2023 Outlook: Sustainability & Impact

We expect meaningful shifts in net zero and other sustainable and impact strategies toward more impactful implementation approaches. In line with this, we expect allocations to diverse managers to rise, as greater numbers of investors embrace stated investment policy objectives.

Approaches to Climate & Net Zero Shift from Window Dressing to Real Change in 2023

Simon Hallett, Head of Climate Strategy

Since the 2015 Paris Agreement, global attention has increased on limiting the global temperature rise to 1.5 degrees Celsius by achieving “net-zero” greenhouse gas emissions by 2050. Glasgow’s COP26 climate conference triggered greater scrutiny of targets set by the increasing number of investors making net-zero commitments. This has focused attention on what net zero should mean for an investment portfolio.

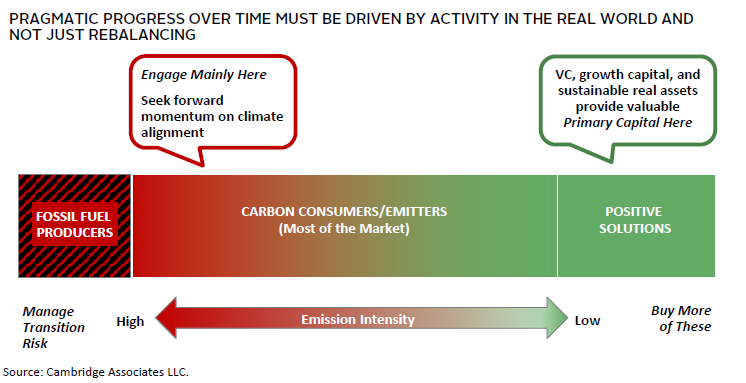

At first, the common interpretation was to reduce “portfolio emissions” by selling high emission companies. This is called portfolio decarbonization. Since most emissions are concentrated among a small number of companies and sectors, it proved surprisingly easy. But it led to accusations of window dressing and greenwashing. While selling high carbon companies does tend to increase those companies’ costs of capital, it made little difference in the emissions those companies contributed.

The focus is now shifting toward driving “real world change” rather than portfolio optics. The main lever is to encourage more portfolio companies—especially the high emission ones—to adopt “Paris-aligned” decarbonization plans with third-party verification. This can be achieved through active ownership—voting and engagement. It needn’t imply portfolio changes, but it must have genuine bite, with investors and their managers prepared to challenge and vote against company management if necessary. It can even be followed by passive investors, though the sanction of divestment adds teeth to any engagement. Private fund general partners can often directly drive better climate performance than small public shareholders, as large or even controlling owners, so they should be held especially accountable.

Voting and engagement works with established self-funding businesses that are hard to influence by public equity capital allocation. Elsewhere, credit strategies and private investments are more likely to provide net new financing to business; in this case, capital allocation does matter since it could fund new climate positive or negative activity. As an extension of this idea, investors increasingly seek opportunities among climate solutions—businesses that are rapidly decarbonizing or enabling others to do so.

Sustainable and Impact Investors Will Prune the Weeds in 2023

Chavon Sutton, Senior Investment Director, Sustainable & Impact Investing

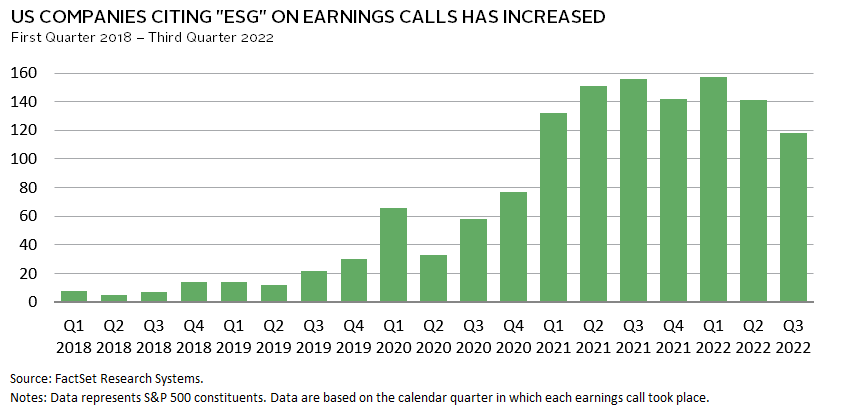

If there was a season of abundance in sustainable and impact investments (SII), it was the past three years. The letters “ESG” (environmental, social, and governance) became a calling cry, sprouting up on earnings calls in what appeared to be a seismic shift in companies wanting to approach business more sustainably. ESG and sustainable exchange-traded fund inflows exploded, reflecting a heightened desire to use capital to right environmental and societal wrongs. The first net outflows since 2017 from the SII investment universe were seen in 2022, as investors began pruning the weeds in their portfolios. In other words, they trimmed sustainable investment allocations that suffered relative underperformance or missed the mark on alignment with sustainability goals.

Investors turned their backs against a swell of so-called green-, blue-, and social-washed products—designed to attract assets rather than achieving genuine social and financial returns. And Russia’s invasion of Ukraine exacerbated this trend by amplifying an already extraordinary run-up in energy prices that hampered the relative performance of sustainability funds that often exclude such companies.

As risk assets struggle with elevated inflation and below-trend economic growth, 2023 will usher in a new—more cautious and demanding—era of SII. A rebound in the pace of SII investing will be propelled by the application of more robust frameworks, 1 which refocus values, reframe risk, widen the investment opportunity set, and produce positive real-world outcomes. Global reporting and measurement standards should continue to converge, giving investors greater clarity around how best to set, measure, and track ESG and impact metrics. Investors will be more discerning in their manager selection, seeking those with greater intentionality around sustainability and impact themes, traceable through lines between intent and execution in their portfolios, and a penchant for risk management.

A turbulent year will compel rigor, which we think is the right kind of fertilizer for newly planted SII seeds.

Diverse Manager Net Flows Will Remain Positive, Supported by Governance Structures in 2023

Jasmine Richards, Head of Diverse Manager Research, and Carolina Gómez, Associate Investment Director, Diverse Manager Research

US public pension plans have long been investors with diverse fund managers. In recent years, this focus has expanded to family offices, corporate pensions, endowments, and foundations. While allocators’ journeys have varied, many have created diverse investing objectives, codified these in investment policies, and begun implementation. With structural changes in place, we expect allocators to continue driving capital to diverse managers in 2023.

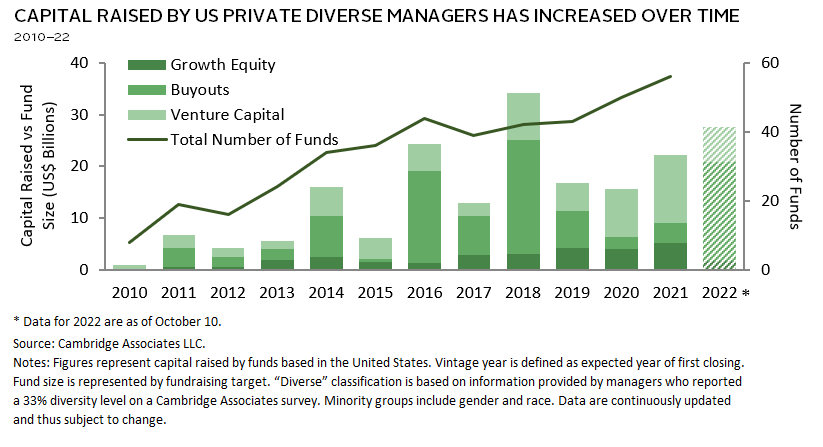

In the wake of increased social unrest due to global inequality, many asset owners have begun to examine diversity within their portfolios. Understanding that less than 2% of global assets are invested with women or people of color, 2 many asset owners are seeking to be more intentional about their investment with diverse managers. With this interest, diverse fund managers are on pace to raise historic levels of assets in 2022, which is even more notable given the challenging fundraising environment.

Historically, allocations to diverse managers have waned during periods of market stress. During these periods, new manager relationships can be perceived as risky particularly with firms that are younger or have lower assets under management (AUM). Given that many asset owners are currently over-allocated to private investments—the area of highest new fund starts for diverse managers—the market could pose specific challenges for sustained AUM growth for diverse fund managers. Despite these headwinds, data indicates that governance revisions instituted in recent years will support continued commitment to increasing diversity among manager lineups of asset owners.

Data from a recent CA client survey show that 15% of survey respondents have codified their diversity, equity, and inclusion objectives in investment policy statements, an increase of more than 10 times since 2020. Of the respondents who have implemented diverse manager strategies, 95% indicated that they have increased allocations over the last five years. Additionally, 92% anticipate increasing their allocations even further over the next five years. While market headwinds create higher bars for new commitments, the structural policies and programs that have been implemented in the recent past will support continued commitment to investments in diverse fund managers.

Footnotes

- Cambridge Associates’ Social and Environmental Equity investing framework seeks to induce investment in SII themes through the application of a more systems-focused lens, breaking down cognitive bias in investment processes and reclassifying investment managers with stronger alignment to investable social and environmental equity themes.

- Diverse-owned firms are defined as those that are over 50% women- or minority-owned.