Look to Specialty Finance and Credit Opportunities Strategies for Diversification

Diversifying private credit strategies provide a good complement to portfolio mainstays. While we believe the economic outlook remains strong, it is not without risks. In direct lending, growing amounts of dry powder are pressuring deal structures and pricing. As a result, we anticipate that commitments to less-correlated private credit funds, such as those focused on life sciences, asset-based lending, and flexible credit strategies, will increase next year.

Specialty finance encompasses most niche credit strategies. For instance, life science–focused funds lend to firms with patented, cash-flow generating drugs. These funds are well placed to capitalize on the growth in drug development. A portfolio of loans secured by a balanced drug portfolio would protect investors in a recession and be less correlated to the broader equity and credit markets. Asset-based lending strategies, where cash flows are not dependent on the performance of a corporate borrower but instead on a pool of cash flow generating assets, also look attractive. These strategies can provide a hedge against potential headwinds facing the market and deal structures, which have weakened in recent years. Most specialty finance strategies offer the added benefit of an attractive yield and a short duration, making them an interesting choice for a diversifiers’ allocation.

Credit opportunities with flexible mandates across special situations and distressed represent another appealing private credit area. Given the unprecedented action by governments and central banks, the distressed opportunity failed to materialize in 2021. However, there are periodic—albeit short-lived—dislocations over a credit cycle. Credit opportunities managers that have proven their ability to pivot to high-quality, stressed credit during market sell-offs are an attractive way to play the distressed cycle. These managers also originate differentiated new financing opportunities in less crowded segments of the market. In addition to offering a more “all-weather”–type approach to generating returns, these strategies retain the benefit of yield and many stress shorter durations, offering another arrow in the credit investor’s quiver.

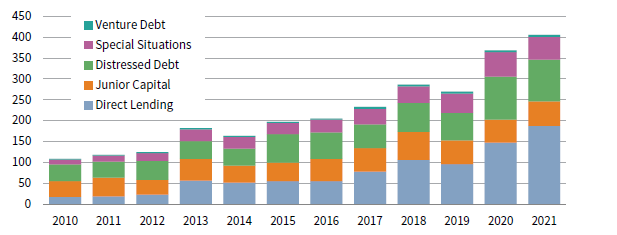

DRY POWDER IS INCREASING IN MOST CREDIT STRATEGIES

2010–21 (November 30, 2021) • US$ Billions

Source: Prequin.

Frank Fama, Global Co-Head of Credit Investment Group

Frank Fama - Frank Fama is Head of Global Credit Research and a Managing Director at Cambridge Associates.