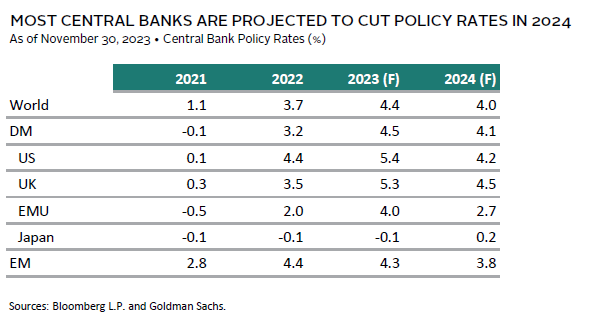

We expect that most major central banks will cut policy rates modestly due to our view that inflation rates will continue to decline. The modest cuts will shift policy rates from restrictive levels closer to neutral levels, which are neither restrictive nor accommodative. Given this view and our view that economic activity will weaken, we see opportunity in US long Treasury securities.

Most Major Central Banks Should Cut Rates in 2024

TJ Scavone, Investment Director, Capital Markets Research

Global central banks have aggressively tightened monetary policy to beat back inflation. While monetary policy now appears to be in restrictive territory, it is still too early to declare victory. Inflation rates are falling, but remain elevated. However, we expect restrictive policy will continue to weigh on economic activity and, in turn, inflation in 2024. This will ease pressure on central banks, which we expect will lead to modest policy rate cuts by year end.

After two successive years of tightening monetary policy, most major central banks currently view policy as appropriately restrictive. Financial conditions have tightened, and inflation globally has fallen considerably from its recent peak. As a result, many central banks are considering pausing tightening and the market consensus projects most central banks will modestly cut rates in 2024. Still, several central banks have suggested rates will need to remain “higher-for-longer,” increasing uncertainty around interest rate forecasts.

In our view, consensus expectations of policy rates are reasonable. Inflation may be elevated, but it is in a downward trend. Global economies have thus far held up better than anticipated, but there are pockets of weakness, particularly in Europe. Even in the United States, which has been more resilient than other economies, some measures of activity are weakening. For instance, US jobs growth has slowed and the unemployment rate has ticked up from a low of 3.4% to 3.9%. Higher rates and reduced fiscal support will add to downward pressure on growth, which should lead to additional softening in the labor market, wages, and inflation.

With inflation moving closer to central banks’ price targets and labor markets showing clearer signs of softening, central banks will be inclined to modestly ease policy rates in 2024 to avoid overtightening. The Fed is projected to cut rates by roughly 100 bps in 2024. This would be only slightly more than previous “soft landings” in the United States. If growth concerns mount, both inflation and rates could fall more than is currently expected.

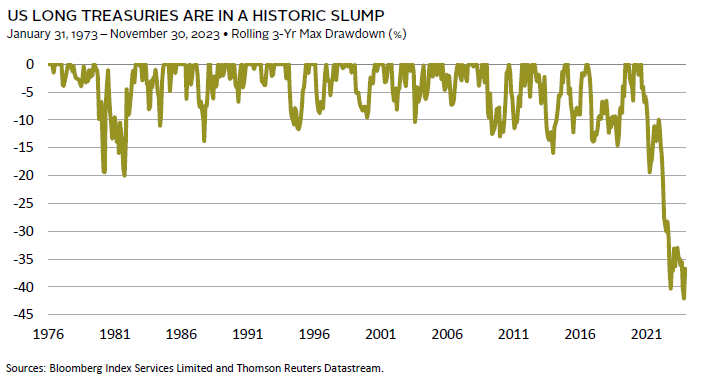

US Long Treasury Securities Should Outperform Cash in 2024

TJ Scavone, Investment Director, Capital Markets Research

US Treasuries are in a historic slump. While performance has been better in 2023 than the prior couple years, US Treasuries are barely on track to finish up for the year and underperforming cash for the third consecutive year. However, in our view, the worst is behind us. We expect US long Treasuries will outperform cash in 2024, given our economic outlook, our view that the bond sell-off is overdone, and the fact that current yields look attractive compared to economic fundamentals.

The bond sell-off clearly appears overdone. This was also the case in fourth quarter 2022, and ten-year US Treasury yields were recently as much as 75 bps above their 2022 peak. Unlike 12 months ago, many of the drivers of the sell-off are currently reversing. For instance, US inflation is declining. Core consumer price increases (4.0%) are still elevated, but the deviation from target is almost entirely due to shelter price rises, which are expected to decelerate in the coming months. The US economy has been resilient, but momentum appeared to peak in third quarter 2023, and weaker growth is forecast in the quarters ahead. If consensus is correct, nominal GDP growth for 2024 will fall below its trailing ten-year average, a trend that is usually consistent with lower Treasury yields.

A “soft landing” would reduce the risk of additional rate hikes. It also makes it more likely the Fed will keep its policy rate elevated for longer. However, this is mostly priced in. The Fed is projected to cut rates by roughly 100 bps in 2024, which is only slightly more than the number of cuts during previous soft landings. In sum, there is limited risk from further rate hikes, little to no risk from a soft-landing, but significant return upside for long Treasuries if growth concerns mount and the Fed cuts rates more than expected.

Another key difference is that yields look more attractive today. Ten-year US Treasury yields recently peaked above 5.00%. That is more than 1 standard deviation above their implied fair value based on economic fundamentals. Since 1973, the Bloomberg US Long Treasury Index has outperformed cash by 11 ppts on average over the next 12 months when this threshold is met, with a 90% probability of a positive excess return. We like those odds.

Data shown in table are year-end central bank policy rates. The policy rates for the US, UK, EMU, and Japan are based on Bloomberg consensus forecasts. The policy rates for the World, DM, and EM are based on Goldman Sachs Research forecasts and are market FX-weighted aggregates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.