VantagePoint: Jumpstarting the Energy Transition

This year may prove to be pivotal in the transition from fossil fuels to renewables. Policy makers, businesses, and investors are accelerating commitments to bring greenhouse gas (GHG) emissions to net zero by 2050. The aim is consistent with the 2015 Paris Agreement to “limit global warming to well below 2°C, preferably to 1.5°C, compared to pre-industrial levels.” 1

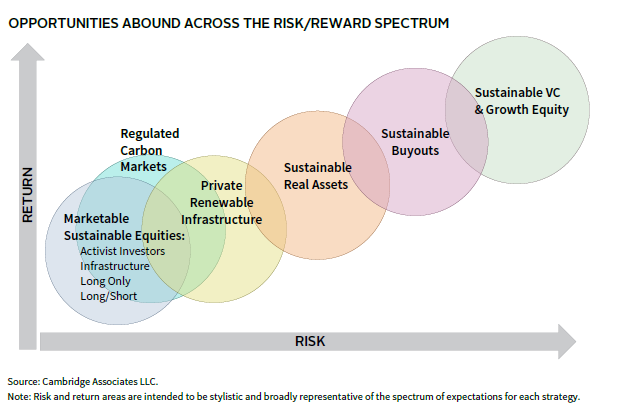

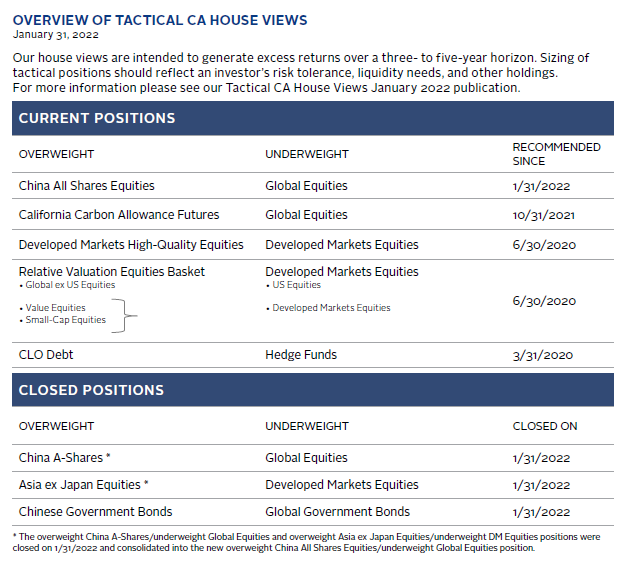

At the same time, technological advancements and the economics of scale have reduced and, in some cases, eliminated the cost difference between renewable energy solutions and conventional technologies. In this edition of VantagePoint, we look at the drivers of the energy transition and potential disruptive implications for various industrial sectors and companies, as well as explore the opportunities this transition may present. We believe the energy transition is creating attractive opportunities across the risk/reward spectrum. To benefit, investors must focus on active managers with specialized industry skills that are attuned to a broad set of dynamics, including technological trends and socio-political winds. Among available opportunities, clean tech stands out, while evolving regulated carbon markets offer attractive return prospects and diversification characteristics.

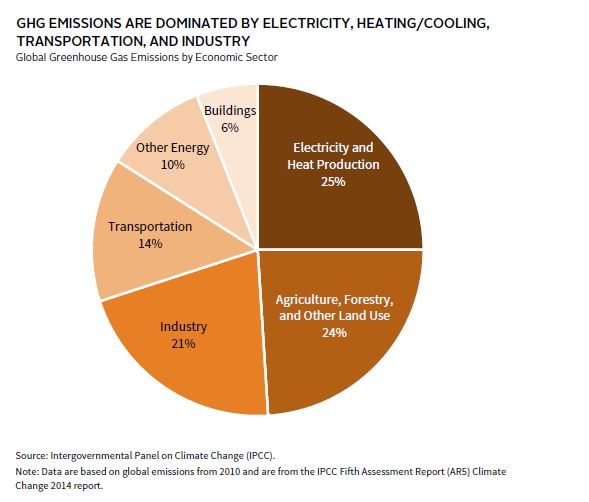

Decarbonization Starts With Electricity, Heating, and Transportation

Two-thirds of GHG emissions come from burning fossil fuels for buildings (electricity and heating/cooling), transportation, and industry, with the remainder coming from agriculture, deforestation, and other sources like fuel production. Commercial solutions exist for reducing GHG emissions in some sectors. Given this, a consensus is forming that the best strategy to reach net zero emissions by 2050 is to invest in areas with proven technologies that, when scaled, can reduce fossil fuel–related emissions, and to pursue innovative strategies to solve more challenging problems.

To date, technologically easier-to-solve high-impact areas, like power and automobiles, have attracted the lion’s share of investment. These areas will continue to attract large investment inflows, but focus will expand to include more challenging themes (e.g., green hydrogen, lower-carbon cement, and primary steel manufacturing processes). There is plenty of research targeting these challenging areas, but investment will escalate as commercial solutions are identified.

Ethical considerations for the developing world are an additional challenge. The developed world and some emerging markets, like China, will invest most heavily in decarbonization solutions and emerging markets will adopt such technologies once they become cost effective. As the world moves from an extractive to a regenerative economy, the transition must be inclusive and equitable, and include workers and communities in developed and most emerging markets that currently focus on extractive businesses. Absent a strategic focus, public support for the transition will naturally fade, diminishing prospects for both transition progress and investment returns.

The How & Why of Energy Transition

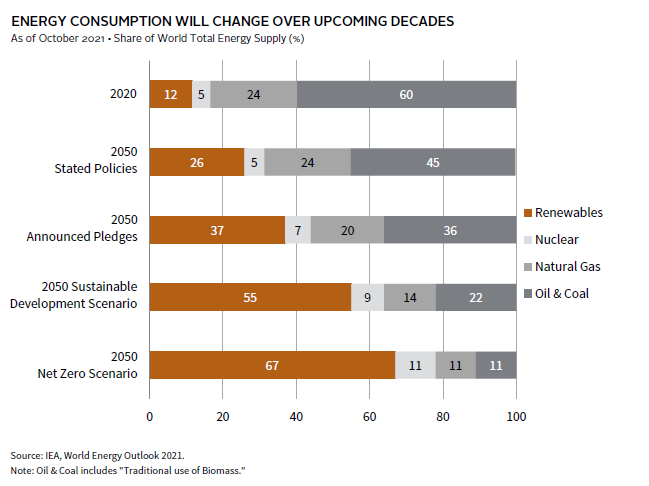

Potential paths for the energy transition are numerous. One variable is the pacing of required investment. Some estimates put the required global annual investment needed to reach net zero at between $2.5 trillion to $3 trillion per year over the next decade, and around $50 trillion cumulatively by 2050. Another is political support, which may wax and wane subject to variables like commodity prices and utility bills. Further complicating matters is the changing supply/demand dynamic. The energy transition is occurring as developing economies increase their share of demand. Meanwhile, the share of global supply from hydrocarbons has been relatively steady at around 80% to 90% for the past couple of decades, but is expected to decline in the decades ahead.

The International Energy Agency (IEA) estimates how primary energy demand would evolve over time under four scenarios: current stated policies, announced pledges, a sustainable development scenario where net zero is delayed, and a path to net zero emissions by 2050. The net zero scenario has been criticized both for being too reliant on nuclear energy and fossil fuels with carbon capture and for being an unrealistic pipe dream. The reality is that any path to net zero emissions by 2050, in line with Paris Agreement objectives, will require an unprecedented and extremely ambitious energy transformation.

Policy initiatives will accelerate the transition. The EU has launched a series of initiatives collectively dubbed the “European Green Deal” that include public and private spending commitments totaling about €1 trillion over the next decade on areas such as offshore wind and green hydrogen. The United States recently passed a $1 trillion US infrastructure bill that included funding for electric vehicle (EV) charging stations, zero- and low-emission buses, and tens of billions to upgrade the power grid. In 2020, China (the world’s largest emitter of greenhouse gases) pledged to become carbon neutral by 2060, and in 2021, launched its own cap and trade scheme.

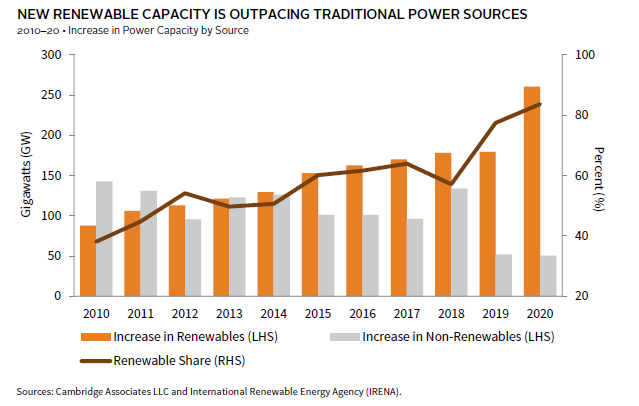

Government support and improving economics have in turn boosted private sector investment in the energy transition. Over the last decade, technological advances and scale mean the cost of power generated by renewables has plunged, making sources like onshore wind and utility-scale photovoltaic (PV) panels increasingly competitive with fossil fuels. The result is that the level of global renewable power generation has increased by almost 400% over the last two decades and the majority of new power generation capacity has come from renewables in recent years.

Investors are increasingly engaged in the energy transition through a variety of initiatives, such as the Glasgow Financial Alliance for Net Zero, the Net-Zero Asset Owner Alliance, and the PRI Net Zero Investment Consultants Initiative. Banks are also committing to transition their lending and investment portfolios to net zero by 2050, in part spurred by central banks, some of which are mandating they run climate-related stress tests on loan portfolios. Finally, disclosure laws—which serve to highlight a fund’s commitment to sustainability—will discourage investments in fossil fuels, including the EU’s Sustainable Finance Disclosure Regulation (SFDR) and proposed SEC rules on climate-related risks.

Rapid Transition in Renewables and EVs Create Opportunities and Risks

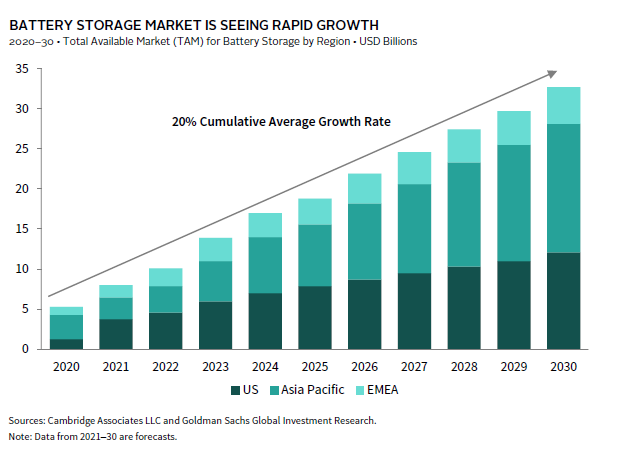

While the energy transition may take decades, some sectors are already seeing rapid technological advances and resulting cost declines that provide a growing opportunity for both current and new incumbents. The utility sector is at the epicenter of the energy transition and will see increased demand from the electrification of homes, business, and transport. Many utility companies are adding new generation capacity through turbines and PV panels, and some are also developing battery storage technologies.

Industrial companies help supply the necessary equipment for electrification, including power generation equipment, such as turbines and PV panels. Electrical equipment makers that provide infrastructure equipment—such as switches, transformers, and meters—are positioned to benefit, as are leaders in battery manufacturing and related software. The price of utility-scale battery storage dropped 70% between 2015 and 2018 and may drop another 45% by 2030. Still, further enhancements are needed in energy density, storage capacity, and battery longevity. One risk for companies involved in the battery supply chain is input costs. Production of key inputs, such as lithium and cobalt, is currently concentrated and often subject to geopolitical risk, though there may be medium-term mitigants, such as the opportunity to recycle some materials.

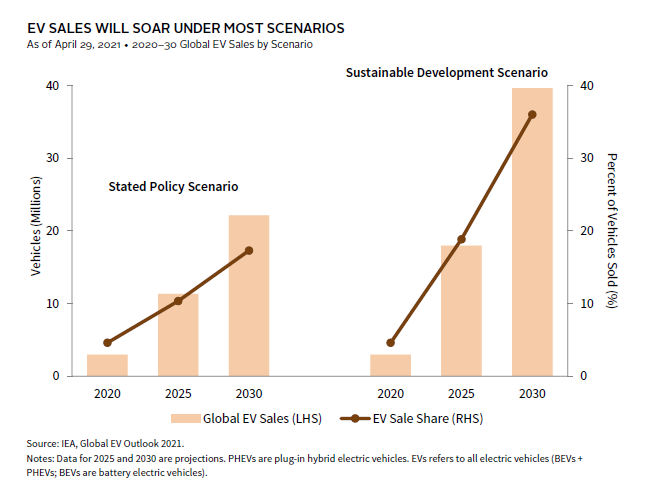

The rapidly growing EV market is another area of both opportunity and risk. The estimated 6.3 million EVs sold in 2021 represented less than 10% of the global total, but as consumer choice expands, battery range increases, and costs drop, their share could reach 30% by 2030. In part, this growth has been spurred by policy developments and subsidies, but in some segments non-subsidized all-in costs of driving EVs are already competitive with similar internal combustion engine (ICE) models. Car makers have taken notice and are expected to spend more than $500 billion on the development of EVs and related products (e.g., batteries) by 2030. Inevitably, there will be winners and losers, as traditional business models evolve (e.g., EVs lower servicing costs) and some manufacturers misjudge the speed or nature of shifting consumer demand.

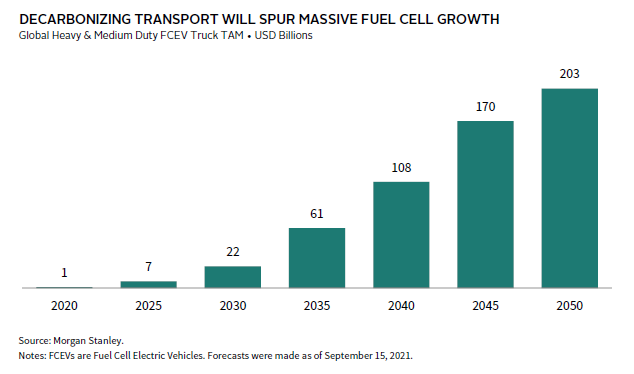

Commercial transport is also changing. Less than 1% of global van and truck sales were zero-emission vehicles in 2021, but this number is expected to increase dramatically as new EV models roll out over the next decade. Fuel cell technology, which could be used to power heavy transport vehicles, is steadily advancing.

The energy sector faces significant challenges from the transition, and companies are responding in a variety of ways. Many upstream companies have cut overall cap ex in recent years, improving capital returns to shareholders. In addition, some traditional energy companies are increasing investments in energy transition initiatives, such as green hydrogen, wind, charging stations, and biofuels. However, longer term, investors must consider that such companies face significant transition risks.

Aligning with Investment Opportunities

For the energy transition to occur at the speed and scale required to avoid the worst climate conditions, there needs to be:

- Innovation in new technology and business models (often expressed in venture capital);

- De-risking and scaling of those disruptive technologies and models (expressed in growth equity, buyouts, public equities, and more opportunistic infrastructure); and

- Large-scale deployment of capital in proven technologies/models (expressed in large buyouts, public equities, and core/core+ infrastructure).

Across these three dimensions, active managers with a broad perspective are best positioned to deliver both impact and performance for several reasons. One is that the energy transition will create winners and losers across sectors. For example, some utilities will successfully invest in clean energy production and see attractive returns on investment, but others may face high costs from decommissioning legacy assets or making poor capital allocation choices. Meanwhile, the growth of EVs will result in increased competition to current dominant players as traditional car companies invest heavily to compete. At the same time, opportunities will shift along supply chains.

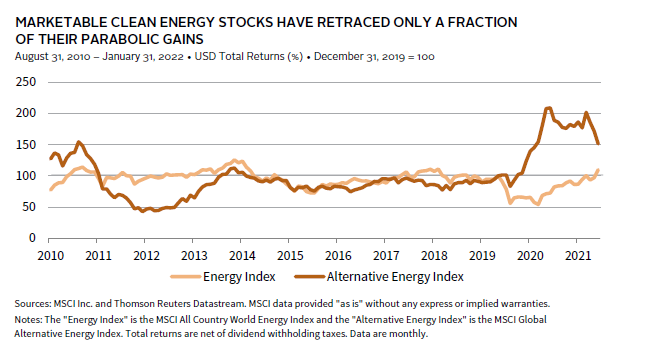

Active managers may also be best positioned to understand how surging ESG fund flows may impact valuations. Passive vehicles are typically valuation-agnostic, and strong inflows can boost valuations for companies whose profits may be many years in the horizon, jeopardizing returns if marketplaces change in unexpected ways. While this is a threat for all types of companies, it seems pronounced for clean energy plays whose market caps (and valuations) have exploded in recent years. Meanwhile, fund outflows and shareholder pressure on traditional energy companies have cheapened their valuations and discouraged investment in traditional hydrocarbon production, elevating the risk of price spikes. Recently, share prices of traditional and renewable energy companies have converged to some degree, although valuations have not.

Investment opportunities are pervasive across public and private markets. While some of the utilities and industrials at the epicenter are publicly traded, many emerging technologies are being created by smaller companies and start-ups that may be best accessed through venture capital and growth equity. Similarly, in areas like the production and distribution of green hydrogen, large companies are participating, but private infrastructure funds may be the best way to gain targeted exposure.

Further, companies (and managers participating in these markets) must have specialized knowledge to be successful in these transition businesses. For example, venture capital firms with proven success in developing software companies may be less skilled in technologies such as battery storage, or related geopolitical risks. Similarly, experience investing in private fossil fuel infrastructure may not be relevant to sustainable infrastructure as the development and financing risks are quite different.

Finally, an important aspect of the net zero transition is to engage with companies to encourage real-world movement toward lower GHG emissions. This can be done through activist managers, but we see a broader application for all active managers to engage with portfolio companies. While results may take time, a growing number of fund managers across asset classes are employing engagement as part of their ESG strategies.

CleanTech 2.0

Clean tech investments are critical in driving innovation and commercialization of next-generation solutions. 2 This market has evolved considerably since the early days of disappointing returns. Recent returns have been competitive with venture capital and private equity broadly, even as our clean tech universe includes some lower-return strategies like renewable infrastructure.

Those investors familiar with clean tech through the early 2010s know of the industry’s growing pains. Upstream renewable subsectors, such as solar panels and biofuels, were crushed by excess capacity. Since that time, operating costs have fallen, supporting increases in profit margins. Further, the scars of the CleanTech 1.0 era provided a laboratory for some managers and management teams to develop.

Today, we see a steady flow of managers investing in innovative solutions to address climate change, often with an eye to benefitting those communities most affected by climate change and the energy transition. Opportunities in recent years have included companies developing electric aviation technology, nuclear fusion technology, energy efficiency solutions, and technology designed to improve performance of autonomous vehicles.

Carbon Credits are Another Way to Play

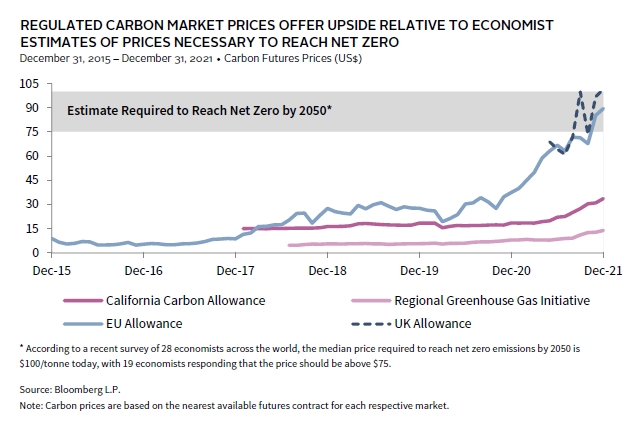

Regulated carbon allowances, also known as cap and trade programs or emission trading systems (ETS), are designed to encourage companies to reduce CO2 emissions by placing a cap on them that declines over time. We believe a number of these ETS markets offer performance competitive to global equities with some diversification characteristics. Entities covered by such programs are required to purchase carbon allowances at auction or in the secondary market to cover emissions beyond set thresholds, while entities with excess carbon allowances can sell them in the secondary market. Governments reduce available carbon allowances over time, creating scarcity that drives carbon prices up.

Regulated carbon markets differ substantially, and investors should carefully evaluate these markets’ characteristics to understand the opportunities. Carbon prices associated with these programs have increased most significantly when allowance supply falls below demand and when program objectives tighten, leading to reductions in new and/or existing supply. 3 While these programs are designed to create scarcity, carbon prices can decline if demand drops.

We currently favor the California Carbon Allowance (CCA) market, given its broad scope of emissions coverage, attractive design features, and expectations for annual supply to move into deficit later this year. While prices have increased significantly in recent months, the CCA price still trades at a discount to estimates of the price needed to hit global emission reduction goals. 4 All major ETS markets are expected to see allowances decline faster than current rules require in order to meet increasingly tight emissions reduction goals. Investors can participate in these markets directly through buying physicals (if registered to do so), futures, or exchange-traded funds.

Conclusion

Investors, businesses, and policymakers alike are committing to net zero emissions by 2050 at an accelerating pace, while technological advances and economics in sectors, like renewable energy and EVs, are reaching more competitive functionality and cost. Even as the energy transition gains speed, we are still in the very early days and anticipate a long and disruptive transition. Along the way, risks and opportunities will develop, starting with proven technologies as they disseminate and moving to more innovative technologies.

Active managers attuned to a broad set of dynamics, including technological trends and socio-political winds, will be best positioned to benefit from the transition. Opportunities will cut across public and private managers as even established incumbents (e.g., utilities and major ICE manufacturers) are investing heavily and evolving their business models to meet the realities of a net zero future. Engagement with managers will also be key in unlocking value from portfolio companies and making real progress toward net zero as a means of encouraging and compelling companies across all economic sectors to find their way in a net zero future.

Celia Dallas, Chief Investment Strategist

Wade O’ Brien, Managing Director, Capital Markets Research

Joe Comras and Liqian Ma also contributed to this publication.

Index Disclosures

CA Clean Tech Company Performance Statistics

As of June 30, 2021, Cambridge Associates (CA) screened over 107,000 investments held by over 8,500 funds to identify clean tech investments. CA includes companies and projects in the clean tech sector if they (1) develop non-fossil fuel energy sources, (2) promote industrial efficiency by conserving resources and replacing existing processes with less-polluting alternatives, (3) recycle waste efficiently, or (4) provide a product or service that creates an environmental improvement. The full report is published quarterly and can be found at http://www.cambridgeassociates.com/private-investment-benchmarks.

MSCI All Country World Energy Index

The MSCI All Country World Energy Index includes large- and mid-cap securities across 23 developed markets (Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States) and 25 emerging markets countries (Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates). All securities in the index are classified in the Energy as per the Global Industry Classification Standard (GICS®). The MSCI ACWI Energy Index was launched on Sep 15, 1999. Data prior to the launch date is back-tested data (i.e., calculations of how the index might have performed over that time period had the index existed). There are frequently material differences between back-tested performance and actual results. Past performance—whether actual or back-tested—is no indication or guarantee of future performance.

MSCI Global Alternative Energy Index

The MSCI Global Alternative Energy Index includes developed and emerging markets large-, mid-, and small-cap companies that derive 50% or more of their revenues from products and services in alternative energy. The MSCI Global Alternative Energy Index was launched on Jan 20, 2009. Data prior to the launch date is back-tested data (i.e. calculations of how the index might have performed over that time period had the index existed). There are frequently material differences between back-tested performance and actual results. Past performance—whether actual or back-tested—is no indication or guarantee of future performance.

Footnotes

- GHG emissions consist primarily of carbon dioxide (CO2) emissions. Measures of GHG emissions are expressed as CO2 equivalents. Our references to net zero emissions are a shorthand for net zero GHG emissions.

- We define clean tech to cover a wide range of venture capital and growth equity strategies investments, ranging from renewable power manufacturing and development to energy optimization solutions (e.g., smart grid technologies, efficient lighting, and energy storage) and resource solutions (e.g., waste and recycling, emissions markets and controls).

- Most recently, in early 2021, the EU’s new Fit for 55 initiative announced a goal of reaching a 55% reduction in emissions relative to 1990 levels by 2030, up from the previous 40% target. As part of the effort to achieve this objective, the EU ETS carbon allowance linear reduction factor was nearly doubled to 4.2% a year, helping boost the price of carbon on the exchange by more than 120% in 2021.

- The price required to hit global emissions goals is clearly an estimate, but according to a recent survey of 28 economists across the world, the median price required to reach net zero emissions by 2050 is $100/tonne if the price were to change right away, with 19 economists responding that the price should be above $75.