A robust opportunity set for credit opportunity funds has emerged thanks to a constellation of factors. Rising interest rates, a retrenchment of bank lending appetite, and an expected economic downturn have combined to increase borrowing costs for stressed issuers and create a broad distressed opportunity. Investors that commit capital to funds this vintage year are likely to be richly rewarded in future years. Managers with the ability to identify good businesses in need of capital and to structure creative solutions will be able to generate attractive risk-adjusted returns. If a broad recession does eventually develop, managers will benefit from additional opportunities to participate in a traditional distressed cycle.

The Macro and Fundamental Backdrop

Economic growth is expected to decelerate as 2023 unfolds, given the lagged impact of Federal Reserve tightening, reduced fiscal stimulus, and consumers running down surpluses amassed during the pandemic. The inverted yield curve indicates the bond markets are expecting a recession, though year-to-date equity market gains suggest not all investors are so pessimistic. Some recent economic data have surpassed modest expectations and, at least for now, the consensus is calling for the US economy to expand around 1% this year.

Defining Credit Opportunity Funds

Credit opportunity funds are closed-end private credit funds whose remit falls between traditional direct lending and control-oriented distressed on either end of the risk spectrum. Credit opportunity funds invest in instruments such as secondary market bonds and loans, directly originated loans, and structured equity solutions. These funds generally target net returns in the low-to-mid teens, but in the current market environment they may outperform these targets.

Whether or not a recession occurs—and if so what type (i.e., length/depth)—corporate debt markets anticipate rising stress for several reasons. The monetary tightening that has occurred means short-term borrowing benchmarks have surpassed 5% and medium-term yields have also risen. Higher interest rates are causing debt service ratios to deteriorate as companies with floating-rate loans face a significant increase in interest expense. Highly leveraged borrowers that are ill equipped to endure any economic slowdown–related weakness in revenues or margins are the most vulnerable, as are those that lack potential avenues of support if conditions worsen (e.g., capital injections from private equity sponsors that have large amounts of equity at risk).

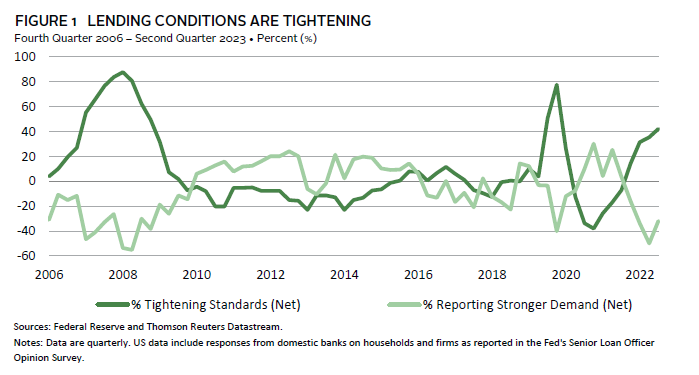

Putting aside the depth of any economic slowdown, weaker borrowers are also the most likely to suffer from the ongoing pullback in bank lending (Figure 1). Even before the recent US bank failures, surveys of loan officers were suggesting banks were battening down the hatches given rising recession calls, and higher bank funding costs (as well as calls for higher capital requirements) are likely to push up the cost of bank financing.

Debt service burdens continue to grow, regardless of whether a recession unfolds or not. Pitchbook Data reports that leveraged loan issuer interest coverage (EBITDA – Maintenance Capex/Interest) declined from 3.1x at the end of 2021 to 2.8x at the end of 2022. However, broad index statistics may overstate the health of many leveraged borrowers. Ratios like interest coverage are calculated using trailing 12-month data, meaning interest expense figures do not fully reflect the roughly 500-basis point (bp) rise in short-term lending rates since the start of 2022. To compare, the same level of EBITDA with a full 12 months of elevated interest expense would reduce the ratio to 1.3x. Direct lending managers and sponsors are identifying companies that are already struggling with declining EBITDA and increased interest expense, and many more that anticipate issues in the coming quarters.

Putting aside index-level statistics, these underlying trends explain why ratings downgrades continue to exceed upgrades by meaningful levels in recent months. During first quarter 2023, S&P ratings downgrades outpaced upgrades by a 1.7 to 1 margin, the worst in two years. The big picture is that, given higher rates and shrinking margins, some companies that financed in a zero-rate environment are having difficulties servicing debt, though some have options to shore up cash positions (cutting investments, selling assets, etc.). The public market dislocation could exacerbate the problems, as market participants are unwilling to refinance maturing debt and are not positioned to provide a capital structure solution to a company that cannot meet its debt obligations in a higher rate environment.

Rising Credit Market Stress

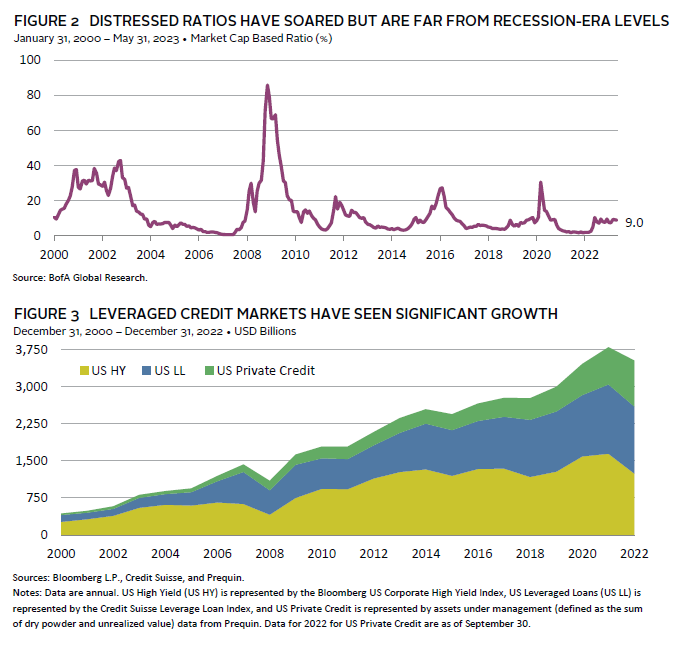

This macro and market environment have created opportunities for managers with flexible and creative capital in both the secondary and primary markets. In the secondary market, high-yield and leveraged loan distressed ratios 1 have increased meaningfully (Figure 2). For example, around 9% of high-yield bonds trade at distressed prices, more than 4x their level from early 2022. Given explosive growth in the leveraged finance markets over the last decade (to a combined market cap of around $2.5 trillion in the United States), this already represents a large opportunity set of almost $250 billion face value and could increase further if a recession ensues (Figure 3). Not all these securities will generate attractive returns, but significant relative value opportunities exist, and pricing can mask meaningful dispersion across underlying fundamentals. This is exacerbated by the lack of financial covenants and restrictions in BSL documents in recent years, allowing some borrowers to move assets and place them out of reach of existing creditors. Credit opportunity managers are positioned to find the best businesses in need of a financial solution and to take advantage of the weaknesses in public market legal documents.

Credit opportunity managers are also seeing an increased opportunity to structure and invest in new loans, as banks continue to pull back from lending markets and public markets remain open only for the very best borrowers. This opportunity set is distinct from the direct lending opportunity we have previously described, as credit opportunity funds typically target solid businesses that are struggling with either the wrong capital structure or a downturn in earnings. Structured solutions can be any place in the capital structure but will often be the first dollar of debt. They will have a meaningfully higher cost of capital to compensate for the complexity, sometimes including payment in kind and often sharing in the upside through warrants or other features.

Several dynamics support this opportunity, including the ratings downgrades mentioned earlier. The number of potential lenders for a struggling CCC-rated borrower is dramatically smaller than that for a well-functioning business. Another is the recent decline in company valuations. Consider the example of a company purchased at an enterprise value of 15x EBITDA, of which around 7x was debt. This loan-to-value ratio was under 50% during the earlier period of heady valuations but has risen due to falling valuations. Refinancing the debt, given the combination of higher leverage and higher interest rates, may not be feasible and trying to raise non-dilutive equity may not be any more doable (or palatable) to the owners of the business.

Even sectors often thought of as defensive and thus able to withstand higher debt levels are under pressure due to rising rates, slower growth, and increased expenses. One example is software companies, which incurred high debt levels based off elevated valuations. In the current economic climate, some of these companies have been able to maintain their revenue, but growth has been elusive. Limited earnings growth means remaining cash flow for investment and eventually debt repayment has not met expectations. Another opportunity is the traditionally defensive healthcare sector. Hospitals and other service providers experienced significant wage inflation but have been unable to increase prices in a timely manner due to contracts with insurance companies. Financing solutions are needed until profitability stabilizes.

How to Implement

We favor experienced managers with a proven track record in sourcing attractive investment ideas in both primary and secondary markets. In particular, we prefer those that can structure around complex situations, whether this means via a primary market capital solution or through leading a complex recapitalization or restructuring. The best managers can originate through the credit cycle, structuring primary market investments in benign markets and pivoting to secondary markets if a dislocation occurs. We believe managers with proven ability to lead complicated processes, stabilizing a borrower’s capital structure and positioning the company for future growth, are likely to outperform.

The current market environment presents a large and growing opportunity set in both primary and secondary markets. Slowing growth, rising rates, and declining bank lending appetite are dynamics that exist across regions, making the credit opportunities set global.

Some managers with deep resources can invest successfully across multiple regions, though others focus on specific regions. Europe can require specialized legal, sourcing, and servicing expertise across jurisdictions, so managers with local experience can be attractive. Labor laws and, importantly, bankruptcy codes will favor different stakeholders (lenders, management, or employees), making regional experience and networks important. The flipside is that there are fewer managers pursuing investments in Europe, and additional macro pressures create an attractive environment for credit opportunities managers. In contrast, the North American market, while more competitive, is larger and operates under one set of rules.

Conclusion

The current macroeconomic and market environment creates an attractive opportunity for credit opportunities managers. Given the significant increase in public and private leveraged finance markets since the Global Financial Crisis, we believe there will be a robust set of companies in need of creative capital solutions. Managers with flexible capital, strong sourcing efforts, and structuring skills will find ample investment opportunities and will deliver strong returns in the coming years.

Frank Fama, Global Head of Credit Investment Group

Wade O’Brien, Managing Director, Capital Markets Research

Drew Boyer, David Kautter, and Brittney McManus also contributed to this publication.

Index Disclosures

Bloomberg US High-Yield Corporate Index

The Bloomberg Barclays US Corporate High Yield Index measures the US corporate market of non-investment-grade, fixed-rate corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Credit Suisse Leveraged Loan Index

The Credit Suisse Leveraged Loan Index tracks the investable market of the USD–denominated leveraged loan market. It consists of issues rated “5B” or lower, meaning that the highest rated issues included in this index are Moody’s/S&P ratings of Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries.