Infrastructure Debt: Understanding the Opportunity

With underlying assets that provide essential services, infrastructure debt can play a key role in institutional investor portfolios.

- The asset class offers the possibility of delivering attractive returns, matching long-term liabilities, and diversifying traditional business cycle-sensitive investment holdings.

- Within infrastructure debt, private debt has been of particular institutional interest, as it offers increased return potential in exchange for reduced liquidity.

- Infrastructure debt strategies can be separated into three broad categories: capital preservation, return enhancement, and opportunistic.

The infrastructure debt market has changed rapidly in recent years, offering institutional investors new opportunities to gain exposure. The change has come as new regulations limit commercial bank incentives to hold long-term debt and as global funding needs have increased. These new opportunities have not gone unnoticed—many institutional investors are considering allocations to infrastructure debt, attracted to the industry’s potential for long-term cash flows, diversification, and attractive risk-adjusted returns.

Yet the opportunity set in this budding part of the market is remarkably diverse. Fund strategies can be grouped by the credit quality of the assets they target: investment-grade credits, crossover credits, or credits with equity features are common focuses. 1 But, within each grouping, strategies will differ based on sector and regional exposures, as well as how the manager seeks to add value. In this research note, we review how infrastructure debt has evolved, discuss its investment qualities, and highlight a few thoughts for those considering an allocation.

Market Backdrop

The global financial crisis fundamentally altered the infrastructure debt market. In the years leading up to the crisis, commercial banks provided an estimated 90% of all private infrastructure debt. Although commercial banks have remained key providers of capital in more recent years, higher capital and liquidity requirements under the new Basel III rules and other regulations have impacted the profitability of long-term loans for banks. As a result, commercial banks’ share of aggregate infrastructure debt financing has dropped in recent years.

For a broader discussion of this topic, please see Kevin Rosenbaum et al., “Digging In: Assessing the Private Infrastructure Opportunity Today,” Cambridge Associates Research Note, April 2017.

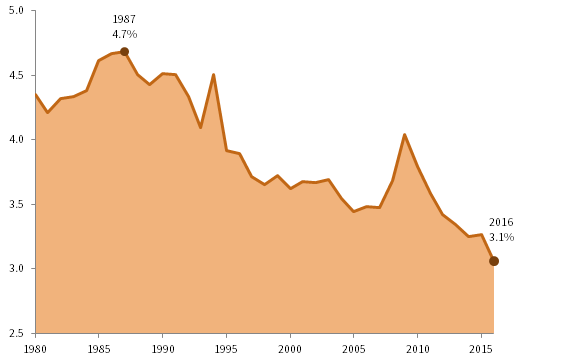

The drop in bank funding has coincided with shortfalls in government infrastructure spending. According to data from the Organization for Economic Co-operation and Development, aggregate investment in infrastructure has fallen among reporting member countries from a high of 4.7% of GDP in 1987 to 3.1% in 2016, the lowest level on record (Figure 1). In many countries, high levels of government indebtedness and little appetite for raising taxes are likely to keep public spending levels low for the foreseeable future.

FIGURE 1 AGGREGATE OECD GOVERNMENT FIXED ASSET INVESTMENT

1980–2016 • Percent (%) of GDP

Source: Organization for Economic Co-operation and Development.

Notes: Data represent the annual aggregate amount of gross fixed capital formation divided by the annual aggregate GDP of OECD countries reporting that year. The number of countries represented in the data changes overtime, beginning with Australia, France, Korea, Norway, and the United States, and expanding to include 35 OECD countries.

These realities have provided an opening for institutional investors. Attracted to its solid investment qualities, long-term investors—particularly those with liability-driven investment strategies—are becoming more active in the space. According to Preqin, more than $8 billion was raised in 2017 across 21 funds targeting infrastructure debt. Although that is small relative to other private investment categories, it’s large relative to the amount the industry raised just a few years ago—just $1 billion was raised in 2010, according to the same source.

Infrastructure debt funds typically invest in debt linked directly to projects, rather than debt linked to a corporate entity. Known as project finance, this type of debt has become increasingly popular in recent decades, as it allows a sponsor to shift risk off its balance sheet. It typically entails the creation of a new economic entity, and income generated by the new entity directly services the debt—leaving debtholders with little or no recourse to the sponsor’s other assets. As a result, these long-term arrangements usually include more protective covenants than ordinary corporate debt, helping to reduce some of the risks inherent to project finance.

Infrastructure debt funds typically target project finance—but there is no single definition among investors of what constitutes infrastructure. Investors favor assets that are either monopolistic or quasi-monopolistic, regulated, and have relatively inelastic demand. Although assets with these characteristics tend to have predictable cash flows that might be more resilient in an economic downturn, investors have different interpretations of exactly what assets meet these criteria. As a result, sector and risk exposures of funds (and public market indexes!) differ.

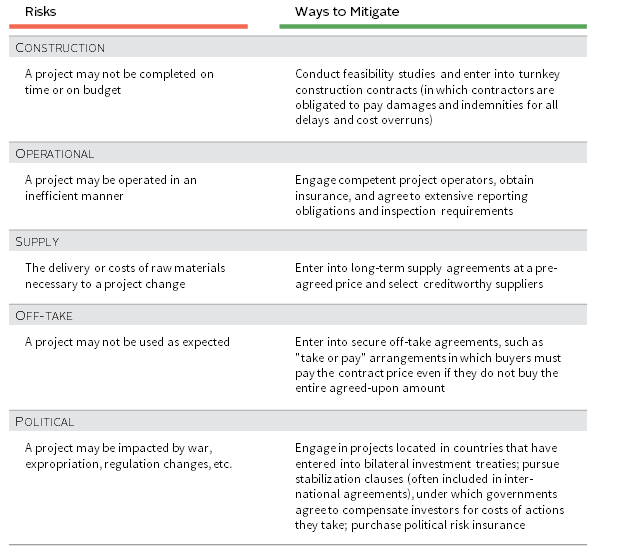

Infrastructure debt managers also differ in their exposure to development risk. Simplistically, funds looking to provide a stable yield may invest primarily in assets that are mature and already operating (brownfield assets) as they may have stronger credit profiles. Funds looking to generate higher rates of return may have more exposure to assets in the development phase (greenfield assets). In practice, though, project finance participants use a variety of risk mitigation techniques to address a variety of risks over the project’s life cycle (Figure 2), allowing funds with risk-averse strategies to invest in greenfield assets.

FIGURE 2 MITIGATING RISKS IN INFRASTRUCTURE INVESTMENTS

As of August 2018

Institutional interest in infrastructure debt has been primarily focused on private debt, as it offers increased return potential in exchange for less liquidity. Private debt also includes a larger universe of potential issuers. More broadly, the majority of infrastructure debt, including publicly traded bonds, takes the form of senior debt. This debt ranks ahead of the borrower’s other financial obligations and is typically investment grade. To improve the credit profile of the senior debt and lower the total cost of capital, many sponsors issue junior or mezzanine debt with higher rates of returns to compensate for greater risk.

Investment Qualities

The positive reception infrastructure debt has enjoyed from institutional investors, particularly pensions, insurance companies, and sovereign wealth funds, stems from its solid investment qualities. With underlying collateral providing essential services, infrastructure debt can play a key role in long-term institutional portfolios. Attractive risk-adjusted returns, the ability to match long-term liabilities, and the potential to diversify traditional business cycle-sensitive investment holdings are key benefits.

Fund managers are enthusiastic promoters of infrastructure debt’s return potential, arguing its illiquid and complex nature can deliver a premium. Though the performance history of infrastructure debt funds is limited, a variety of private strategies with longer histories have performed well, and investors in illiquid and complex investments should demand higher rates of return. At the deal level, Deutsche Bank estimated that private investment-grade infrastructure debt in 2017 offered a spread premium between roughly 60 basis points (bps) and 100 bps in Europe, and 60 bps and 130 bps in the United States, relative to public equivalents.

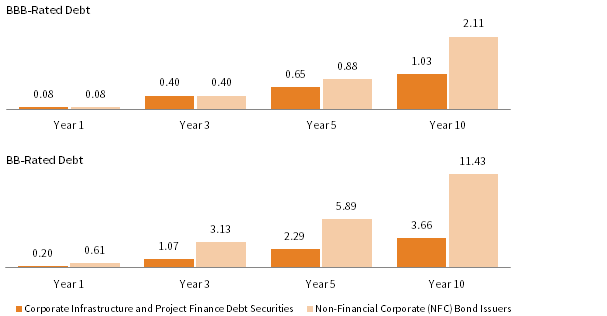

Infrastructure debt may also exhibit less default risk than similarly rated corporate issuers. As many assets are monopolistic, regulated, and have relatively inelastic demand, it stands to reason that they may be more resilient. In comparing 30 years of corporate infrastructure and project finance debt with non-financial corporate equivalents, credit rating agency Moody’s found that the former were less likely to incur credit losses, especially over long-time horizons, and exhibited greater stability in credit ratings (Figure 3). For unrated project finance bank loans, Moody’s also found superior recovery rates for infrastructure credit compared to corporate credit, with nearly two-thirds of all infrastructure defaults ultimately recovering 100%.

FIGURE 3 INFRASTRUCTURE VS NON-FINANCIAL CORPORATE DEBT LOSS RATES

1983–2015 • BBB- and BB-Rated Debt • Percent (%)

Notes: BBB- and BB-rated debt are equivalent to Baa and Ba ratings assigned by Moody’s. NFC issuers include industrial, transportation, and utility companies. Because utilities and transportation issuers are considered part of both the infrastructure and the NFC debt universes, there is an overlap but the magnitude of the intersection is small and does not meaningfully impact the comparison.

Infrastructure debt’s long-term nature is a key feature, particularly for institutional investors driven by liabilities. Though banking regulations adopted following the global financial crisis have shifted much of the infrastructure market into shorter maturity loans (often between five and seven years), longer-dated maturities (15–30 years) remain common for high-quality assets. As these assets also tend to be regulated and often have customer off-take agreements in place, investors have a high degree of visibility into long-term cash flows and many appreciate the asset as a key source of duration.

Infrastructure debt’s long-term nature may also help diversify traditional investment holdings. As infrastructure debt structures typically finance individual projects and not corporate entities, they represent a more direct exposure to the asset class. Corporate entities may also engage in business lines outside of what is traditionally considered infrastructure, making those cash flows more correlated to conditions in those markets. Assets that are more “pure-play” infrastructure should be more resilient in a downturn, given their demand typically is relatively inelastic, and should better diversify traditional business cycle-sensitive investment holdings.

Still, investors considering an infrastructure debt investment should fully understand the risks involved. As many investors opt to gain exposure through a closed-end fund, investors should be able to tolerate capital that is locked up for a decade or longer. Infrastructure debt’s long-term nature, which tends to attract many investors, also means that an investment is likely to be more sensitive to interest rates than a comparable short-term fixed income security. And, even though many debt providers look to structure deals to mitigate risk as much as possible (as highlighted in Figure 2), investors should recognize that no investment is risk free.

Implementation Options

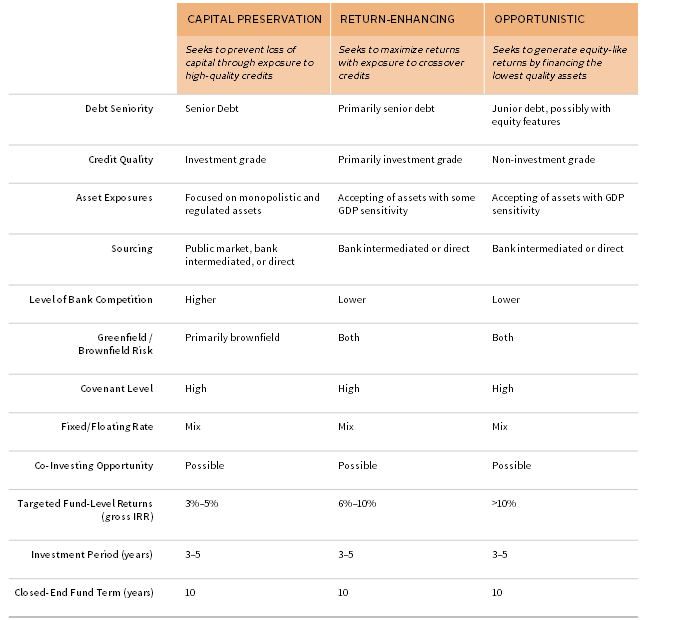

Infrastructure debt funds employ a variety of strategies. One way to categorize the various strategies is by the credit quality of the assets they target. By dividing the infrastructure debt fund universe in this manner, strategies tend to fall neatly into one of three broad types, which we label capital preservation, return enhancement, and opportunistic (Figure 4). Though funds that share a label also will share some common characteristics, including roughly similar risk and return objectives, investors should understand that no two funds are exactly the same.

FIGURE 4 COMMON CHARACTERISTICS OF INFRASTRUCTURE DEBT STRATEGIES

As of August 2018

Source: Cambridge Associates LLC.Notes: The table reflects primary trends we see across infrastructure debt fund strategies. There are exceptions to these observations.

Capital preservation strategies invest in senior secured investment-grade debt. These funds target gross internal rates of return (IRRs) in the 3%–5% range and tend to attract regulated insurance companies and pension funds that seek duration and stable income. Although the majority of the exposure comes in the form of private loans, much of which is not rated by external credit rating agencies, funds may also have exposure to publicly traded bonds. Capital preservation strategies typically have exposure to assets with maturities ranging from seven to 30 years, with open-ended funds and segregated accounts tending to have longer average lives than other strategies.

Further up the risk/return spectrum are managers seeking to enhance returns with exposure to crossover credits that straddle the investment-grade and non-investment-grade universes. These strategies typically target gross IRRs in the 6%–10% range, with debt that may be senior and junior in the capital structure. By venturing into non-investment-grade territory, these managers face less competition from banks, which have reduced balance sheet exposures due to tighter reserving regulations. This potentially gives investor capital more influence over the terms of individual deals. Lower-rated investments tend to have shorter maturities, shorter duration, and some additional sensitivity to broad market factors, such as credit spreads and economic growth.

Opportunistic debt strategies are likely to have the most exposure to junior debt instruments, some of which may have equity features. The target gross IRRs on these strategies tend to be 10% or higher, rivaling the return targets for core infrastructure equity funds. This high level of return comes as managers seek to provide capital to assets that have few options for financing, and as they accept greater credit risk or structural subordination. Relative to our other two strategy labels, opportunistic managers frequently have exposure to assets with shorter maturities and higher sensitivity to market conditions.

On the surface, opportunistic debt strategies may appear to have a better risk/return trade-off than core infrastructure equity strategies, considering the former would target investments higher in the capital structure. Unfortunately, as is true elsewhere in investing, the answer is rarely that straightforward. To generate comparable equity returns, debt strategies typically seek exposure to riskier collateral. This may mean that the assets tied to an opportunistic debt strategy may be in less appealing sectors or regions, have more exposure to greenfield risk, or have a less stable customer support base than a core infrastructure equity strategy. To be sure, a variety of opportunities exist (Figure 5).

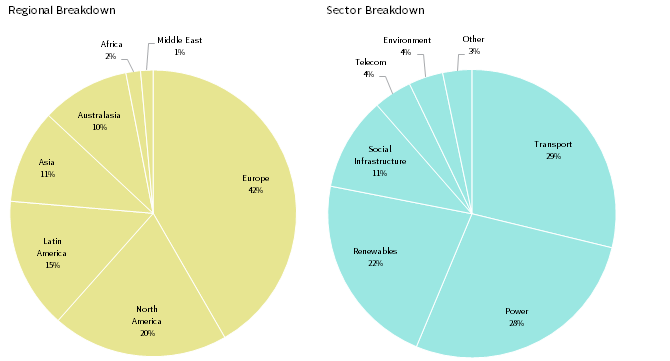

FIGURE 5 GLOBAL PROJECT FINANCE TRANSACTION VOLUME

2017 • By Region and Sector

Source: InfraDeals.

Note: Australasia is composed of Australia and New Zealand.

Infrastructure debt managers across our strategy labels routinely cite their ability to source and influence loan terms as the keys to adding value. To a large extent, sourcing is relationship based, so identifying teams with experience in the markets in which they operate and that are broadly respected is important. But even experienced teams likely have limited influence in structuring transaction terms to their advantage, at least in highly competitive investment-grade deals, or deals that are broadly syndicated. Managers that can finance deals directly—bypassing financial intermediaries—or that invest in more risky assets may have more influence in structuring key terms.

Investors should be aware that the documentation for some strategies outlines a broad mandate, permitting investments in a variety of countries and sectors, but, in practice, their managers may end up investing much more narrowly, with a majority of exposure to one country and/or one sector. Also, though infrastructure debt is a space where investors can put substantial sums of capital to work, co-investing opportunities and fee breaks may be available only to investors with larger allocations. A detailed understanding of manager intentions and key fund terms will lead to better investment outcomes.

Conclusion

With underlying assets providing essential services, infrastructure debt can play a key role in institutional investor portfolios, offering the possibility of attractive returns, matching long-term liabilities, and diversifying traditional business cycle–sensitive investments. Even though they are relatively new entrants among private asset classes, a variety of strategies targeting infrastructure debt already exist, from focusing on capital preservation to having a flexible and opportunistic mandate. Although the space is still maturing, it’s clear that infrastructure debt will attract more institutional attention and capital in the years ahead.

Kevin Rosenbaum, Senior Investment Director

Robert Lang, Managing Director

Dan Day, Senior Investment Associate