Is Deregulation the Death Knell of Direct Lending? Reviewing the Evidence

Did US regulation, specifically the passage of The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) in July 2010, give rise to direct lending? Certainly direct lending fund managers have defined their opportunity in terms of a void left by banks—a void often claimed to be created by regulations—and anecdotal evidence of banks’ absence from middle-market lending abounds and is not without merit. With the Trump administration voicing policy objectives that include possibly repealing significant portions of Dodd-Frank, is direct lending imperiled? We don’t believe a repeal of all or a portion of Dodd-Frank is a death knell for direct lending strategies. In this brief, we review the data and show that changes in banks’ lending behavior cannot clearly be traced to the passage of Dodd-Frank or its implementation.

Bank Lending: Cyclical and Secular Trends

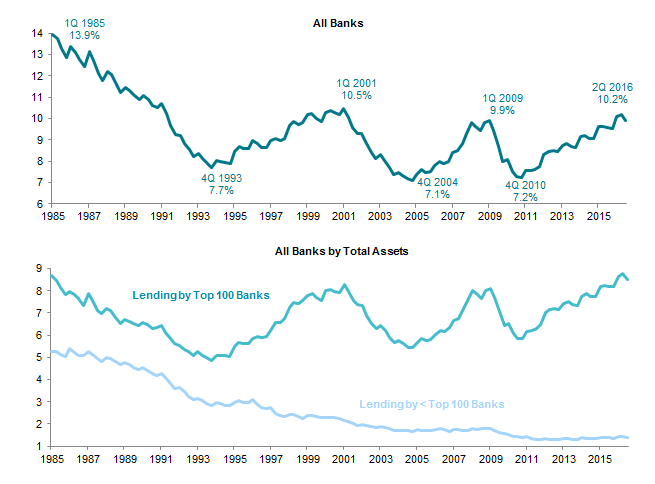

How has bank lending changed over time? The chart on the next page compares total commercial and industrial (C&I) loans made by banks (that report to the Federal Reserve) as a percentage of US GDP from 1985 to 2016. Since 1994, C&I loans by all banks have peaked as a percentage of GDP three times: early 2001, early 2009, and (as of this writing) early 2016. In total dollars, C&I loans from all Fed reporting banks have increased 69% since third quarter 2010. Parsing the data by size of banks shows that the largest 100 banks by assets are the drivers of cyclical trends in lending.

Judging from the data, C&I lending by large banks appears unaffected by Dodd-Frank, which was passed in July 2010, or near the last trough in lending. Smaller banks appear similarly unaffected by regulation, as their secular decline started in the mid-1980s (based on available data). Their lending has crept inexorably lower, with three brief plateaus in the late 1990s, the mid-2000s, and the last five years.

Source: Federal Reserve Bank of St. Louis, Economic Research Division.

Note: Bottom chart reflects commercial & industrial lending by the top 100 banks by assets versus the rest.

If Dodd-Frank really did drive banks out of lending, then the years since its passage should exhibit a decline in lending, not a rise for large banks and a plateau for smaller banks. In fact, smaller banks have increased lending in dollar terms by 22% since third quarter 2010.

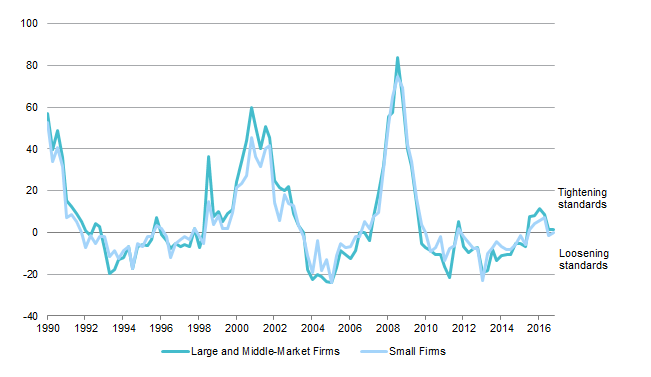

In addition to collecting this lending data, the Fed also surveys senior loan officers each quarter on their lending practices. One question the survey asks is whether these loan officers are tightening or loosening their credit standards for C&I loans. The responses are summed to arrive at a net percentage. A negative net percentage means lenders are loosening standards, while a positive one means they are tightening. As the chart below illustrates, lenders have been mainly easing underwriting standards since the passage of Dodd-Frank—behavior distinctly at odds with an unwillingness to lend.

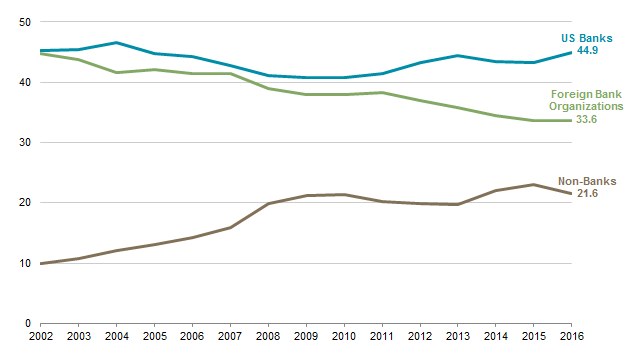

The Office of the Comptroller of the Currency (OCC), an often overlooked yet important financial regulator, conducts an annual review of “shared national credits,” defined as any loan greater than $20 million that contains three or more unaffiliated lenders. The OCC categorizes participants as either US banks, foreign bank organizations (FBOs), or non-bank entities.

Net Percentage of Domestic Banks Tightening/Loosening Standards for C&I Loans

Second Quarter 1990 – First Quarter 2017

Source: Federal Reserve Bank of St. Louis, Economic Research Division.

A review of these data suggests it is foreign banks that have lost their appetite for lending since 2010. Based on annual OCC data, US banks increased their portion of shared national credits by over 4 percentage points (ppts) from 2010 to 2016. The 2016 share (44.9%) represents the highest proportion for US banks since 2004, when they accounted for 46.5% of total commitments. Over the same 2010–16 period, non-banks increased their proportion by 0.3 ppt and FBOs dropped by over 4 ppts. Regulation likely played a role in cooling foreign banks’ ardor, but that regulation is unlikely to have been Dodd-Frank.

Obviously, these data do not perfectly reflect the uses of direct lending debt, which overwhelmingly goes to finance leveraged buyouts (LBOs) and other private equity–linked events. It is possible that Dodd-Frank’s impact has been narrowly limited to sponsor financing by banks. Commercial bank credit officers across the country could have been easing lending standards to small- and medium-sized businesses but tightening them for sponsor-backed LBOs, refinancings, etc. This posture would have obvious implications for direct lenders’ claims that sponsor-owned businesses are more creditable than unsponsored businesses. To the extent that Dodd-Frank had a laser-like impact on lending to sponsor-backed companies, then deregulation should augur poorly for direct lenders. However, we estimate the likelihood is low that banks across the country read Dodd-Frank and decided to continue lending across the board, while pulling back wholesale from sponsor-backed businesses.

Sources: Office of the Comptroller of the Currency, Shared National Credits Program Review, 2008 and First Quarter 2016.

The statement “banks don’t want to lend because of regulation” is thus more likely to apply to the notion that arrangers who specialize in packaging and selling loans may no longer be as active, preferring to hold less inventory than before. Very little arranging activity would be captured in the data from the Fed (whatever might be captured would appear in the OCC data). This is different than interpreting the statement to mean that commercial banks have withdrawn from lending altogether, which the data have shown not to be the case.

The Bottom Line

Some market participants have feared the worst for direct lending from a potential repeal of Dodd-Frank. We don’t find the regulation to have been a meaningful driver in changing banks’ lending behavior. There are other reasons why direct lenders have found demand for their debt. Those reside in interest rates and the innovation of the unitranche product, which we will discuss in a separate paper, “Tracing the Rise of Direct Lending: The Importance of Rates and Loan Structure.” If we are correct in our analysis that regulation did not spawn direct lenders, then investors should take comfort that deregulation will not sound their death knell.

Tod Trabocco, Managing Director