Endowment Governance Part 1 – The Job Description

The job is not forever, but the capital is.

Committee members oversee capital intended to support an institution in perpetuity. Together with the finance committee and staff, they must balance immediate needs and long-term sustainability.

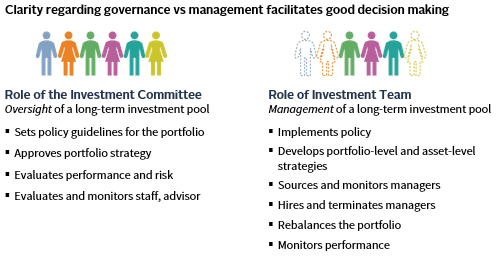

The investment committee’s role is to govern. In the words of the late businessman and arts philanthropist Kenneth Dayton, “governance is governance … governance is not management.” 1 The role of every board, committee, and sub-committee is to focus on governance, not on management. Tasks falling within the purview of endowment governance include setting investment policy and evaluating results. This work is successful when it focuses on the long term and overrides short-term behavioral impulses. Investment management is the work of implementing policy, rebalancing the portfolio, and monitoring managers and portfolio activity.

Clear boundaries between governance and management can prevent duplicate efforts, micromanagement, and missed assignments. For example, a committee that is deep in the weeds of manager selection may not spend sufficient time on policy and evaluation.

For the investment committee, the primary responsibility is to govern, and this responsibility cannot be delegated. But day-to-day portfolio management can and often should be delegated. One of the most important governance responsibilities is hiring excellent management to implement the investment policy and construct the portfolio. Management resources may range from an advisor who supports committee decisions, to a fully staffed in-house investment office, or an outsourced investment office (OCIO). While some committees still take on management tasks of an endowment, a committee-led model is unusual, given the complexity and time-sensitive demands of managing a multi-million-dollar, diversified portfolio and the mismatch between the time horizon of the portfolio and the tenure of committee members. Even when a committee maintains discretion over investment manager decisions, discussions of the managers themselves and manager presentations should occupy little of the investment committee’s time—on the assumption that “management” (advisor, investment office, or OCIO) will do the research and due diligence necessary to ensure the appropriateness of manager-related decisions.

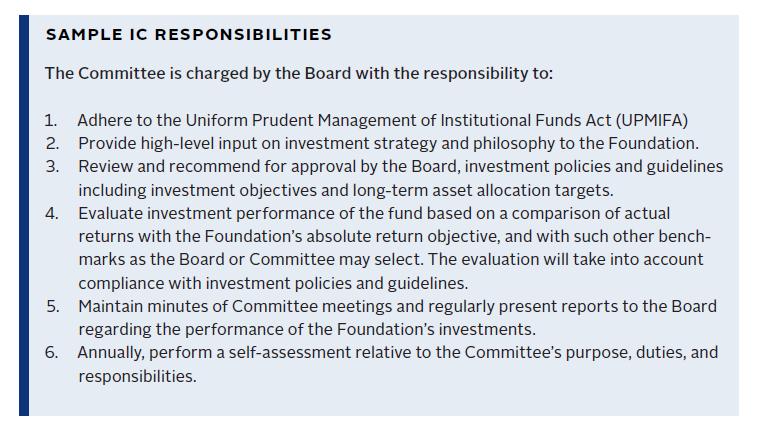

Clear definitions of roles and responsibilities help investment committee members, staff, and advisors understand and do their jobs effectively and establish an environment of accountability. These expectations may be documented in a committee charter, the investment policy statement, or another Board document.

FIGURE 1 DISTINGUISHING GOVERNANCE FROM MANAGEMENT

Source: Cambridge Associates LLC.

Fiduciary Responsibilities

Members of the investment committee have fiduciary responsibilities, as defined by state and sometimes federal law. A well-designed governance/management structure, as described above, will readily accommodate the fulfillment of fiduciary responsibilities. A suboptimal arrangement will make meeting these responsibilities more difficult.

The standard responsibilities of fiduciaries of tax-exempt institutions (this most often applies to investment committee members who have taken on the responsibility of investment oversight, even if they are not full board members) are the duty of care, the duty of loyalty, and the duty of mission (or “obedience”).

- Duty of care requires the most time and focus on the part of a Board member. The member must not only be present (preferably in person) at virtually all committee meetings, but must also exercise sufficient “care” to identify the relevant issues, to become knowledgeable about the issues, and to have weighed the choices systematically and with sufficient due diligence before making decisions. To exercise their duty of care, investment committee members must be supported by sufficient investment resources—whether internal or external—to make informed decisions.

- The duty of loyalty requires that fiduciaries carry out their duties solely in the interest of the institution and avoid self-dealing. This duty is typically met by means of a conflict of interest (COI) policy that spells out a process for dealing with any conflicting loyalties. The policy must be adhered to and periodically reviewed, because over time additional kinds of conflicts of interest may arise. Best practice requires that there be a COI policy that applies to both directors and staff involved in investments. A robust COI policy identifies the actions or interests requiring disclosure, judgement, recusal, voting, and careful documentation. Conflicts of interest are all but unavoidable in the investment world; this makes it all the more important that they be managed appropriately and guided by policy.

- Duty of mission, also known as duty of obedience, means that fiduciaries must make sure that the nonprofit institution is abiding by all applicable laws and regulations and doesn’t engage in illegal activities. The duty of mission also means making decisions that are consistent with the mission of the institution as a whole, and in accordance with the purpose that was stated in the organization’s qualification as a nonprofit. In practice, breach of this duty is less frequent than missteps in connection with the other two duties. Nevertheless, for investment committees, it is important to be mindful of laws and mission when stewarding institutional assets.

Emphasis on the Loooongggg Run

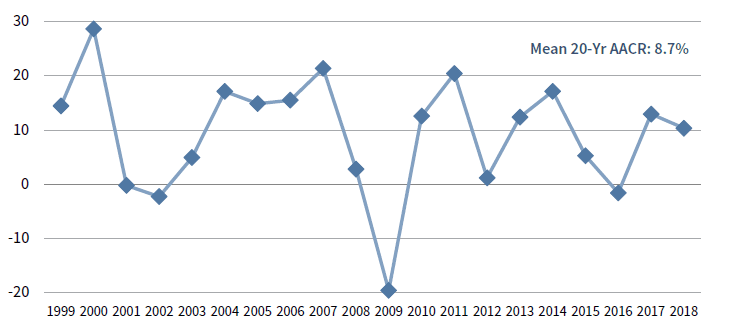

An investment program is successful when it secures and grows resources that can support the mission year in and year out, but long-term investing does not follow a neat, straight line. During a given tenure, the endowment may experience tremendous growth, great volatility, shifting market dynamics, challenging financial results, or all of the above. Each committee member should have a knowledge of market history and behavior to put current environment and policy decisions into context. This knowledge may come from professional experience and/or education and context that is furnished by committee orientation, an advisor, or staff.

There is randomness to what a tenure on an investment committee might be like, and there is no telling what the future will bring. Consider the experience of top-performing endowments over the past 20 years (Figure 2). It was a bumpy ride, but ultimately these endowments experienced an 8.7% average annualized return.

FIGURE 2 MEAN FISCAL YEAR RETURNS OF LONG-TERM TOP PERFORMERS

1999–2018 • Percent (%) • n=67

Source: Cambridge Associates LLC.

Notes: Long-term top performers group defined as the 67 institutions that fell within the top quartile of 20-year AACRs as of June 30, 2018. Analysis includes institutions that provided data for each of the last ten years and performed in the top quartile in terms of ten-year AACR.

Long-term orientation. Markets and investments will evolve over time, but the long-term goals for permanent capital are steadfast. For investment committee members, effective policies, reports, and meeting materials reflect the perpetual nature of the institution and provide guideposts to implement and evaluate the program over the long term. Policy setting should have a long-term horizon, and while it should be reviewed periodically, it shouldn’t be undone or changed every six months based on current environment or committee fears. It is designed to govern the committee and prevent them from timing markets. The payoff from investment practices (such as diversification, rebalancing, value bias, and active management) may not coincide with committee tenure. Members should bear that in mind when evaluating performance lest they undo good work that will succeed over the long run because they are taking a short-term view.

Committees that set long-term goals and evaluate performance over years and decades, not quarters, have the right orientation to perpetuate the capital for multiple generations. When it works, investing is about long-term commitment. In many ways, it is about favoring stability over change—and really working to justify any changes that you do make.

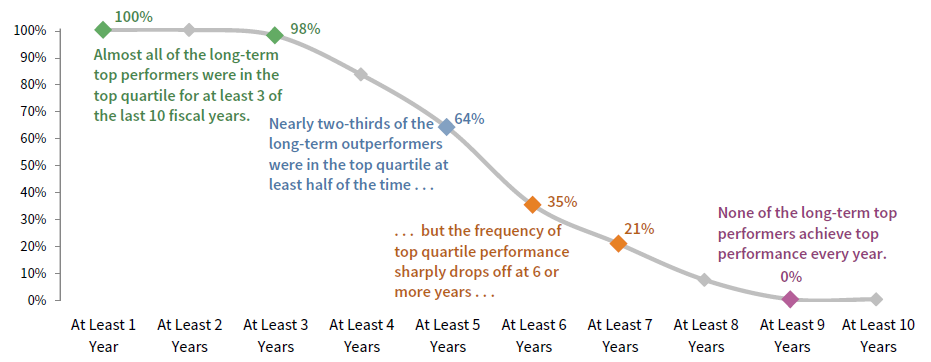

Short-termism is often the downfall of an investment committee and the portfolio they steward. Some committee members are surprised to learn that even top-performing institutions have high variability in their short-term performance. In fact, of the institutions that achieved the best long-term performance across the last decade, many were not top performers in any given year, according to our data (Figure 3).

FIGURE 3 FREQUENCY OF TOP-QUARTILE RETURNS AMONG LONG-TERM TOP PERFORMERS

Percentage of Institutions Achieving Top-Quartile Returns in the Last 10 Fiscal Years • n=97

Notes: Long-term top performers include 97 institutions that had a ten-year AACR in the top quartile of the All Endowments & Foundations peer group. This analysis shows the distribution of long-term top performers within the broader peer group of 388 institutions.

There will inevitably be years when an institution’s return fares better or worse relative to peers. It is impossible to construct a portfolio that can achieve top peer performance every single year. Falling short over the short term should not cause panic among committee members. Further, an institution’s ranking within a peer group, whether over short-term or long-term periods, should not be the primary measure for defining investment success. The policy portfolio benchmark and any asset class-specific benchmarks should be the primary tools for evaluating an institution’s investment performance. But first and foremost, the committee should ensure its governance of the endowment supports long-term investment success. Governance is the hidden risk and the secret sauce to optimal endowment management. ■

Tracy Abedon Filosa, Head of CA Institute

READ THE ENDOWMENT GOVERNANCE SERIES

The “secret sauce” to long-term investment success is, in most cases, the governance that guides and oversees the investment program. Read part 2 of the series to learn more about building the team and part 3 for tips on process and engagement.