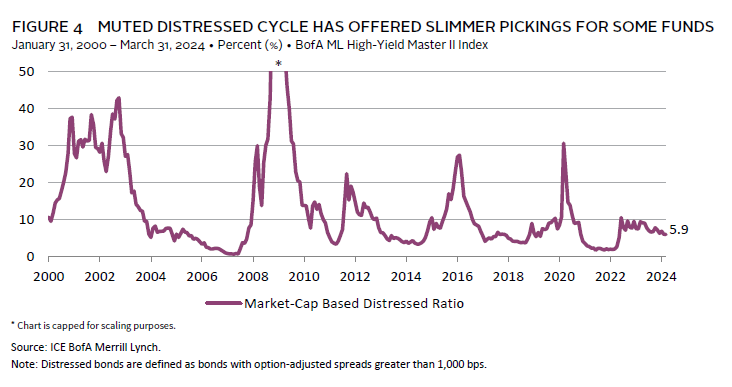

Using public indexes as proxies for other categories suggests some trading-oriented distressed investors have also enjoyed healthy returns. CCC-rated US high-yield bonds returned nearly 20% in fiscal year 2023, nearly 700 basis points (bps) more than the broad high-yield index. The flipside is that, currently, markets offer slimmer pickings, with just 5.9% of high-yield bonds traded at distressed spreads (>1,000 bps), well below historical average (Figure 4). Outside the United States, the distressed debt opportunity based on prices is much larger, but investing in assets like loans from distressed Chinese property developers requires specialized skills and is not a beta play.

Opportunities for Investors

Higher capital requirements, asset quality concerns, and competition for deposits are significantly impacting bank business models and reducing their ability to conduct certain types of business. Some of these forces have been in place for a decade or more and stem from increased regulatory scrutiny following the Global Financial Crisis. Other factors, such as concern around US commercial real estate loans and funding pressures following the March 2023 US banking crisis, are more recent. The upshot for private credit funds is that many banks are looking to reduce risk exposures, which lowers competition in areas like corporate and real estate lending and also creates new opportunities such as risk transfer deals.

Direct Lending

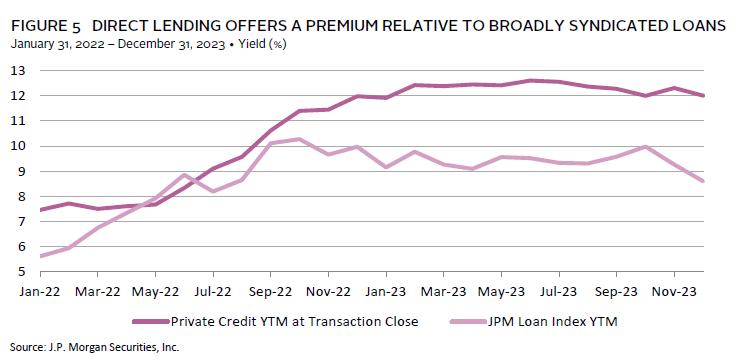

The direct lending opportunity has steadily grown over the past decade as large banks reined in their lending to riskier companies. The market is evolving, with more entrants, growing fund sizes, and larger check sizes as firms marshal resources from a variety of sources—separately managed accounts (SMAs), commingled funds, business development companies (BDCs). Despite the market dynamics mentioned above—specifically stagnant direct lending volumes in 2023—and rising competition, pricing has held fairly steady. Figure 5 illustrates the premium earned by lenders compared to broadly syndicated loans. This premium has persisted even though private loans have experienced lower default rates, 4 in part due to better lender protections (covenants), but also because equity sponsors have been willing to step in and support struggling companies.

Not all parts of the market are equally attractive. While larger funds (and related pools) mean private credit firms can write larger checks, they also mean that protections are being diluted as the top end of the market (larger loans) becomes more covenant light and resembles the broadly syndicated equivalent. This may serve to put a ceiling on spreads for these larger loans, as companies can shop debt needs in both public and private markets—though this is less true for loans to small- and medium-sized companies. Still, according to PitchBook, the average direct lending deal size in 2023 was around $170 million, 5 well below the traditional $500 million minimum thought required for the broadly syndicated loans market.

Business Development Companies

BDCs are legal vehicles created under the Small Business Investment Incentive Act of 1980 in an effort to stimulate lending to small companies. The remit of BDCs is like that of banks and direct lending funds, and most large BDC managers also offer direct lending vehicles. BDCs can be either public or private, with liquidity for perpetual versions of the latter typically available at set intervals and subject to certain limits. These vehicles are both an additional tool for credit firms to help finance large transactions, as well as a stable and lucrative source of fees (especially given their ability to use leverage up to 2x NAV).

While overlapping with direct lending funds in terms of remit, 6 public BDCs typically charge higher fees and their prices can materially diverge from the underlying NAV, making them less attractive to many LPs. Private BDCs, in contrast, typically offer periodic liquidity (typically via tender) and are more targeted at institutions and high-net-worth channels. For tactically minded investors, the propensity of some public BDCs to trade below NAV can offer an opportunity to generate above-coupon returns if and when discounts close. This was the case in 2023, with the S&P BDC Index returning 28%, bringing its five-year annualized return to more than 13%. Fees on private BDCs can make them less compelling than direct lending. That said, institutional investors may at times be offered attractive terms (i.e., lower fees, management fee sharing) to help launch new vehicles, with liquidity typically coming in the form of an eventual initial public offering (IPO).

Credit Opportunity Funds

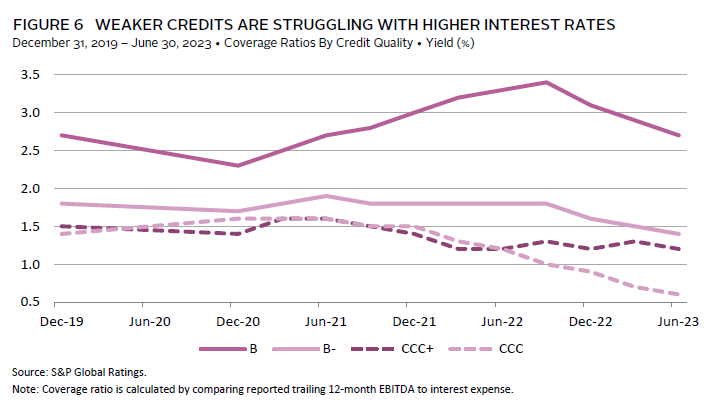

While distressed ratios remain subdued and economic growth has exceeded expectations, some companies have not been able to grow revenues as fast as costs. Part of this dynamic is the delayed impact of higher interest rates, which continues to boost interest expenses and weaken metrics like interest coverage ratios. As shown below, the median CCC-rated issuer doesn’t have enough cash flow to cover its interest expense, and B-rated issuers, which account for a record high percentage of the high-yield and loan markets, are also operating on shakier ground (Figure 6).

These dynamics create a fertile environment for credit opportunity funds, as some borrowers need immediate help finding more sustainable capital structures. Two potential solutions are adding subordinated debt, which includes a payment in kind (PIK) feature, or replacing existing debt with lower coupon substitutes, which offer the lender equity upside through features like warrants. Generally speaking, the investor base for lower-rated credits is smaller (as many funds don’t want to own potential distress candidates and collateralized loan obligations (CLOs) are discouraged from owning CCC loans) and spreads can gap higher as issuers are downgraded. The key for investors contemplating these funds is to consider the strength and resources of the overall platform, because to the extent that these companies need to be restructured, specialized legal and accounting expertise will be required to supplement the ability to buy and sell CUSIPs.

Fund Finance

Relative to direct lending, the business of lending to investment managers and fund investors is a more recent opportunity for private credit funds. Historically, private equity funds typically met liquidity needs via so-called subscription lines, which were backed by committed yet uncalled capital from LPs. These lines were offered by banks and often provided for relatively low costs, given the hope of providing more lucrative services to the funds. Banks have pulled back from this market due to rising capital requirements and the fact that the failure of Silicon Valley Bank removed one of the largest providers. Meanwhile, demand for funding and liquidity is growing. Many private equity firms are looking for capital as they seek to finance GP commitments to new strategies and ever larger fund sizes. At the same time, quiet mergers & acquisitions markets and reduced IPO issuance are increasing hold times and slowing the ability to return or recycle capital. LPs are suffering from similar dynamics, as a slower pace of distributions can impede the ability to make new investments or meet spending needs.

Private credit firms, both on a dedicated basis and as a sub-strategy in multi-strategy funds, have stepped in to fill this gap. These loans can have various terms and security packages and be made to both GPs and LPs. Variables include the type of collateral (typically they are against the NAV of the underlying investments in the fund), the types of funds (buyout, venture), and whether they are also backed by other fee income. Generally speaking, loans against fund NAV tend to have low loan-to-values (LTVs) and seniority in terms of other distributions to both LPs and the GP. This market, which is currently estimated to be around $100 billion in value, is expected to grow rapidly, given the overall size of the private equity market. LPs can potentially earn attractive returns in this space, but should work closely with a skilled manager, given potential fluctuations in collateral value (and thus security for lender), as well as possible mismatches between the term of the loan and when the underlying collateral can be sold.

Real Estate Lending

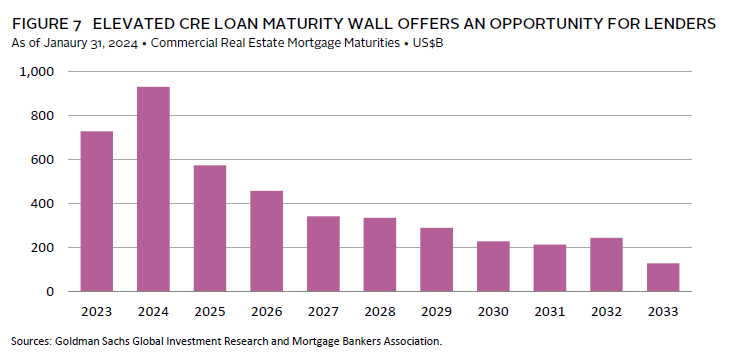

Outstanding US commercial real estate loans total almost $5 trillion, and banks have provided around 40% of this total (Figure 7). Around 40% of these loans will mature over the next three years and some will face refinancing risk, given asset values have declined and higher interest rates weaken debt coverage ratios. Meanwhile, at least some banks are looking to reduce exposure to these markets, given higher capital requirements and/or investor pressures. Funding from other sources such as CMBS, CRE CLOs, and mortgage REITs also has become constricted. These vehicles are experiencing higher-than-expected losses, and some have seen payment streams from lower-rated tranches imperiled, raising questions about future investor demand.

The vacuum that is being created generates sizable opportunities for private credit funds willing to make new loans, as does the dislocation in the meantime as falling asset values and deteriorating fundamentals force some holders to sell existing loans or securities. A variety of private debt funds already play in these markets, while the pipeline of fund launches is building. Approaches can vary, with some funds targeting new loans to specific property types (e.g., hotel or apartment specialists), while others are taking a blended approach by combining new loans with purchases of existing loans and structured finance instruments (CLO and CMBS). Return potential varies in line with risk; for example, funds looking to provide loans to stabilized assets at low LTVs are seeking mid/high single-digit unlevered returns, while others willing to provide mezzanine or preferred equity may be aiming for low double-digit returns. Given declining property valuations and the prospects that some assets will need to be recapitalized with equity, real estate equity funds should also find ample opportunities, though the cash flow profiles of these funds for investors will be quite different from those of the debt funds described above.

Significant Risk Transfer

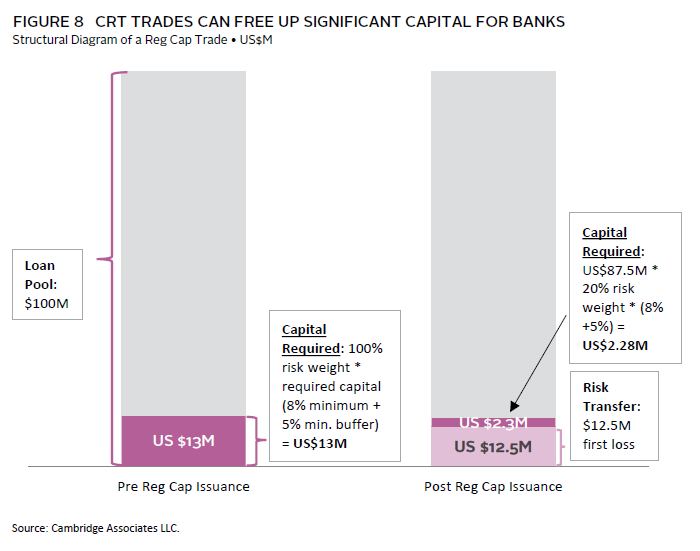

Significant risk transfer (SRT), also known as credit risk transfer (CRT) transactions, involve banks buying protection (thus transferring default risk) on a pool of loans from a counterparty in exchange for periodic payments. Structures can vary, though credit-linked notes (which reference the pool) either issued directly from a bank’s balance sheet or from a separate special purpose vehicle (SPV) are commonly used. Banks engage in these deals to reduce required capital amounts, while at the same time keeping loans and thus maintaining relationships with underlying borrowers (reference risk can be large corporates, small- and medium-sized enterprises, CRE, etc.). Outstanding volumes grew around $25 billion in 2023 to $200 billion globally and are expected to continue growing briskly. 7 Banks face capital shortages or are not inclined to issue more capital at dilutive levels, while at the same time changing capital requirement regimes (e.g., Basel 4 or Basel 3 Endgame) are increasing in many instances the amount of capital they need to hold against assets.

Figure 8 illustrates some simple math on a deal, with the bank in this example transferring risk (buying protection) on a $100 million pool to a SPV. The SPV in turn purchases protection (issues a credit-linked note) from a credit fund on the first potential 12.5% of losses in the pool. The bank (purchaser of protection) pays an annual premium to the SPV, which in turn pays a coupon on the note. The capital required to be held by the bank falls as its risk-weighted assets shrink under two dynamics. The notional amount of assets falls by 12.5% to $87.5 million. But more importantly, the “risk weight” that drives how much capital the bank must hold against these assets also falls given the lower risk profile. In this example, the bank’s risk-weighted assets fall from $100 million (100% risk weight * $100 million) to $17.5 million (20% * $87.5 million), reducing the amount of capital the bank needs to hold by 82%.

CRT transactions are not new. European banks have been significant issuers for years and issuance from countries like Canada has recently ticked up. Long anticipated clarification from the Federal Reserve last September on the risk transfer process for US banks sparked a wave of deals in fourth quarter 2023, led by J.P. Morgan. This is expected to continue into 2024 and beyond. Given that the technology used to structure these deals is not new and some loan pools are somewhat commoditized, returns from certain transactions may be lower than others. However, as issuance rises and skilled credit firms can exercise their advantage sourcing and underwriting more complex pools, credit funds and their LPs will have an opportunity to potentially earn healthy returns.

Conclusion

Many tailwinds for private credit remain in place and in some cases are even getting stronger; banks continue to step back from markets like corporate and real estate lending, and private funds are able to execute ever larger and more complex solutions. The flipside is that headwinds are also growing, be they diminished lender protections for upper-middle-market direct lending or rising stress in some parts of the market. We continue to think that opportunities abound for private credit investors and a variety of markets offer compelling risk/reward. This said, choosing the right partner is essential, and whether a “rifle shot” allocation to a given strategy is appropriate depends greatly on the quality of the GP, as well as the illiquidity and risk tolerance of the LP.

Wade O’Brien, Managing Director, Capital Markets Research

Guillermo Garcia Montenegro and Ilona Vdovina also contributed to this publication.

BofA Merrill Lynch US High Yield Master II Index

The BofA Merrill Lynch US High Yield Master II Index is a bond index for high-yield corporate bonds. The Master II is a measure of the broad high-yield market, unlike the Merrill Lynch BB/B Index, which excludes lower-rated securities. The index tracks the performance of USD-denominated below investment-grade rated corporate debt publicly issued in the US domestic market.

Cliffwater Direct Lending Index

The Cliffwater Direct Lending Index (CDLI) seeks to measure the unlevered, gross of fee performance of US middle-market corporate loans, as represented by the asset-weighted performance of the underlying assets of Business Development Companies (BDCs), including both exchange-traded and unlisted BDCs, subject to certain eligibility requirements.MSCI All Country World Index (ACWI)

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 24 emerging markets (EM) countries. With 2,947 constituents, the index covers approximately 85% of the global investable equity opportunity set. DM countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. EM countries include: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.S&P BDC Index

The S&P BDC Index is designed to track leading business development companies that trade on major US exchanges.

Footnotes

- See Hugo Pereira, “2023 Direct Lending Review,” Loan Syndications and Trading Association (LSTA), January 31, 2024.

- See Fang Cai and Sharjil Haque, “Private Credit: Characteristics and Risks,” FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 23, 2024.

- The ten-year AACR for MSCI All Country World Index ($ gross) was 8.1% as of September 30, 2023.

- See Lisa Lee, “Private Credit’s Default Recovery Rates Are Worse Than Its Biggest Rival,” Bloomberg L.P., March 21, 2024.

- See Joyce Jiang, Vishwas Patkar, and Vishwanath Tirupattur, “Deciphering the Credit in Private Credit,” Morgan Stanley, February 9, 2024.

- BDCs are technically allowed to own up to 30% non-qualifying assets, such as equity, but typically own well below this limit.

- See Esteban Duarte and Cecile Gutscher, “BlackRock Manager Predicts 40% Jump in Bank Risk Transfer Deals,” Bloomberg L.P., March 6, 2024.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.