US Real Estate Faces Challenges, But Opportunities Exist

Investors are understandably concerned about US commercial real estate (CRE), given the rapid changes in interest rates since the beginning of 2022 and the recent banking sector stress. Indeed, the Federal Reserve now expects a recession, which we anticipate will lead to declines in real estate prices in the near term. In the medium term, however, we think that secular tailwinds will continue to benefit select real estate sectors, such as industrial, multifamily housing, and some niche segments.

Furthermore, we do not think that the current environment presents a structural problem with CRE, which is not immune from recessionary pressures, but typically performs well during the early recovery phase of the cycle. Indeed, US real estate investment trusts (REITs) have outperformed broader US equities more than 80% of the time since 1975 during the early recovery phase. Thus, we think cyclical pressures will likely create opportunities in sectors we prefer and advise investors to selectively invest in these areas to benefit from a rebound during the recovery.

It is difficult not to be alarmed about CRE, given recent headlines. However, these are often referring to the office sector, which is both cyclically and secularly challenged by changes in consumer and business behavior. Disruption in the sector due to oversupply can create attractive distressed opportunities, but investors should look beyond a deep discount at acquisition and focus on the long-term outlook for the building (vintage, amenities, tenant mix, and the ability to lease up and to [re]finance the asset).

In this note, we will explain why valuations lag in the private sector, highlight the impact of current economic conditions on CRE thus far, outline why we do not think this is a repeat of the Global Financial Crisis (GFC), and share more detail on our sector views.

Private CRE Beginning to Show Cracks

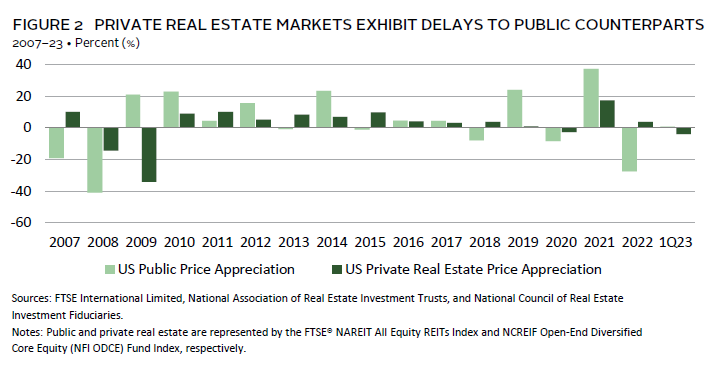

Without making any statistical adjustments to the data, one of the attractive attributes of investing in private CRE is that it is generally less volatile than its publicly traded counterpart—REITs. In fact, in 2022, private core real estate funds returned 7.5%, according to the NCREIF Fund Index – Open End Diversified Core Equity (NFI-ODCE), while US REITs returned -25%, according to the FTSE® NAREIT All-Equity REITs Index. This lower volatility meant the private NFI-ODCE Index has only had negative returns recently, returning -5.0% in fourth quarter 2022 and -3.0% in first quarter 2023.

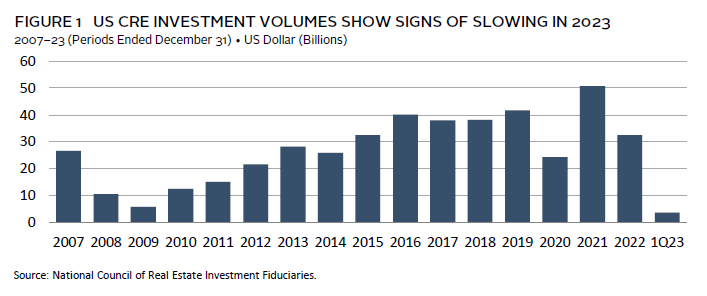

Transaction volumes have also slowed considerably since the Fed began raising interest rates. Historically, this has often been a precursor to value declines. Transaction volumes contracted by more than 35% in 2022, and year-over-year first quarter 2023 decreased 62%—reflecting ongoing price discovery and uncertainty about markets (Figure 1). Other indicators of CRE health, such as rent, net operating income (NOI) growth, and cap rates (the yield an investor expects to earn on an investment property), have also softened. Based on conversations with multiple industry participants, the overall consensus is that cap rates have expanded (meaning a decline in underlying asset values) by 100 basis points (bps) to 150 bps across all real estate sectors and may expand 25 bps to 50 bps more in 2023.

REITs are liquid and allow investors to swiftly express their sentiment of the asset class. However, while these movements may be directionally accurate, reflecting weakening fundamentals, they can be prone to overcorrections in times of investor panic, leading to higher volatility in public than private markets. On the other hand, private real estate valuations are slower to reflect change, as they rely heavily on healthy transaction volume to establish fair market values. Thus, as transactions become infrequent, private markets exhibit a lag in reflecting current market sentiment (Figure 2). We anticipate private asset values will continue to come under pressure as the economy slows, even if the average decline does not surpass what REITs’ valuations are currently implying.

The Banking Crisis in Context

Recent scrutiny of bank balance sheets has put a spotlight on the volume of CRE loans held by banks. Investor concern grew as it became evident that a record amount of CRE loan origination took place over the last three years, as borrowers took advantage of very low financing costs. Additionally, a record amount of CRE loans held at banks are maturing over the next two years. This exposes CRE to higher-than-normal refinancing and default risk, as banks begin to decrease lending volumes and add stricter borrowing terms (e.g., requiring additional equity injection into the asset). This may create opportunities for alternative sources of lending (i.e., direct private lending, bridge loans, private equity), but the financing terms will not be as accommodating as in recent years. Thus, we do think the cyclical downturn will present challenges to CRE owners’ ability to refinance assets, resulting in lower NOI (due to higher financing costs) and creating pockets of distressed selling.

Despite the temptation to draw parallels, we do not think this is a repeat of the distress seen in CRE during the GFC as the 2007–08 episode led to new regulations requiring more stringent lending standards for banks. For example, prior to the GFC, the average loan-to-value (LTV) ratio of underlying loans in the CMBS market was 70%, with approximately 60% of loans underwritten above 70% LTV. However, by 2019, average LTVs were down to 55%, with less than 10% of loans issued above 70% LTV. This gives banks considerable cushion to absorb declines in property values. Moreover, banks are more diversified now, with CRE loans accounting for only about 5% of total assets at large banks. 1 CRE loan concentration risk is also more manageable than in 2006, with only 13% of banks exceeding regulatory recommendation on CRE concentration thresholds as of fourth quarter 2022, compared to 31% in 2006. 2 Overall, we do not expect the banking system to face a systemic problem. Thus, even as tighter lending conditions may make it harder for CRE owners to access funding, we do not expect the scale of distress to be like the GFC.

Select CRE Opportunities During the Economic Slowdown

The CRE sector is diverse, with each segment driven by distinct factors, such as demographics, consumer preferences, and GDP. As such, opportunities may arise during a recession, which investors should be prepared to act on.

We remain optimistic on the industrial segment, where strong secular tailwinds remain. The segment has benefited from the growth in e-commerce and evolving consumer preferences, together with the supply chain disruptions and onshoring trends stemming from the COVID-19 pandemic. We think these supportive trends will sustain over the long term, but may soften during times of economic downturn and as new supply comes to market. Analysts at Green Street project industrial rents to generate an attractive 6.0% annual growth rate over the next five years, coming down from double-digit growth in recent years, but above long-term trends. Occupancy is also expected to remain heathy, at above 96%.

Another segment that we think will continue to demonstrate resilience is multifamily rental housing. The segment has begun to show some weakness as economic conditions soften and a massive wave of new supply comes to market in 2023 and 2024. Although rent growth is still above the long-term average, it slowed to 5% at the end of 2022 from double-digit highs in 2021. On the supply-side, the pullback in lending will result in a decline in new apartment starts, so any period of oversupply will likely be short lived as there is still a deficit in US housing. With the ongoing shortage of housing in the United States, especially as mortgage rates approach high single-digits, making home ownership less affordable, we think the long-term outlook for the segment remains attractive.

Niche segments, such as self-storage and industrial outdoor storage, are also attractive for institutional investors. These segments share common characteristics of operating in fragmented markets, with a high share of small private owners, and have visibility to a runway of operational enhancements, improving profitability and asset quality.

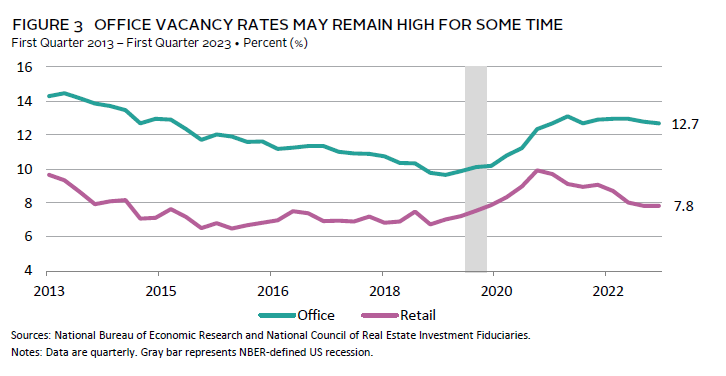

However, one segment of CRE where we think the problem goes beyond cyclical softening, and is secular in nature, is office. Vacancy rates have climbed as businesses allow employees to work-from-home, resulting in empty office buildings and foot traffic to business centers cut in half from pre-pandemic levels. Indeed, the office segment had been softening prior to the pandemic, due to its high-capital expenditure requirements, evolving tenant preferences for newer, more exciting, amenity-rich spaces, and softening NOI growth. Slowing demand has already changed behavior, with construction beginning to slow. This year will see less than 38 million square feet of new office space coming to market, which is 27% lower than the five-year average.

“Bifurcation” best describes the segment today, with varying levels of headwinds. Class-A and newer, more modern properties will likely see modest depreciation in value as demand remains strong, while owners of older buildings or in cities with excess supply likely have little to no negotiating power. Indeed, industry chatter suggests that some properties from the latter cohort trade for just land value. Similarly, performance in public REITs implies that private property values in office could fall by 30%–40%.

Interestingly, geographic disparity has been stark. Markets hit hardest by the slowdown in the technology sector have seen harsh drops in office values, with price per square foot in San Francisco more than 30% lower in February 2023 than its peak levels of more than $1,200 per square foot in December 2020. Miami, on the other hand, has seen the price of offices go up 1.5x since February 2020, as many businesses have chosen to move offices there.

The structural disruption in office is not unique. Retail serves as a good case study for office on how a sector is disrupted when consumer behavior changes drastically, creating unique opportunities. Grocery-anchored and street retail demonstrated resilience, while suburban shopping malls of older vintages continued to struggle. Successful retailers adapted to new shopping behaviors by reformatting and upgrading their tenant mix to prioritize services. Similarly, office owners will need to upgrade or repurpose their assets to their highest and best use. However, we recognize that in the near term, access to financing these projects is challenging.

During the pandemic, vacancy rates deteriorated for both sectors. However, conditions improved considerably in 2022 for retail, while office lagged. It may take some time before we see a meaningful reversal in office vacancy rates, especially since “actual” vacancy rates are higher, when you consider the increased space available for sub-lease (Figure 3).

Selective Investors Will Be Rewarded

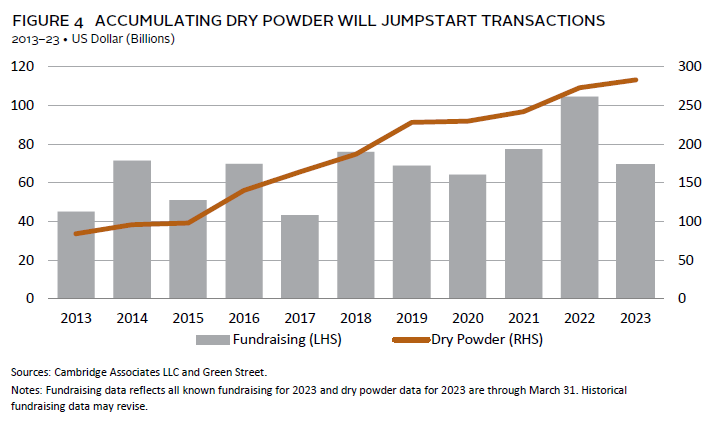

With record fundraising and decreased transaction volumes, we estimate that more than $280 billion of uninvested capital has accumulated in funds, which is 3x more than 2013 levels (Figure 4). As defaults increase, this dry powder will likely jumpstart transactions, helping to minimize the decline in valuations across the CRE sector.

We advise investors to keep the pace of commitments consistent with their policies. In a diversified strategy, we favor managers with flexibility to invest across the capital stack. In the current environment, with limited liquidity, debt can offer downside protection and generate equity-like returns.

Conclusion

Commercial real estate is not immune to economic cyclicality, and we think the sector will be challenged through an economic downturn. Property write-downs, slowing rent growth, and difficulty in accessing funding will depress returns in the near term. However, we do not think these issues will last beyond a recession—except for the office sector, where secular headwinds will likely take longer to abate. As such, we expect most CRE to recover alongside an economic expansion. Investors with the ability to conduct in-depth due diligence will benefit during this time of uncertainty and should be rewarded over the long term.

Maria Surina, Senior Investment Director, Real Assets

Sehr Dsani, Investment Director, Capital Markets Research

Patrick Michaud, Investment Associate, Real Assets

Graham Landrith and Ilona Vdovina also contributed to this publication.

Index Disclosures

FTSE® NAREIT All-Equity REITs Index

The FTSE® NAREIT All Equity REITs Index is a free–float adjusted, market capitalization–weighted index of US equity REITs. Constituents of the index include all tax-qualified REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property.

NCREIF Fund Index – Open End Diversified Core Equity (NFI ODCE)

The NCREIF Fund Index – Open End Diversified Core Equity (NFI-ODCE), is an index of investment returns of the largest private real estate funds pursuing lower risk investment strategies utilizing low leverage and generally represented by equity ownership positions in stable US operating properties diversified across regions and property types. The NFI-ODCE has been widely used since 1978 to track institutional core private real estate returns.