Defining the OCIO Benefit: What Value Can It Provide to Plan Sponsors?

In just the last five years, total US institutional assets under management (AUM) by Outsourced Chief Investment Officers (OCIO) has continued to grow steadily, and is projected to reach nearly $2 trillion in 2021. With corporate defined benefit plans representing the largest share by far, at 55% of total institutional assets, this interest in outsourcing shows no signs of abating.

Although OCIO has become a buzzword across the broad investment community, many defined benefit plan sponsors have questions about what an OCIO does, whether employing an OCIO interferes with their fiduciary obligation to participants, and what factors can help to make a partnership with an OCIO successful.

Sona Menon, Head of the North American Pension Practice at Cambridge Associates, recently shared her perspective on some of the most common questions plan sponsors ask about the OCIO relationship. Sona brings a wealth of knowledge and experience to bear in addressing these concerns, having served as an OCIO for defined benefit plans for over a decade.

The OCIO concept has evolved significantly over the past decade and has come to mean different things to different people. How do you define it?

There are many OCIO models in the marketplace today. Broadly speaking, the common thread among all of them is that an investment team outside of the sponsor is delegated the responsibility for managing a portfolio or a specific asset class within a portfolio. This includes developing and implementing an investment strategy, selecting investment managers, managing risk, and providing day-to-day oversight of the plan assets. The OCIO is also responsible for tactical investment decisions and rebalancing to take timely advantage of market moves and investment opportunities. Operationally, the OCIO is responsible for executing transactions and ensuring cash is available to meet monthly benefit payments and plan expenses. Any or all of these functions may be performed in collaboration with an oversight committee or specific other constituents within the plans sponsor’s organization.

Have you seen growing demand for OCIOs among defined benefit plan sponsors, and why?

We definitely have; at Cambridge Associates, by way of example, we’ve nearly doubled our pension OCIO assets in the past five years alone.

One reason for this strong interest is the overall market and investment backdrop. Rich valuations across most risk assets and persistently low interest rates have left sponsors wondering where future returns will come from to help close funding gaps or offset future required contributions. They realize that the next ten years are unlikely to produce the kinds of outsized gains seen over the past ten. However, due to a myriad of factors, plan sponsors have been reluctant to lower their high return targets. Add in the increasingly complex and diverse investment opportunity set, and it is no wonder that many plan sponsors are questioning whether their current investment strategy and oversight model is suitable for what lies ahead.

In addition, we’ve seen an increasing number of sponsors want to simplify the operational, audit, compliance oversight, and costs of managing a pension portfolio, which can all detract from other budgetary objectives. Some plan sponsors want to ensure that they are appropriately meeting their fiduciary duties without the resource and time burden of executing trades, filling out paperwork, performing legal reviews, ensuring adherence to the investment policy statement, and providing appropriate documentation for audit purposes.

Are there other, more institution-specific motivations?

Certainly, and those often are related to a plan sponsor’s particular investment “pain points.” For instance, some sponsors may simply not have the resources and scale to perform the deep due diligence that is necessary to identify the best managers across all asset classes. Even large, well-resourced organizations that have an internal investment office may find that they need to augment their own resources by partnering with an OCIO on specific asset classes within the portfolio. We frequently see this, for instance, with alternative investments, where successful manager selection is pivotal to generating alpha.

Another common situation results from the need for improved governance and faster investment decision making. An OCIO can react more nimbly to fast-changing markets and exploit dislocations as they happen, without waiting for a quarterly investment committee meeting to obtain approval. The pronounced equity market sell-off in March 2020, followed by the strong rally only two weeks later, is one recent example of when I was able to rebalance my portfolios almost immediately to take advantage of an equity market that was oversold.

Does a plan sponsor’s decision to outsource day-to-day portfolio management to an OCIO mean they relinquish their fiduciary responsibility?

Not at all. The plan sponsor retains two very important responsibilities as the fiduciary of the plan. The first is to provide critical input relative to plan objectives, so that the appropriate strategic asset allocation plan can be developed. At CA, for example, we undertake a rigorous enterprise-level review at the outset to understand the plan sponsor’s key goals, their pain points, and the role of the pension within the broader organization. The second is to monitor the OCIO’s performance against established objectives and risk parameters. In some ways, plan governance may actually be strengthened by hiring an outside investment professional as a co-fiduciary of the plan. This enables both sides to focus on their core competencies—the OCIO on investment decisions and implementation and the plan sponsor on broader strategic decisions and fiduciary oversight.

Do plan sponsors who work with an OCIO give up all their control over investment decision making?

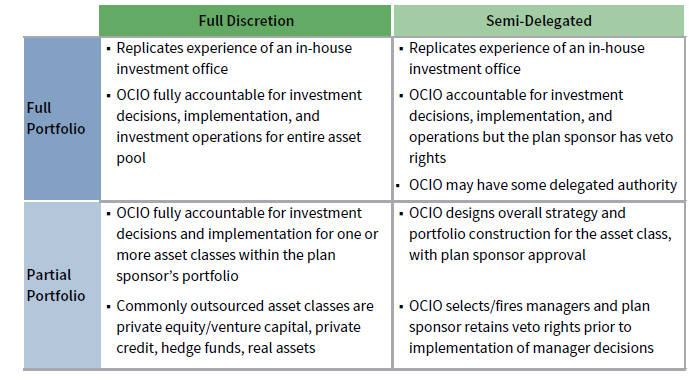

Not necessarily—in fact, that’s a common misperception and is an important point to clarify. We recognize that not all plan sponsors may want the OCIO to have full discretion over the entire portfolio. They may prefer to retain some discretion or outsource management of only part of the portfolio, assigning one or more asset classes for the OCIO to manage. I think of this as two distinct decisions that a plan sponsor should make. At Cambridge Associates, we use a flexible OCIO model in order to accommodate these various approaches to outsourcing.

Regarding the level of discretion, a sponsor can give the OCIO full discretion over portfolio implementation or partial discretion, also known as a semi-delegated model. The semi-delegated model allows the plan sponsor to retain veto power over investment portfolio recommendations, in which case the OCIO would typically preview and get approval for manager hiring or termination recommendations before implementing (Figure 1).

FIGURE 1 LEVEL OF OUTSOURCING AND OCIO DISCRETION

Source: Cambridge Associates LLC.

Regardless of the model, the plan sponsor should always be involved with confirming the investment policy, establishing risk guidelines, and overseeing the OCIO. If there is a material change in the sponsor’s willingness or ability to assume investment risk or goals and objectives have changed, the OCIO should work with the sponsor to craft a new strategic asset allocation and modify guidelines as appropriate to ensure that the portfolio always remains on track to meet the sponsor’s goals.

How does Cambridge Associates approach the role of OCIO?

For all our clients, we believe that being a trusted partner that can deliver customized, objective advice is the foundation of success. Our OCIO relationships begin with a rigorous enterprise and asset-liability review, working alongside members of the institution to get a 360-degree view of all the factors outside of the pension portfolio that may impact the ability to assume market and liquidity risk within the portfolio. For example, I work with many clients where the pension is one of the investment pools alongside a defined contribution plan, endowment, or other operating pool. By consolidating oversight of all the pools, we believe we can devise a unique investment strategy for each pool that is most appropriate from a total enterprise level and take full advantage of economies of scale with managers to enhance cost savings.

Another important output of the asset/liability review is agreement on the appropriate level of funded status volatility, liquidity, long-term goals, and constraints. For example, some sponsors are particularly concerned with lowering minimum required contributions, while others are focused on the pension’s impact on their organization’s financial statements. Some are aiming to become fully funded and prepared for a full risk transfer, while others are comfortable maintaining the plan on the balance sheet. The investment strategy that is most appropriate for fulfilling these various objectives can be quite different. Aside from ensuring that the strategic asset allocation is appropriate for the institution, ongoing risk management is an important part of the value we bring. In fact, for some of my clients, hiring us to create and implement a sophisticated liability hedge and/or de-risking plan was an even more important priority than the potential to generate excess returns.

We believe one distinction with Cambridge Associates’ model is the way specialized expertise is embedded into the OCIO team directly. These specialists, such as an actuary or an alternative assets specialist, are important for both risk control and portfolio optimization purposes, as pension liabilities and investment opportunities may change quickly and unexpectedly. If material changes to interest rates, funded status, regulations, markets or other risk factors occur, the investment team is able to understand the plan implications of these changes. I can then refine the portfolio accordingly. In my experience, this type of integrated team structure allows me to reflect changes in the portfolio in a timely manner.

What do you think are the key components of a successful OCIO relationship?

Many factors can drive a successful OCIO relationship, but ultimately, I believe that the three most important factors are:

- A strong partnership. One that is established early on and cultivated over time.

- Role clarity. A clear division of labor and responsibilities, combined with well-defined metrics for success.

- Trust. All parties should have confidence in the partnership’s long-term plan.

The partnership should be established early in the relationship while devising the strategic asset allocation. This helps ensure that the return objectives, risk parameters, liquidity considerations, and any sponsor-specific enterprise considerations are fully analyzed and understood when developing the investment strategy and building the investment portfolio. In short, I believe that the investment strategy should reflect the goals of the plan sponsor, and our implementation should help realize them.

Clarity on roles, responsibilities, and success metrics is essential between the OCIO and all plan stakeholders. Setting expectations for which decisions are made only by the OCIO (for example, manager selection) and those that are made by the sponsor (for example, the strategic asset allocation, benchmarks, and risk parameters—often with input from the OCIO) will help ensure productive ongoing dialogue to keep the portfolio on track to meeting the sponsor’s objectives. Additionally, discussing up front what success looks like over the short and long term, and how that success can be measured, provides the sponsor with a framework to evaluate the OCIO.

Finally, having conviction in your plan and maintaining a long-term mindset is critical for success, particularly during periods of heightened volatility or market stress. For this to happen, trust in your OCIO as well as in your strategy is paramount, and this can be fostered in many ways. Our clients, for instance, take comfort in the fact that we do not earn revenue from investing in certain managers, or have other business agendas that would interfere with our clients’ best interests. Therefore, all of our investment decisions are made only because we believe they will result in what is best for the client and their portfolio. An OCIO also should provide full transparency on portfolio activity, exposures, and performance that can provide the sponsor with comfort that the OCIO is adhering to established risk guidelines and on track to meet return objectives. Furthermore, the OCIO can provide education to the plan sponsor on topics that may be unfamiliar, giving the sponsor a look “behind the curtain” to better understand the OCIO’s decision-making process and rationale for portfolio decisions.

OCIO Client Case Studies

To illustrate the diverse set of plan scenarios where an OCIO relationship can be beneficial, Sona drew on her client experiences to share the following high-level case studies. Although based on real client work, each example has been kept anonymous out of respect for client confidentiality.

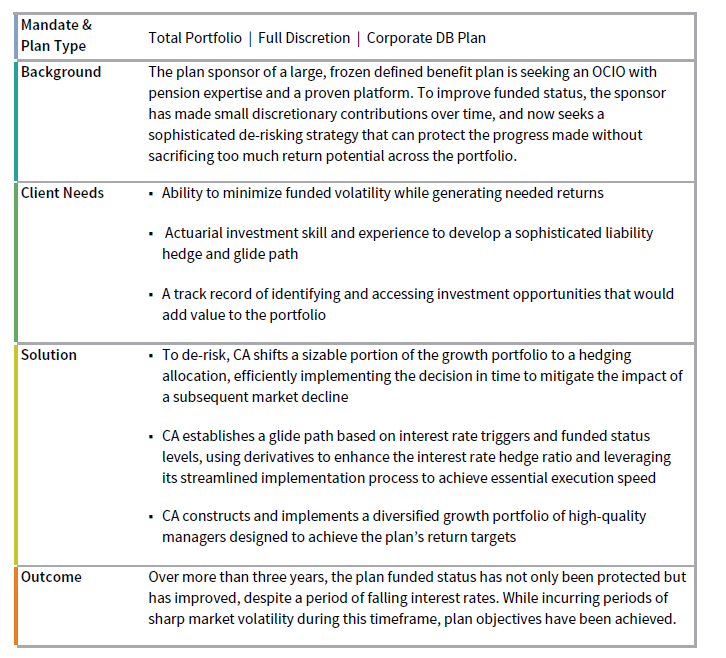

Case Study #1: De-Risking to Protect Funded Status Improvements While Continuing to Grow

Source: Cambridge Associates LLC.

Note: The narrative has been fictionalized to ensure anonymity, but is based on actual client work.

Case Study #2: Realizing the Differing Objectives of Multiple Investment Pools While Ensuring Capital Efficiency

Source: Cambridge Associates LLC.

Note: The narrative has been fictionalized to ensure anonymity, but is based on actual client work.

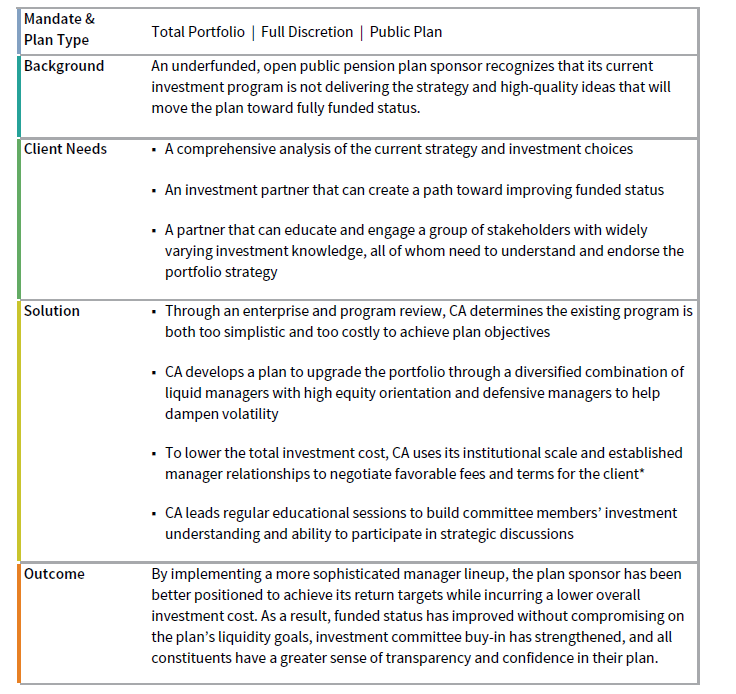

Case Study #3: Achieving Growth for an Underfunded Plan Without Sacrificing Liquidity

* Cambridge Associates negotiates on behalf of discretionary clients; for CA clients with non-discretionary relationships, fee, access, minimum, and other preferential terms are offered at-will. Cambridge Associates does not provide legal or tax advice. CA does not benefit nor receive compensation from managers in negotiated situations. All economic benefits accrue to our clients directly. Does not reflect the complete scope of feedback and influence on terms. Terms may not be available to all CA clients; may be contingent on certain criteria such as client type, investment amount, or aggregate CA capital invested with a manager or in a specific product; and are subject to change at the manager’s discretion. Managers may cease any such concessions at any time unless formal documentation between the manager and the client(s) has been executed.

Source: Cambridge Associates LLC.

Note: The narrative has been fictionalized to ensure anonymity, but is based on actual client work.

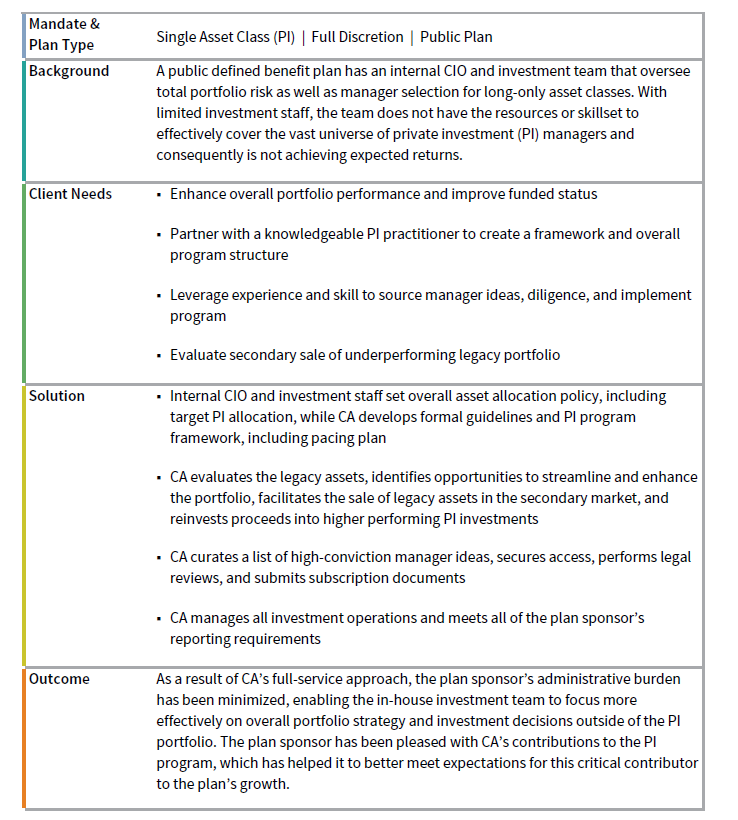

Case Study #4: Restructuring a Plan Sponsor’s Underperforming Private Investment Portfolio

Source: Cambridge Associates LLC.

Note: The narrative has been fictionalized to ensure anonymity, but is based on actual client work.