Investing in 21st Century Infrastructure: Benefiting from the Digital Revolution

The importance of digitisation has grown during the pandemic, as people have relied more on digital platforms, video streaming, and cloud storage. Should these platforms cease functioning, or if bandwidth were insufficient, the impact on both businesses and consumers would be substantial. Key factors behind the exponential growth of data usage have been a combination of industries being digitised, including e-commerce, analytics, or storage, and adoption of social media. Given these fundamental cultural changes, investment across the digital infrastructure value chain continues to rise and should increasingly be a priority for real asset investors. Benefits from recently announced financial and policy support within recovery budgets by major economies across Asia, Europe, and the United States are another factor making the sector compelling.

We consider that the sector’s strong tailwinds and resultant growth are sustainable, a view supported by the sector’s resilience since COVID-19. The sector will continue to provide opportunities for investors across digital-focused real assets, particularly strategies that center on development of digital assets to mitigate rising valuations and target mid- to high-teens net returns. Such opportunities are not targeting to generate returns equivalent to public technology stocks that support the underlying growth in data usage; instead, they offer defensiveness and lower volatility versus growth-focused technology companies to provide diversification benefits to investment portfolios. Now is the time to consider the role of the digital infrastructure sector in portfolios.

Data and Cloud Growth Increase Fundamental Role of Sector

Growth of profitability within technology, media, and telecoms (TMT), of which digital is a key sub-sector, has been more substantial than in any other sector since the turn of the millennium, rising 100-fold from 2000 to 2014. Technological development has allowed industries to evolve with digital trends such as the transition to e-commerce, data analytics, social media, and video streaming. This has resulted in a low barrier across industries, with companies such as Amazon, Google, and Netflix highlighting the changing nature of how we undertake our lives. The following statistics highlight what has occurred and is expected to happen next:

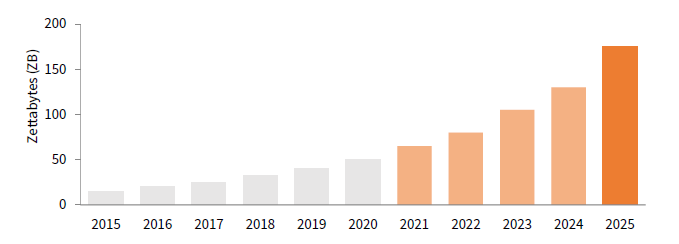

- Data usage has approximately doubled since 2015 and is forecasted to rise by around 400% from today to approximately 170 zettabytes by 2025, which is a substantial amount of data usage (Figure 1).

- This future growth is driven across industries, not just media and entertainment, with growth rates in data usage of 36% in healthcare, 30% in manufacturing, and 26% in financial services.

- Growth in devices has also risen dramatically as costs have fallen, such that we now have more devices, often up to seven per person, and we are using substantially more services each day (almost 1,500 data interactions per day), according to IDC Seagate.

- As a result, digital economies are starting to represent around 10% of GDP and growing across markets.

FIGURE 1 DATA CONSUMPTION FORECAST TO INCREASE BY 400% IN NEXT FIVE YEARS

2015–25 • Global Growth of the Datasphere • Zettabytes (ZB)

Source: IDC Seagate.

Significantly more infrastructure capacity is needed to manage these increasing data flows. The risks to this unavailability are that bottlenecks appear, which inhibit growth. Central to this is the digital infrastructure ecosystem described below, and where infrastructure investors are increasingly focused as the sector’s essentialness becomes increasingly apparent.

The Importance of Digital for Real Asset Investors

Data require infrastructure to be transmitted and ultimately stored somewhere. Fortunately, there are various mediums to facilitate this growth, where substantial opportunities are developing in real assets. Leading infrastructure investors have led the charge in developing and purchasing digital infrastructure platforms to provide the operational capability to invest across the digital infrastructure value chain (Figure 2). The recent US 5G spectrum auction that received more than $80 billion in commitments highlighted that telecom operators maintain a strong focus on wireless services. Both they and large technology companies are generally seeking to partner with infrastructure investors to implement necessary backbone infrastructure to provide a clear end-user for digital infrastructure owners. This dynamic illustrates the sector’s defensiveness and enhances risk-adjusted returns for digital infrastructure investors.

Regarding the key areas for real asset investment, firstly, fibre has proved to be the technology of choice to support high bandwidth and speed of data transmission across international, national, or local networks. There is a clear need for investment, as most markets, such as the United Kingdom, United States, and Germany, are still relying on older copper or cable networks, as noted by the Oragnisation for Economic Co-operation and Development. These deficiencies have been highlighted as many have moved to remote working, so investment within fibre is expected to expand in both urban and rural networks. Competing technologies, such as satellites or 5G, which are complementary as well, cannot reliably offer the same bandwidth or low latency (minimal delay).

FIGURE 2 THE DIGITAL VALUE CHAIN CONTINUES TO GROW AND EXPAND

Source: Arthur D. Little and Cambridge Associates LLC.

Notes: FTTO/X/A refers to a variety of fiber networks deployed according to end-user requirements. Hyperscale Towers refer to large data centres, typically single-use and managing critical loads. >1MW Edge Centres refer to data centres that are typically multi-use in dense locations managing critical loads. <1MW Small Cell refers to fiber-fed antenna systems leased by wifi/carrier operators in dense areas (e.g., venues) to reduce latency. End-Point Enablers refer to middleware devices that enable internet-dependent systems, such as smart city solutions, to operate reliably.

Secondly, telecom towers are an essential infrastructure given the reliance on smartphones today, and upgrades to 5G will increase their necessity. Nodes on towers are linked to wider networks with fibre to provide the increased bandwidth needed across all frequencies, including 5G, and hence are part of an integrated network. With the increase in speed and potential for further ‘Internet of Things’ (IoT), tower investment is also expected to remain critical.

Thirdly, data clearly needs to have an end destination, and it is no longer possible to store all data on increasingly smaller devices or localised servers. Therefore, the growth in data centres and the shift to the cloud has been as dramatic as the growth in data usage. Growth rates of cloud storage vary between 30% and 50% from the US to Asian markets to accommodate data usage, with regulatory trends also impacting location of data centres. Furthermore, the data centre model is also evolving with a wider array of solutions to suit different needs; this includes where low latency is key, resulting in smaller localised data centres like Edge (small-scale data centres often in urban areas) versus hyperscale-type developments (large-scale centres supporting high data volumes in more remote areas). These innovations are creating more opportunities and require greater strategic awareness of local market requirements. Moreover, the significant power needs of such facilities require careful planning, an area where infrastructure investors are very knowledgeable, to manage the full planning and diligence of developments.

Finally, more private equity opportunities have emerged all along the value chain, including small-cell opportunities (e.g., series of low powered antenna to increase bandwidth), development platforms, and technology solutions such as smart cities. This supports eventual demand-side and usage growth for core infrastructure, such as fibre, towers, and data centres, but remains contingent on the supply of necessary infrastructure to create a somewhat circular network.

How Can Investors Benefit from This?

In summary, there are opportunities for real asset investors for outperformance within telecoms, though they come with increased operational and market risks related to this. Figure 3 highlights the outperformance of value-add infrastructure managers across infrastructure, linking it to increased commitments to telecom infrastructure.

FIGURE 3 VALUE-ADD MANAGERS ARE OUTPERFORMING IN THE INFRASTRUCTURE SECTOR

As at 30 June 2020

Sources: Cambridge Associates LLC, FTSE International Limited, and Thomson Reuters Datastream.

Notes: Pooled private investment returns are net of fees, expenses, and carried interest. The Public Market Equivalent is based on a constructed index [UBS Global Infrastructure & Utilities 50/50 Index/FTSE® Developed Core Infrastructure 50/50 Index (Net)], using Cambridge Associates modified Public Market Equivalent methodology.

It also highlights general outperformance of value-add infrastructure and the importance of manager selection, with significant ranges between top- and bottom-quartile performance. Within telecoms, investment is often centred around fibre, data centres, and towers, with different degrees of focus on development. Strategies inherently have increased operational and market risk factors, such as exposure to varying credits, reliance on strong sales models, or increased customer churn; appropriate partnership with operational-orientated managers is important to mitigate such risks.

The forecast data and cloud growth rates create significant opportunities for top-line growth in companies investing across the digital value chain. Where more infrastructure characteristics are prevalent, there is also the opportunity to have sustainable returns, as revenues are often underpinned by contracts to high credit–worth counterparties (e.g., Amazon, AT&T, Google, Microsoft, and Verizon), with an ability to add small enterprises with strong growth prospects.

Opportunities exist with value-add infrastructure investors specialised in investing and growing fibre, data centre, or tower platforms, or with real estate investors increasingly attracted to data centres applying real estate development models. Given the need to invest to drive performance and meet capacity demands, investment performance should be optimally positioned with operational approaches like buy-and-build versus overly leveraged approaches. Following COVID-19, managers that have focused on these industries have shown significant resilience in portfolios, which is likely to attract lower cost of capital investors. Whilst this could further impact growing valuations, for managers capable of undertaking more buy-and-build approaches, there is an opportunity to benefit from this trend and maintain outperformance versus the sector as a whole. Overall, digital infrastructure is increasingly becoming fundamental to real asset portfolios as an attractive diversifier with defensive growth and yield prospects.

Minesh Mashru, Head of Infrastructure Investing

Sean Knudsen also contributed to this publication.

INDEX DISCLOSURES

UBS Global Infrastructure & Utilities 50/50 Index

The index tracks a 50% exposure to the global developed markets infrastructure sector and a 50% exposure to the global developed markets utilities sector, the returns of which reflect no deduction for fees and expenses but are net of dividend withholding taxes.

FTSE® Developed Core Infrastructure 50/50 Index (Net)

The FTSE Developed Core Infrastructure 50/50 Index gives participants an industry-defined interpretation of infrastructure and adjusts the exposure to certain infrastructure sub-sectors. The constituent weights for this index is adjusted as part of the semi-annual review according to three broad industry sectors: 50% Utilities; 30% Transportation, including capping of 7.5% for railroads/railways; and, a 20% mix of other sectors, including pipelines, satellites, and telecommunication towers. Company weights within each group are adjusted in proportion to their investable market capitalization.

Cambridge Associates modified Public Market Equivalent Methodology (mPME)

The CA mPME replicates private investment performance under public market conditions and allows for an appropriate comparison of private and public market returns. The mPME analysis evaluates what return would have been earned had the dollars invested in private investments been invested in the public market index instead. With data currently unavailable for fourth quarter 2020, the period evaluated for the private investment and mPME indexes is for the trailing nine months ended June 30, 2020.

Minesh Mashru, CFA - Minesh Mashru is the Head of Global Infrastructure and a Managing Director at Cambridge Associates. Minesh is focused on the infrastructure investment activities for the Real Assets Investment Group, in both public and private markets, debt, equity, and across different structures, including underwriting funds, management teams, co-investments and direct investments. Minesh works with a global […]