The Growing Importance of Asia Equity Long/Short

Equity long/short investing is one of the most widely adopted strategies by hedge fund managers in Asia. Its importance has increased over time, and we believe that this strategy can play a key role within a global hedge fund portfolio. There have been several positive developments in recent years that build the case for investors to allocate to the strategy, including better market access, continued alpha opportunity, and a greater talent pool.

Improved Market Access for Shorting

The depth and breadth of the stock borrow pool has improved over the years in most major Asian markets. In particular, the ability to access China A-share borrow through Stock Connect and Qualified Foreign Institutional Investor (QFII) has broadened the lending pool. Managers have often cited that the capacity of their funds has been limited by the depth and breadth of the stock lending pool. However, assets under management of high-performing managers have been growing consistently year-on-year, on the back of positive performance and new inflows, while maintaining a healthy portfolio of alpha generating longs and shorts. More importantly, the short books have been accreditive to returns during market drawdowns. This presents an attractive opportunity set for managers with skilled shorting capabilities.

Better Alpha Potential

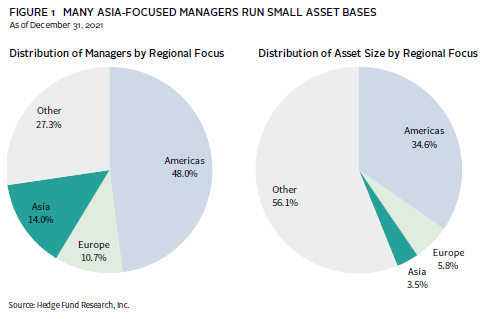

Competition amongst institutional quality hedge funds is less intense in Asia than elsewhere. HFRI fourth quarter 2021 data indicate that 14% of the global hedge fund universe is Asia-focused, but they represent only 3.5% by asset size (Figure 1). In other words, while there might be a slightly higher number of Asia-focused managers than Europe-focused managers, many of them are running small asset bases and not of institutional quality. Western-focused managers tend to invest in the same companies, and this competition for ideas and name overlap is less frequent in Asia, which provides managers with a larger pool of opportunities to generate returns.

Greater Inefficiencies and Broader Investible Universe

Moreover, the investible universe in the Asia-Pacific region, in terms of number of companies, is larger than the European and US exchanges combined. The broad opportunity set, coupled with lower sell-side coverage, augers well for fundamental-driven, competent long/short equity managers to seek out the winners and losers in Asian equity markets (Figure 2).

Geopolitical developments are also creating new investment opportunities. As China seeks to decouple itself from the United States and enhance its self-reliance, new investment themes are emerging, such as its focus on advanced manufacturing, technology (artificial intelligence, hardware, deep tech), climate and energy security–related, enterprise services, and cyber security. There is a growing universe of non-technology investible companies in the onshore markets. Shorting opportunities have become more attractive in areas where original business models of growth are no longer sustainable, e.g., in the technology sector.

The geopolitical tension between China and the United States has also set off a trend of companies moving production plants away from China into other emerging economies within Asia, e.g., India and Vietnam. Apart from that, there are about a dozen economies in Asia, each with idiosyncratic opportunities that are not reliant on external factors or related to China. This has broadened the opportunity set for managers.

Improving Quality of Managers

Over the past decade, the pedigree of Asia-based managers has improved significantly. Many of them have been trained in Western-based hedge funds and brought back their expertise to manage portfolios in the local markets. There are also spin-offs from some of these longer-tenured managers, which have helped to expand the number of investible options. The quality of the non-investment teams in Asia has improved in tandem, bringing their operational setup on par with their peers in the United States and Europe.

Manager Selection is Critical

Despite the attractiveness of the region, it is important for investors to have a robust framework to evaluate and find the best managers. We highlight examples to review in three core areas: organisation, investment process, and risk management.

1. Organisation

Historically, Asian managers have tended to place less emphasis on organisational structure and operations. Hence it is important to focus on:

- Operations. Hiring experienced operational staff in Asia continues to be a challenge. Moreover, many of the fund assets are smaller at launch, resulting in less ability to spend on operational talent and systems. Reviewing a fund’s internal controls and systems is thus essential.

- Transparency. Portfolio-level transparency tends to be lower for Asian managers than their peers in the United States and Europe. While that has improved over time, there remains a group of managers that will not disclose top positions or provide access to the investment team.

- Team. The portfolio manager needs to be thoughtful about staff retention and attraction as the competition for talent can be intense.

2. Investment Process

- Primary Research. Managers have to be able to provide evidence of primary sourcing and research depth, along with the ability to articulate their competitive edge versus their peers. In addition, the consistency and repeatability of the investment process has to be considered.

- Team. Managers that invest across the region will require a broader team with local language and knowledge capabilities.

3. Risk Management

- Liquidity. Market capitalisation of companies may not be a fair reflection of the actual outstanding free floats, when compared to similarly sized companies in the United States and Europe. Thus, investors must closely monitor fund liquidity.

- Portfolio. Managers should employ an appropriate level of leverage for their strategy and top positions should not be outsized.

Asia Long/Short Equities: Multiple Roles in Institutional Portfolios

Institutional investors have traditionally included Asia long/short equities in their global hedge fund portfolio for diversification. Asia would complement, in geography, other long/short managers in the portfolio that are more focused on the United States or Europe. Asia long/short would be expected to have higher volatility on average and, hence, higher returns than hedge funds that have similar net exposures but are focused on more developed and efficient markets. Asia equity hedge funds also bring diversification benefits to a portfolio that contains so-called ‘absolute return’ type hedge fund strategies that generally have lower exposure and correlation to broader markets.

Beyond diversification, investors can use Asia long/short for more specific roles in portfolios. With increasing opportunities and quality of sector-focused Asia long/short funds, such as in healthcare and technology, some investors have incorporated them as part of their public equities portfolio. In these situations, they would expect sector-focused long/short funds with higher net exposures to generate returns, when measured over a suitably long period, that are comparable or even better than broader equity markets. In other words, they see, as part of portfolio construction, the ‘opportunity cost’ of investing in Asia long/short as taking capital from an active, long-only equities manager.

At the other end of the spectrum, there are also institutional quality Asia long/short hedge funds that are designed to be more market neutral and to generate returns predominantly from alpha rather than market beta. Here, investors can use them to lower overall market exposure in their equities portfolio. Such funds could even be reasonably considered as part of the lower volatility ‘absolute return’ hedge fund book, to complement other strategies such as global macro and long/short credit.

Today’s opportunity set of Asia long/short equity is in fact broad enough for investors to construct a stand-alone, diversified long/short equity portfolio. It could have a mix of managers that invest across Asia, within specific countries, include both generalist and sector-specialists, and/or have varying net market exposures.

Conclusion

We are confident that having a dedicated allocation to Asia long/short equity will become increasingly additive to global hedge fund portfolios. The inefficiencies and growing opportunity set from an investment and manager pool perspective provide a differentiated alpha stream for investors. This, coupled with a careful and detailed manager selection process, can enhance portfolios and position investors for success.