We expect direct lending and European opportunistic private credit funds will outperform their long-term averages because of high asset yields and the pull back in credit availability among traditional lenders. We like structured credits, particularly high-quality collateralized loan obligation debt, and we expect high-yield bonds will outperform leveraged loans. But we remain neutral on high yield because spreads are compressed.

US High-Yield Bonds Should Outperform Loans in 2024

Wade O’Brien, Managing Director, Capital Markets Research

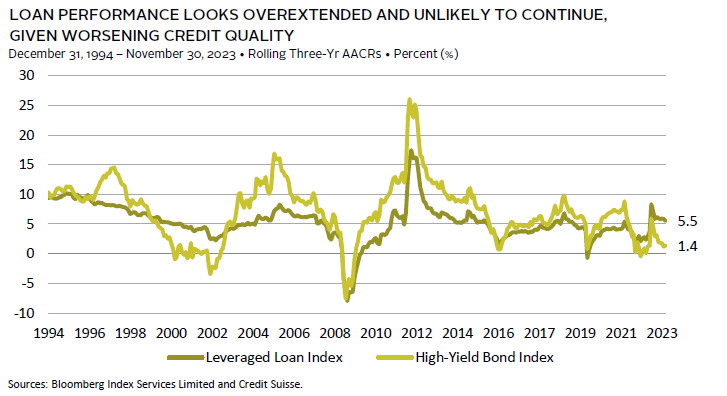

Leveraged loans are on track for their third consecutive year of outperformance compared to US high-yield (HY) bonds for the first time in more than 20 years. This is unlikely to continue in 2024 as leveraged loans face greater headwinds from slowing economic growth and rising debt servicing costs.

Rising short-term yields have boosted loan coupons and returns but hurt issuer fundamentals. Loan interest coverage ratios have dropped from 4.4x at the end of 2022 to 3.0x at the end of third quarter 2023 and are even lower once expenses, such as maintenance capex, are considered. Ratios look even shakier for the weakest borrowers that have driven recent performance. B- rated borrowers have a coverage ratio of less than 2x. US loan default rates (3.1% over the past 12 months) already outpace those of bonds and higher rating downgrade ratios suggest this will continue. Further, weak loan documentation and an increasing share of loan-only issuers mean these defaults will continue to prove more painful for investors.

In contrast, HY index coverage ratios have also declined but remain much higher (around 5.0x as of mid-year). Much smaller HY index weights for lower rated (B- and CCC) issuers are one explanation. Looking forward, the gap between HY and loan issuer fundamentals should widen as the impact of higher short-term rates continues to be reflected in loan issuer borrowing costs.

While we think HY bonds will outperform loans in 2024, we remain neutral overall, given current spreads are below their historical average and levels typically seen during recessions. HY defaults are likely to rise, especially if growth disappoints in 2024. Loan defaults also could prove manageable if weak covenants provide companies more cushion and/or private equity owners step in to provide support. Given these dynamics, our preferences in liquid credit remain for securitized assets like investment-grade collateralized loan obligation debt, where yields are in mid-to-high single digits and elevated spreads provide cushion if issuer fundamentals deteriorate in 2024.

Direct Lending Strategies Should Deliver Above-Average Returns in 2024

Frank Fama, Co-Head of Global Credit Investment Group

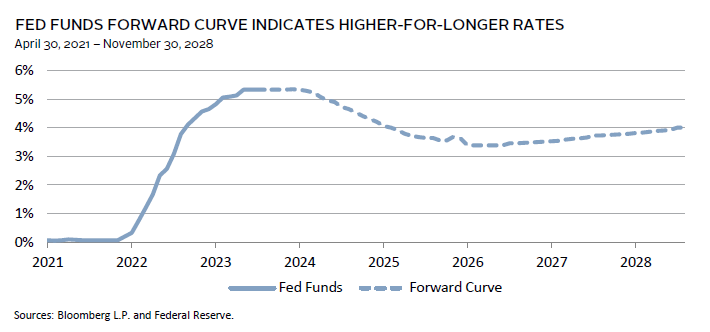

After a decade-plus era of cheap money, the higher-rate environment will continue to directly benefit the floating-rate direct lending asset class. Direct lending strategies tend to provide steady cash flows, generate consistent returns, and distribute capital at a faster rate than other private investment strategies, particularly in today’s environment. We expect that direct lending strategies will deliver returns above the long-term average of 6% to 7% for unlevered funds and 8% to 10% including fund level leverage, given attractive current yields and solid underwriting standards.

Direct lending funds provide first-lien senior-secured loans to middle-market companies. These loans are typically floating rate and had a yield of around 7% when rates were low. Currently, with three-month secured overnight financing rate roughly 550 bps and credit spreads around 600 bps, investors are enjoying low double-digit asset yields. Direct lending funds will distribute that income quarterly.

Loans structured in the current environment are more favorable to lenders than in the recent past. In a higher-rate environment, debt capacity of borrowers is lower, meaning leverage levels have come down and sponsors are contributing more equity to transactions. Financial covenants are being set tighter, helping to protect downside if the borrower underperforms. Additionally, loan funds will have a shorter duration than other private investment asset classes. Loans will typically have a maturity of five years and an average life of three to four years, so distributions to LPs will begin shortly after the end of the investment period.

Direct lending strategies have grown significantly over the last ten years amid a period of low interest rates and a strong economy, leading to low defaults. This has resulted in a period of little dispersion in returns. While today’s attractive all-in yields are an opportunity for lenders, they also increase borrowers’ interest expenses and potential risk. We expect that managers with experience across credit cycles and the discipline to maintain underwriting standards will differentiate themselves from the pack.

European Opportunistic Private Credit Funds Raised in 2024 Should Deliver Above-Average Returns

Vijay Padmanabhan, Managing Director, Credit Investments

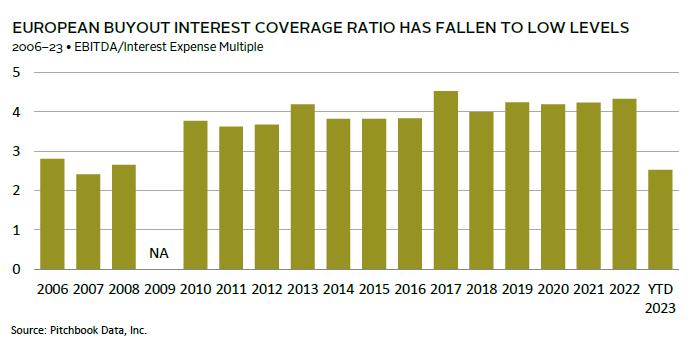

European credit opportunities funds have returned an underwhelming 7.0% since mid-2011 against a targeted return in the mid-teens. A decade of near-zero interest rates gave corporates easy access to low-cost capital and allowed them to build strong balance sheets. Except for short periods of market dislocations or isolated cases of stress, it was mostly a challenging time for funds that specialize in providing highly structured customized solutions to balance sheet problems. But we believe this is set to change in 2024, as we expect corporates to actively look for ways to reduce interest costs and improve liquidity.

With interest costs almost doubling and operating costs remaining high, we have started to see a decline in key coverage ratios. One key metric, EBITDA-to-interest expense ratio for European buyouts, has fallen from 4.3x in 2022 to 2.5x in 2023. This goes to show the declining level of cash generation by corporates due to the rise in costs. We are likely to see more dispersion in credit with companies in certain sectors and geographies facing more pressure than others.

Since 2022, the pace of public market debt issuance has slowed, and European banks have pulled back to focus on their regulatory capital requirements. We have seen the commercial real estate market come under immediate pressure post-COVID. Pockets of distress are emerging in sectors, such as financial services and healthcare, as pandemic- induced financial support has waned. Credit strategies that can provide capital solutions to larger corporates that otherwise would have accessed public market and/or that can pivot into distressed opportunistically will see a robust deployment environment in 2024. While individual manager performance will, of course, vary, we expect next year’s vintage of European opportunistic private credit managers will deliver above-average returns.

Fed Funds Forward Curve Indicates Higher-for-Longer Rates

Data are as of November 30, 2023.

European Buyout Interest Coverage Ratio Has Fallen to Low Levels

Includes only transactions for which Pro Forma financials were made available. Data for 2023 are through September 30.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.