Tracing the Rise of Direct Lending: The Importance of Rates and Loan Structure

In an earlier paper, “Is Deregulation the Death Knell of Direct Lending? Reviewing the Evidence,” we discussed our skepticism that deregulation will be the demise of direct lenders. Our analysis of the data found that changes in bank lending could not clearly be traced to the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act in July 2010, or its implementation. If regulation did not spawn direct lending, what did? In this analysis we explore the genesis of the recent direct lending phenomenon to identify risks to the strategy and what investors should watch going forward.

Who Have Direct Lenders Been Replacing?

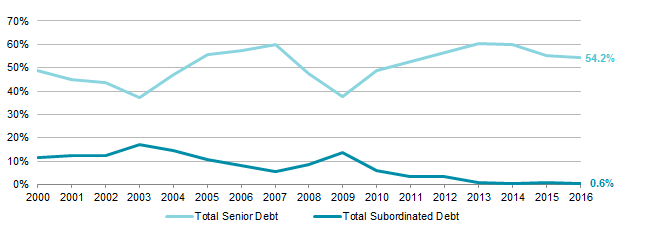

Direct lending is not so much a substitute for bank lending as a complement to leveraged buyouts (LBOs). This message used to be emphasized in direct lending pitchbooks but has recently been eclipsed by the theme of regulation. Historically, LBOs were financed by banks and mezzanine lenders in a combination of senior bank debt and subordinated debt. The casualty of the direct lending expansion appears to be subordinated debt, which has seen a dramatic decline since 2011. The magnitude of this displacement is quite large. From 2000 to 2010, subordinated debt averaged 11% of total sources before declining to an average 1.6% from 2011 to 2016.

Source: Standard & Poor’s Leveraged Commentary & Data.

Although the underlying data are heavily skewed toward the institutional market and may not perfectly reflect the middle market where many direct lenders play, the trend is instructive if one assumes that the syndicated market and the middle market are not completely distinct and insulated from each other.

Much of this capital is now being provided by direct lenders through unitranche loans. This new product replaced two tranches of debt, senior bank loans and subordinated debt, with one tranche, hence the name. Unitranches debuted in size after the global financial crisis and offered an entire financing “solution” to equity sponsors. Needless to say, direct lenders have indeed displaced banks, but as a result (in part) of innovation, not regulation.

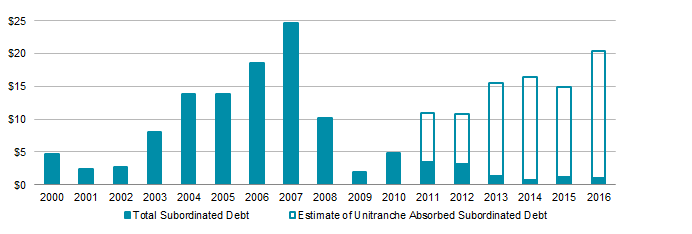

How much of this debt has direct lending replaced? The chart below estimates this by showing how much subordinated debt might have been issued had such debt retained the same 11% share of total debt from 2011 through 2016 that it held from 2000 to 2010.

Source: Standard & Poor’s Leveraged Commentary & Data.

Notes: Total subordinated debt in each year is estimated. To estimate unitranche absorption of subordinated debt, we assume that post-2010 subordinated debt maintained the same proportion of total debt as its average from 2000 to 2010 (11%).

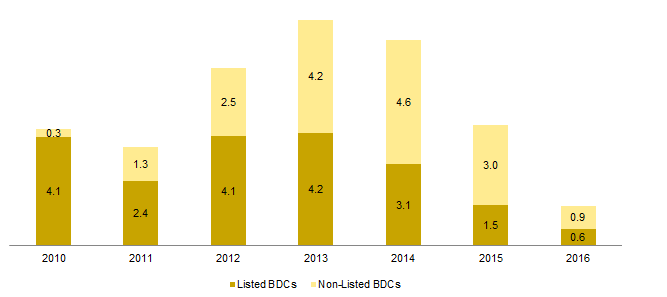

These disruptive unitranche loans were primarily provided by direct lenders, either in locked up partnerships or as publicly listed or privately held business development corporations (BDCs). The rising trend of BDC formation broadly reflects the early decline of subordinated debt.

Sources: Bloomberg L.P., S&P Global Market Intelligence, and Wells Fargo Securities LLC.

The Value of Unitranche Financing

For institutional investors, unitranche solved the yield problem. By going deep enough into the capital structure to displace subordinated debt, unitranche loans could blend to a 7% to 10% instrument yield (depending on company size, sector, etc.) with almost no volatility. As high-yield spreads probed the downside for years, investors started to find unitranche funds more appealing. Moreover, because unitranche loans span the senior and junior tranches of a financing, managers could raise bigger funds, which accommodate larger investors.

Private equity funds also like the unitranche because they can secure financing from one source. In the past, sponsors needed to raise two tranches of debt from two different lenders. That meant not only another set of negotiations between the sponsor and the second lender, but also a third set between the two lenders. The unitranche structure likely also found favor with private equity funds given the potential for greater negotiating power against direct lenders during difficult times. It is one thing to negotiate against a professional at a direct lender, a fund whose entire existence is premised upon sponsor deal flow. It is an entirely different dynamic talking to a professional workout officer of a gigantic bank with multiple business lines and layers of bureaucracy.

Perhaps the biggest appeal to private equity sponsors is the flexibility offered by unitranche lenders. Direct lenders frequently commit at closing to fund future acquisitions and capital expenditures, a crucially important term for private equity funds seeking to roll up industries or expand EBITDA (earnings before interest, tax, depreciation, and amortization) through acquisitions in a low growth environment. The combination of a bank and mezzanine lender might not be so easily accommodating.

Finally, the unitranche may have benefitted the private credit markets by removing the 4.0 to 6.0 times levered debt financing from bank balance sheets and their depositors, and placing it squarely with more informed and sophisticated institutional investors.

A Boon for Direct Lenders

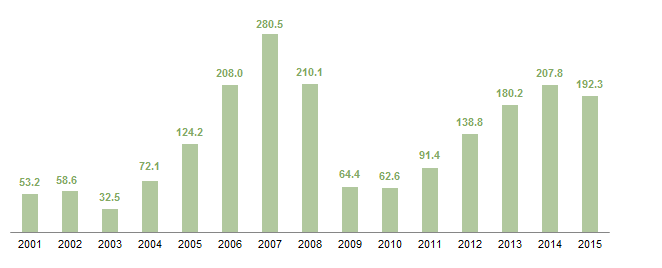

This innovative product came at the right time, just as private equity was beginning a new cycle of capital raising. Private equity funds have raised almost as much in the last five years ($810 billion) as they did in the five years leading up to the global financial crisis ($895 billion). If LBO funds are the natural consumers of direct lending financing, then it appears safe to conclude that the market for direct lending has rebounded since the crisis. Direct lenders have responded by capturing significant market share.

Sources: Cambridge Associates LLC and The Private Equity Analyst.

Please see Tod Trabocco, “Is Deregulation the Death Knell of Direct Lending? Reviewing the Evidence,” Cambridge Associates Research Brief, June 12, 2017.

Viewing the rise of direct lending as a product of innovation—rather than regulation—changes the outlook for direct lending. If direct lending grew out of regulation (and we don’t think it did, as discussed in our earlier paper), then the threat of deregulation conjures images of banks returning to the LBO market and reclaiming ceded market share. Direct lenders’ incumbency value is low. However, if direct lending funds are really a way to deliver a new and far more suitable form of LBO financing, then banks have a higher hurdle to clear if they want to re-enter the LBO market. They must either begin offering the same product at lower prices, or find a form of financing superior to the unitranche. We believe that offering the unitranche would require banks to fundamentally change their historic approach to lending. As a result, we do not see bank deregulation as a threat to direct lending.

Risks to Direct Lending: Rising Competition

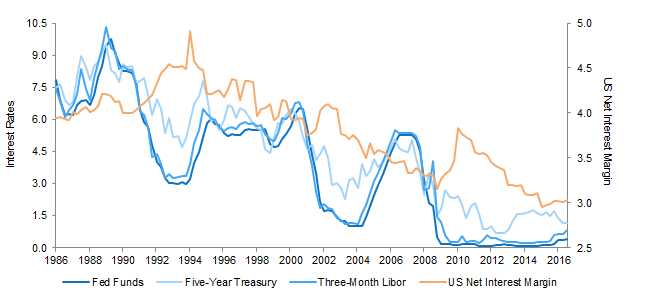

But we should not be too hasty to count out the banking sector. The decline of bank lending corresponds very well to declines in its profitability. Since peaking in 1994, net interest margins (the difference between interest income and interest expense, a measure of the profitability of traditional bank lending) have been on a downward trend, meaning lending is increasingly less profitable. Net interest margins declined broadly in line with other market indicators, and there is an obvious similarity between bank lending margins and other headline indicators.

Bank Lending Margins and Various Market Interest Rates

First Quarter 1986 – Second Quarter 2016 • Percent (%)

Source: Federal Reserve Bank of St. Louis, Economic Research Division.

Now that monetary policy is showing signs of reversing, the decline in bank lending could as well. If rising interest rates return profitability to bank lending, a return by banks to LBO lending activity would create more competition for direct lenders. Recall that a unitranche loan replaces the two tranches of bank and mezzanine debt, and that pricing can be viewed as a blend between bank debt financing cost and mezzanine debt financing cost. Consider further that banks’ capital costs (they are more highly levered than direct lenders and their liabilities are cheap deposits) are below those of direct lending funds. If a window develops whereby banks can team up with mezzanine lenders to provide cheap financing, sponsors may be enticed to forego lower execution risk and more flexible terms for cheaper capital. However, with each passing year, the unitranche matures and gains more adherents, increasingly muting the threat of renewed bank competition.

The Bottom Line

Although it is impossible to identify whether banks willingly exited LBO lending for reasons of profitability (or other reasons) or whether the unitranche proved irresistible for sponsors, one thing is clear: the unitranche has contributed meaningfully to the rise in investor interest in private debt. Viewing direct lenders’ future through this lens suggests that it’s not regulatory policy that investors should keep an eye on. Rather, it’s interest rate policy. As most direct lending instruments have floating rates, increases in interest rates will increase debt service burdens on borrowers. If rising rates outpace earnings growth, credit fundamentals will weaken. Fed rate rises will also fatten net interest margins and may attract commercial lenders back into the LBO market. This could test the appeal of unitranche through competition from the historic financing duo of banks and mezzanine lenders.

Tod Trabocco, Managing Director