2026 Outlook: Portfolio-Wide Views

Investors should embrace diversification in 2026

by Kevin Rosenbaum

Many investors have seen the share of their portfolios invested in equities—both public and private—increase over the past decade. This shift was fueled partly by the maturation of private investment asset classes, the growth of passive investing, and low bond yields that accompanied extraordinary fiscal and monetary stimulus, all of which contributed to robust equity returns and reinforced higher allocations. However, the landscape has changed meaningfully in that time. Elevated valuations, increased market concentration, and mediocre macroeconomic conditions underpin our view that equity risks are heightened. For investors whose equity allocations are at elevated levels, 2026 presents a timely opportunity to reassess policy allocations and embrace greater diversification.

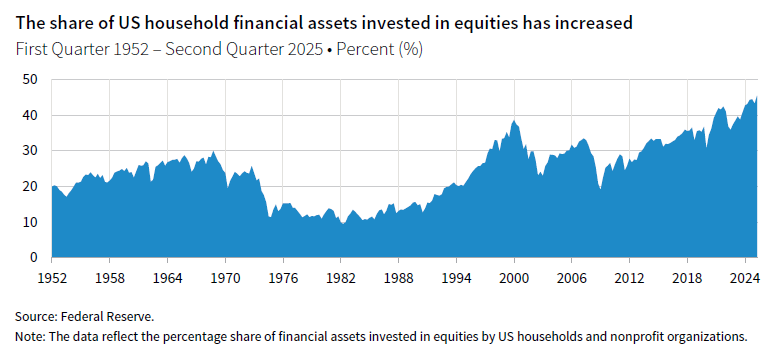

The upward shift in equity allocations is apparent across different investor types. For example, our analysis of a consistent group of 247 US endowments and foundations reveals that their average allocation to public and private equity increased from 51.7% in June 2015 to 64.8% in June 2025. This pattern is echoed among US households, who, according to the latest Fed data, held a record proportion of their financial assets in equities as of second quarter 2025. The magnitude of these changes suggests that many portfolios globally may now be less resilient to adverse market events.

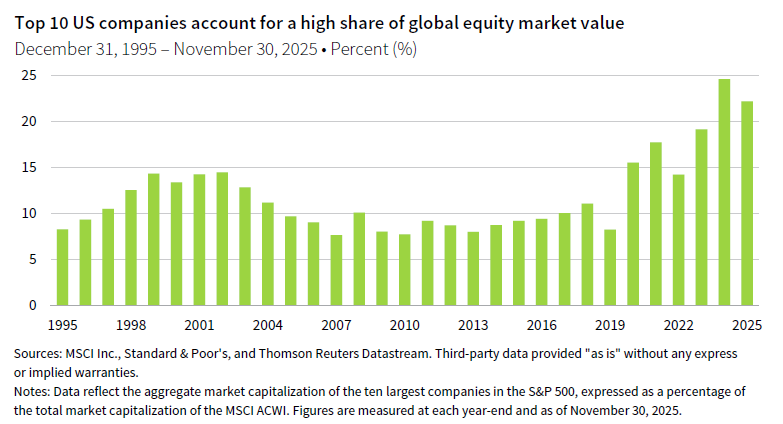

This shift has occurred as the likelihood of such an event has increased. Valuation measures across equities signal caution in virtually any way you look at them, reflecting both years of strong performance and the recent surge of enthusiasm around AI. The excitement surrounding AI has also contributed to greater market concentration, with the ten largest US companies now representing 22.2% of total global equity exposure—one of the highest levels on record. At the same time, recent data trends suggest that labor markets may be more likely to weaken than strengthen in the coming months, a development that often serves as a key indicator of the global economy’s direction. Collectively, these factors point to elevated idiosyncratic and systemic risks compared to historical norms.

To be sure, the future is uncertain. That uncertainty is why we seek diversified exposure rather than allocating solely to the next best-performing investment. While we cannot predict the future, we can assess the factors likely to shape the range of potential outcomes. In today’s environment, these factors point to a distribution of expected equity returns with a lower median than typical and greater negative skewness. Still, the possibility of an equity rally remains within that distribution, despite heightened risks. For long-term investors able to withstand volatility, or those facing substantial tax implications from reducing equity exposure, maintaining current allocations may be appropriate. However, for investors sensitive to drawdowns—due to spending needs, risk tolerance, or other constraints—now may be an opportune time to reassess equity allocations if they are currently elevated.

Any shifts in policy allocations should reflect not only the outlook for equities, but also the relative attractiveness of other asset classes. Assessing these opportunities requires weighing how new exposures align with portfolio constraints, enhance diversification, and offer potential for manager value add—considerations that are often unique to each portfolio. One area that merits consideration in the current environment is hedge funds. They can provide differentiated sources of return and help reduce drawdown risks, particularly as many strategies are adept at navigating market inefficiencies and macroeconomic uncertainty. In addition to the potential for compelling returns, a thoughtfully constructed sleeve of hedge funds, or broader diversifying strategies, can also deliver substantial value add. We explore our hedge fund perspective, along with considerations across other asset classes, throughout the rest of this publication.

Once policy allocations are set, investors may also identify tactical opportunities that further diversify risks and support value add. By broadening diversification and thoughtfully adjusting policy allocations, investors can strengthen portfolio resilience and better navigate changing market environments. As risks shift, so should our thinking.

Investors should lean into AI thoughtfully in 2026

by Celia Dallas

Artificial intelligence is rapidly emerging as one of the most significant disruptive transformations to the technology ecosystem, with the potential to reshape business models, drive productivity, and address demographic headwinds. The sector’s promise is substantial, but the current investment environment is marked by exuberance, with capital flowing into AI infrastructure and applications at an unprecedented scale. Investors must balance optimism with caution, seeking exposure that is both strategic and disciplined.

The four largest hyperscalers (Alphabet, Amazon, Meta, and Microsoft) are projected to spend $350 billion in capital expenditures in 2025, with cumulative investment reaching trillions over the next five years. This capex boom echoes historical technology revolutions—railroads, telecom, dot-com—where transformative innovation led to overinvestment, excess capacity, and ultimately poor shareholder returns for the builders. Today’s AI leaders are shifting from asset-light, high-ROIC models to asset-heavy, capital-intensive businesses, a transition historically associated with deteriorating fundamentals and lower free cash flow.

Valuations for core AI infrastructure stocks are elevated, and the competitive arms race among Big Tech resembles a prisoner’s dilemma: firms feel compelled to overspend to avoid losing market leadership, even at the expense of collective profitability. The risk is that inflated multiples and massive capex may not be justified by future growth, echoing the dot-com bust. Asset lifecycles are shortening, with rapid depreciation of AI hardware requiring faster returns and exposing investors to higher risk if growth slows. Funding quality is shifting, with more reliance on private credit and securitized finance. Additionally, the ecosystem’s “circularity”—where companies are simultaneously customers, suppliers, and investors in one another—can mask underlying demand and profitability issues.

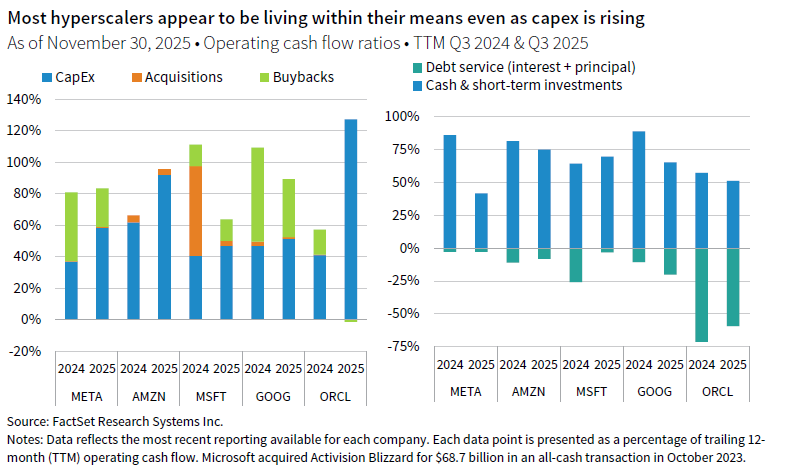

For now, most of the large public AI players have been living within their means, but operating cash flows are increasingly consumed by capex, share buybacks (in part to offset dilutive effects of share-based compensation), and acquisitions, all of which are strategic investments to remain competitive in this race to dominate the AI landscape. On average, capex accounts for 75% of cash flow from operations across these five companies, up from 45% in 2024.

Beyond the mega-cap tech firms, for companies broadly able to leverage the technology, AI is not just a source of top-line growth but also a powerful lever for cost reduction and margin expansion. Such opportunities are difficult to recognize at this stage of AI development, giving skilled managers with appropriate insights the potential to invest in such companies at relatively attractive valuations.

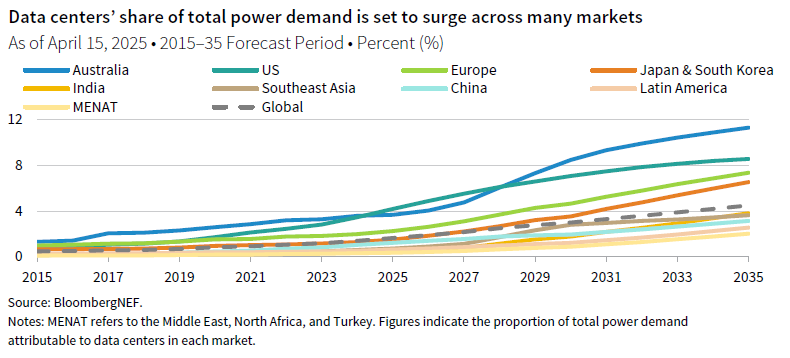

The buildout of AI physical infrastructure is creating new opportunities in power generation, grid modernization, and energy efficiency. As data centers and AI workloads drive up electricity demand, companies focused on improving access to power—whether through renewables, grid upgrades, or distributed energy solutions—stand to benefit. Even if AI promises are delivered more slowly than anticipated, such investments would still benefit from other electricity demand drivers like electrification of transportation and digitalization trends. These segments are essential to the sustainable scaling of AI and may provide more stable, diversified returns than the core technology providers.

Venture capital plays a critical role in the AI ecosystem, serving as the engine for innovation and disruption. Many of the most transformative companies of the internet era—such as Amazon and Uber—were venture-backed disruptors that redefined entire industries. Today, venture capital is fueling the next generation of AI innovators. These companies are often the source of breakthrough technologies and new business models that can reshape markets and create outsized value. However, the surge of interest in AI has led to a dramatic escalation in venture capital valuations requiring discipline to separate hype from legitimate opportunity.

AI’s investment frontier is rich with potential but fraught with complexity. The sector’s productivity and economic impact may take longer to materialize than current capex and valuations imply. Thoughtful AI exposure requires diversification beyond the largest AI-exposed names. Success will require partnering with skilled managers, maintaining price discipline, and staying adaptive as the landscape evolves. By eschewing hype, focusing on fundamentals, and diversifying exposure—especially toward asset-light early adopters, power and energy efficiency themes, and innovative venture-backed disruptors—investors can position themselves to outperform as the AI era unfolds.

Investors should invest across the electricity transmission food chain in 2026

by Simon Hallett

Much attention has been given to AI’s growing appetite for electricity and the resulting demands on grid capacity to support new, power-intensive data centers. However, AI is just the icing on the cake for an industry that, until now, was considered mature but is now poised for multi-year growth. Investors should prioritize cross-asset exposure to the expansion and modernization of electricity grids.

Grid operators need to build capacity and connect different locations at a pace not seen since the 1960s. This rapid expansion is straining supply chains for equipment and materials, leading to growing order backlogs and firm pricing for equipment manufacturers. At the same time, technological solutions are essential for operating smarter, more efficient grids that maximize existing capacity and seamlessly integrate multiple distributed and intermittent power sources.

Twin sustainability trends essential to a low-carbon transition are (1) the build out of renewables on global power grids, and (2) the expansion and redesign of grids to integrate this distributed power from new locations. This includes the addition of storage, load balancing, and “smart grid” technologies necessary to maintain stability with intermittent generation. These trends are deeply interconnected. As noted in a 2023 International Energy Agency (IEA) report, “Grids need to both operate in new ways and leverage the benefits of distributed resources, such as rooftop solar, and all sources of flexibility.”

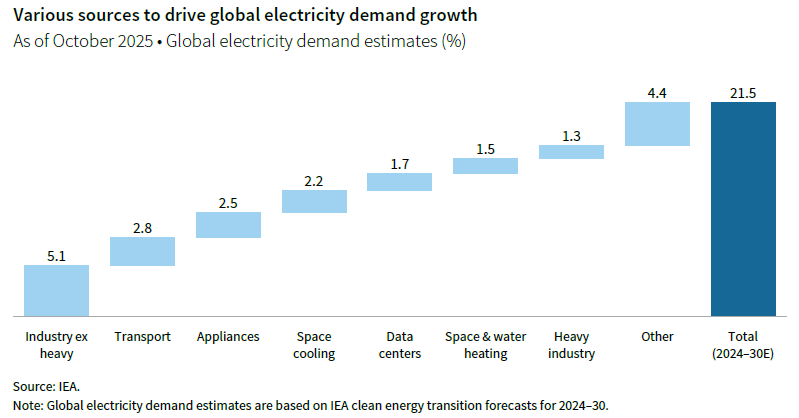

The changing nature of electricity supply is a major driver of grid investment, but rising demand is reinforcing this need. After years of flat growth—when efficiency gains largely offset increased usage—global electricity demand is now accelerating as more activities, such as transportation (notably electric vehicles), heating, and industrial processes, become electrified. The most widely discussed theme is the AI-driven surge in data centers, which require not only more power but also new connections to the transmission system in previously unserved locations. While there is some risk that advances in technology and efficiency could eventually render certain data centers surplus to requirements, the growth in electricity demand extends well beyond AI alone.

Meanwhile, electricity grids worldwide have suffered from years of underinvestment. According to the IEA, while investment in renewables has doubled since 2010, capital expenditure on grids has remained largely flat. As a result, grid operators are now playing catch-up. Both the IEA and BloombergNEF estimate that grid capex must double by 2030, requiring an additional $300 billion in annual spending.

This is good news for a range of players. Utilities can expand their regulated asset bases at an unprecedented pace. Equipment makers and contractors are building order backlogs several years long, as are gas turbine makers. The situation for wind turbine makers is less clear, given political and regulatory changes have caused a swath of project cancellations, but growing demand outside the United States is underpinning recovery. For us, the clearest and most robust opportunity from electrification is in the grid itself rather than generation, considering the combination of historic underinvestment, new technologies and the need to “re-wire” many developed countries to cope with a completely different pattern of supply/demand.

Investors can access this opportunity through thematic strategies spanning a wide range of assets, from infrastructure to venture capital. Public equity managers focused on the energy transition may invest in large industrial companies supplying grid equipment, as well as the utility operators building out the grid. Similar opportunities exist in private markets, including private infrastructure funds and select buyout managers. Venture and growth equity managers with transition expertise are also active, targeting grid-enhancing technologies and unlocking the potential of demand response and energy storage through digitalization. One risk to note is the recent surge in public market valuations for some large industrial stocks tied to grid spending. Public market investors may benefit from waiting for a pullback or being highly selective.

The expansion and modernization of electricity grids is a broad theme with several distinct, independent drivers. It is not solely about AI or renewables; rather, it encompasses a range of factors shaping demand and investment. Additionally, the long timescales for infrastructure investments and equipment lead times suggest this will remain a multi-year opportunity.

Investors should underweight the US dollar in 2026

by Aaron Costello

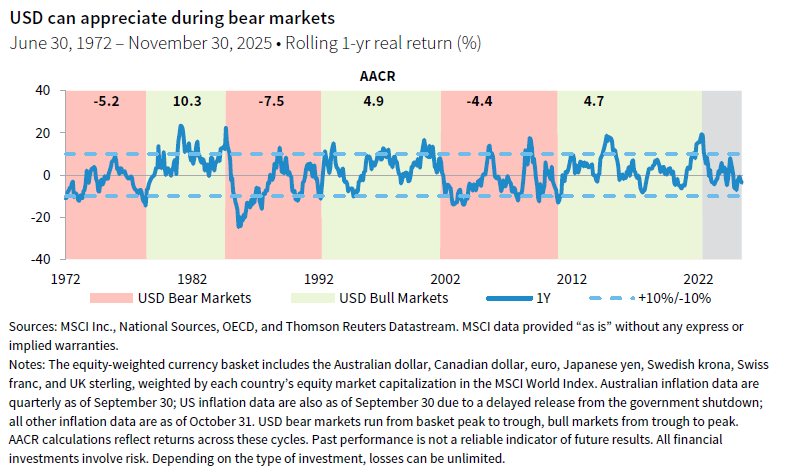

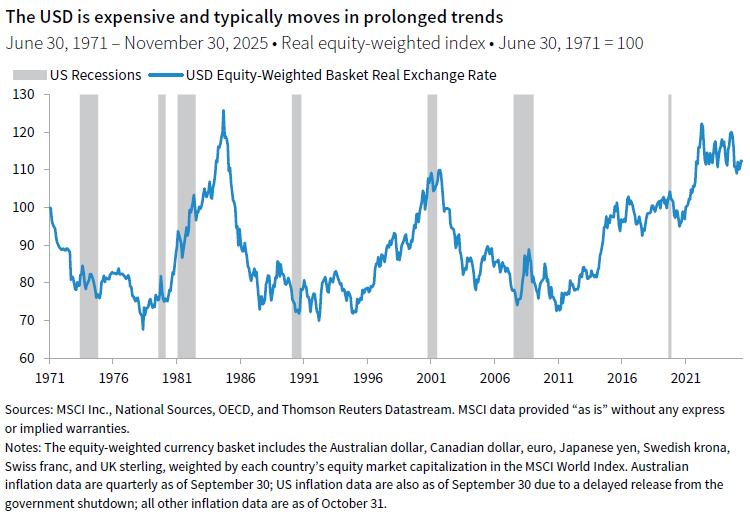

After experiencing a decade-long bull run that started in 2011, the US dollar (USD) weakened sharply in 2025, falling by 10% at one point. We believe the US dollar has begun a multi-year bear market, but given recent oversold momentum, we expect the dollar will rally at some point in 2026. This is consistent with historical trends, whereby the US dollar tends to stage a rebound after experiencing declines of 10% or more. However, we do not think investors should try to market-time any USD rebound, due to the inherent uncertainty in the duration of any such rally and the fact that the US dollar remains overvalued, with ample scope to decline over the coming years. Instead, investors should underweight the US dollar relative to policy targets and use any rebound as an opportunity to initiate or add to USD underweights, with non-US equities and unhedged non-US sovereign bonds as two potential implementation options.

For 2026, the US dollar could strengthen if US economic growth remains resilient relative to elsewhere. Indeed, non-US economic growth faces headwinds in 2026 as the boost from tariff front-running fades. Relatively stronger economic momentum in the United States would also place less pressure on the Fed to cut rates, resulting in higher US rate differentials versus elsewhere and lending support to the US dollar, a dynamic that has already started to play out in late 2025. Conversely, the US dollar has historically rallied at some point during a US recession, albeit sometimes only briefly. While a recession is not our base case, the US dollar could still jump amid a growth scare in the United States triggered by further weakness in the US labor market spilling over into lower consumption and investment.

But investors should not chase any such rally. This is because we expect the dollar to remain in a downtrend over a multi-year horizon. The US dollar still faces headwinds from economic policy uncertainty, overvalued assets, and fiscal sustainability concerns, factors that dampen the attractiveness of US assets relative to elsewhere and therefore demand for the US dollar. The US dollar has benefited from equity-related portfolio inflows and given the growing froth in US equity markets, anything that shakes confidence in the AI theme could see reduced flows and a weakening US dollar. While the US dollar has benefited recently from a reduction in Fed rate cut expectations, this could change over the course of 2026 as a new Fed chair (and potentially two other Fed governors) will be appointed by the Trump administration. These upcoming appointments may bias the Fed toward more aggressive easing and narrowing of interest rate support for the US dollar. Regardless of who chairs the Fed, lower interest rates and a weaker US dollar are a stated goal of the Trump administration to help narrow the US trade deficit and spur a revival of US industry.

Overall, we expect the US dollar will weaken. Counter-trend rallies are common amid multi-year USD bear markets and despite the recent decline, the US dollar remains 32% overvalued in equity-weighted terms. Non-US equities and unhedged non-US sovereign bonds have typically outperformed during USD bear markets, especially when relative valuations are in their favor, making them effective potential options for implementing a dollar underweight. While we acknowledge the likelihood of a USD rally at some point in 2026, investors should remain underweight the US dollar because of the scope for continued USD weakness over a multi-year horizon.

The MSCI World Index represents a free float–adjusted, market capitalization–weighted index that is designed to measure the equity market performance of developed markets. It includes 23 DM country indexes.

The S&P 500 Index includes 500 leading companies and covers approximately 80% of available market capitalization.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.