Unlocking Innovation with Blockchain and Crypto Venture Capital Funds

Blockchain and crypto-focused 1 venture capital (BCVC) funds offer a compelling opportunity alongside traditional venture capital (VC) strategies. While some investors question the merits of blockchain technology and may overlook these funds, this could mean missing out on exposure to managers and innovations with the potential to transform industries and deliver outperformance. However, investors should expect significant dispersion in blockchain-focused funds, similar to that of other VC funds. As such, rigorous diligence in fund selection and thoughtful integration into a well-diversified VC portfolio will be essential to enhancing overall portfolio returns. For investors with VC exposure, this may mean allocating up to 1%–2% of the total portfolio exposure to BCVC. In this piece, we explore the market dynamics shaping cryptoassets, 2 share our rationale for including BCVC in VC portfolios, and outline key considerations for integration into institutional portfolios.

The evolving blockchain landscape

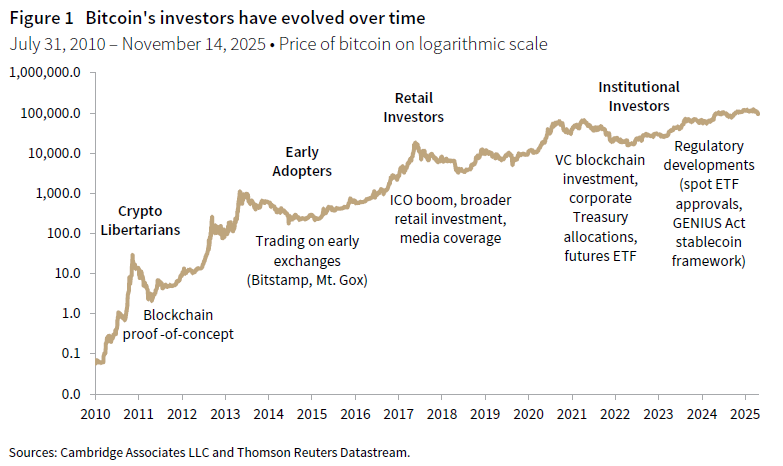

Since the first bitcoin block was mined more than 15 years ago, cryptoassets have grown from a niche experiment to a sector attracting major institutional capital (Figure 1). Early adoption was driven by technologists and crypto “libertarians” that sought financial sovereignty in a volatile, low-liquidity environment. Their efforts laid the groundwork for broader participation, which spurred the rise of exchanges, altcoins, and increased trading. Setbacks such as the Mt. Gox collapse—when the world’s largest bitcoin exchange lost hundreds of thousands of bitcoins to theft and mismanagement in 2014—exposed critical security gaps and prompted industry-wide improvements. Today, the sector’s maturation is evident in real-world applications like decentralized finance (DeFi), tokenized assets, and enterprise blockchain solutions, with major institutions and governments piloting blockchain-based systems.

A distinction exists between direct liquid token exposure and thematic blockchain and crypto investing. Liquid tokens, such as bitcoin, are as the name suggests, publicly traded. As such, they have exhibited a higher observed correlation to risk assets. They are also more directly influenced by retail investor sentiment, particularly as liquid crypto markets operate 24/7 and are easily accessible to individual investors. This contributes to their high observed volatility. For example, bitcoin has experienced 11 drawdowns exceeding 50% since 2011, with the most recent—a 77% decline—occurring from November 2021 to November 2022.

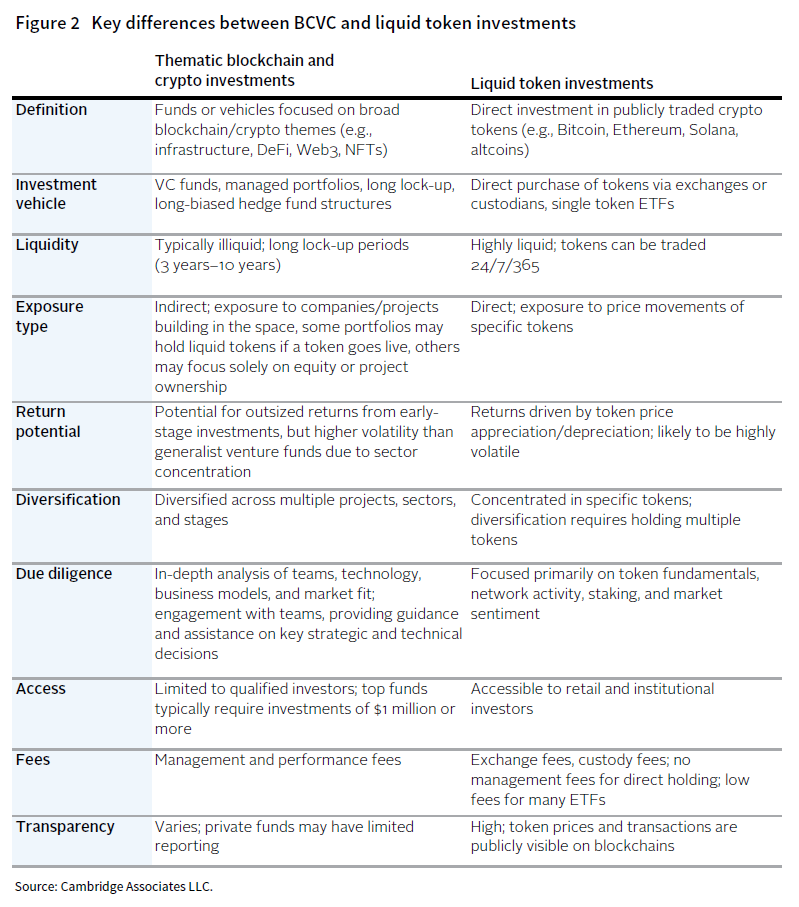

Thematic blockchain and crypto investing, typically accessed through VC funds, offers diversified exposure to companies and projects building in the space (Figure 2). Given the generally illiquid nature of these investments, their observed volatility tends to be lower. While these investments are subject to the typical risks associated with early-stage VC—such as high failure rates, uncertain business models, and limited operating history—they also offer the potential for outsized returns. Venture structures foster strong alignment between limited partners (LPs) and general partners and suit the extended development timelines of blockchain innovation. Their legal and operational frameworks support patient capital, enabling managers to realize value as projects mature.

Thematic blockchain and crypto investing can also be implemented via a hedge fund structure. Most hedge funds pursuing early-stage crypto investments use side pockets to manage illiquid assets, isolating them from the main portfolio to help reduce asset-liability mismatches. These structures can offer more frequent liquidity for the liquid portion of the portfolio and provide access to both liquid and venture-style opportunities, allowing investors to target venture-like returns. However, investments held in side pockets may remain illiquid for extended periods—sometimes even longer than the typical term of a VC fund. As a result, LPs should carefully evaluate the fund’s structure and liquidity terms, as the flexibility of a hedge fund does not necessarily extend to all underlying investments.

For investors seeking strong alignment, a defined investment horizon, and patient capital suited to the extended development timelines of blockchain innovation, the longer-term orientation of BCVC fund structures may be more appropriate for accessing early-stage opportunities in the space.

Performance

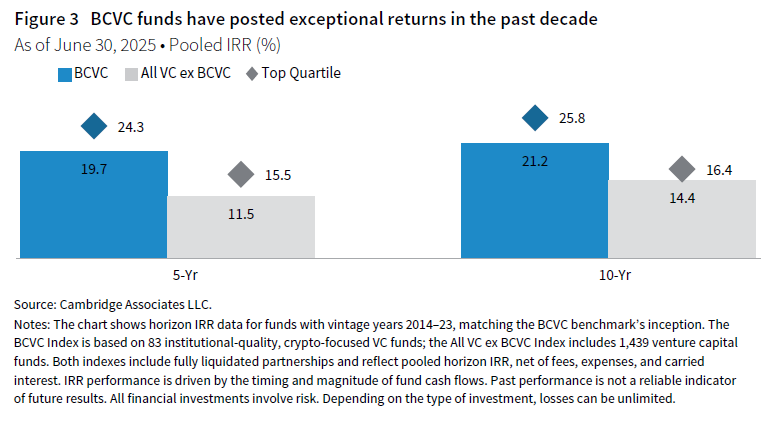

BCVC funds’ strong performance track record is a key reason we believe they merit inclusion in VC portfolios. Over the past ten years, BCVC funds delivered a pooled net internal rate of return (IRR) that surpassed that of all other VC funds (Figure 3). We do not attribute this outperformance to differences in fund size, as sizes have been largely comparable. Rather, we believe it is partly connected to exceptional gains in the broader crypto market—including bitcoin—which have increased interest in the space and technology.

Examining BCVC fund vintages reveals how timing and entry conditions can shape outcomes. Vintages launched during crypto “winters”—periods marked by sustained declines in cryptocurrency prices, negative sentiment, and reduced market activity—have often benefited from lower entry valuations, less competition for deals, and exposure to resilient projects. These conditions have positioned such funds for strong performance as markets recover. For example, the IRR for the 2018 vintage of BCVC funds has been 39% since inception, highlighting the potential for outsized returns when capital is deployed counter-cyclically.

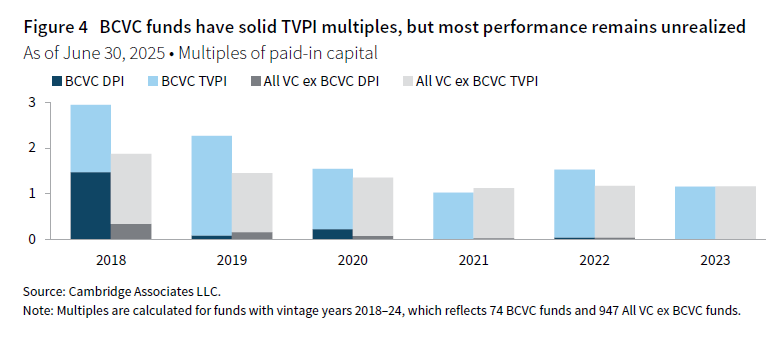

Beyond IRR, other performance metrics also highlight the strength of BCVC funds. Despite the relatively short history and limited universe of institutional-quality BCVC funds prior to 2018, available data indicate that total value to paid-in (TVPI) multiples have generally been robust (Figure 4). Realized returns (DPI) remain modest, but this pattern is not unique to BCVC; it reflects the long time horizons and exit dynamics typical of VC investing more broadly.

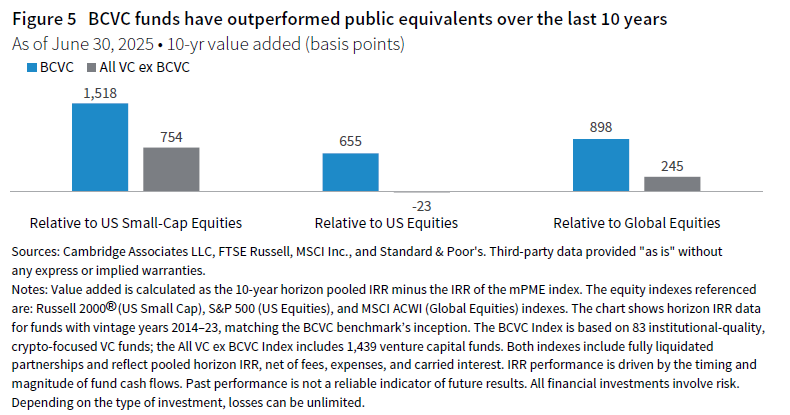

Beyond absolute return metrics, funds have also compared favorably to public equities in relative terms. Our modified Public Market Equivalent (mPME) analysis demonstrates that, over the past ten years, BCVC funds have outperformed major public equity indexes—including US equities, which themselves have delivered strong returns—highlighting their potential to enhance value within diversified VC portfolios (Figure 5).

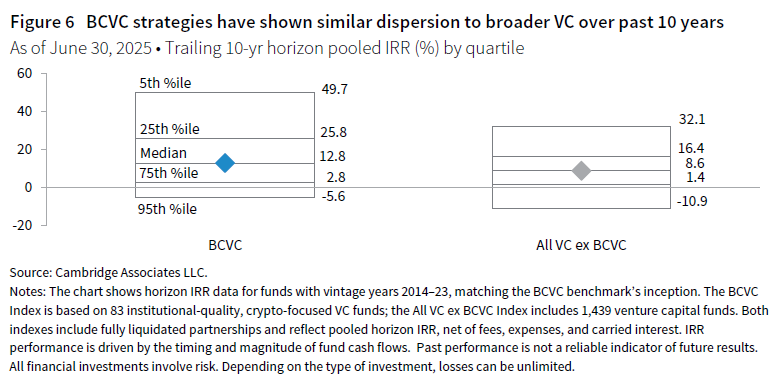

Performance dispersion is another important consideration. BCVC funds exhibit a range of outcomes similar to the broader VC universe. The interquartile range of returns over the past ten years reached approximately 20 percentage points (ppts)—slightly wider than the 15 ppts observed in non-BCVC funds, and much greater than the sub-5 ppt range typical of public equity strategies (Figure 6). This variability underscores the importance of rigorous manager selection and thorough due diligence, as well as thoughtful manager sizing and new fund commitment pacing, since the difference between top- and bottom-quartile performers can be substantial.

Thematic drivers

Another key reason to include BCVC funds with traditional VC strategies is their unique exposure to new and evolving areas of innovation. Several key trends—such as the convergence of crypto and artificial intelligence (AI), tokenization of real-world assets, and the rapid evolution of stablecoins—demonstrate the unique value creation opportunities accessible through BCVC-backed ventures.

- Crypto and AI convergence. Decentralized platforms are unlocking new models for collaboration and value exchange. For example, Zero Gravity (oG) AI is a next-generation infrastructure that enables AI to operate across distributed networks without relying on centralized servers like traditional AI companies. There are many possible uses for this technology, but potential applications include allowing smart devices—such as home appliances—to securely share and process data directly with each other, coordinating to optimize energy usage while keeping personal information private, or to use unused server capacity at data centers. Similarly, wearable health monitors could one day provide real-time insights to doctors without sending sensitive data to big tech companies.

- Tokenization of real-world assets. Blockchain technology is facilitating the digital representation and ownership of assets such as commodities, stocks, and bonds. Robinhood’s launch of tokenized US stocks allows customers to trade fractionalized shares 24/7, expanding market access and liquidity. Many of these technological advancements originate from privately held companies supported by VC, which benefit from new revenue streams and broader market reach.

- Stablecoins. Stablecoins have become foundational infrastructure for decentralized finance, trading, and cross-border payments, with market capitalization and transaction volumes now rivaling traditional payment networks. In June 2025, Circle’s successful initial public offering (IPO) saw its market capitalization surge from $7 billion to $60 billion, delivering substantial returns to VC investors. Regulatory developments—such as the GENIUS Act and the pending CLARITY Act—are accelerating institutional adoption and driving early-stage investment in stablecoin infrastructure, compliance, and integration with emerging technologies.

These innovation themes, among many others, are directly shaping the evolution of the blockchain and crypto VC landscape. As the sector matures, seed and early-stage funds are closing larger deals at record-high valuations, 3 reflecting robust demand for digital asset infrastructure and payments innovation. Recent IPOs and acquisitions—particularly in areas like DeFi, Web3, and stablecoin infrastructure—underscore the market’s appetite for these transformative technologies. While exits via token launches are becoming more common, fully monetized exits remain less established than traditional IPOs or mergers & acquisitions, highlighting the unique dynamics of the space, as well as the emerging nature of the field. Regulatory progress and record stablecoin circulation are fueling investor interest, and blockchain networks and developer tools continue to attract capital. BCVC funds are well positioned to capture the next wave of innovation and growth, making their inclusion in VC portfolios compelling.

Portfolio considerations

The decision to allocate to BCVC funds within a VC portfolio should also consider the degree of crypto-related exposure present in the broader portfolio. The exposure could come in a variety of forms, such as direct crypto holdings, investments in blockchain initiatives (e.g., projects or companies developing or adopting blockchain technology), or significant revenue tied to blockchain-based services. For instance, Strategy (formerly MicroStrategy) alone, which is the world’s largest corporate holder of bitcoin, contributes roughly 6 basis points of exposure to the MSCI All Country World Index. Private equity and VC portfolios may also include stakes in the space or related fintech firms, exchanges, or infrastructure providers. We believe having up to 1%–2% exposure in blockchain-related assets at the total portfolio level is appropriate.

Once current exposure is clarified, investors should ensure they have confidence in the managers responsible for navigating the rapidly evolving crypto landscape. Specialist managers with deep technical expertise and sector knowledge are well positioned to identify opportunities and manage risks, considering the wide dispersion of the funds in the space. A disciplined, research-driven approach—grounded in understanding the technological foundations, market dynamics, and practical applications of blockchain—can help investors participate in the sector’s growth while maintaining appropriate risk controls. Strong conviction in manager capability is essential for sound allocation decisions.

One distinctive aspect of BCVC funds is they often generate significant liquid token holdings once private investments in projects launch public tokens through an Initial Coin Offering (ICO) or Token Generation Event (TGE). Because tokens are typically much more volatile than public equities or traditional private investments, the overall volatility of BCVC funds can be substantially higher than LPs might expect from conventional private investments—sometimes as early as three to five years into the fund’s life. As a result, BCVC investors should anticipate greater swings in quarter-to-quarter portfolio valuations and calibrate their expectations accordingly. While this increased volatility can be challenging, it also creates the opportunity for funds to return capital earlier, since ICOs and TGEs often occur much sooner than traditional IPOs.

BCVC funds—especially those managed by blockchain specialists—provide access to a broad spectrum of opportunities within the digital asset ecosystem. These funds invest across diverse themes such as DeFi, infrastructure, applications, and AI integration. The broader crypto market includes both venture-stage projects and liquid tokens, offering exposure to a wide range of technologies and business models. A thoughtfully constructed portfolio of blockchain venture investments—whether by a pure venture structure, a hybrid structure, or a long-lockup hedge fund structure with side pockets—can deliver diversification benefits and access to innovation and growth throughout the blockchain sector.

The strategic role of blockchain and crypto VC in portfolios

The rapid evolution of the cryptoasset sector is creating new frontiers for innovation, diversification, and growth, with BCVC funds standing out as a strategic way to access these transformative opportunities. We believe their strong track records, differentiated exposure to emerging themes, and potential for outsized returns make them a compelling complement to traditional VC strategies.

Looking ahead, the dispersion of outcomes among BCVC funds underscores the importance of rigorous manager selection and thoughtful portfolio construction, investment pacing, and manager sizing. Investors who approach the space with discipline, deep research, and a willingness to engage with specialist managers will be best positioned to capture the next wave of digital innovation. A modest allocation to BCVC funds—alongside other VC strategies—can deliver meaningful exposure to the technologies and business models driving the future of finance and beyond.

As the digital asset ecosystem matures, the case for including BCVC funds in institutional VC portfolios is only growing stronger. Those who act proactively and intentionally will diversify their VC portfolios and gain access to the engines of tomorrow’s growth.

Graham Landrith also contributed to this publication.

Footnotes

- In this paper, “blockchain and crypto” refers to VC strategies that invest in companies and projects developing blockchain technology, as well as those building applications and infrastructure across the broader crypto ecosystem. This includes areas such as DeFi, Web3, and tokenization.

- “Cryptoassets” serves as a catch-all term to describe cryptocurrencies and all other blockchain applications.

- Please see “Crypto VC Trends: Q2 2025,” PitchBook Data, Inc, August 19, 2025.

Sean Duffin - Sean Duffin is a Senior Investment Director for the Capital Markets Research team at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.