“Divest now!” Passionate voices are demanding distance between the endowment and investments that can be connected to war and human suffering. Divestment campaigns may seek to influence change, take an ethical investing stance, and/or ensure that the capital of the institution they care about does not fund or profit from a cause or actions they oppose. Divestment demands are often difficult to implement, given the fiduciary responsibilities that govern endowments, as well as the challenge of determining which investments are consistently aligned or misaligned with institutional values. Campus stakeholders do not have a unified set of beliefs, so it may be impossible to reflect a shared moral imperative, definition of wrong or right, or political stance 1 through investment policy.

This paper frames a decision-making process to enable an institution to achieve something that feels untenable—a roadmap for action (or not). The result may feel unsatisfactory, perhaps for all stakeholders on some level, but a divisive climate demands a clear perspective and an explicable institutional response. Fiduciaries have a responsibility to determine a course of action that considers the future of the institution given its mission and mandate.

A return to first principles and an orderly decision-making process can enable an institution to move forward and feel confident about how and why the outcome was achieved. The resulting position and/or action around divestment is an outcome of the process.

In summary, our experience suggests a decision-making process as follows:

- Define the exclusion. Each institution needs a well-defined process to evaluate divestment proposals and determine the specific investments that would be excluded from the portfolio. Included in the exclusion definition are the reasons for divestment, expected outcomes, and how they would be measured. Following a consistent process and criteria are especially important to address fervent opinions equitably and to communicate clearly.

- Navigate complex issues with good governance. Good governance is a roadmap that can provide structure, processes, and policies to respond to and communicate with stakeholders while upholding fiduciary responsibilities.

- Weigh other considerations. There are several related considerations that need to be included in the evaluation, namely costs, timing, legal requirements, and the relationship to a bigger picture.

Define the Exclusion

What is Divested and Why

What set of investments should be excluded from the investment portfolio? Divestment proposals usually start with a sentiment or concern. Recommendations for divestment may be as broad as a demand to avoid affiliation with perceived unacceptable behavior or more specific recommendations for exclusion of economic sectors, regions, nations, or companies associated with or involved in conflict, human rights violations, and other harms. To implement a divestment effort, the investment management team needs clarity about the investments that should be excluded from the investment portfolio. This is often quite difficult, as investments that fail an aspect of the exclusion criteria may have other qualities that are additive to the portfolio in other ways.

Closely related to the recommendation of what should be excluded is the answer to why should it be excluded. Is the reason for the divestment decisions a moral statement or an effort to influence policy through economic impact? Some divestment policies require an economic reason if endowment resources are going to be redeployed because the endowment is an asset with economic value. Would the institution divest to avoid economic risk and stranded assets, or is the intention to influence geopolitical strife—such as compelling a company to stop supplying equipment to an aggressor nation—through withholding capital? If change is the goal, investor engagement as a shareholder may provide a more direct path to influence a company’s decisions.

Values

Many calls for divestment ask an institution to express its values or exercise power to change the course of a conflict or to support a specific movement. Organizational values can be more specific for a private foundation, but shared values are harder to define for a university. By their very nature, universities are designed to explore and cultivate different perspectives. For example, students may weigh values differently or may have different values entirely, especially in today’s divisive political and cultural environment. Faculty and alumni stakeholders bring their values and expectations as well. As a result, it is difficult to eliminate a particular type of investment based on shared institutional values. It is up to those with fiduciary responsibilities to determine whether these divestment requests reflect the mission and commitments of the entire institution.

Goals and Outcomes

What will be the outcome of eliminating a sector or set of companies? How will the impact of the divestment decision be measured over time? Before embarking on a divestment journey, it is important to understand the destination. What is the ultimate goal of the call to action? Are outcomes measurable within the institution or beyond?

Decision makers must determine if the goal is achievable and aligns with institutional and investment principles and policies. This includes weighing fiduciary responsibility, investment implications, and institutional and societal implications.

Navigate Complex Issues with Good Governance

Stakeholder concerns are a form of engagement, and each endowment program needs effective governance to acknowledge and respond to inquiries and requests clearly and effectively. Endowment governance shapes the structure, policies, and processes that direct endowment investments. Good governance is the framework for engagement and communication.

Structure

The first step is to develop a governance structure to consider requests, so that a group is prepared to do the work on behalf of the institution if a divestment issue is presented. Who is eligible to make a divestment recommendation? Who decides whether to implement the request? A decision that involves an interpretation or amendment to existing policy is the responsibility of the Board of Trustees. However, an institutional governance structure can identify the group of people that will receive the divestment proposal. That body may be the Board, the investment committee, a sub-committee of the Board, or a separate group designated to evaluate resources in light of institutional policies. 2 Policies and guidelines provide a framework for the group to assess the considerations of the proposal and to determine the best course of action. While one viewpoint may be expressed in the divestment proposal, it is important for the group to consider different sides of the issue within the institutional community.

Process

What is the review and evaluation process? Process establishes the criteria for consideration and the steps for how a proposal may flow from consideration to potential adoption. Criteria for consideration will provide guidelines on specificity of the divestment request, rationale, and goals. Some institutions specifically ask that a proposal include how divestment will help achieve the desired goal. Criteria should also determine the financial and broader considerations for the institution, such as reputation and social or moral implications. Providing the basis and expectations for the divestment request will enable the governing groups to assess the institutional merit and determine how the proposal fits into the broader policy framework.

Policy

The investment policy ultimately must reflect all of the guidance for how endowment assets will be invested. Institutional leadership must base their decision in policy and have a firm understanding of both the short-term and long-term financial implications of divestment. How does the justification for divestment align with institutional bylaws and investment policy? Does the current investment policy outline ethical investment guidelines or environmental, social, and governance (ESG) guidelines? If current policies are insufficient, the Board may need to revise or augment them. Some institutions also have a specific divestment policy to manage proposals.

- Investment policy: The investment policy governs endowment investments. It outlines the goals of the investment program, investment strategy, and asset allocation guidelines, risk and liquidity parameters, and any ESG and impact investment guidelines. If the investment policy rules out divestment or outlines divestment consideration criteria, then no additional policy is needed to address divestment.

- Divestment policy: Some institutions also have a specific divestment policy or statement to outline how divestment considerations are managed. A divestment policy can be employed to outline criteria for consideration and the decision-making process. If a recommendation to divest is approved and requires a change in investment policy, the Board will need to refer to the divestment statement or revise the investment policy to accommodate the new approach.

Weigh Other Considerations

There are further considerations that fiduciaries need to weigh before making a divestment decision because endowment assets are part of a vast institutional ecosystem and must comply with laws and regulations. When responding to calls to divest, we believe institutions should assess financial and regulatory implications, and if the endowment is the appropriate mechanism to affect the issue at hand.

Costs

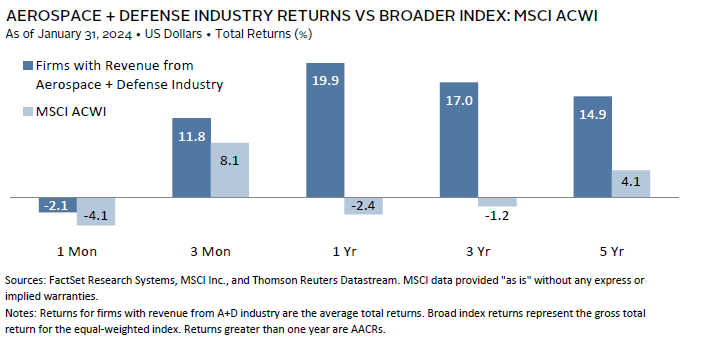

Divestment narrows the investment opportunity set and introduces new trade-offs. In addition to the elimination of certain direct investments, the divestment decision may steer the portfolio away from asset managers that do not screen for the excluded investments. The divested assets may ultimately become less favorable holdings because of growing pressure to move away from the goods and services involved in the conflict. Or they may be profitable endeavors, and, as a result of divestment, the institution chooses not to participate in financial gains. For example, firms with sales generated in aerospace and defense outperformed the broader index of stocks over the past five years.

Is the institution willing to trade off real, long-term dollars that could be used to provide impact in a different way? Higher endowment returns educate more students, hire more faculty, and invest in teaching and research that can influence policy through writing, legal work, and media. How should the institution balance current causes and views with future views, obligations, and priorities? The endowment is composed of long-term capital intended to support the institution in perpetuity. A change in investment policy can alter the long-term return potential of the portfolio.

Timeline

Very specific, short-term changes to investment policy are contrary to the long-term nature of a diversified investment strategy and the time horizon of the perpetual assets. It takes time to divest, especially if ownership is through external investment managers and private investments that involve longer-term lock-ups for limited partners. Does the timing of the cause inspiring divestment align with the long-term nature of an endowment? Are there other more immediate forms of expression that could affect change sooner?

Another element of timing is how often fiduciaries will review the divestment. How long will the institution withhold capital? If the offending company or industry changes its ways will positive change call for restored investment? At what frequency will circumstances be reviewed to evaluate outcomes? Are those responsibilities defined in the governance process? Questions of timing are connected to the desired outcomes and the nature of the concern.

Legal and Fiduciary Responsibilities

The endowment functions within the bylaws of the institution, as well as regional and national laws. It is important to understand whether the exclusionary action of divestment is permitted under those laws. The action may also be counter to government policy, so it is important to understand the potential impact on government contracts and oversight. Does the opposition impel the institution to extend its boycott to its own government?

Bigger Picture

Endowment policy fits into broader institutional strategy and actions. If the divestment issue is an institutional priority, are other elements of the institution also being employed or deployed to address the issue? How does the endowment’s divestment fit into a broader strategy? Is the endowment one piece of an activist strategy? Would the divestment action be amplified by other forms of activism and collective change? For example, if the endowment is divesting from a popular food chain that is operating in a contentious region, but members of the university community continue to eat at the local franchise, the endowment would be held to a different standard than the community and would be divesting in an isolated vacuum.

Concluding Thoughts

Divestment is a complex decision. The endowment portfolio is composed of a group of gifts entrusted to the institution in perpetuity. Endowment funds are invested with a shared mandate to withstand geopolitical and economic tumult and to equitably distribute funding to multiple generations of stakeholders. The endowment assets serve the entire institution, forever. Fiduciaries have a responsibility to determine a course of action that considers the future of the institution, given its mission and mandate.

This paper offers considerations for how to manage calls for divestment and raises questions that need to be answered to respond clearly and effectively to divestment requests. To navigate tumultuous times and passionate entreaties, we believe institutions need to lean into good governance. It is important that the decision-making process provides clarity, and by extension an opportunity for learning, listening, and engagement, especially when the outcome of the process will not satisfy all stakeholders. An orderly process and response can enable an institution to move forward and feel confident about how and why the outcome was achieved.

Tracy Abedon Filosa, Head of CA Institute

Margaret Chen, Global Head, Endowment and Foundation Practice

Footnotes

- There is a separate but related question that asks if an institution should take a political stance, from acknowledgement to action.

- Relevant policies may include the investment policy, ethical investing guidelines, ESG guidelines, divestment criteria or policy, and university mission and values statements.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.