Solvency Beyond Relief: Unlocking the Full Potential of SFA Program Assets

The American Rescue Plan Act of 2021 1 (ARPA) included substantial relief funds for the most troubled US multiemployer pension plans through its Special Financial Assistance (SFA) program. The SFA program was created to help seriously underfunded multiemployer pension plans maintain solvency through 2051. Multiemployer pension plans receiving SFA funds now have a unique opportunity to refine their investment approach—a feat that was once impractical for plans that didn’t have enough assets or needed to worry about liquidity.

This paper discusses how multiemployer pension plans can optimize their investment strategy using existing plan assets as well as SFA funds. Plans that allocate across traditional and alternative asset classes—including private investments—can increase their likelihood of maintaining solvency to 2051 and beyond. We begin with a general overview of the SFA program, with a focus on the investment implications for multiemployer pension plans.

Background: The SFA Program

The SFA program was initiated following ARPA’s passage into law in March 2021. It organized pension plans into six priority groups, with the most troubled plans receiving funds first. Plans deemed non-priority eligible, but still facing solvency issues—generally in the Critical and Declining Pension Protection Act Zone Status 2 —can apply for funds beginning in March 2023.

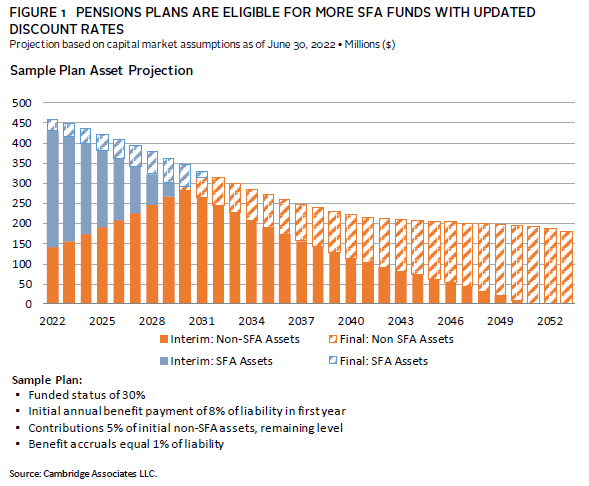

The SFA program’s initial stipulations faced some pushback from plan sponsors and practitioners. The amount of SFA funds made available to a plan was based on an asset projection using a discount rate that, at the time, far exceeded current bond yields. This liability rate mismatch was addressed in the final rules announced in July 2022 to better support improved funded status projections. A lower discount rate used to project SFA assets consequently allowed for plans to be eligible for a greater amount of SFA funds (Figure 1).

While SFA funds are still required to be segregated from non-SFA funds in pension portfolios, previous requirements about their allocation were also modified in the July 2022 update, which removed the stipulation that program funds could only be invested in investment-grade bonds. Final regulations allow for 33% of a plan’s SFA funds to be invested in equities and other growth assets.

Moving Forward, Better Prepared

With the final rule, the Pension Benefit Guaranty Corporation has provided troubled multiemployer pension plans with a much higher likelihood of survival. While asset and funded status projections now look more favorable, chances of survival will be greatest for plans that can employ holistic investment approaches that maximize the efficiency of their strategic asset allocations. Periods of market volatility in 2021 and 2022 have driven home the notion that allocations to traditional assets alone are not enough to achieve adequate portfolio diversification or sufficiently prepare portfolios for market headwinds. In fact, the traditional 60/40 investment portfolio is on pace for one of the worst annual performances in history, returning -21% through September 30, 2022. In such an environment, plans run the risk of having to sell assets at depressed values to make benefit payments.

SFA regulations specify which asset classes can be used by program funds, stipulating a 67% allocation to investment-grade bonds and the rest to equities and other public growth assets. If structured appropriately, relief assets can be used to reduce much of the liquidity risk of the portfolio. A simple bond ladder or a cash with investment-grade bond mix should provide ample liquidity to meet benefit obligations. Another alternative is to use a cash flow–driven investment (CDI) approach, which minimizes liquidity risk using the following structure:

- Purchase specific set of bonds whose coupon and principal cash flows align with the plan’s projected benefit payments.

- Sell growth assets in the portfolio to replenish the fixed income assets as the CDI portfolio starts dwindling in value due to benefit payments.

- Continue this process until all SFA funds are depleted.

While this strategy would greatly reduce much of the liquidity risk in the portfolio, another benefit is that under this approach, the non-SFA portfolio may not be used for many years. This timeframe affords ample opportunity to grow the asset base of the non-SFA portfolio and further increase the chance of solvency.

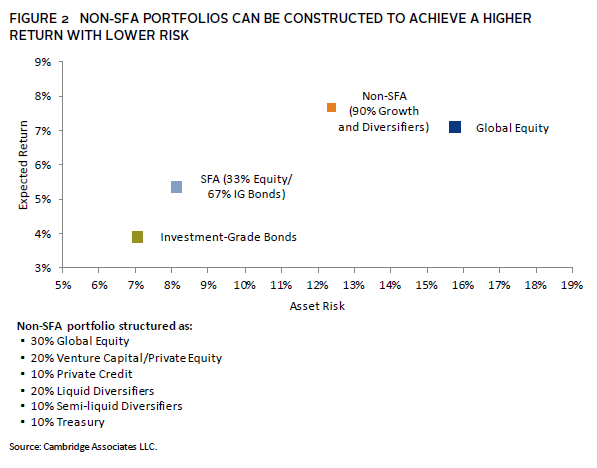

Illiquid and semi-liquid securities can help increase the likelihood of plan survival. Private investments (private equity, venture capital, and private credit), as well as both public and private diversifiers, have the potential to improve a portfolio’s risk/return profile, leading to increased asset value and likelihood of long-term solvency. By employing these strategies, the non-SFA portfolio can be constructed to achieve a higher return and lower risk than a pure equity portfolio, and much higher return profile than the SFA option (Figure 2). In this example, the portfolio could still employ a modest allocation to Treasuries to help with any capital calls and rebalancing.

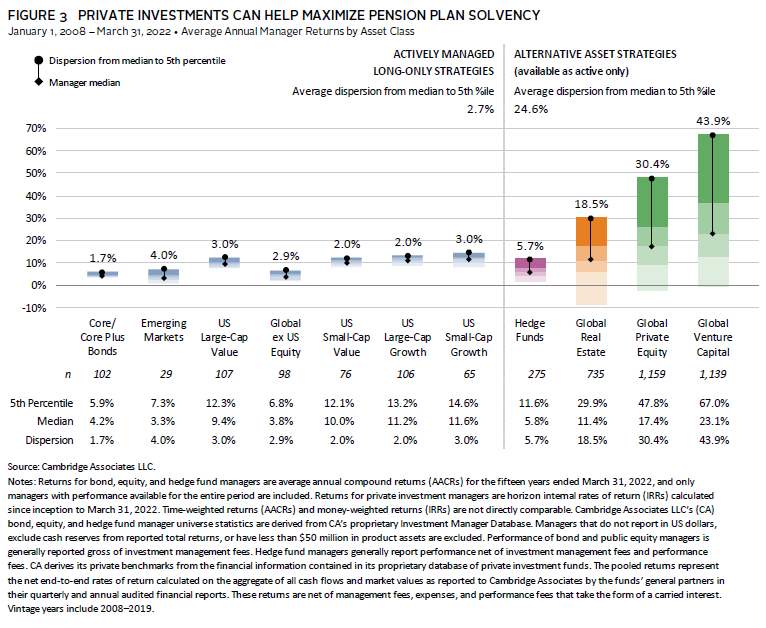

Historically, private investments have been an optimal asset class for helping pension plans maximize solvency (Figure 3). As the non-SFA assets will have minimal liquidity needs, assets such as venture capital and long-life private equity can be used at the onset of receiving the SFA funds. Over time, additional allocations can be made into more traditional private equity and, once liquidity needs arise, the portfolio can allocate into private credit. This varied allocation approach can take advantage of longer-life assets early and transition into shorter-life assets over time. If done efficiently, a large portion of the non-SFA portfolio can be invested into private investments with enough liquidity from the rest of the portfolio. Similar CDI strategies can also be used once the non-SFA portfolio begins paying out benefit payments.

Hedge funds, particularly absolute return strategies, represent another potential avenue for plans seeking a better diversification option as they look to the future. Figure 4 depicts how hedge fund strategies can perform well when all other asset classes suffer, such as the post-COVID inflationary period during 2022.

Under the improved SFA program regulatory framework of July 2022, median asset projections now look more favorable for most plans. However, we understand that future market conditions rarely, if ever, follow median return projections. If we develop a probabilistic (or random variable) projection of funded status, more realistic chances of solvency can be estimated. By constructing a well-rounded portfolio, the likelihood of increasing funded status and maintaining solvency is greatly improved.

Conclusion

With the larger asset base provided by SFA funds, the use of private investments and diversifiers by multiemployer pension plans is now not only more feasible but may be necessary to increase the likelihood of achieving long-term objectives. Recent market experience has shown that traditional asset allocations may not be enough to protect even the most conservative portfolios. Multiemployer pension plans should consider using alternative investments to increase returns, help manage risk, and provide diversification. Being able to use the return generation of privates, as well as specialized public and private diversifiers opportunities, can help improve the risk/return profiles of the portfolio, with liquidity needs addressed by cash flow matching. Employing these strategies will help multiemployer pension plans improve solvency to 2051 and beyond.

Footnotes

- The American Rescue Plan Act of 2021 (also known as the COVID-19 Stimulus Package) was a $1.9 trillion stimulus bill designed to counter the economic and public health effects of the COVID-19 pandemic. It was signed into law on March 11, 2021.

- The Pension Protection Act of 2006 required multiemployer pension plans to be certified based on their financial health. The certification of Green Zone plans is considered in good health, Yellow Zone plans is considered endangered, and Red Zone plans is considered to be critical.