Allocations to 21st-Century Infrastructure Increase

The infrastructure market has evolved since the financial crisis. Almost a majority of current investing is now in “21st-century infrastructure,” which includes digital and renewable assets. Given the expected importance of both sectors to future growth, we anticipate that investors will commit greater amounts of capital to each in 2022.

Data usage is forecast to grow by around five-fold by 2025 as the digital economy continues to expand. This includes growth in analytics, government and industrial usage, social media, and streaming, with 5G and the Internet of Things (“IoT”) further catalyzing this level of digitization. However, growth cannot be sustained without significant infrastructure investment, and most OECD countries lag Asian peers in fiber rollouts, for example. Hence, Europe and the United States are increasingly focusing their recovery agendas on this, which may benefit infrastructure investors. Valuations have risen materially as investor interest has grown, supported by post-COVID-19 trends. Thus, managers that are able to develop fiber or data centers, for instance, can often benefit from later-stage investors.

Renewables are expected to overtake other fuel sources as the dominant global energy in the coming years, increasing from around 10% of the total market today to around 50%–60% by 2050. This is driven by energy investment increasingly concentrated on solar and wind assets, particularly displacing coal. While government subsidies supported this initially, renewables today are increasingly the cheapest energy source, and the inclusion of carbon taxes would provide a further advantage. Renewable investors have hence benefited from increased demand, with developers particularly well rewarded by investors seeking attractive long-term contracted yields and the ESG benefits of holding such assets.

However, these opportunities are not without risks, which may include performance concerns, a more competitive environment, development problems, or increasing construction costs. In summary, infrastructure has demonstrated robustness since the onset of COVID-19, with any challenges mainly in more cyclical assets (e.g., transportation) versus newer-age infrastructure. Greater confidence in infrastructure’s defensiveness will likely support the asset class’s growing liquidity and the next phase of 21st-century infrastructure growth.

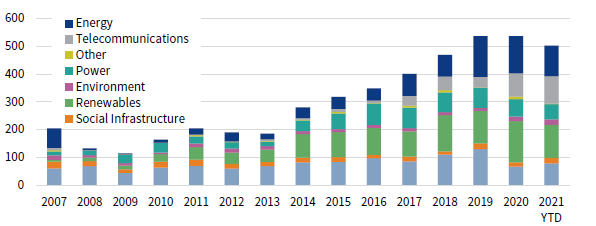

INFRASTRUCTURE TRANSACTIONS HAVE TENDED TO INCREASE THROUGH TIME

2007–21 (December 3, 2021) • Infrastructure Transaction Volume by Sector (US$ Billions)

Source: Inframation Group.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.