2024 Outlook: Public Equities

We expect global equity performance will be below its long-term median level, but we believe investors should hold equity allocations in line with policy targets. Within equities, we see opportunities in developed value, developed small caps, and China. We doubt European and emerging markets ex China equities will outperform, and we believe the share of active strategies that outperform will increase.

Global Equity Performance Should Be Below Median in 2024

Kevin Rosenbaum, Head of Global Capital Markets Research

Global equities face headwinds as we enter 2024. The most prominent headwinds stem from the interest rate changes we have seen in recent years. They have impacted corporate financing costs, economic growth expectations, and the relative appeal of equities versus fixed income. Taken together, we expect global equity performance will be below its long-term median of 15% in 2024. Still, we do not believe investors should underweight equities and overweight fixed income relative to policy allocations, as we see better tactical opportunities within equities and fixed income.

Financing cost changes are the direct channel in which interest rate changes impact corporates. But as it stands, global equity profit margins are expected to expand by roughly 50 basis points (bps) to 10.6% in 2024, despite higher financing costs and according to the consensus analyst opinion. While analyst expectations at the start of the year have little relationship with that year’s equity performance, how those expectations evolve during the year are informative. To us, the near-record profit margin estimate is vulnerable to downside revisions.

Economic growth expectation changes are an indirect channel in which interest rate changes impact corporates. Because we expect risks are skewed to either matching or missing the 2024 consensus global economic growth forecast of 2.7%, we suspect downward revisions to the 2024 consensus corporate sales growth expectation of 4.8% are more likely than upward revisions. Given global companies employ operational leverage, lower-than-expected sales growth would add additional pressure to profit margins.

Taken together, these factors act as headwinds to equities, which already have diminished appeal relative to fixed income. One such measure of relative appeal—the excess yield spread of real equity earnings over real bonds—recently compressed to the lowest level other than during the dot-com bubble and the Global Financial Crisis (GFC). But instead of underweighting equities relative to policy, we see opportunities within fixed income to add protection (i.e., long sovereigns) and within equities to allocate to segments where price levels have already adjusted to reflect difficult conditions ahead (i.e., small-cap and value equities).

Global Equity Market Volatility Should Increase in 2024

Sean Duffin, Senior Investment Director, Capital Markets Research

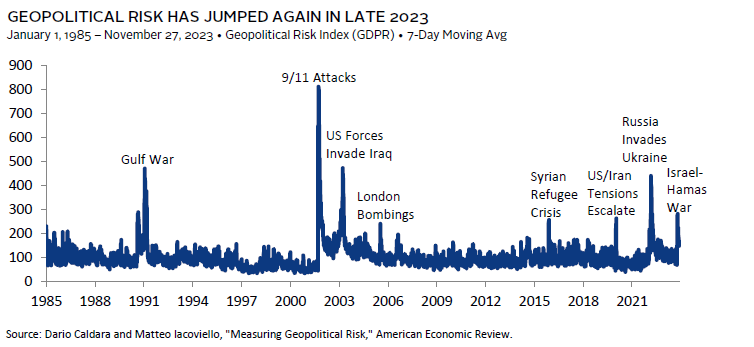

Equity volatility was relatively muted in 2023, even as markets contended with rising interest rates and the emergence and intensification of multiple geopolitical conflicts. These unresolved conflicts, coupled with the lagged impact of higher central bank policy rates and the polarized US political environment, will spell more volatility for equities in 2024.

Global policymakers continue to walk a fine line balancing economic stability with reining in inflation. Thus far, rate hikes have not caused significant economic pain, as economic data have generally held up better than feared. But key inflation rates remain above central bank targets. While we expect most major central banks will cut rates modestly in 2024, a policy or communication misstep is a key risk. Such a scenario would be sure to unsettle equity markets.

Beyond rates, military conflicts loom ominously over global markets. The ongoing war in Ukraine stands as the most significant military confrontation in Europe since World War II and has escalated for nearly two years. Moreover, violence erupted in the Middle East when Hamas initiated an attack on Israel in October, raising the specter of a prolonged conflict. Both conflicts have already taken a devastating human toll, and while we hope both conflicts resolve themselves peacefully, the unfortunate reality is that they could worsen.

Tensions between the United States and China remain strained. Trade and financial decoupling between the world’s two largest economies has intensified in recent years, bringing with it the potential for further disruption of supply chains and corporate profits. This trend is unlikely to reverse soon, given the bipartisan US stance on China. Escalating rhetoric or punitive measures could trigger more significant market jitters next year.

US presidential elections will introduce another wave of political uncertainty. The prior election highlighted the deep polarization of American politics and culminated in unprecedented federal charges of election interference against the former president. The pending legal aftermath of those events is likely to become clearer in 2024 and could prove disruptive to the election process. Investors dislike uncertainty, and this sort of disruption could increase equity market volatility in the run up to the November election.

Developed Value Equities Should Outperform Developed Equities in 2024

Sean Duffin, Senior Investment Director, Capital Markets Research

2023 was another disappointing year for value investors, as the MSCI World Value Index trailed the MSCI World Index for the 12th time in the past 15 years. Value indexes saw their margin of underperformance widen as a subset of tech-related growth stocks surged in tandem with the artificial intelligence (AI) boom this year. Despite this, we see several reasons to believe value stocks will outpace broader equities in 2024.

Value stocks trade at heavily discounted prices relative to broader equities and started to show improving short-term momentum in the latter half of 2023. Developed value traded at a normalized price-earnings (P/E) ratio of 9.3, a 38% discount to broad developed equities, which is substantially wider than its median 22% discount over the previous four decades. Short-term momentum began to turn at the midway point of 2023, with rolling six-month relative momentum jumping off recent lows.

Part of this reversal can be attributed to the market’s repricing of future interest rates. Value stocks have often held up better in higher rate environments, and although we expect most major central banks will cut rates modestly by the end of 2024, costs of capital will still be much higher than just a couple years ago. We expect this reality may be a headwind to growth stocks, so investors should anticipate the rate environment in 2024 will continue to remove froth from pricey growth stocks and help value outperform.

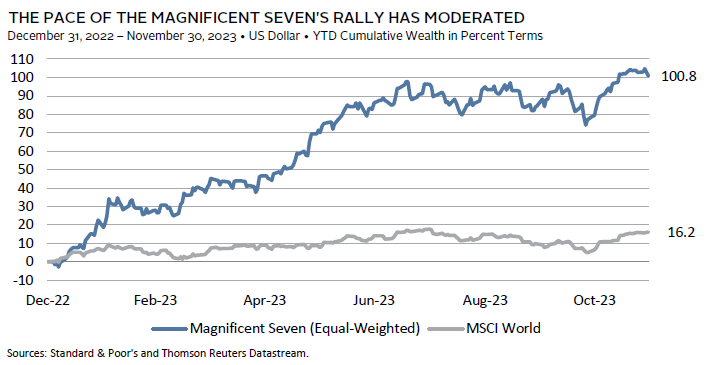

Moreover, the pace of the meteoric price rise in a subset of tech stocks linked to the AI boom—the so-called Magnificent Seven—downshifted in the second half of the year. Indeed, an equal-weighted basket of those seven stocks registered a 98% return from January through mid-July, but is only up 3% since then. While we anticipate that AI will continue to play a pivotal role in transforming productivity, we expect these productivity enhancements will support all sectors, particularly financials and energy, both of which carry substantial weight in value indexes. We expect the market to better factor in the broad benefits of AI next year, which should support value.

Developed Small-Cap Equities Should Outperform Developed Equities in 2024

Sehr Dsani, Investment Director, Capital Markets Research

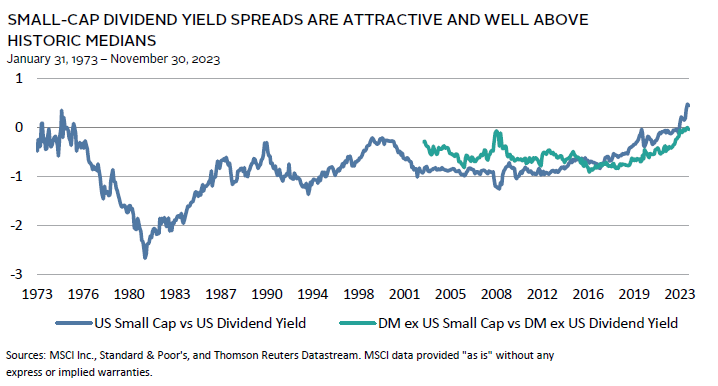

Developed markets (DM) small-cap equities have outperformed their large- and mid-cap counterparts over the last 25 years by a wide margin, but they lagged by 12 percentage points (ppts) in 2023 through November. However, we think small-cap equities will outperform large- and mid-cap equities in 2024, given attractive valuations, interest rate expectations, favorable sector exposures, and improving fundamentals.

Weak recent returns have resulted in attractive valuations. For instance, the cyclically adjusted price-to–cash earnings multiple is currently at the 22nd percentile of observations spanning nearly 20 years. Additionally, the P/E ratio relative to DM large- and mid-cap equities is even more compelling, sitting at the 3rd percentile over the last 20 years.

While these equities are higher risk investments with less robust balance sheets than their large- and mid-cap counterparts, we believe the valuation discount provides a significant cushion to small-cap performance going forward. Indeed, small-cap equities have tended to outperform during the early stage of a new business cycle precisely for this reason.

Small caps underperformed large- and mid-cap equivalents in part due to sector tilts within the index. The small-cap index is underweight communication services and IT, two of the best-performing large- and mid-cap sectors in 2023. The elevated valuation of these two large- and mid-cap sectors will make it more difficult for outperformance to continue in 2024. As investors position for rate cuts, sectors such as real estate, industrials, and materials—which are overweights in the small-cap index—should support outperformance. Furthermore, the industrials and materials sectors will benefit from continued increases in investment for infrastructure projects and reshoring supply chains.

Additionally, favorable fundamentals should support small-cap equity outperformance. As inflation continues to subside, analysts are estimating small caps will achieve better margin improvement and higher earnings per share (EPS) growth than large- and mid-cap equities. We think these improving fundamentals help increase the odds for outperformance versus large- and mid-cap equities.

European Equities Should Underperform Global Equities in 2024

Thomas O’Mahony, Senior Investment Director, Capital Markets Research

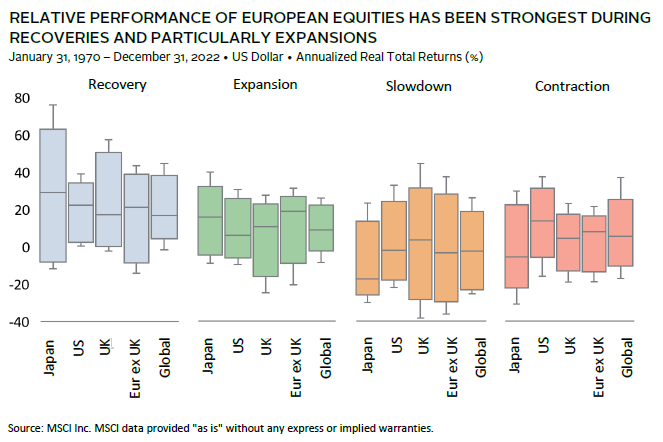

European equities have underperformed global equities by nearly 250 bps in 2023. Perhaps surprisingly, given the growth disparity between Europe and the United States, earnings growth in Europe has easily outstripped that of all global companies, growing by 7.4% versus a contraction of 2.5%. It has been a much weaker multiple expansion, by contrast, that lies behind this underperformance. We believe the greater cyclicality of European equities sees risks tilted to weak EPS growth and continued underperformance in 2024.

As 2023 draws to a close, the growth impulse in Europe is weaker than in peers, such as Japan and the United States. Cumulative GDP growth in the Eurozone and United Kingdom in the first three quarters of 2023 was 0.1% and 0.5%, respectively, lagging the 1.5% and 2.3% seen in Japan and the United States. Moreover, the delivered monetary tightening looks likely to weigh more heavily on Europe, given lower potential growth and the structure of mortgage markets. This is already evident in weak credit data. Finally, the external exposure of many European economies, particularly to China, may continue to weigh on export-led growth.

Therefore, we believe that European EPS growth is likely to lag in 2024. Admittedly, the bar is set reasonably low on a relative basis for European economic and earnings growth in 2024. Consensus expects earnings to grow by 6.1% in Europe versus 10.4% for all global companies. Similarly, European GDP growth is expected to be 0.5% in comparison to 1.2% for broader developed markets and 2.7% for the world. Nonetheless, expectations of EPS growth of 6.1% are ahead of the region’s long-run average of 5.8%. A material valuation discount (European forward P/E is just 0.77x that of the MSCI ACWI) restrains us from actively underweighting the region. However, if we see a continued slowdown or recession next year, that valuation cushion may not provide much mitigation, given the United States tends to perform more defensively than its peers in such circumstances. Ultimately, we continue to see risks skewed to the downside for the region in 2024.

Developed Equities Should Outperform Emerging Markets ex China Equities in 2024

Stuart Brown, Investment Director, Capital Markets Research

Emerging markets (EM) ex China equities are set to lag DM peers for a sixth straight year in 2023. Despite this extended underperformance, we don’t expect a reversal of fortune in 2024. Still, we see better tactical opportunities elsewhere, and, as a result, we recommend that investors hold EM ex China equities in line with the policy target allocation.

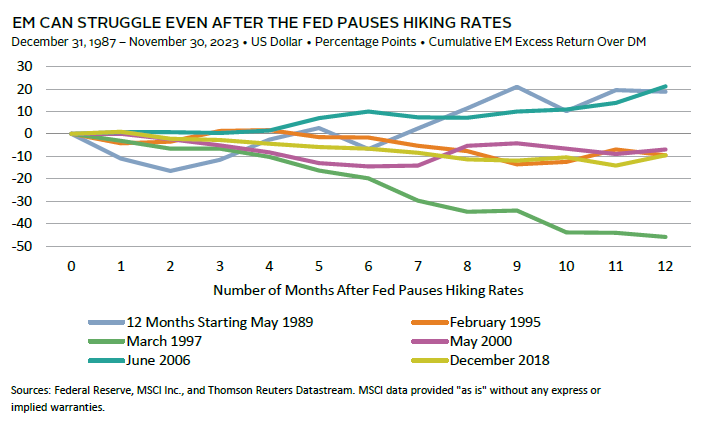

EM stocks tend to underperform during the late stage of the US business cycle. We expect that cyclical backdrop will persist in 2024, given the US yield curve remains inverted, the Federal Reserve likely just ended its rate-hiking cycle, and the US dollar is historically rich. In addition, global trade activity has slowed, as China’s economic growth has weakened relative to years past. These factors complicate EM’s ability to outperform.

Monetary policy is another factor weighing on the EM ex China outlook. EM ex China tends to struggle following the end of Fed rate-hiking cycles. Further, EM central bank policies tended to be more restrictive than DM counterparts, and the lagged impacts of these higher rates may weigh on EM domestic activity in 2024. Indeed, our measure of EM money supply growth—a leading indicator for the EM profit cycle—was recently the weakest since at least the mid-1990s, suggesting that earnings growth will be challenged.

Low valuations and the current growth outlook prevent us from being outright negative. Equity valuations relative to DM peers are in the bottom percentile of historical observations, suggesting that markets may be well-priced for a late-stage environment. In addition, EM GDP growth is expected to outpace DM by one of the widest margins in the past decade, despite higher EM rates. Taken together, we recommend investors hold EM ex China equity allocations in line with policy.

Chinese Equities Should Rebound in 2024

Celia Dallas, Chief Investment Strategist

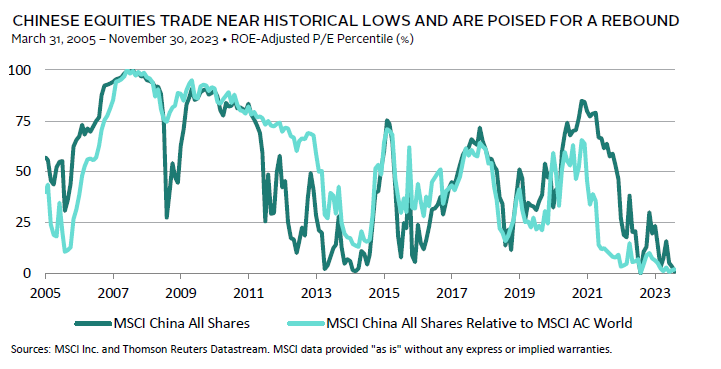

Slowing growth, shifting government priorities, property sector stresses, and geopolitical concerns have pushed Chinese equity valuations back near historical lows. After rallying sharply from October 2022 lows, Chinese equities have underperformed in 2023, returning -9.7% versus 16.6% for global equities, in US dollar terms. As a result, Chinese equity valuations are back to the depressed levels seen in late 2022 when China was in the teeth of its COVID-19 lockdowns.

A de-rating of Chinese equities is justified, given uncertainty over the economic outlook, but we think markets have gone too far. Chinese equity fundamentals need only be less bad than priced in for the market to rally. Catalysts for such a turnaround include continued fiscal and monetary policy easing and signs of improving domestic investor confidence. Indeed, Beijing has introduced new, albeit modest, stimulus measures, and Chinese economic data have shown signs of stabilization with recent economic data surprising to the upside. While the economy has disappointed this year, consensus expects China’s real GDP to grow by 5.2% in 2023 and 4.5% in 2024. Further, the consensus still expects higher corporate earnings growth in China than in most major developed economies through 2024.

Recent policy actions also suggest the government is placing increased focus on controlling financial stress in the property sector, where ongoing weakness has weighed on the recovery in domestic confidence and demand. Comments from officials at the People’s Bank of China and financial regulators have indicated further support is forthcoming in the form of financial institutions increasing lending to developers. Should the Fed begin cutting rates next year, as we expect, this would allow the PBOC to increase monetary stimulus without placing excessive downward pressure on the renminbi. Simultaneously, officials have signaled a desire to increase government spending on building affordable housing and improving infrastructure for natural disaster preparedness. Whether the government decides to act more aggressively to support the property sector and the economy remains to be seen. Still, Chinese equities are already priced for a recession-like scenario. Thus, public equities present a near-term opportunity despite the challenges and slower growth outlook.

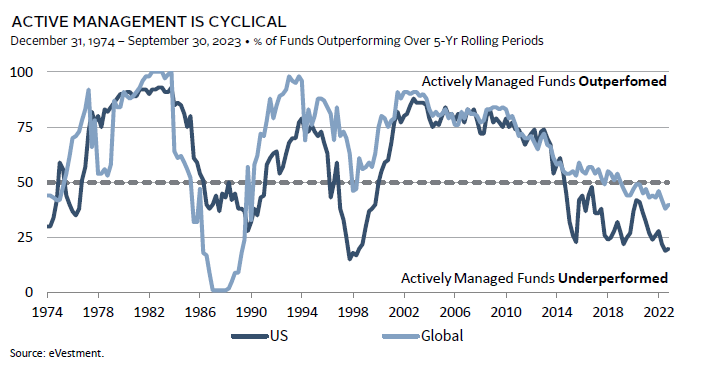

A Higher Share of Active Public Equity Managers Should Outperform in 2024

Eric Thielscher, Head of Global Public Equities, and Michael Broucek, Investment Director, Public Equities

Active equity strategies, in aggregate, have experienced a sustained period of underperformance, but few investors appreciate the truly cyclical nature of active management. Over the last 50 years, professionally managed portfolios have found themselves in- and out-of-favor for protracted periods. Prior highs and lows of these serpentine results have occurred well before the introduction of various regulations or the onslaught of passive investing, two of the most common arguments attempting to explain why low efficacy rates are here to stay. Instead, narrow equity market leadership in 2023 and outsized IT sector representation in benchmarks—a sector with lofty valuations—should help drive a greater share of manager outperformance.

Since most benchmarks are weighted by market capitalization, they become more exposed to stocks with strong recent performance. In 2023, equity markets experienced narrow share price leadership and, as a result, indexes became more exposed to a small number of stocks. The rapid ascent of this small collection of stocks improves the prospective appeal for the rest of the equity market, which should boost the odds for active managers to generate excess returns.

Similarly, thanks to a multiyear period of sustained outperformance of IT stocks, indexes feature them more prominently than any other sector. Meanwhile, IT valuation multiples are particularly high relative to history. This combination, a sector with elevated valuations and one that features prominently in indexes, is a significant benchmark index risk. Of course, one of the longest-lasting cycles for active management occurred when the same conditions were at play during the technology, media, and telecommunications era. That boon for stock pickers, which lasted well more than a decade, was further supported by the GFC era, another period with outsized (financials) sector representation.

Ultimately, we believe the landscape is ripe for active managers to reassert themselves in 2024. Expanded breadth of investment opportunities and IT top-heavy benchmarks will be key factors in this recovery.

Equities Appeal Relative to Bonds Has Diminished

The spread reflects the difference between the cyclically adjusted real earnings yield less the government bond real yield. The global spread calculations are based on data from the MSCI World Index, FTSE World Government Bond Index 7-10 Year, and OECD Total CPI Index.

Geopolitical Risk Has Jumped Again In Late 2023

Data downloaded from https://www.matteoiacoviello.com/gpr.htm on December 1, 2023.

The Pace of the Magnificent Seven’s Rally Has Moderated

Magnificent Seven is an equal-weighted basket consisting of the following seven common stocks: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. Alphabet returns are based on A-shares.

Small-Cap Dividend Yield Spreads Are Attractive and Well Above Historic Medians

US SC and US are represented by the S&P SmallCap® 600 and MSCI US indexes, respectively. DM ex US SC and DM ex US are represented by the MSCI World ex US Small Cap and MSCI World ex US indexes, respectively. Data for DM ex US Small Cap vs DM ex US begin March 31, 2003.

Relative Performance of European Equities Has Been Strongest During Recoveries and Particularly Expansions

Performances shown are annualized for each observed cycle. Top and bottom boxes represent 75th and 25th percentiles, respectively. The whiskers represent 90th and 10th percentiles. Middle line represents median. Asset performance has been deflated by G7 inflation.

EM Can Struggle Even After the Fed Pauses Hiking Rates

EM and DM are represented by the MSCI Emerging Markets and the MSCI World indexes, respectively. Returns are gross of dividend taxes.

Chinese Equities Trade Near Historical Lows and Are Poised for a Rebound

Data for MSCI China All Shares begin November 30, 2008. Data prior to November 30, 2008, are implied based on the market cap–weighted valuation of the MSCI China and MSCI China A Onshore indexes.

Active Management Is Cyclical

Data are quarterly. US and Global equities are represented by the S&P 500 and MSCI World indexes, respectively.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.