Friend or Foe: Hedge Funds Versus Alternative Risk Premia (Euro Edition)

It has been a challenging time for hedge funds in recent years. Loose monetary policy has driven equity markets upwards and hurt short books. The growth of quantitatively traded funds has eroded some of the inefficiencies commonly exploited by hedge funds. This fact, coupled with the shift toward low-fee passive and alternative risk premia (ARP) products, has raised questions about the merits of hedge funds in investor portfolios.

In this paper, we focus on comparing ARP versus hedge funds. We investigate whether hedge funds and ARP funds are complementary or whether ARP funds are actually a viable replacement for hedge funds. The outcome of our analysis is that while diversified ARP strategies may complement some hedge fund strategies, particularly global macro, select hedge funds continue to offer different characteristics that may attract institutional investor portfolios. Still, investors should remember that ARP track records are short, meaning these conclusions may evolve as the industry matures.

Background

ARP funds extend the approach of factor investing across multiple factors and asset classes. This extension means these funds are less exposed to any one individual risk factor. Some factors are more prevalent in certain asset classes than others, but most ARP funds apply multiple factor approaches across equities, commodities, fixed income, and currencies. Typically, these funds target four main factors—value, momentum, carry, and quality—but they may incorporate other risk premia or market anomalies into their strategies.

The diversified nature of ARP funds has proved attractive to investors looking for cheaper solutions to hedge fund portfolios. We compare diversified ARP funds to long/short equity, global macro, trend followers, and against a broader hedge fund composite, all of which are denominated in euro. 1 USD-denominated strategies offer a broader range of investing options, including in event-driven, credit, distressed, and multi-strategy. These areas may enable hedge funds to generate additional alpha versus traditional investment strategies. Therefore, we must accept the limitations of considering purely euro-denominated strategies as offering a narrower scope for hedge fund investors to generate alpha for their portfolios.

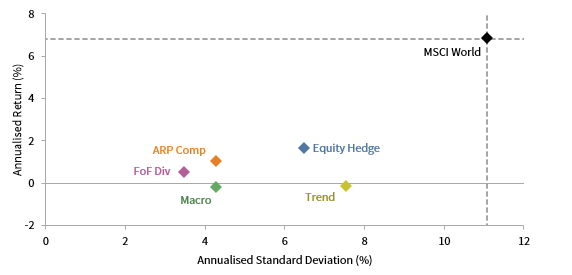

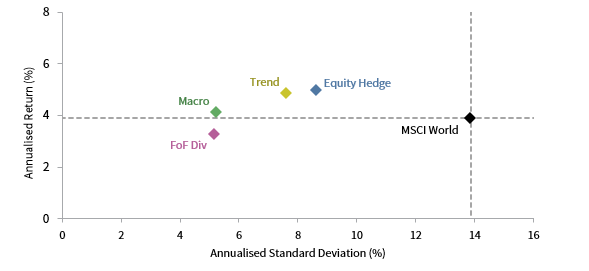

Despite impressive back-tests and a small subset of funds that have generated strong returns over several years, the live track record of the Cambridge Associates ARP Composite (EUR) generated mixed results over five years. Figure 1 illustrates the five-year period ending 30 June 2019 in which ARP funds returned 1.0% annually. Over this period, ARP funds outperformed the broader hedge fund industry, which recorded a gain of 0.5% for the HFR Fund of Funds Diversified Index (Hedged, EUR).

FIGURE 1 RISK/RETURN ANALYSIS OF ARP AND HEDGE FUND STRATEGIES

1 July 2014 – 30 June 2019 • EUR

Sources: Cambridge Associates LLC, Hedge Fund Research, Inc., and MSCI Inc. MSCI data provided ‘as is’ without any express or implied warranties.

Notes: MSCI World is the MSCI World Index (Hedged, EUR) (Net). ARP Comp is the Cambridge Associates Alternative Risk Premia Composite (EUR). FoF Div is the Hedge Fund Research Fund of Funds Diversified Index (Hedged, EUR). Equity Hedge is the Hedge Fund Research Equity Hedge (Total Return) Index (Hedged, EUR). Macro is the Hedge Fund Research Macro (Total Return) Index (Hedged, EUR). Trend is the Hedge Fund Research Macro: Systematic Diversified Index (Hedged, EUR).

Global equity markets steadily moved higher throughout this period, which undercut hedge fund performance given they tend to have low betas to the market. Equity hedge funds performed positively (1.7%), with lower volatility and less gains than equity markets. Over this period, macro and trend funds both returned an annualised -0.2%.

The past five years were a challenging time for global macro funds as low volatility levels and slow economic growth resulted in a narrower opportunity set to exploit. Trend followers experienced improved performance in 2019, although prior years compressed multi-year return figures. Trend followers increased long equity and bond exposures in pursuit of trend-driven opportunities in recent years. The absolute returns of equity-oriented hedge funds were better, helped by a general appreciation of global equities, although most underperformed equity markets due to negative performance from alpha shorts and hedges.

ARP funds demonstrated similar levels of volatility to hedge funds. The Sharpe ratio for the CA ARP Composite EUR (0.3) was similar to equity hedge strategies, slightly higher than the fund-of-funds universe (0.2), and significantly higher than global macro and trend strategies (0.0).

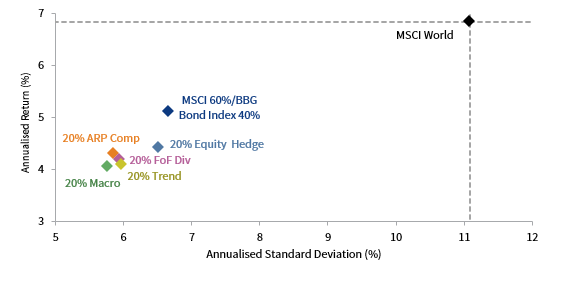

Adding ARP or hedge funds to a balanced portfolio (60% equities/40% bonds) over the last five-year period would have produced similar results. In Figure 2, we show the risk/return profiles of portfolios composed of a balanced portfolio reduced pro-rata to include 20% allocations to different strategies. A balanced portfolio, including ARP strategies, would have generated a marginally higher return than a portfolio with a fund-of-funds allocation. An equity hedge allocation would have led to similar returns but with higher volatility. When viewed in the context of a diversified portfolio, ARP strategies would have had a similar impact on reducing volatility versus hedge fund strategies over the five-year period. The results on diversified portfolio beta would have been broadly similar for ARP strategies and hedge fund strategies, with the inclusion of ARP and hedge fund strategies reducing overall balanced portfolio betas to between 0.5 and 0.6.

FIGURE 2 RISK/RETURN ANALYSIS OF BALANCED PORTFOLIO INCLUDING ARP AND HEDGE FUND STRATEGIES

1 July 2014 – 30 June 2019 • EUR

Sources: Bloomberg Index Services Limited, Cambridge Associates LLC, Hedge Fund Research, Inc., and MSCI Inc. MSCI data provided ‘as is’ without any express or implied warranties.

Notes: All portfolios displayed are based on the 60/40 Portfolio, which is 60% MSCI World Index (Hedged, EUR) (Net) and 40% Bloomberg Barclays Global Aggregate Bond Index (Hedged, EUR). ARP Comp refers to the 60/40 Portfolio reduced pro-rata to include a 20% allocation to the Cambridge Associates Alternative Risk Premia Composite (EUR). FoF Div refers to the 60/40 Portfolio reduced pro-rata to include a 20% allocation to the Hedge Fund Research Fund of Funds Diversified Index (Hedged, EUR). Equity Hedge refers to the 60/40 Portfolio reduced pro-rata to include a 20% allocation to the Hedge Fund Research Equity Hedge (Total Return) Index (Hedged, EUR). Macro refers to the 60/40 Portfolio reduced pro-rata to include a 20% allocation to the Hedge Fund Research Macro (Total Return) Index (Hedged, EUR). Trend refers to the 60/40 Portfolio reduced pro-rata to include a 20% allocation to the Hedge Fund Research Macro: Systematic Diversified Index (Hedged, EUR).

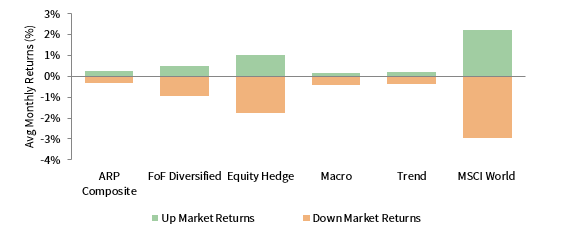

When considering periods of negative equity markets, ARP strategies displayed strong downside protection as demonstrated in Figure 3. ARP strategies generated smaller movements in up and down equity markets than fund-of-funds and equity hedge strategies. Average monthly performance in down markets across ARP, global macro, and trend strategies was relatively similar, indicating all three strategies demonstrated good downside protection in times of market decline.

FIGURE 3 AVERAGE MONTHLY PERFORMANCE IN UP AND DOWN MARKETS

1 July 2014 – 30 June 2019 • EUR

Sources: Bloomberg Index Services Limited, Cambridge Associates LLC, and MSCI Inc. MSCI data provided ‘as is’ without any express or implied warranties.

Notes: MSCI World is the MSCI World Index (Hedged, EUR) (Net). ARP Composite is the Cambridge Associates Alternative Risk Premia Composite (EUR). FoF Diversified is the Hedge Fund Research Fund of Funds Diversified Index (Hedged, EUR). Equity Hedge is the Hedge Fund Research Equity Hedge (Total Return) Index (Hedged, EUR). Macro is the Hedge Fund Research Macro (Total Return) Index (Hedged, EUR). Trend is the Hedge Fund Research Macro Systematic Diversified Index (Hedged, EUR).

ARP funds also have had a relatively low correlation to the global equity market, as compared to hedge funds (Figure 4). They could have been complementary to existing hedge fund allocations in institutional investors’ portfolios, given the 0.52 correlation between ARP and hedge fund industry over the five-year period. The correlation to equity hedge funds was lower still (0.41). Global macro, which has traditionally been a strong diversifier versus other hedge fund strategies, has shown a correlation of 0.54 to the hedge fund industry over the past five years, while trend strategies have shown the strongest diversification against the broader hedge fund industry with a correlation of 0.39. The correlation to global macro and trend following was higher (0.80 and 0.75, respectively) to ARP funds over the five-year period. This relatively high correlation could indicate that ARP funds could be used in conjunction with some diversifying strategies, such as fund-of-funds strategies, although the diversification benefits of an ARP allocation would be less impactful in a portfolio with pre-existing global macro and trend allocations.

FIGURE 4 CORRELATIONS ACROSS ARP AND HEDGE FUND STRATEGIES

1 July 2014 – 30 June 2019 • EUR

Sources: Bloomberg Index Services Limited, Cambridge Associates LLC, Hedge Fund Research, Inc., and MSCI Inc. MSCI data provided ‘as is’ without any express or implied warranties.

Notes: Equities is the MSCI World Index (Hedged, EUR) (Net). Bonds is the Bloomberg Barclays Global Aggregate Bond Index (Hedged, EUR). ARP Comp is the Cambridge Associates Alternative Risk Premia Composite (EUR). FoF Diversified is the Hedge Fund Research Fund of Funds Diversified Index (Hedged, EUR). Equity Hedge is the Hedge Fund Research Equity Hedge (Total Return) Index (Hedged, EUR). Macro is the Hedge Fund Research Macro (Total Return) Index (Hedged, EUR). Trend is the Hedge Fund Research Macro: Systematic Diversified Index (Hedged, EUR).

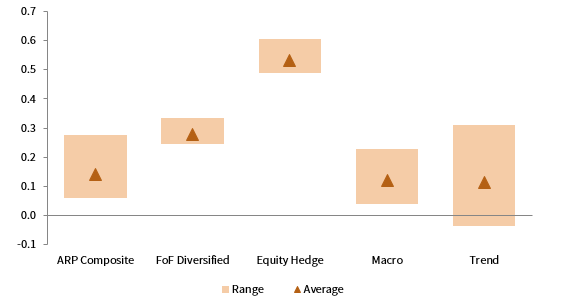

When considering an allocation to ARP strategies as a portfolio diversifier, the beta persistence of the underlying fund is important. For a fund to be a good diversifier, a low or negative beta to other asset classes is necessary, especially in times of market stress. A fund with a wide beta range may be sub-optimal in providing diversified returns.

Figure 5 shows beta ranges for ARP and hedge fund strategies across rolling 36-month time periods. The CA ARP Composite produces a satisfactory beta range to the MSCI World Index with an average beta of 0.14, indicating low beta characteristics. Diversified hedge fund strategies also have low betas, averaging 0.28 and demonstrating a narrower overall range to developed equity markets than the CA ARP Composite. Global macro strategies also have a low-average beta (0.12) and a range similar to ARP strategies. In contrast, pure trend-following strategies have a wide beta range although the average is at a similar level to ARP and global macro strategies (0.11). It could be argued that ARP strategies offer similar beta reducing properties to balanced portfolios as global macro or trend strategies.

FIGURE 5 ROLLING BETA ACROSS ARP AND HEDGE FUND STRATEGIES

31 July 2017 – 30 June 2019 • Rolling 36-M Min/Max Range • EUR

Sources: Cambridge Associates LLC, Hedge Fund Research, Inc., and MSCI Inc. MSCI data provided ‘as is’ without any express or implied warranties.

Notes: Beta is based on monthly excess returns versus MSCI World Index (Hedged, EUR) (Net) over the trailing 36-months. ARP Composite is the Cambridge Associates Alternative Risk Premia Composite (EUR). FoF Diversified is the Hedge Fund Research Fund of Funds Diversified Index (Hedged, EUR). Equity Hedge is the Hedge Fund Research Equity Hedge (Total Return) Index (Hedged, EUR). Macro is the Hedge Fund Research Macro (Total Return) Index (Hedged, EUR). Trend is the Hedge Fund Research Macro: Systematic Diversified Index (Hedged, EUR).

Our analysis indicates that ARP funds may have periods during which they exhibit higher beta to equity markets than expected. Fourth quarter 2018 was a case in point, where many ARP strategies experienced challenging performance on the back of negative pressure from value factors. We conducted similar analysis over shorter time periods to measure shorter term fluctuations in beta and observed that the average betas fluctuate significantly across ARP, global macro, equity hedge, and trend-following strategies. The broader hedge fund industry, however, maintains a relatively consistent beta exposure even over shorter time periods, indicating more reliable diversifier characteristics. ARP and global macro strategies demonstrated similar beta ranges and average betas over the five-year period.

Different Risk Factors

ARP funds seek to take advantage of persistent risk premia across instruments. They are expected to be broadly consistent in terms of the premia they seek to exploit, and their diversified nature should mean that elements of their portfolios work in most markets. Hedge funds, by contrast, can flex their exposures more actively and this is how many seek to generate alpha. We ran a multi-factor risk decomposition of ARP funds versus the hedge fund strategy that exhibits the closest correlation (global macro) to determine whether there is a significant amount of risk factor overlap. The results, over a five-year period, were that many traditional risk factors were not statistically significant in explaining the return profiles of either strategy. However, the CA ARP Composite did have a statistically significant relationship with credit, rates momentum, equity markets, and equity momentum factors. Global macro funds showed more significant factor risks across rates momentum and credit, although there also was a sizable percentage of overall returns that were not explained by major risk factors. Rates, carry, and FX carry did not exhibit positive significance for ARP funds or global macro funds in the five-year time period analysed. The equity markets factor was not significant for global macro funds, implying that these strategies may offer more diversification for an equity-heavy portfolio.

Overall, it could be observed that the return profiles of ARP funds and global macro exhibit some similarities but also noticeable differences in terms of factor composition and cannot be easily replicated by passive long-only allocations to major risk factors. Due to their differences, they could be considered to both have roles in investor portfolios. Also, the low correlations of equities and bonds over the last five years (-0.06) have been favourable for strategies that have simultaneously loaded up on both equity and credit factors. Diversification, while a strong tailwind over recent years, cannot be relied on going forward. ARP strategies are likely to be more susceptible than global macro to changes in these correlations.

Considering the Long Term

Our ARP fund analysis is limited due to short data history. In contrast, the longer return streams that exist for hedge funds may help investors gain confidence with hedge funds’ ability to navigate turbulent market periods. High alpha hedge funds can still justify their place in investor portfolios when considering attractive risk-adjusted return profiles and their diversifying nature versus global equities and bonds over the long term. Figure 6 shows the returns of hedge funds over 20 years. The risk-adjusted returns over this period show an attractive profile versus global equities with lower volatility and higher returns for equity hedge, global macro, and trend strategies.

FIGURE 6 RISK/RETURN OF HEDGE FUND STRATEGIES OVER A 20-YR PERIOD

1 July 1999 – 30 June 2019 • EUR

Sources: Cambridge Associates LLC, Hedge Fund Research, Inc., and MSCI Inc. MSCI data provided ‘as is’ without any express or implied warranties.

Notes: MSCI World is the MSCI World Index (Hedged, EUR) (Net). FoF Div is the Hedge Fund Research Fund of Funds Diversified Index (Hedged, EUR). Equity Hedge is the Hedge Fund Research Equity Hedge (Total Return) Index (Hedged, EUR). Macro is the Hedge Fund Research Macro (Total Return) Index (Hedged, EUR). Trend is the Hedge Fund Research Macro: Systematic Diversified Index (Hedged, EUR).

The performance of the hedge fund industry as a whole has been muted with 20-year annualised returns of 3.3% as shown in Figure 6. However, performance dispersion amongst hedge funds has been high. Historical annual return dispersion across the best and worst 2 performers has been in excess of 10% and high-performing funds are still available. We consider less than 6% of the overall universe to be worthy of institutional investor capital. For this reason, manager selection is significantly more important than in traditional assets. The same may be true of ARP strategies.

Cost and Liquidity Advantages

Hedge fund fees have fallen as investors have raised concerns. However, hedge fund fees on average remain significantly higher than ARP funds. The average offshore hedge fund management fee, prior to any fee negotiations, in the CA hedge fund manager database is 1.6%, and the range is 0%–3.5%. Underlying funds in the CA ARP Composite (EUR) operate with lower fees on average. ARP fund management fees typically range between 0.5% and 1.0%. Average management fees within our composite are 1.0%, a roughly 30% reduction versus the average hedge fund. Nearly all the offshore hedge funds in the CA hedge fund manager database also charge performance fees. These performance fees average 19%. Five out of eight funds in the CA ARP Composite (EUR) charge no performance fee. Of the three ARP funds that charge a performance fee, the average level is 13%. Given these lower fees, the inclusion of ARP strategies in hedge fund allocations can help to reduce overall fee levels. However, investors should consider fees in the context of the level of volatility targeted and consider how that target compares to realised volatility. Investors may choose to use a mix of lower fee diversifying options alongside higher fee, higher alpha generative hedge fund strategies to reduce the total level of fees in their portfolios.

Liquidity is also better for ARP funds than most hedge funds. Funds in the CA ARP Composite (EUR) generally allow monthly exit, with some permitting daily redemptions. Hedge fund liquidity (excluding UCITS funds), by contrast, tends to range between monthly and quarterly (most common) and lock-ups can be a year or more.

Summary

Investors may conclude that there is some friend and some foe in the relationship between ARP and hedge funds. The common characteristics displayed in the last five years indicate investors could have replicated many of the benefits of global macro funds in particular through an ARP allocation. However, investors should remember that dispersion is broad across these asset classes and our analysis is confined to the “average” offering. Also, correlations are not perfect, and there is a case for considering ARP and hedge funds as complementary.

ARP funds (EUR) may demonstrate worthwhile diversification benefits to a balanced portfolio, although in periods of highly appreciating equity markets, absolute performance should lag. There is some argument to be made that ARP funds (EUR) offer similar diversification benefits to the average global macro and trend-following offering. Indeed, many institutional investors are complementing global macro allocations with ARP strategies in diversified portfolios.

ARP funds demonstrate diversifying characteristics versus traditional assets, as well as hedge funds. They also offer lower fee levels and more liquid terms versus the average hedge fund. For investors that are averse to higher fees and require liquidity, they may offer an appealing solution to the challenges posed by traditional hedge fund terms. However, investors that prefer longer track records, want to see evidence of successfully managing through a market cycle, focus on alpha generation, or are less liquidity constrained are likely to find select hedge funds to be a more appealing solution over the long term. The middle ground is a solution employed by many investors whereby ARP funds are used within hedge fund portfolios to balance out higher fee, more alpha-focused hedge funds. The result is a lower total fee burden while still participating in select alternative opportunities.

Trudi Boardman, Senior Investment Director

Tomas Kmetko, Senior Investment Director

Jack Hardiman, Investment Analyst

Index Disclosures

Bloomberg Barclays Global Aggregate Bond Index

The Bloomberg Barclays Global Aggregate Bond Index consists of more than 5,000 government, corporate, asset-backed, and mortgage-backed securities.

HFRI Equity Hedge (Total) Index

The HFRI Equity Hedge (Total) Index consists of investment managers that maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. EH managers would typically maintain at least 50% exposure to, and may in some cases be entirely invested in, equities, both long and short.

HFRI Fund of Funds Diversified Index

The HFRI FOF Diversified Index is a non-investable product of diversified fund-of-funds. The Index is equal weighted (fund weighted) with an inception of January 1990.

HFRI Macro (Total) Index

The HFRI Macro (Total) Index consists of investment managers that trade a broad range of strategies in which the investment process is predicated on movements in underlying economic variables and the impact these have on equity, fixed income, hard currency, and commodity markets. Managers employ a variety of techniques, both discretionary and systematic analysis, combinations of top-down and bottom-up theses, quantitative and fundamental approaches and long and short-term holding periods.

HFRI Macro Systematic Diversified Index

Systematic Diversified strategies have investment processes typically as a function of mathematical, algorithmic, and technical models, with little or no influence of individuals over the portfolio positioning. Systematic Diversified strategies typically would expect to have no greater than 35% of portfolio in either dedicated currency or commodity exposures over a given market cycle.

MSCI World Index

The MSCI World Index represents a free float–adjusted, market capitalization–weighted index that is designed to measure the equity market performance of developed markets. As at December 2019, it includes 23 developed markets country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

Footnotes

- Our analysis is based on the Cambridge Associates ARP Composite (Euro). The CA ARP Composite (EUR), includes eight ARP funds with total assets of US$24.5 billion. These funds are all denominated in EUR to avoid the distorting nature of converting return streams from other currencies. Funds included in this composite have audited net track records in excess of five years. Long/short equity is represented by Hedge Fund Research Equity Hedge (Total Return) Index (Hedged, EUR), global macro by Hedge Fund Research Macro (Total Return) Index (Hedged, EUR), trend followers by Hedge Fund Research Macro: Systematic Diversified Index (Hedged, EUR), and the broader hedge fund composite by the Hedge Fund Research Fund of Funds Diversified Index (Hedged, EUR).

- The 5th and 95th percentile annualised returns for hedge fund managers in Cambridge Associates database for 14 years ended 30 September 2019.

Tomas Kmetko - FootnotesOur analysis is based on the Cambridge Associates ARP Composite (Euro). The CA ARP Composite (EUR), includes eight ARP funds with total assets of US$24.5 billion. These funds are all denominated in EUR to avoid the distorting nature of converting return streams from other currencies. Funds included in this composite have audited net track records […]

Jack Hardiman - FootnotesOur analysis is based on the Cambridge Associates ARP Composite (Euro). The CA ARP Composite (EUR), includes eight ARP funds with total assets of US$24.5 billion. These funds are all denominated in EUR to avoid the distorting nature of converting return streams from other currencies. Funds included in this composite have audited net track records […]