Interest in Private Investments Continues to Expand

Investors with mature private investment programs tend to have private exposure to major developed markets, such as the United States and Europe. While many of these investors have added Chinese exposure to their private programs over the last decade, interest has recently increased in less-trafficked Asian markets and more specialized European strategies. We expect this interest will continue to expand next year.

In Asia, China has overshadowed the rest of the continent in terms of private capital raised for some time. In fact, between 2015 and 2021, investors committed 1.2 times as much capital to China private equity and venture capital as they did to the rest of Asia combined. But with China’s geopolitical tensions seemingly always in the news and its recent regulatory announcements, many investors have given greater attention to other destinations.

One such destination is India. Home to many examples of PE- and of late, VC-backed companies listing publicly, India is expected to grow strongly over the coming years. Beyond India, developed Asia-Pacific countries—Australia, Japan, Korea—also offer appeal. Each has strong debt and equity capital markets, offers accelerating corporate divestiture activity, and presents less regulatory or geopolitical risk than China or India. Across all jurisdictions, founders or controlling families are selling businesses outright.

Beyond less-trafficked Asia, more specialized European strategies have also attracted greater attention. These include the emergence of technology- and healthcare-focused strategies and an expanded number of lower mid-market buyout managers. Traditional European growth equity and venture capital have also attracted greater attention, given compelling recent performances.

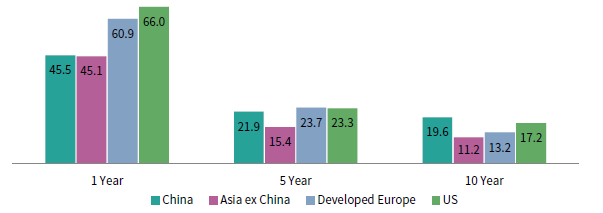

PERFORMANCES ACROSS JURISDICATIONS HAVE ATTRACTED ATTENTION

As of June 30, 2021 • Horizon Private Equity and Venture Capital Returns

Source: Cambridge Associates LLC.

Will this interest in Asia ex China markets and more specialized European strategies come at the expense of other markets? Not necessarily, because investors rightly focus on selecting the best managers globally. But in each of these sometimes overlooked market segments, there are strong managers capable of delivering returns on par with or better than global peers. We expect this reality will continue to drive interest in these markets.

Vish Ramaswami - Vish Ramaswami is a Partner and the Head of Asia-Pacific Private Investments at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.