Inverted World: The Attractiveness of Short-Term Tiers for Healthcare Systems

A healthcare system’s investment structure is intentionally aligned to match varying enterprise needs over the short, intermediate, and long term. Most have gravitated toward the use of tiers—pools of capital delineated as available immediately (operating cash), within the next few years (short-duration bonds), or strategically over time (long-term investment pools). However, the need for capital flexibility and liquidity has grown as the demands of providing care have become more complex. Fortunately, higher interest rates have made the return profile of highly liquid, short-duration tiers more attractive. As a result, we expect many hospitals will benefit from allocating any new funds that come available to short-term tiers, given the yields available in short rates and superior liquidity.

The Case for Keeping Dry Powder

The operating environment for healthcare systems continues to be difficult. Hospitals have been hurt by margin pressures, and unlike in 2020, there has been little government support to help alleviate significant operating losses. There are signs of stabilization as providers have made good progress in reducing reliance upon higher cost temporary contract labor, and the rate of inflation on wages, equipment, supplies, and services has decelerated. However, it is premature to say healthcare systems are out of the woods from cost pressures, and ultimate recovery toward normalized operating margins may take several years.

Strategically, capital spending needs continue to be high. Healthcare systems are executing cost management plans, streamlining day-to-day expenses, and increasing operating efficiency to help deploy cash toward multiyear investments in technology and new facilities. But cost rationalization can only go so far, and in many cases capital plans require the net use of cash. As the industry grows more competitive, those that fail to deliver become vulnerable to financial pressures, adverse patient market share trends, and credit rating downgrades. With these crosscurrents of capital demand and the ability to raise new debt compromised by higher market yields, investment liquidity is at a premium.

Impacts of the Rising Rate Environment

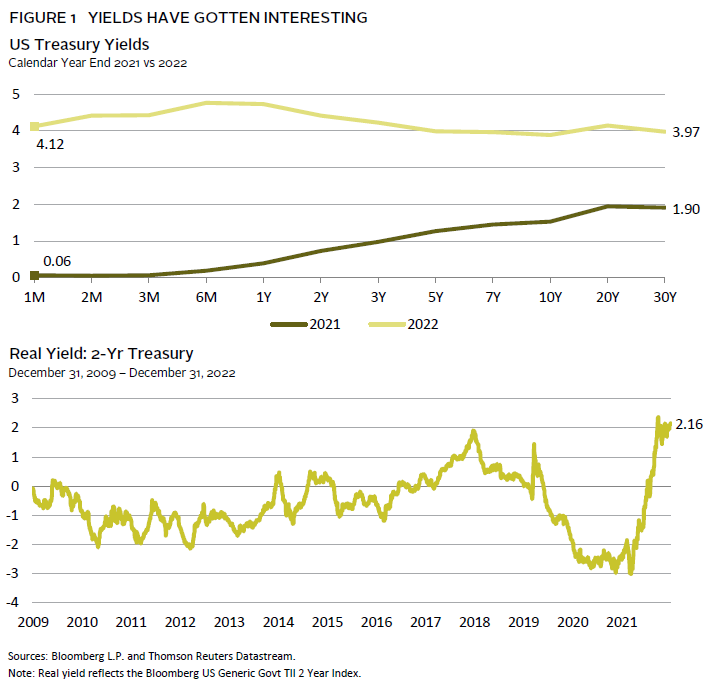

The Federal Reserve’s most aggressive tightening cycle in decades has resulted in a dramatic change in the interest rate environment. Rates spiked significantly, and the yield curve has changed from upward sloping to inverted, as central bank policy rates have driven short yields upward. Notably, the real (inflation-adjusted) interest rate on two-year yields has increased to positive levels of more than 2%, after many years of negative real rates in the past decade. Bottom line, yields have gotten interesting in both a nominal and real context (Figure 1).

This journey in interest rates had dramatically different impacts on each tier of capital on the balance sheet for healthcare systems. The shortest tiers held in cash and money markets for working capital purposes were stable, although such cash holdings lost value in real terms, given high inflation. Intermediate tiers—reserves for capital spending and other near-term purposes—suffered moderate losses given the fact that even low-duration pools were exposed to the abrupt spike in rates. And finally, longer-term tiers—invested in a mix of growth-oriented investments and core fixed income—incurred significant losses, given higher interest rate sensitivity and poor equity performance in response to the uncertainty created by extreme monetary tightening. Going forward, the sizing of these pools is an important discussion point. But as healthcare systems debate how to deploy excess funds between intermediate- and longer-term pools (with the trade-off of added volatility and lessened liquidity), we note that the pendulum has swung in favor of short duration by virtue of the extreme increases in interest rates.

Opportunity Cost or Gain?

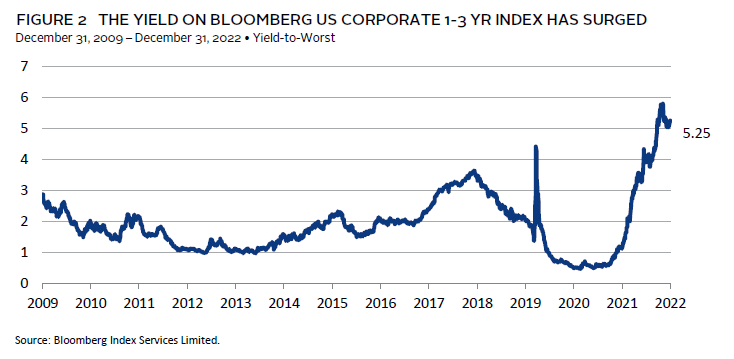

For the first time in years, healthcare systems can earn decent returns on their dry powder. Previously, the decision to park funds in intermediate pools came at a cost, with low yields failing to meaningfully outperform inflation. Now, inverted yield curves provide the highest yields on the shorter end of the curve. Higher short-term interest rates directly benefit investment assets in the intermediate tier. Investment mandates for these intermediate pools are typically benchmarked to high-quality indexes with short duration (one to three years). Benefiting from higher Treasury yields and slightly wider credit spreads, the yield on the Bloomberg US Corporate 1-3 Year Index has surged to more than 5% (Figure 2).

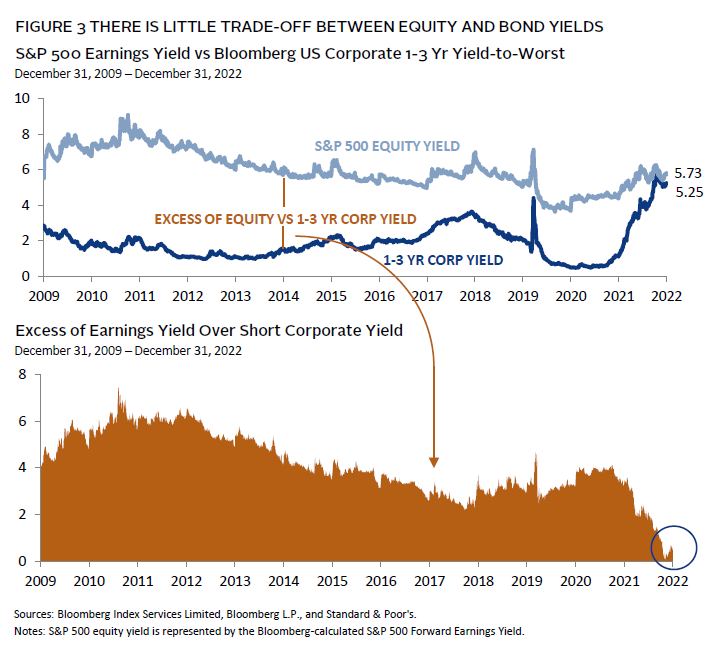

Over long periods, there has been an opportunity cost when keeping excess funds invested conservatively in short-duration bonds, as long-term investment pools typically outperform due to their equity orientation. While equities have pulled back significantly (MSCI ACWI fell 18.4% in 2022), equity valuations are still at levels above historical averages and the earnings outlook is underwhelming. With short-duration yields meaningfully higher and future equity returns highly uncertain, it is important to reassess the current opportunity cost of holding dry powder rather than deploying into long-term tiers.

To assess the relative value of short-duration bonds and equities, it is useful to monitor the earnings yield of equities—reversing the calculation of a price-earnings ratio and taking earnings over price. By putting equities and short-duration bonds on the same wavelength of yield, it is interesting to note compression between the two. As it currently stands, there is little trade-off between the inherent yield of equities and bonds (Figure 3).

Healthcare systems are in a uniquely favorable position to keep dry powder for capital purposes parked in short-duration bonds with far less opportunity cost. As excess assets become available, it may make sense (dependent on the institution’s specific circumstances) to deploy funds into short-duration fixed income for an interim period. The healthcare system gets the dual benefit of capital flexibility, given extremely high liquidity, while getting compensated with solid returns in the process.

Caveats of Favoring Short-Duration Bonds

The ability to earn yield with low-rate sensitivity is certainly welcome, but the decision to take advantage of this opportunity should be viewed as specific to the current environment. Longer term, as the level and shape of yield curves normalize, it is likely that longer-term pools will outperform short-duration pools. We note several key considerations as healthcare system executives determine the best course of action.

- Rates may fall significantly. Rates can move quickly, as can the shape of the yield curve. The opportunity to earn solid mid-single digit returns on the front end may prove ephemeral, as yields could decline as rapidly as they increased. In such a scenario, short-duration pools would benefit from higher bond prices, but the subsequent lower yield may be insufficient for future budgeting purposes and necessitate a reevaluation of pool sizing.

- Bond yield is different from equity yield. The yields inherent in fixed income and equities do differ in character, as equity returns benefit both from current earnings streams and the potential for future growth. As a result, equities are likely to outperform short-duration fixed income over longer periods of time, given the ability to grow cash flow streams.

- Equities could rally significantly. If global central banks win their battle against inflation and engineer a “soft landing” with sustainable growth, equities will likely benefit from normalized policy rates with associated lower yields (lower discount rates and costs of funding) and an appetite for “risk-on” assets, at a rate that could exceed the annualized yield of short-duration bonds.

- Rates may rise significantly. It is possible interest rates may climb higher, presumably due to another upswing in inflation that causes central banks to raise policy rates beyond expectations. In this scenario, short-duration bonds may incur losses, but at much milder levels than losses inflicted upon longer-duration bonds and equities.

Getting to the Right Answer

Capital allocation decisions are seldom binary, and healthcare systems are best served by studying multiple iterations of investment outcomes. High yields on short duration provide good support on return expectations, but pool sizing and portfolio construction should be informed by the strategic role in portfolio first, and by the opportunity set second. If an enterprise review validates the ability to align investments with an extended long-term time horizon, those assets ultimately should make their way into long-term investment pools, even if done gradually in implementation. High income potential on low-risk short-duration bonds provides healthcare executives with a degree of freedom in keeping capital flexible during this period of uncertainty for the sector.

David Kautter also contributed to this publication.

Index Disclosures

Bloomberg US Corporate 1-3 Year Index

The Bloomberg US Corporate 1-3 Yr Index measures the investment grade, fixed-rate, taxable corporate bond market with 1-3 year maturities. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

S&P 500 Index

The S&P 500 Index measures the stock performance of 500 large companies listed on stock exchanges in the United States. The S&P 500 is a capitalization-weighted index and the performance of the ten largest companies in the index account for 21.8% of the performance of the index. The average annual total return of the index, including dividends, since inception in 1926 has been 9.8%; however, there were several years where the index declined more than 30%.