Powering the Future: Infrastructure Trends, Performance, and Portfolio Impact

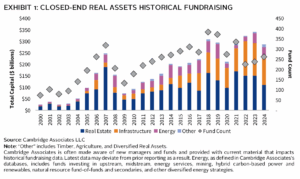

In our previous articles for the PREA Quarterly, we noted that in 2024, for the first time since we began tracking fundraising trends, infrastructure fundraising activity surpassed that of real estate, as shown in Exhibit 1 1 . Infrastructure continues to garner investor interest as the asset class provides resilient income with inflation protection, exposure to megatrends such as decarbonization and digitalization, and the potential for attractive total returns. For investors seeking income, we believe secondaries vehicles and infrastructure debt strategies are increasingly attractive investment opportunities. For those looking for growth, strategies pursuing a mix of infrastructure and private equity investment approaches can be compelling.

Today’s market environment is complicated by higher interest rates, regulatory risks, and increasing supply chain bottlenecks, and remaining selective and partnering with managers with operational expertise is critical. In this article, we explore infrastructure fundraising trends and comment upon historical performance; we also discuss emerging themes, risks, and the role that infrastructure can play within portfolios.

What We’ve Observed

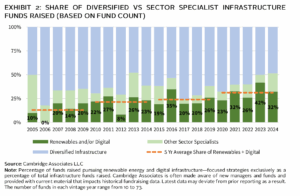

In 2024, the median infrastructure target fund size was $1.15 billion versus $500 million for real estate. The relative difference in size is mainly attributable to the scale of underlying infrastructure investments and, more recently, to the increasing number of digital / datacenter and energy transition—focused funds. As shown in Exhibit 2, the share of fundraising activity targeting these sectors has increased, fueled in part by demand from generative Artificial Intelligence for computing capacity and clean power. In 2023, the number of funds exclusively targeting either renewable or digital investments rose to 43% of total infrastructure funds launched. The relative share dipped to 32% in 2024 but remained in line with the 31% average share over the past five years.

Evolution of Infrastructure

The infrastructure landscape has evolved over the past 20 years. Traditional infrastructure investments targeted essential, mature public-private partnership types of assets, such as schools, hospitals, and toll roads—each with long-term leases in place and often with government counterparties. Additionally, traditional infrastructure included regulated utilities with monopolistic characteristics (i.e., water and waste facilities, gas and electricity networks). However, as private capital flowed into the space and new societal trends emerged, infrastructure has evolved to reflect broader transformations in the modern economy, including digitalization and an increasing push for clean energy resources.

The trends in renewable energy and digital infrastructure are expanding opportunities for investors—the need for reliable, sustainable energy and robust digital connectivity becomes increasingly central to economic growth and societal development. The accelerating shift towards cleaner energy sources is driving demand for assets such as wind, solar, battery storage, and power grid modernization. At the same time, the rapid growth of data consumption, cloud computing, and artificial intelligence is fueling demand for digital infrastructure, including data centers, fiber networks, and wireless towers.

As these themes of digitalization and electrification continue to evolve, many funds will turn to greenfield (i.e., development) opportunities, which are often complex and require meaningful amounts of capital. These projects carry their own risks related to construction and planning approvals but offer higher upside potential. Consequently, infrastructure funds can serve as a growth driver in portfolios with these managers targeting higher returns (12-16% or more net internal rate of return, or IRR) compared to traditional, inflation-hedging core-plus funds (8-10% net IRR). Looking ahead, as infrastructure becomes more competitive, investors may need to seek opportunities that incorporate a combination of traditional asset management and private equity approaches. Like private equity, these funds focus on backing management teams to build and scale assets and platforms but often involve higher capital expenditure requirements that are de-risked by long-term contracts, resulting in less price risk. As the infrastructure market continues to grow, manager selection is critical to identify top performers with proven processes and strong operational skills.

Rise of Infrastructure: Performance

Although past performance is not a reliable indicator of future results, particularly for the less-mature infrastructure asset class, Cambridge Associates’ (CA’s) database of performance data offers meaningful insights. We analyzed the performance of over 120 developed markets’ private infrastructure funds with vintage years from 2009-2020. Because of the evolving nature of the asset class and the limited number of funds in early vintages, we grouped funds into three-year buckets to minimize variability and provide a clearer picture of performance over time (as shown in Exhibit 3). We excluded emerging markets managers from our analysis because of the small number of funds focused on those regions, wider performance dispersion, and limited opportunities for institutional capital historically. That said, emerging markets are becoming increasingly attractive for infrastructure development, driven by advancements in technology, security priorities, and shifts in global trade dynamics, making this an area to watch in the future.

For funds with vintage years ranging from 2009- 2020, the median net IRR was 9.8%, and median returns have stayed relatively consistent over time, highlighting the attractive, stable, risk-adjusted returns that infrastructure investments offer. After median returns peaked in the 2012-2014 vintage year cohort (10.6%), returns have started to normalize as more capital and players have entered the space. Furthermore, dispersion has widened and is especially pronounced in the most recent cohort (vintage years 2018–2020), which may be attributable to a more competitive market environment, disruptions from the COVID-19 pandemic, and fewer realizations in recent funds that can heavily impact returns.

Top Performance Comes in Different Sizes

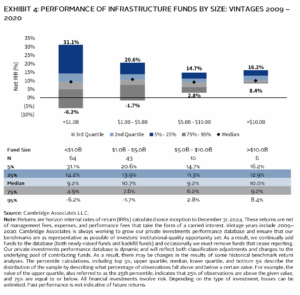

As we did for real estate in the Spring edition of the PREA Quarterly, we examined the relationship between infrastructure fund size and performance. We grouped funds by their total capitalization and reviewed the performance of funds from vintage years 2009-2020 (as shown in Exhibit 4). We found that the smallest funds (under $1 billion) had the lowest median net IRR (9.2%) but the highest top quartile returns and the widest dispersion. At the other end of the size spectrum, the largest funds (over $10 billion) delivered a higher median net IRR (10.0%) with lower return variability and no negative outcomes among bottom performers. Similar to real estate funds, the smallest infrastructure funds had the greatest dispersion of outcomes, and the largest funds had the least dispersion with no negative outcomes. As we noted earlier in the article, infrastructure funds are typically much larger in size because of the scale of underlying projects, and the sample size for this analysis is much smaller than the one used for real estate funds.

Multiple factors contribute to the relationship between fund sizes and returns. Larger funds typically execute large-scale investments with less development risk and more stable return profiles and are often more diversified across sectors and markets. However, as funds target larger infrastructure investments, exit options are more limited, with only a few buyers able to absorb assets of such magnitude. Conversely, smaller funds are often raised by emerging managers that face greater execution and portfolio concentration risk, which may contribute to the greater performance dispersion. As a result, we believe manager selection is especially critical for smaller funds, because success depends on both investment/execution skill and the ability to build a strong organization. We discuss how these managers approach investing in the sector later in this article. From a portfolio construction perspective, investors targeting smaller funds should spread their commitments across a larger number of funds to account for the increased variance of returns. Similar to real estate, investors with limited resources or smaller infrastructure allocations may be better served gaining exposure to the asset class through diversified funds.

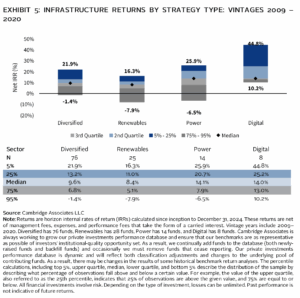

Top Performance Comes in Different Forms – Emerging Trends

We have also compared performance of diversified infrastructure funds and sector specialists (renewables, power, and digital). In vintages 2009-2020, sector-specialist funds slightly outperformed diversified funds (10.4% versus 9.6% net IRR) and showed greater performance dispersion. As shown in Exhibit 5, digital-focused infrastructure funds stood out, delivering the second-highest median return (14.0% net IRR) and no negative returns, though they represent a smaller cohort (in terms of fund count), and results may change as the sector grows. Traditional power-focused funds had the highest median return (14.1% net IRR) but with greater dispersion and negative outcomes than diversified or digital had, reflecting the volatility of the sub-sector. Early renewable managers’ underperformance was due to delayed technology development, slower adoption, and higher construction and financing costs. In recent years, however, the performance of renewable funds has improved, reflecting both the maturation of technologies from earlier funds and the green premium being offered for such assets recently. Going forward, secular trends like decarbonization and digitalization are expected to continue to support growth in these emerging infrastructure sectors.

There has also been a rise of lower-middle-market-focused infrastructure managers’ targeting value-added and opportunistic returns through platform developments, which are increasingly attractive. Many of these managers were spinouts from larger, established firms and are focusing on higher risk, growth-oriented strategies in niche platform buildouts that blend elements of infrastructure and private equity. These managers combine aspects of traditional infrastructure— a focus on capital preservation, long-term contracts, and downside protection—with the value-creation approach of private equity. Returns are generated through platform growth, rather than solely through financial structuring or value creation of a single asset. As a result, growth opportunities can be significantly more substantial today, and operational expertise has become more important than ever.

Conclusion

Infrastructure investments provide diversification and inflation-hedging benefits. However, unexpected or sustained periods of high inflation and regulatory or social pressures can impact valuations broadly across markets and dampen these benefits for infrastructure investors. Although infrastructure’s core attributes have remained resilient—as evidenced by steady secondary market pricing—elevated valuations, regulatory risks, and macroeconomic uncertainty could present challenges for investors.

Despite the risks, high-quality infrastructure managers should continue to serve as both a source of stability and growth in investor portfolios. In the current environment, investors have multiple ways of investing in infrastructure, allowing them to tailor portfolios to their risk-return objectives and liquidity needs. Opportunities exist, ranging from core and core-plus funds for stable income and inflation protection to value-added and opportunistic strategies for higher returns and risk. Infrastructure debt and secondaries have also become attractive options, with debt offering stable income at appealing spreads and secondaries offering access to high-quality assets, often at discounts to net asset value, while providing diversification and J-curve mitigation. As traditional infrastructure firms have matured, and fund sizes and valuations have increased, there is also an emerging cohort of middle-market managers targeting development opportunities with higher risk-return profiles that blend elements of infrastructure and private equity. Building an optimal infrastructure portfolio requires thoughtful diversification across size, structure, and strategy, as performance varies by manager and approach. An anchor commitment to a large, diversified fund manager can provide market beta and, with savvy manager selection, opportunity for upside; and smaller, adjoining commitments to sector specialists or emerging managers can better help clients dictate their sector and market weightings in search of alpha. In today’s evolving market environment, manager selection remains especially critical.

Authored by:

- Maria Surina, Investment Managing Director, Real Assets

- Ricky Roellke, Associate Investment Director, Real Assets

- Cameron Roy, Investment Associate, Real Assets

In partnership with PREA

Footnotes

Maria Surina - Maria Surina is a Managing Director at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.