Disruption, Liquidity Sources, and the Role of the Endowment

The COVID-19 pandemic has upended economic and social activity across the world in 2020. Nonprofit institutions have not been spared, with many experiencing disruptions to their normal operations and the revenues that come along with those activities. In June 2020, when many endowed institutions were completing fiscal year 2020 and on the brink of a new fiscal year, Cambridge Associates issued a survey that focused on endowment spending and other sources of liquidity for these institutions.

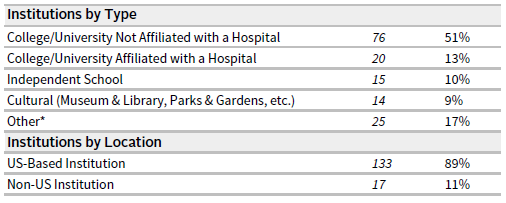

Responses to the survey were submitted by 150 institutions that included colleges, universities, independent schools, museums, and cultural and environmental organizations. Nearly two-thirds of respondents (64%) were colleges or universities. The vast majority (89%) of respondents are domiciled in the United States (Figure 1).

FIGURE 1 MOST SURVEY RESPONDENTS ARE US-DOMICILED C&Us

n = 150 • Percent (%)

* Other includes environmental, religious, and member organizations, as well as other miscellaneous charities.

Source: Cambridge Associates LLC.

Note: n denotes number of respondents.

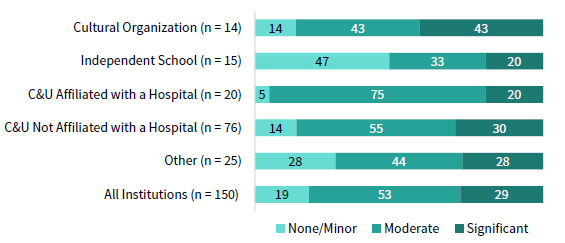

Revenue Disruption

The overwhelming majority of the nonprofits in the study anticipated moderate to significant revenue disruption for fiscal year 2021. At the time of the survey, more than 50% expected moderate revenue disruption and nearly a third rated the revenue displacement as significant. Fewer than 20% expected this to be minor. These disruptions are the result of limited enrollment and attendance and loss of auxiliary revenues from facility rentals, bookstores, museum shops, dining, and residential life. Annual fundraising levels may also be challenged, given the economic strain on many supporters and canceled reunions and other events.

Colleges and universities, especially those with hospitals, expected the greatest level of disruption. Because of the limitations on performances, visitors, and events, 86% of the cultural organizations responded that they expect revenue disruptions, and this group anticipated the highest level of significant volatility. Interestingly, independent schools are expecting the lowest level of disruption to revenues, with nearly 50% responding that it would be minor (Figure 2).

FIGURE 2 EXPECTATIONS OF REVENUE DISRUPTION VARIED BY INSTITUTION TYPE

Fiscal Year 2021 • n = 150 • Percent (%)

Source: Cambridge Associates LLC.

Note: n denotes number of respondents.

Balancing the Financial Equation

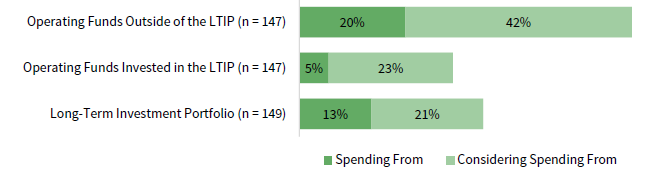

Institutions are turning to a variety of funding sources as they consider how to bridge the gap between revenues and often growing expenses in response to the crisis. The composition of the financial resources that are available determines their spending strategy.

Reserves are usually set aside to help respond to emergency needs. By design, they are the most flexible source of funding. Of the 81% of institutions that have reserves or flexible operating funds outside of the long-term investment portfolio (LTIP), 20% expect to spend those funds to respond to the pandemic and another 42% were considering drawing on the most flexible reserves (Figure 3).

FIGURE 3 INSTITUTIONS USING A VARIETY OF FUNDING SOURCES TO BRIDGE

REVENUE/EXPENSES GAP

Fiscal Year 2021 • Percent (%)

Source: Cambridge Associates LLC.

Note: n denotes number of respondents.

More than half of the respondents (56%) have some reserves invested alongside the endowment in the LTIP. As of June 2020, 5% of those institutions planned to spend those funds at a rate that exceeds endowment spending policy and 23% were still considering drawing on those funds.

Many institutions are also planning or considering higher endowment spending rates in 2021, which will mean exceeding their endowment spending policy. Going into the fiscal year, 13% of endowments surveyed planned to spend more and 21% were still considering that option.

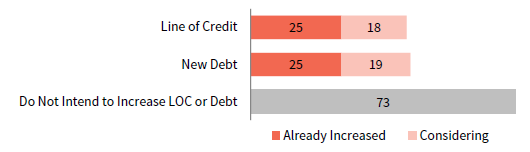

Institutions are also turning to the other side of the balance sheet and borrowing to meet their liquidity and funding needs. More than half of the respondents had a line of credit entering into calendar year 2020 before the virus turmoil was in play. More than a third that had a line of credit in place had drawn on it in June.

Although half of the respondents do not intend to borrow more to cope with volatility, many others consider this strategy a viable option. More than half of the participants have already increased their line of credit or long-term debt load or are considering turning to these credit instruments (Figure 4).

FIGURE 4 INSTITUTIONS CONSIDERING BORROWING TO COPE WITH VOLATILITY

Fiscal Year 2021 • n = 160

Source: Cambridge Associates LLC.

Note: n denotes number of respondents. Respondents could select multiple strategies.

The global pandemic has created great upheaval in the enterprises and financial circumstances of endowed institutions, requiring an unprecedented response. Reserves, borrowing, budget adjustments, and the endowment are all considerations as institutions craft a response to survive the pandemic and come through it in a position to thrive in the future.

Meredith Wyse also contributed to this publication.